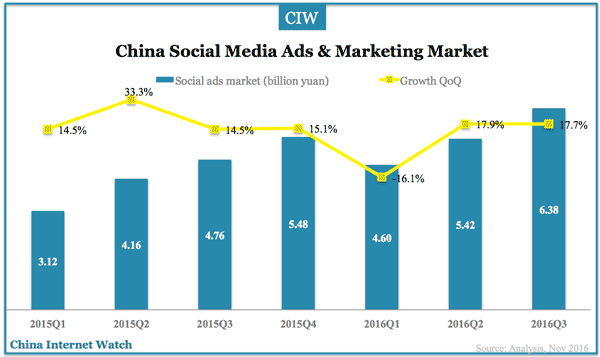

China social media advertising and marketing market reached 6.38 billion yuan, an increase of 17.7% QoQ.

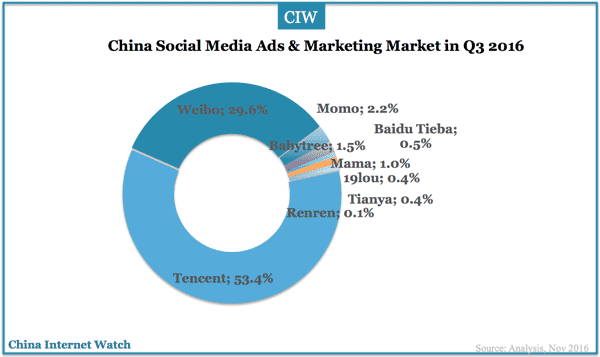

Tencent had 53.4% market share in China’s social advertising and marketing market in Q3 2016. WeChat MAU reached 846 million in Q3 2016; QQ 877 million; and, QZone 632 million.

Weibo’s Monthly active users (“MAUs”) grew 34% year over year to 297 million in September 2016, 89% of which were mobile users. It had 29.6% share in China’s social ad market in Q3 2016.

INFOGRAPHIC: Every 60 seconds on China social media