Despite the revenue dip, net profit attributable to the parent company increased by 7.00% to 10.51 billion yuan, with non-GAAP net profit rising 18.56% to 9.25 billion yuan. This profit growth, juxtaposed against declining revenues, underscores CATL’s enhanced focus on cost control and efficiency.

Cost Management and Profitability

The company’s improved profitability can be attributed to rigorous cost reductions and enhanced operational efficiency.

CATL reported a decrease in operating costs by 16% to 58.7 billion yuan, reflecting the first drop in fourteen quarters and signaling strong cost management capabilities.

These efforts have brought the gross margin back to the high levels of late 2021, over 26%.

Technological Advancements and Competitive Landscape

Market Share and Technological Edge

CATL continues to dominate the domestic power battery market, holding a 48.93% market share as of March 2024, an increase from the previous year.

This dominance is particularly notable in the segment of lithium iron phosphate (LFP) batteries, where CATL’s installed capacity market share surpassed that of its main competitor, BYD.

Challenges in LFP Market

However, the LFP market shows intense competition, especially from BYD, which has recently gained a significant market share due to rapid sales growth of its new models.

CATL’s ability to maintain its leadership in this segment amidst BYD’s surge is crucial and will require continued innovation and improvement in battery technology and production efficiencies.

Strategic Shifts and Operational Efficiency

Reduced Capital Expenditure

In response to market saturation and the need for heightened efficiency, CATL has consciously reduced its capital expenditures.

In the first quarter, payments for the acquisition of fixed assets, intangible assets, and other long-term assets were cut by 32.34% to 7.08 billion yuan. This strategic pullback reflects a broader trend among Chinese tech companies to optimize existing capacities and prioritize profitability over expansion.

Cash Flow and Investment Activities

Enhanced sales activities and operational improvements have led to a notable increase in cash flow from operating activities, which rose by 35.25% to 28.36 billion yuan. Investment activities also saw a growth, attributed to significant investment recoveries.

Future Outlook and Implications

Navigating Market Dynamics

As the competitive landscape intensifies, with newcomers like Xiaomi entering the market and established players like BYD expanding aggressively, CATL faces the challenge of maintaining its profitability while continuing to lead in cost reduction. T

he first quarter results suggest that CATL is finding ways to balance these pressures effectively.

Conclusion: Sustaining Leadership Through Innovation and Efficiency

CATL’s first quarter performance of 2024 illustrates a strategic pivot from rapid expansion to enhancing profitability and efficiency.

This shift is indicative of broader trends in China’s tech industry, where companies are increasingly focusing on maximizing returns from existing capacities and technologies amidst a challenging economic environment.

As market conditions evolve, CATL’s continued focus on technological innovation and operational efficiency will be crucial in sustaining its leadership position in the global battery market.

]]>AI-Enhanced Automotive Assistants

NIO’s incorporation of AI through Microsoft Azure OpenAI service into its NOMI assistant is not just an upgrade—it’s a transformation.

NOMI now employs a car-specific version of GPT (Generative Pre-trained Transformer) to handle complex queries and provide intuitive, vehicle-specific information. This enables drivers to receive more accurate and relevant responses without diverting their attention from driving, enhancing safety and user experience.

The AI capabilities include personalized greetings, weather updates, and a new range of interactive features designed to optimize journey experiences by providing timely operational guidance for vehicle features.

For example, when asked, NOMI can now explain how to adjust mirrors or check tire pressure directly via the car’s display—tasks traditionally requiring manual lookup in user manuals.

Interactive Features and User Engagement

Beyond the basics, NOMI GPT introduces enhanced interactivity through a new FAQ feature that educates users about NOMI’s capabilities and preferences, personalizing the user experience further.

This feature allows users to engage in more natural conversations with their vehicle, asking about NOMI’s favorite music, games, or even its opinions on other AI systems.

Phased Rollout and Language Support

To ensure the best and safest user experience, NIO has begun a phased rollout of the NOMI GPT feature, starting from April 5, 2024.

The feature is initially available in English, German, and Norwegian, catering to NIO’s diverse European market. This strategic deployment underscores NIO’s commitment to accessibility and customer satisfaction through its leading over-the-air (OTA) update capabilities.

Implications for the Future

The integration of advanced AI into NIO’s vehicles is more than a mere enhancement; it’s a forward-looking move that signals the future direction of the automotive industry.

As articulated by NIO’s European Product Experience Director, Benjamin Steinmetz, the new AI features not only make the user’s journey more valuable but are also set to expand quickly, bringing exciting new functionalities with each update.

This development is not just about enhancing individual vehicles but about pushing the entire industry toward smarter, more interactive, and more intuitive automotive solutions.

The partnership between NIO and Microsoft, through the use of Azure and OpenAI technologies, exemplifies how collaborations between tech giants and automotive innovators can drive significant advancements.

Conclusion

The evolution of AI in vehicles through initiatives like NIO’s enhanced NOMI assistant demonstrates the potential for AI to transform everyday experiences and interactions with technology.

As these technologies mature and become more integrated into various aspects of driving and vehicle management, they pave the way for more connected, intelligent, and user-centric automotive environments.

This trend is set to continue, reshaping how we think about mobility and technology’s role in it, with China at the forefront of this technological revolution in the automotive sector.

]]>In 2023, China’s ride-hailing companies experienced strong revenue growth and accelerated steps toward commercializing autonomous driving, marking a new phase in the industry’s development.

The sector saw rapid expansion with significant increases in both the number of ride-hailing platforms and order volumes.

By December 31, 2023, a total of 337 ride-hailing companies had obtained operating licenses, up by 39 companies from the previous year. The ride-hailing regulatory information exchange system processed 9.114 billion orders throughout the year, a 30.76% increase from the previous year.

Against this backdrop, ride-hailing companies achieved fast growth in performance. For example, in the first three quarters, Didi’s total revenue increased by 31.2% year-over-year, with its domestic travel and international business growing by 32.8% and 33.9%, respectively.

The commercial operation of autonomous taxis also made steady progress.

Ride-hailing platforms actively deployed commercial autonomous taxi services, offering smart travel solutions.

In August, Baidu Apollo’s autonomous driving service platform “Luobo Kuaipao” was officially launched in Wuhan’s Dongxihu District, providing citizens with autonomous driving services and achieving breakthroughs in cross-district travel and full unmanned night-time operations.

In September, Pony.ai obtained the first unmanned demonstration application license in Shenzhen, covering nearly 150 autonomous driving service stations across many high-frequency travel destinations, operating during peak morning and evening hours.

Technological advancements have shifted market competition from traffic to service quality, propelling the ride-hailing industry into a new stage of development.

]]>This development is part of Baidu’s strategic expansion of its autonomous ride-hailing service platform, which now ensures uninterrupted service to meet diverse travel needs, including those at night.

In a series of strategic moves, Apollo Go introduced fully driverless rides across Wuhan’s Yangtze River in February 2024, showcasing its advanced capability in navigating complex terrains.

This was closely followed by the initiation of a robotaxi pilot operation on highways leading to Beijing Daxing Airport, positioning Beijing as the first world capital to embrace airport robotaxi services. These achievements highlight Baidu’s commitment to enhancing urban mobility and safety through technological innovation.

Wuhan, a leader in smart transportation, has seen autonomous vehicles cover over 3,378.73 kilometers in testing, serving a population of over 7.7 million.

With a fleet of 300 fully driverless vehicles, Apollo Go’s operations in Wuhan are a testament to Baidu’s pioneering role in the autonomous driving industry.

Additionally, in observance of International Women’s Day, Apollo Go has launched a campaign offering female users priority service during late-night hours, further emphasizing its user-centric approach. This service has garnered widespread approval, with a remarkable 97.12% five-star rating from users.

Since its inception, Apollo Go has provided over 5 million cumulative rides, reflecting Baidu’s commitment to expanding autonomous ride-hailing services across China.

With operations in over 10 cities, including Beijing, Wuhan, Shenzhen, and Chongqing, Apollo Go stands out as the premier provider of fully driverless robotaxi services, underscoring Baidu’s leading position in China’s autonomous driving evolution.

]]>In 2023, BYD showcased its remarkable performance, selling 3.02 million vehicles and securing the top spot in the Chinese market. Notably, its exports surged by 334% year-over-year, making it the fastest-growing car manufacturer among the top ten global brands.

This achievement signifies that one in every five new energy vehicles (NEVs) sold globally and one in three hybrids worldwide is a BYD. Within China, BYD claims one in three NEV sales and one in two plug-in hybrid sales.

This victory marks the end of a 39-year dominance by joint venture brands in the Chinese market, a monumental shift for local manufacturers. BYD stands out as the first and only Chinese brand to enter the global top ten auto sales list, with a continuously growing market share among these elite ranks.

BYD’s strategy of “lower price, no lower specs” is backed by its entry into the global top ten in sales, a testament to its leadership in the NEV sector.

BYD has sold over 3.2 million plug-in hybrid models to date, and in the fourth quarter of 2023, its pure electric vehicle (EV) sales surpassed Tesla, claiming the title of global leader in EV sales.

Several BYD models have dominated their respective segments: the Seagull leads in the A00 category, while the Yuan PLUS and Song PLUS are champions in the A-level pure electric and SUV categories, respectively.

The Qin family tops sedan sales, and the Tang DM9 is the leader in the MPV segment, securing BYD’s position as a “top scholar” across various markets.

BYD’s sales achievements are underpinned by its multifaceted strength.

In 2023, the company unveiled groundbreaking technologies like Yi Si Fang, Yun Nian, and DMO, and in early 2024, it announced a new strategy for the intelligent development of NEVs.

Backed by 11 research institutes, over 90,000 engineers, and cumulative R&D investments exceeding 100 billion, BYD’s innovations are well-supported.

BYD’s control over product pricing and its comprehensive industry chain integration, coupled with the benefits of scale, have enhanced its cost-control capabilities.

This strategic advantage not only secured BYD’s leading position in China’s auto market in 2023 but also allowed it to launch an array of “Glory Edition” models in 2024, challenging joint venture fuel vehicles in a significant battle.

]]>

In the third quarter, DiDi reported total revenues of RMB 51.4 billion, a notable 25.0% increase compared to the same period last year.

This surge is primarily attributed to the strong performance of its China Mobility segment, which brought in revenues of RMB 46.6 billion, marking a 26.6% year-on-year growth. The international segment also showed promising progress with a 27.7% increase in revenue, totaling RMB 2.0 billion.

A critical factor in this growth trajectory is the increase in core platform transactions, which rose by 33.9% year-over-year, reaching 3,579 million transactions. This uptick in user engagement also saw the Gross Transaction Value (GTV) climb by 36.7% to RMB 91.5 billion.

Despite these positive indicators, the company’s financial health presents a nuanced picture. While net income stood at RMB 0.4 billion, with RMB 0.1 billion attributable to ordinary shareholders, the Adjusted EBITA (Non-GAAP) showed a loss of RMB 0.3 billion.

This loss underscores the ongoing challenges DiDi faces in achieving operational profitability, especially in its international and other initiatives segments.

DiDi’s CEO, Mr. Will Wei Cheng, expressed optimism, highlighting the recovery in domestic demand and the company’s strategic focus on core mobility services. He also underscored the commitment to expanding the business and enhancing product capabilities, signaling a confident outlook for the future.

The quarter also saw significant strategic movements, including a focus on marketing and incentives in key international markets like Brazil and Mexico. Additionally, the completion of a transaction involving the sale of certain smart auto business segments to XPeng Inc. reflects DiDi’s strategic refocusing efforts.

As DiDi navigates its way forward, its robust revenue growth and strategic decisions, such as international market investments and business restructuring, are pivotal.

However, the challenge remains in balancing these growth aspirations with achieving profitability, especially in competitive international markets. The company’s next steps will be closely watched as it strives to maintain its momentum in the ever-evolving mobility technology landscape.

]]>One in four cars sold in China was an EV, highlighting the country’s vibrant EV market. Interestingly, plug-in hybrid EVs (PHEVs) increased their share to 24%, while battery EVs (BEVs) saw a decrease.

BYD, Wuling, Chery, Changan, and GAC are some of the top Chinese brands that dominate the EV market, with local brands commanding 81%.

Furthermore, the study shows that China accounts for nearly 59% of the global EV sales volume, making it the second fastest-growing market among the world’s top 10 EV markets. In contrast, Japan was the fastest-growing market, with a YoY growth of 119%.

Counterpoint forecasts that EV sales will exceed eight million units in 2023. However, phasing out subsidies and EV players’ wealth could lead to a price war as brands fight for market share.

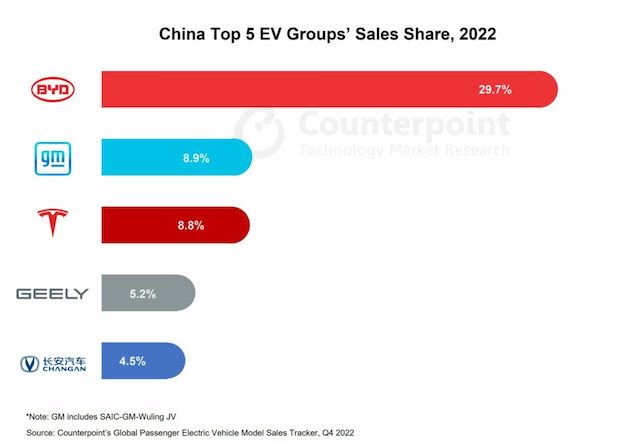

Meanwhile, in 2022, BYD increased its market share by over 11% YoY, with six out of the top 10 EV models in the Chinese market coming from the brand. In comparison, Tesla’s market share dropped by nearly 5% YoY due to production halts in April and May 2022.

Moreover, the availability of a limited product mix, increased costs due to a problematic supply situation, competition from affordable options offered by EV start-ups, and domestic sentiment hindered Tesla’s efforts to solidify its position in the Chinese market.

In Q4 2022, the BYD Song overtook the Wuling Hongguang MINI EV as the top-selling EV model, ending the latter’s eight-quarter reign in the market. The top 10 EV models accounted for almost 45% of the total EV sales, indicating that new start-ups are offering intense competition to established players.

]]>China has surpassed Germany as the world’s second-largest auto exporter. Analysts said that China’s auto exports are also approaching Japan, and it may win the title of the world’s largest auto exporter in the next few years.

Regarding vehicle types, 2.529 million passenger cars were exported, up 56.7% year on year, and 582000 commercial vehicles were exported, up 44.9% year on year.

The export of new energy vehicles reached 679,000, up 120% year on year. Since 2021, China’s total export of automobiles exceeded 2 million for the first time, breaking the previous situation of hovering around one million vehicles and achieving a leapfrog breakthrough.

China has been the world’s largest auto market since 2009. However, China’s auto consumption market has long been dominated by foreign brands such as Volkswagen, General Motors, BMW, and Benz.

In the past two years, with the overall rise of domestic cars, local Chinese brands such as BYD and Geely have accelerated their efforts to seize the domestic market and promote them globally. Today, BYD is a leading brand in the domestic new energy vehicle market, and the joint venture brand is hard to catch up quickly.

]]>The number of new energy passenger vehicles in the world reached 6.96 million from January to September 2022, with a year-on-year growth of 69%. The sales volume in September was 1.05 million, up 63% year on year.

In September 2022, China’s share of new energy vehicles in the world was 67%.

The number of commercial vehicles in the world’s new energy vehicles market is less than 4%, with new energy passenger vehicles as the main segment. From January to September 2022, China’s new energy passenger vehicles accounted for 62% of the world’s new energy vehicle market, which is mainly due to the strong demand for the new energy market in China.

While the production and sales of traditional vehicles and new energy vehicles in Europe are low, so China’s development is very strong.

According to the data of the Passenger Transport Association, the wholesale sales of new energy passenger vehicles in September reached 675000, up 94.9% year on year and 6.2% month on month.

From January to September, 4341,000 new energy passenger cars were wholesale, up 115.4% year on year. In September, the retail sales of new energy passenger vehicles reached 611,000, with a year-on-year growth of 82.9% and a month-on-month growth of 14.7%.

From January to September, the domestic retail sales of new energy passenger vehicles reached 3.877 million, with a year-on-year growth of 113.2%.

Forecast of China’s digital automobile and transportation market 2021-2025

]]>Apollo Go, Baidu’s autonomous ride-hailing service, is now authorized to collect fares for robotaxi rides – completely without human drivers in the car – in Chongqing and Wuhan, two of China’s largest megacities.

Amid increasing regulatory approval of the expansion of autonomous vehicles (AVs), the permits reflect regulatory authorities’ strong recognition and trust in the strength of Baidu’s autonomous driving technology.

They also mark a key turning point for the future of mobility in China, leading to an eventual expansion of driverless ride-hailing services to paying users across the country.

The permits were granted to Baidu by government agencies in Wuhan and Chongqing’s Yongchuan District. Both cities have been pioneering new approaches to intelligent transportation in recent years, from developing infrastructure to updating new regulations for AVs.

Having received the permits, Baidu will begin to provide fully driverless robotaxi services in the designated areas in Wuhan from 9 am to 5 pm, and Chongqing from 9:30 am to 4:30 pm, with five Apollo 5th gen robotaxis operating in each city.

The areas of service cover 13 square kilometers in the Wuhan Economic & Technological Development Zone, and 30 square kilometers in Chongqing’s Yongchuan District.

First Driverless Permits in China for Autonomous Ride Hailing Services

Baidu received the first-ever permits in late April this year in China authorizing the company to provide driverless ride-hailing services to the public on open roads in Beijing.

This regulatory approval marks a significant milestone for the autonomous ride-hailing industry in China, indicating a regulatory openness to taking a further step toward a fully driverless mobility future.

With these permits issued by the head office of the Beijing High-level Automated Driving Demonstration Area (BJHAD), ten autonomous vehicles without drivers behind the steering wheel will offer rides to passengers in a designated area of 60 square kilometers in Beijing.

These licensed cars will join an existing fleet provided by Apollo Go, Baidu’s autonomous ride-hailing service, in the capital city of China. Starting April 28, 2022, users will be able to hail a driverless ride using the Apollo Go mobile app in daytime from 10:00 to 16:00.

Currently, Baidu has the largest autonomous driving fleet in China. In expanding its driverless vehicle services, Baidu has worked to meet the unique technical challenges of Beijing’s complex traffic environment. The company plans to add 30 more such vehicles at a later stage, expanding its fleet to provide more convenient driverless services to the public.

Baidu has a proven track record of over 27 million kilometers (16 million miles) of road testing accumulated in the past 9 years with zero traffic accidents, including mileage recorded by driverless test cars in multiple cities across China as well as in California.

In September 2020, Baidu became the first company in Beijing to offer autonomous ride-hailing services. Starting in November of last year, Baidu has been charging fees for the Apollo Go autonomous services offered to the public under granted commercial permits, though safety operators are required in the driver’s seat.

Apollo Go has expanded to 9 cities in China since its first launch in 2020, including all first-tier cities (Beijing, Shanghai, Shenzhen and Guangzhou), and five other cities (Chongqing, Changsha, Cangzhou, Yangquan and Wuzhen). There have been 213,000 orders on Apollo Go in Q4 2021, making it the global leader by order volume.

Baidu released intelligent vehicle solutions for automakers in China

Baidu showcases Fully Automated Driving and 5G Remote Driving Service

Baidu displayed Fully Automated Driving during Baidu World 2020 on 15 September 2020, the company’s annual technology conference that was held in cooperation with CCTV.

With Apollo’s new Fully Automated Driving capability, the AI system can independently drive without a safety driver inside the vehicle, a breakthrough that will accelerate the large-scale deployment of autonomous driving technology across China.

Zhenyu Li, Corporate Vice President of Baidu and General Manager of Intelligent Driving Group (IDG), demonstrated the technology in Beijing’s Shougang Park with CCTV anchor Xiaofeng Bao.

“The three core components of Apollo’s Fully Automated Driving technology are pre-installed and mass-produced vehicles, the ‘experienced AI driver’, and the 5G Remote Driving Service,” said Zhenyu Li during the demonstration.

With pre-installed and mass-produced vehicles as the foundation, the AI driving system is now capable of operating the vehicles independently, and the 5G Remote Driving Service allows remote human operators to intervene in case of emergencies.

Apollo’s leading technology in pre-installed and mass-produced vehicles is a key precondition for Fully Automated Driving.

In 2019, Baidu partnered with FAW Group and jointly developed Hongqi EV robotaxi, the first pre-installed and mass-produced robotaxi in China, which has since been deployed in unmanned driving tests in multiple cities including Beijing, Changsha, G

Compared with modified models, pre-installed and mass-produced vehicles better guarantee consistency and safety.

Apollo has also released its fifth-generation autonomous driving kit, and the first pre-installed and mass-produced vehicles that meet the requirements for fully automated operations will be launched soon.

With each new generation of Apollo vehicles, the cost will be halved while performance will increase by tenfold, said Zhenyu Li.

The “experienced AI driver” refers to the capacity of the AI system to control the vehicle independent of a human driver. Apollo has completed over six million kilometers of road testing with a record low of zero accidents.

Having carried over 100,000 passengers across 27 cities around the world, Apollo’s “experienced AI driver” is well-trained. It is capable of handling various technological challenges of unmanned driving and solving the overwhelming majority of possible issues on the road.

The 5G Remote Driving Service is an indispensable complement to the “experienced AI driver” and allows human operators to remotely access vehicles in the case of exceptional emergencies.

Powered by smart transportation systems, vehicle-to-everything (V2X) technologies, and the high bandwidth and response speed of 5G networks, the 5G Remote Driving Service is engaged instantaneously to provide immediate assistance from remote human operators when the user or the system switches to parallel driving mode.

All remote human operators have completed over 1,000 hours of cloud-based driving training without any accidents, so they can ensure the safety of passengers and pedestrians under the non-autonomous driving mode.

As the “experienced AI driver” can handle most road conditions, extreme occasions that require human intervention are rare. Hence, one remote human operator will be able to manage multiple vehicles simultaneously, largely increasing efficiency compared to the traditional one operator per vehicle model.

With these advancements, unmanned driving will create a new ecosystem of shared transportation, and the autonomous driving industry will enter the stage of full commercialization in 2025, said Robin Li, Co-founder, Chairman and CEO of Baidu.

Apollo also announced new product and technological developments at the conference.

Vehicle manufacturer Weltmeister will launch a new model incorporating Apollo’s valet parking in 2021, which will be the first in China to be equipped with L4 autonomous valet parking technology.

It will be able to identify vacant parking slots in multistory parking garages and allow people to use the autonomous-parking and smart summons functions with one simple click.

In addition, DuerOS for Apollo with smart voice-interaction has been installed on over one million smart vehicles.

DuerOS for Apollo is partnering with over 60 major automotive brands and covers more than 500 vehicle models on the market.

According to IHS Markit’s latest “Report on Connected and Autonomous Vehicle (CAV) Development Trends in the Chinese Market”, DuerOS for Apollo is the world’s most installed system for CAV.

The Apollo smart transportation solution “ACE Transportation Engine” has been put in use in nearly 20 cities in China.

Robin Li estimates that by 2025 major Chinese cities will no longer need to limit vehicle purchases and usage, and by 2030 most traffic congestion issues can be solved by higher transportation efficiency.

Smart transportation infrastructure based on V2X technologies promises to improve traffic efficiency by 15% to 30% and boost the contribution to GDP by 2.4% to 4.8% in absolute value.

During the smart transportation sub-forum at Baidu World 2020, Baidu launched Apollo 6.0, the latest version of its open platform, adding multiple cloud services to make it more accessible for developers.

The Apollo open platform has now released 600,000 lines of open source code, gathering 45,000 developers and 210 ecosystem partners globally.

China’s automobile sales up 16% in July 2020; new energy vehicles up 19%

]]>

With a per unit cost of RMB 250,000 (about $37,000), the arrival of Apollo RT6 is set to accelerate AV deployment at scale, bringing the world closer to a future of driverless shared mobility.

Baidu Apollo RT6’s steering wheel-free design unleashes more space to craft unique interiors, allowing for the installation of extra seating, vending machines, desktops, or gaming consoles.

At 4760mm long with a wheelbase of 2830mm, the rider-first Apollo RT6 delivers comfort with independent rear seating, ample rear legroom of 1050mm, a flat floor, and an intelligent interaction system.

The Apollo RT6 exterior features a revolutionary look that seamlessly integrates sensors on the sunroof alongside interactive lights and intelligent electric sliding doors to enhance the riding experience further.

Apollo RT6 integrates Baidu’s most advanced L4 autonomous driving system, powered by automotive-grade dual computing units with a computing power of up to 1200 TOPS.

The vehicle utilizes 38 sensors, including 8 LiDARs and 12 cameras, to obtain highly accurate, long-range detection on all sides. The safety and reliability of Apollo RT6 are backed by a massive trove of real-world data, a total test mileage of over 32 million kilometers (~20 million miles) driven by Baidu’s AV to date.

Speaking at Baidu World 2022, Zhenyu Li, senior corporate vice president of Baidu and general manager of Intelligent Driving Group (IDG), said the autonomous driving capability of Apollo RT6 is equivalent to a skilled driver with 20 years of experience.

Apollo RT6 is the first vehicle model built on Xinghe, Baidu’s self-developed automotive E/E architecture for fully autonomous driving. The vehicle is 100% automotive-grade and has full redundancy throughout the hardware and autonomous driving software.

Apollo Go has expanded to 10 cities in China since its launch in 2020, including all first-tier cities, and provided more than 1 million orders.

Baidu Wins First Driverless Permits in China for Autonomous Ride Hailing Services

]]>The gross margin was 22.6%, compared with 25.2% in the fourth quarter of last year. Net income was RMB 47.6 million, a decrease of 18.1% compared with RMB 58.2 million in the fourth quarter of last year. Adjusted net income (non-GAAP) was RMB 60.2 million, a decrease of 12.2% compared with RMB 68.6 million in the fourth quarter of last year.

The number of Niu e-scooters sold reached 238,188, up 58.3% year over year:

- The number of e-scooters sold in China reached 205,239, up 49.2% year over year

- The number of e-scooters sold in the international markets was 32,949, up 155.8% year over year

The number of franchised stores in China was 3,108 as of December 31, 2021, an increase of 422 from September 30, 2021. The international sales network expanded to 42 distributors covering 50 countries.

In Q4, Niu successfully delivered 14,916 units of kick-scooters in the international markets. Furthermore, it debuted five exciting new products at EICMA 2021 in Milan for the global markets, including its most powerful 125cc electric moped, the MQiGT-EVO, the first 150cc hybrid moped, the YQi, e-bike BQi, and two additional KQi series kick scooters.

Revenues in full-year 2021 were RMB 3,704.5 million, an increase of 51.6% year over year, mainly driven by 72.5% increases in e-scooter sales volume.

E-scooter sales revenues from China market represented 89.9% of its total revenues from e-scooter sales, and e-scooter sales revenues from overseas markets represented 10.1% of the total revenues from e-scooter sales.

]]>Vehicle sales were RMB8,636.8 million (US$1,340.4 million) in Q3 2021, representing an increase of 102.4% from Q3 2020 and an increase of 9.2% from Q2 2021. The vehicle margin was 18.0%, compared with 14.5% in Q3 2020 and 20.3% in Q2 2021.

Total revenues were RMB9,805.3 million (US$1,521.8 million) in Q3 2021, representing an increase of 116.6% from Q3 2020 and an increase of 16.1% from Q2 2021.

Gross profit was RMB1,993.2 million (US$309.3 million) in Q3 2021, representing an increase of 240.3% from Q3 2020 and an increase of 26.6% from Q2 2021. The gross margin was 20.3%, compared with 12.9% in Q3 2020 and 18.6% in Q2 2021.

Loss from operations was RMB991.9 million (US$153.9 million) in Q3 2021, representing an increase of 4.9% from Q3 2020 and an increase of 29.9% from Q2 2021.

Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB726.3 million (US$112.7 million) in Q3 2021, representing a decrease of 19.0% from Q3 2020 and an increase of 41.9% from the second quarter of 2021.

Net loss was RMB835.3 million (US$129.6 million) in Q3 2021, representing a decrease of 20.2% from Q3 2020 and an increase of 42.3% from Q2 2021.

Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB 569.7 million (US$88.4 million) in Q3 2021, representing a decrease of 42.9% from Q3 2020 and an increase of 69.7% from Q2 2021.

Net loss attributable to NIO’s ordinary shareholders was RMB2,858.9 million (US$443.7 million) in Q3 2021, representing an increase of 140.7% from Q3 2020 and an increase of 333.6% from the Q2 2021.

In Q3 2021, NIO repurchased 1.418% equity interest in NIO China from a minority strategic investor for a total consideration of RMB2.5 billion and recorded an amount of RMB2,023.5 million (US$314.0 million) in accretion on redeemable non-controlling interests to redemption value.

Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB569.7 million (US$88.4 million).

Basic and diluted net loss per American Depositary Share (ADS)iii were both RMB1.82 (US$0.28) in the third quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB0.36 (US$0.06).

Cash and cash equivalents, restricted cash and short-term investment were RMB47.0 billion (US$7.3 billion).

]]>Apollo Moon Arcfox hit the road

First unveiled in June 2021, Apollo Moon is Baidu’s 5th generation of robotaxis for fully autonomous ride-hailing services in the smart transportation industry. Compared to the 4th generation of Apollo robotaxis, the Apollo Moon models cost half in manufacturing with a tenfold performance increase.

With the introduction of three models to its robotaxi fleet: Apollo Moon Arcfox , Apollo Moon WM Motor, and Apollo Moon Aion, Baidu is expected to expand the options for Apollo Go customers in cities across China, aiming to quickly scale up the offering and lead the estimated 1.3 trillion RMB robotaxi market by 2030.

Related report: Outlook of China’s Autonomous Driving Market and MaaS Market

The Apollo Moon robotaxi models utilize the so-called “ANP-Robotaxi” architecture, a leading navigation pilot product that can reduce the weight of autonomous vehicle kits while sharing intelligent driving vehicle data to create a closed-loop information ecosystem.

By combining these capabilities along with a customized LiDAR and corresponding unmanned redundancy functions, fully autonomous driving can be realized.

At the event, Apollo Moon Arcfox hit the road with no safety driver on board, offering a brand new riding experience.

Tripling Test Mileage

Baidu Apollo also announced that it has expanded its safe road test mileage from 6 million kilometers to 18 million kilometers – tripling the amount of road driven by its autonomous fleet.

This marks a significant achievement for Baidu Apollo in its development of autonomous technology, as it applies learnings from the data and kilometers driven to improve the safety and efficiency of its autonomous vehicles.

5G Remote Driving for Enterprise

The network is an integral technology in self-driving vehicles and 5G will play a critical role in making autonomous driving a reality.

At the event, Baidu unveiled its new 5G Remote Driving for Enterprise, which expands the ability of the 5G cloud-based teleoperation technology to support unmanned vehicles in a single scenario to three.

As a remote driving solution, the 5G Remote Driving for Enterprise has four key advantages: high safety, high efficiency, large scale, and support in multiple scenarios.

With a number of patented technologies, 5G Remote Driving can recognize abnormal traffic conditions such as road closures and assist the vehicle in navigating around these conditions safely and efficiently.

Baidu launched autonomous driving MaaS platform with five models

Baidu Apollo topped industry peers across every testing category for the third consecutive year according to Beijing Autonomous Vehicles Road Test Report 2020.

In addition to maintaining the largest fleet of test vehicles and accumulating the highest total testing mileage, Baidu is also the first and only company that has obtained permission to operate fully driverless road tests on public roads in Beijing, according to information sent to CIW from Baidu.

Baidu was the leading company across all four categories:

- number of vehicles for general technology testing

- number of vehicles piloting autonomous vehicle passenger service

- number of vehicles carrying out fully driverless testing, and

- the total mileage of testing

Beijing Autonomous Vehicles Road Test Report is the only authoritative industry assessment of its kind published in China.

As the world’s leading open platform for autonomous driving, Baidu was early in commencing road testing initiatives in Beijing and leads the industry in areas including the total number of testing vehicles, the scale of testing, and diversification of testing scenarios.

Baidu has achieved a cumulative mileage of 2,019,230 kilometers over a three-year period in Beijing, accounting for 91.23% of Beijing’s total testing mileage in three years.

In 2020, Baidu operated a fleet of 55 autonomous vehicles on the roads of Beijing, accounting for 75% of the overall number of vehicles that conducted automated driving tests in the city.

Baidu also accumulated 1,125,305 kilometers of total testing distance, comprising 95.92% of the total autonomous vehicle testing distance in the municipality with a 49.24% increase in comparison to previous efforts in 2019.

To put Baidu’s achievements in perspective, a total number of 87 vehicles from 14 companies had received general road testing permits in Beijing as of December 31, 2020, according to the report.

In late 2020, Baidu was awarded five autonomous vehicle driverless testing permits from the Beijing Municipal Commission of Transport, marking the inaugural batch of permits issued to a company that allows driverless vehicles on public roads.

In preparation for this achievement, Baidu has collaborated with the Beijing Innovation Center for Mobility Intelligent to optimize test parameters and technological specifications by running 64,827 kilometers of driverless vehicle testing in Beijing.

As part of its push to commercialize autonomous driving technologies, Baidu Apollo launched the Apollo Go Robotaxi service in Beijing, as part of the third phase of its autonomous vehicle passenger service pilot.

From October 10 to December 31, a total of 15,006 users hailed an Apollo Go Robotaxi through their mobile devices. The Apollo Go experience was well received, with over 90% of riders stating that they would like to continue using this service in the future.

With a total of 200 autonomous vehicle testing roads across four districts comprising of a distance of 699.58 kilometers, Beijing has become the leading city for promoting domestic autonomous driving initiatives in China, with Baidu spearheading its growth.

Forecast for China’s future connectivity 2021-2024

Multi-Modal Autonomous Driving MaaS Platform

Baidu deployed a multi-modal autonomous driving MaaS (mobility as a service) platform on 9 February 2021 that will provide AI-driven city transportation services in Guangzhou.

Utilizing a fleet of Apollo Robotaxis and Robobuses along with three other model types of autonomous vehicles, this initiative will allow local users to order smart transport services on demand, starting in the Chinese New Year holiday period.

Baidu has partnered with the Guangzhou Huangpu District government to roll out the world’s first multi-modal autonomous driving MaaS platform.

By integrating an assortment of autonomous driving services to provide travel recommendations, this diverse platform can holistically optimize the traveling experience of users in line with combined platform strategies.

Comprising of over 40 autonomous vehicles, the collective fleet has deployed five different model types – Robotaxi, Robobus, Apolong, Apollocop and New Species Vehicle – to begin comprehensively serving the city during the bustling holiday period.

Citizens are able to make reservations on the Baidu Maps and Apollo Go mobile applications to witness these new autonomous driving initiatives and experience the convenience brought on by intelligent transportation technology.

With the ability to cover a variety of usage scenarios, the MaaS platform ecosystem can meet the diverse needs of many citizens during their holiday sightseeing, shopping and celebratory outings.

To facilitate this, Baidu Apollo has established over 50 Robotaxi pickup stations in the district, providing users with easy access to Chinese New Year festival sites using autonomous vehicles.

Simultaneously, a batch of New Species Vehicles are cruising around the city, tasked with unmanned retail, as well as routine cleaning and disinfection.

Apolong minibusses will shuttle eager sightseers to the flower blossoms around scenic parks and lakes. Meanwhile, Apollocop patrols the main roads near key areas and the Baidu Robobus will ferry passengers along fixed routes, facilitating community travels towards festive destinations.

Real-time signal light information such as stoplight countdowns, traffic event alerts, and intersection queue length are broadcasted on both the interactive monitors embedded in Robobus or Robotaxi cabins as well as the exterior screens fixed on the rear of Robobuses.

Additionally, users can utilize the Baidu Maps app or DuerOS-powered smart rearview mirrors to receive voice alerts of electronic fence monitoring, access signal light reminders, live traffic event venue broadcasting and other connected online services.

The ACE Transportation Engine – a full-stack solution that stands for “Autonomous Driving, Connected Road, Efficient Mobility” – has been introduced to improve the traffic flow around the district, reflecting Guangzhou’s status as a center of smart transportation.

A large ACE smart traffic electronic display has been set up on a prominent skyscraper to visually display the AI solutions at work; from the coordination of smart transportation for local commuters by the transportation bureau to the intricate traffic management maintained by law enforcement, the technology is being brought to life and exhibited to the inhabitants of Guangzhou.

The MaaS platform for multi-modal autonomous driving vehicles and ACE Transportation Engine demonstrated by this Chinese New Year launch has accelerated the arrival of the intelligent era of smart transportation.

Guangzhou’s open and inclusive policy environment fosters and encourages the development of the autonomous driving industry. Going forward, Baidu will continue conducting regular trial operations by additionally deploying over 100 Robotaxis and establishing almost 1,000 pickup stations in Guangzhou Huangpu District; this will allow local citizens to continue utilizing autonomous driving services in their daily lives, in lieu of similar Robotaxi programs implemented in Beijing, Changsha, Cangzhou and other areas of China.

In the face of immense opportunities in terms of increasing digitalization, high-speed networking and automation of transportation in the future, this strategic partnership with Baidu has enabled the Guangzhou Huangpu District to become a benchmark city for new smart transportation infrastructure.

Top 10 forecasts of China’s AI market 2021-2024

Baidu co-developed self-driving car to deliver in H1 2021

Weimar Motors announced on 19 January 2021 that Weimar W6, jointly developed with Baidu Apollo, rolled off the production line at Weimar Hubei base today and will be delivered in the first half of this year.

Weimar W6 can realize unmanned driving in specific scenarios through Baidu Apollo. In addition, Weimar Motors founder Shen Hui revealed that Weimar’s next-generation intelligent vehicle platform has been officially launched.

Baidu to produce intelligent electric vehicles with Geely

Baidu announced its plan to establish a company to produce intelligent electric vehicles (EV) on January 10, 2021, and that it has entered into a strategic partnership with multinational auto manufacturer Zhejiang Geely Holding Group (“Geely”).

Baidu released new intelligent vehicle solutions for automakers and several high-end intelligent driving products last December.

Baidu will provide intelligent driving capabilities to power the passenger vehicles for the new venture, and Geely, which holds the distinction of best-selling Chinese automobile brand in past years under the Volvo and Geely brands, will contribute its expertise in automobile design and manufacturing.

At Baidu, we have long believed in the future of intelligent driving and have over the past decade invested heavily in AI to build a portfolio of world-class self-driving services. China has become the world’s largest market for EVs, and we are seeing EV consumers demanding next generation vehicles to be more intelligent.

said Robin Li, Co-founder and CEO of Baidu.

As a top Chinese automaker with global reach, Geely has the unique experience and resources to design, produce and market energy-efficient, reliable and safe automobiles in large scale. We believe that by combining Baidu’s expertise in smart transportation, connected vehicles and autonomous driving with Geely’s expertise as a leading automobile and EV manufacturer, the new partnership will pave the way for future passenger vehicles.

Baidu released intelligent vehicle solutions for automakers in China

Baidu yesterday released new intelligent vehicle solutions for automakers and several high-end intelligent driving products during the second Apollo Ecosystem Conference, reinforcing the company’s commitment to win-win partnerships to propel industry development.

Apollo’s four series of solutions include intelligent driving, intelligent cabin, intelligent map, and intelligent cloud.

Baidu also announced an enhanced Apollo presence in Guangzhou and demonstrated the progress of the Apollo Go Robotaxi service rollout in Beijing, Changsha, and Cangzhou, underscoring both the commercialization prospects and revolutionary potential of intelligent transportation, intelligent vehicles, and autonomous driving.

“The transportation industry and automobile industry are undergoing a once-in-a-century transformation,” said Zhenyu Li, Corporate Vice President of Baidu and General Manager of Intelligent Driving Group (IDG), during the conference.

“With its focus on ‘intelligence’, Apollo is helping automakers to build good cars and governments to build good roads through intelligent transformation.”

“Apollo is committed to openness and hopes to work with partners to create a better future for autonomous driving,” Li added, speaking before a crowd of representatives from 500 ecosystem partners at the conference.

Intelligent Solutions and Products for Automakers

At the conference, Baidu released new or upgraded solutions combining hardware and software to help automakers build more intelligent vehicles.

Apollo’s four series of solutions include intelligent driving, intelligent cabin, intelligent map, and intelligent cloud. Intelligent cabin solutions are already empowering 600 types of vehicles from over 70 automakers, with DuerOS for Apollo pre-installed on over one million vehicles.

Meanwhile, Apollo’s intelligent high-definition map series continued to hold the top market share in 2020 and brought on new automaker partners.

Adding to its existing intelligent driving solutions, Baidu also announced an advanced solution for passenger vehicles called Apollo Navigation Pilot (ANP), which is powered by Apollo’s L4 autonomous driving technology.

Baidu had previously announced cooperation with automakers Guangzhou Automobile Group (GAC), Weltmeister, and Great Wall Motors to mass-produce Apollo Valet Parking (AVP), an L4 autonomous parking solution.

Apollo’s intelligent driving solutions aim to be pre-installed on one million vehicles over the next three-to-five years, bringing a safe and cutting-edge autonomous driving experience to more consumers.

Building an Intelligent Urban Transportation System

During the event, Guangzhou Huangpu district officially launched an intelligent transportation MaaS (mobility as a service) platform, which will include the deployment of robotaxis, robobuses, and autonomous driving utility vehicles that can perform various functions.

The rollout of these autonomous vehicles will cover the core area of Huangpu, where AI roadside sensors and cloud engines are already set up.

Baidu and Guangzhou will also cooperate on a new model for Guangzhou’s digital transportation operator that leverages Baidu’s ACE Transportation Engine – a full-stack solution that stands for “Autonomous Driving, Connected Road, Efficient Mobility” – helping the city establish a leading position in autonomous driving new infrastructure.

Apollo Go to Expand to Thirty Cities

Baidu also highlighted various applications and milestones for its world-leading autonomous driving technologies during the conference, especially Apollo Go, which operates robotaxis and robobuses in multiple cities.

Already operational in Beijing, Changsha, and Cangzhou, Apollo Go has carried over 210,000 passengers and plans to expand to roughly 30 cities over the next three years. Baidu also announced a partnership with ride-hailing app Shouqi to allow users to hail a Robotaxi through the app, opening up a new model of commercialization.

Digitization, connectivity, and automation present revolutionary opportunities for the transportation industry, Zhenyu Li stressed at the conference. Apollo could seize these opportunities to create a new growth engine for Baidu.

]]>It took Li only 17 months to reach the milestone of the 50,000th delivery from the first delivery of Li ONE in December 2019, creating the fastest record among all new energy vehicle companies.

Li had 73 retail stores covering 53 cities, and 143 servicing centers and Li Auto-authorized body and paint shops operating in 105 cities as of April 30, 2021.

Li Auto in Q1 2021

Li Auto delivered 4,900 Li ONEs in March 2021, representing a 238.6 % year-over-year increase. This brought deliveries for the first quarter of 2021 to 12,579, up 334.4 % year over year.

As of March 31, 2021, Li Auto had 65 retail stores covering 49 cities, and 135 servicing centers and Li Auto-authorized body and paint shops operating in 98 cities.

In response to robust demand for Li ONEs and in anticipation of new model launches in 2022 and beyond, Li Auto plans to further bolster its direct sales and servicing network.

Li Auto NEV deliveries up 67% in Q4 2020

Li Auto Inc (Lixiang) reported 64.6% growth in total vehicle sales in Q4 2020.

Deliveries of Li ONEs were 14,464 vehicles in the fourth quarter of 2020, representing a 67.0% quarter-over-quarter increase and setting a new quarterly record.

With 32,624 vehicles delivered to its customers in 2020, Li ONE became the best-selling new energy SUV of the year in China.

In January 2021, Li Auto delivered 5,379 Li ONEs, representing a 355.8% increase compared to January 2020. As of January 31, 2021, it had 60 retail stores covering 47 cities, in addition to 121 servicing centers and Li Auto-authorized body and paint shops operating in 89 cities.

For the first quarter of 2021, Li expects deliveries of vehicles to be between 10,500 and 11,500 vehicles, representing an increase of 262.6% to 297.1% from the first quarter of 2020.

China electric vehicles (EVs) sales grew 8% to 1.3 million units in 2020

Financial Highlights in Q4 2020

Vehicle sales were RMB4.06 billion (US$621.9 million) in the fourth quarter of 2020, representing a 64.6% increase from RMB2.46 billion in the third quarter of 2020.

The vehicle margin was 17.1% in the fourth quarter of 2020, compared with 19.8% in the third quarter of 2020.

Total revenues were RMB4.15 billion (US$635.5 million) in the fourth quarter of 2020, representing a 65.2% increase from RMB2.51 billion in the third quarter of 2020.

Gross profit was RMB724.6 million (US$111.0 million) in the fourth quarter of 2020, representing a 45.9% increase from RMB496.8 million in the third quarter of 2020.

The gross margin was 17.5% in the fourth quarter of 2020, compared with 19.8% in the third quarter of 2020.

Loss from operations was RMB78.9 million (US$12.1 million) in the fourth quarter of 2020, representing a 56.2% decrease from RMB180.0 million in the third quarter of 2020.

Non-GAAP loss from operations was RMB71.1 million (US$10.9 million) in the fourth quarter of 2020, representing a 58.0% increase from RMB45.0 million in the third quarter of 2020.

Net income was RMB107.5 million (US$16.5 million) in the fourth quarter of 2020, compared with RMB106.9 million net loss in the third quarter of 2020. Non-GAAP net income was RMB115.4 million (US$17.7 million) in the fourth quarter of 2020, representing a 621.3% increase from RMB16.0 million in the third quarter of 2020.

Operating cash flow was RMB1.82 billion (US$279.1 million) in the fourth quarter of 2020, representing a 95.9% increase from RMB929.8 million in the third quarter of 2020.

Free cash flow was RMB1.60 billion (US$245.1 million) in the fourth quarter of 2020, representing a 113.2% increase from RMB749.9 million in the third quarter of 2020.

Li Auto forecasts total revenues to be between RMB2.94 billion (US$450.6 million) and RMB3.22 billion (US$493.5 million), representing an increase of 245.9% to 278.8% from the first quarter of 2020.

]]>