China’s automotive market rebounded strongly in 2016 with record-breaking sales of almost 23 million passenger vehicles after its lowest growth since 2011. Car sales jumped 20%, nearly twice the rate of increase in 2015 according to McKinesey.

McKinsey conducted an extensive survey in July 2017 of over 5,800 auto buyers who purchased cars within the last year. These consumers came from 44 Tier-1 to -4 cities and seven counties, located in 19 key city clusters across China. Collectively, these clusters contribute 90 percent of China’s urban GDP and contain half its population.

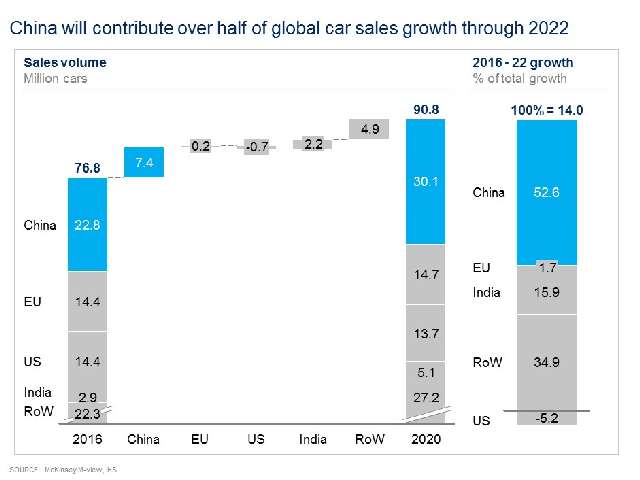

Although sales should increase by a modest-for-China 5 percent annual rate through 2022, this will equal 53 percent of the growth in the global car market – still a lower share than in the last five years, when China contributed 78 percent of global car sales growth.

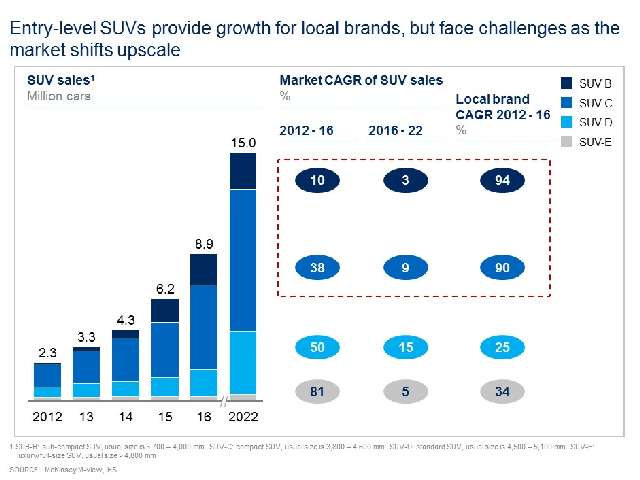

SUV sales continue to dominate growth in China, as they move beyond entry-level segments. Small SUVs in the B and C segments1have accounted for 78 percent of sales in the past two years

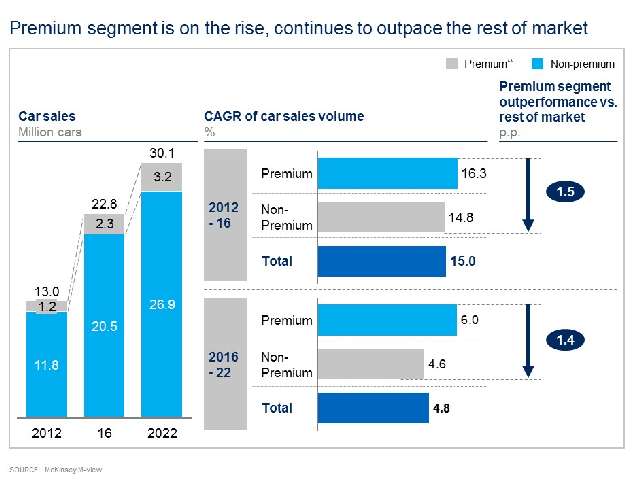

From a price segment perspective, cars costing more than RMB 250,000 should see sales expand at a 10.5 percent CAGR, while the rest increase just 4.1 percent a year.

Entry-level SUVs have propelled local OEM growth, explaining 98 percent of their sales increase from 2012 to 2016. The overall B and C segment SUV markets grew by 10 percent and 38 percent a year, respectively, from 2012 to 2016. In comparison, local brands in these segments grew by 94 percent and 90 percent, respectively, during the same period

Read the complete article on McKinsey.