Alibaba Group Holding Limited reported a robust performance for the quarter ending March 31, 2024, showcasing a strategic rebound and growth across its diverse business segments. The e-commerce giant’s focus on enhancing customer experience and strategic investments has resulted in notable year-over-year growth, despite challenging market conditions.

Alipay

Alipay is China’s leading online payment service by both the number of users and total transaction volume. It has more than 1.3 billion annual active users as of June 2020 and processed $17 trillion worth of transactions in mainland China over the course of a year.

More than 80 million merchants use Alipay for business over the course of a month, and the app has more than 2,000 partner financial institutions.

Once a member of the Alibaba Group now affiliated with Alibaba under Ant Financial, it enables individuals and businesses to securely, easily and quickly send and receive payments online. Alipay works like an escrow service, solving the issue of settlement risk in China.

Since its launch in 2004, AliPay has become the most popular and extensively used online payment tool for all areas of e-commerce in China, and is fast becoming the industry standard. As of 20 Oct 2008, AliPay had more than 110 million users and a daily transaction volume exceeding RMB550 million, through more than 2,500,000 daily transactions.

AliPay continues to extend its leadership in online payments to merchants outside of the Alibaba and Taobao marketplaces, with more than 460,000 external merchants using AliPay as their preferred online payment platform, including leading local brands Lenovo, CCTV, Aigo, and New Oriental.

AliPay’s products and services are built on trust. Not only does AliPay guarantee the safety of each online transaction, it helps Internet users create their own trust profile which fosters a safe online payment environment.

To provide Alipay, Alibaba partnered with all the leading banks in China, including Bank of China, China Construction Bank, Agricultural Bank of China, and the Industrial and Commercial Bank of China, as well as visa and other financial institutions.

Alipay received the endorsement of traditional banks and financial institutions because of its advanced e-commerce payment technology and sophisticated risk management system. Alipay wants to be the e-commerce payment partner of choice for financial institutions.

Alipay Honors and Awards

Alipay has received many honors and awards from the industry and its customers:

In 2007

- “People’s Choice Awards in Electronic Payment” in 3rd China Top E-payment forum (2007) sponsored by E-Business World Magazine

- “China’s Excellent E-Payment Enterprise” by China Electronic Commerce Association

- “Yearly Award for Successful Enterprise in China’s Online Market (2006-2007)” by Internet Market China 2007 sponsored by CCID and CCIDConsulting.

In 2006

- “Top 10 Market Strategy Company” by China Business Post

- “Excellence in Product Innovation” by China Business

- “Most Trusted Online Payment System” and “No. 1 E-commerce Payment Service” in a survey of internet users by China Association for Quality and CCW Research

- “Safest Brand” by China’s E-payment Leaders Convention

In 2005

- “Most Popular Online Payment Tool” by 21eChina

- “Most Innovative Product” by 21st Century Business Herald

- “No. 1 E-commerce Payment Service” and one of the “Most innovated Company”, list in 50 Most Famous Internet Brands in a survey of China’s internet industry by Internet Society of China

Alipay and WeChat Pay Open up Mobile Wallets to Foreigners in China

In a significant move to facilitate foreign visitors in China, Ant Group and Tencent have announced new developments in their mobile wallet services, Alipay and WeChat Pay, respectively.

Taobao’s 20th Anniversary Sets Stage for Largest 618 Shopping Festival Yet

In China’s e-commerce realm, the 618 Shopping Festival is an event of monumental scale and impact. It owes its inception to the Chinese e-commerce giant Taobao, which was founded on May 10, 2003.

China’s CBDC Digital RMB App Launches Express Payment Function on WeChat Pay

The Digital RMB app, which is China’s CBDC, has recently launched an express payment feature on WeChat Pay. The app is currently in a pilot phase and enables users to pay using their digital currency wallet, including the Alipay digital currency wallet. Users need to register with the same phone number associated with their WeChat […]

China’s mobile payment market overview 2023: Alipay vs. WeChat Pay

QR code payment is still the most commonly used payment method for mobile payment users in China according to China Payment & Clearing Association’s research. “Which payment do you use more in daily life?” According to recent research conducted by the China Payment & Clearing Association, QR code payment remains the most frequently used payment […]

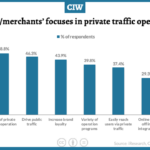

Top 3 private traffic platforms for merchants in China

WeChat, Alipay, and short video platforms (Douyin, Kuaishou, etc) have become the most important platforms for Chinese merchants’ private traffic operation according to a report from iResearch. More than 80% of businesses believe that the cost of private traffic has increased by 40%, so the conversion rate and leveraging public traffic have become the core […]

UnionPay integrates with Alipay and WeChat Pay

WeChat Pay has officially implemented mutual recognition and mutual scanning of offline QR codes with UnionPay’s Flash app. Users can scan WeChat payment codes through the UnionPay Flash payment app in provincial capitals across the country to complete payment.

China’s 3rd-party payment market 2021-2025e: mobile vs. internet

The third-party mobile payment transactions in China increased to 74.0 trillion yuan in the first quarter of 2021, a year-on-year increase of 39.1%, according to data from iResearch. iReserarch forecasts China’s third-party mobile payment market would reach 74.2 trillion yuan in the second quarter of 2021. China’s third-party mobile payment is mainly composed of three […]

Mini Program platforms 2021: WeChat vs. Alibaba vs. Baidu (Updated)

Mini Programs (MP) are light applications designed to run on top of a specific mobile app. Top technology companies in China have designed and run their own mini-program framework; and, the most popular ones include WeChat platform, Alibaba (Alipay platform; Taobao platform), Baidu Smart Program, and QuickApp. Lifestyle service is the most popular category on […]

Double 11 2020: Alibaba Tmall, JD Singles’ Day sales exceeded US$116 billion

Jingdong (JD.com) total 11-day sales during Double 11 2020 grew by 32% YoY and reached 271.5 billion yuan (US$41.02 bn) in GMV. Tmall’s 11-day Singles’ Day sales reached 498.2 billion yuan (US$75.27 billion) with an increase of 26% YoY.

China FinTech unicorn Ant Group’s gross profit exceeded US$10 billion in 2020

Ant Group, China’s fintech unicorn behind Alipay, announced that in the first three quarters of 2020, it realized 118.191 billion yuan of operating revenue, with a year-on-year increase of 42.56%.

S&P Global: Bank disruptors doubling down on mobile payments in China

Users of most payment platforms reported high engagement for mobile payments (around 90% considering the margin of error), with Du Xiaoman Pay users being a notable exception (80%). WeChat Pay users appeared to be evenly distributed across all ages, but QQ Wallet users skewed younger. A pair of big technology firms has further consolidated its […]

The war is on between Alibaba and Meituan

Alibaba and Meituan could become a serious threat to each other. For Alibaba, it’s critical for its success in the local services sector with high hopes on Ele.me and Alipay. Lei Wang took on the role of CEO after Alibaba acquired Ele.me at US$9.5 billion in 2018. He then proposed that acquiring 50% of the […]

Alibaba-backed Ant Group going duo-IPOs in Hong Kong and Shanghai

Ant Group, renamed from Ant Financial and the parent company of China’s largest payments platform Alipay and leading provider of financial services technology, announced its concurrent initial public offering (“IPO”) on the Shanghai Stock Exchange’s STAR board (“SSE STAR” market) and The Stock Exchange of Hong Kong Limited (the “SEHK”).

China third-party mobile payment market overview in 2019

In the fourth quarter of 2019, China’s third-party mobile payment transactions reached 59.8 trillion yuan (US$8.56 trillion), with a year-on-year growth rate of 13.4%. The proportion of mobile consumption in China’s third-party mobile payment increased to 24.5% in Q4 2019 from22.2% in Q3 2019. Alipay and Tenpay continued to dominate the third-party mobile payment in […]