83.0% of its average MAUs was attributed to Tencent-based platforms with the majority of the traffic coming from WeChat Pay portal and the dropdown list of users’ favorite or most frequently used mini-programs.

The average MPUs increased by 84.5% year-to-year from 14.8 million in the same period of 2020 to 27.3 million, mainly attributable to its stable traffic on WeChat channels. Read our WeChat Mini Programs Insights 2021.

Paying users for the 12-month period ended March 31, 2021, increased by 12.9% year-on-year from 149.9 million in the same twelve-month period of 2020 to 169.3 million. And, Tongcheng Elong’s paying ratio recovered to 11.7% for Q1 2021.

Revenues increased by 60.6% year-to-year to RMB1,613.8 million from RMB1,005.1 million in the same period of 2020.

Compared with Q1 2019, it has achieved 45.0% growth in its domestic room nights sold, with more than 70.0% growth in lower-tier cities, around 20.0% increase in domestic air ticketing volume, and nearly 150.0% increase in bus ticketing volume.

Its total GMV increased by 83.0% year-on-year to RMB33.3 billion.

The adjusted EBITDA increased by 162.7% year-to-year to RMB417.4 million from RMB158.9 million in the same period of 2020. Adjusted EBITDA margin increased from 15.8% in the same period of 2020 to 25.9%.

The adjusted profit for the period increased by 279.5% year-to-year to RMB296.3 million from RMB78.1 million in the same period of 2020. The adjusted net margin increased from 7.8% in the same period of 2020 to 18.4%.

Tongcheng-Elong cooperated with short video platforms to promote its hotel and tourist attraction products. Besides, it has commenced cooperation with a leading e-commerce platform in China by providing its travel-related products and services on the platform, to explore new traffic sources and further penetrate into lower-tier cities market.

It also cooperated with hotels to set up QR code scanning function to convert traffic from offline to its WeChat mini-program.

]]>

Tongcheng-eLong’s average MPUs increased by 21.5% year-to-year from 22.3 million in Q4 2018 to 27.1 million in Q4 2019.

Its revenue increased by 24.4% year-to-year to RMB1,956.5 million in Q4 2019. And, the adjusted EBITDA increased by 47.7% year-to-year to RMB415.1 million. Adjusted EBITDA margin increased from 17.9% YoY to 21.2%.

The adjusted profit for Q4 2019 increased by 67.7% year-to-year to RMB 331.1 million in Q4 2019. The adjusted net margin increased from 12.6% in Q4 2018 to 16.9%.

In 2019, the average MAUs of Tongcheng-eLong increased by 17.1% year-to-year from 175.2 million in 2018 to 205.2 million. And, the average MPUs increased by 34.5% year-to-year from 20.0 million in 2018 to 26.9 million.

The total GMV grew by 26.3% to 166.1 billion yuan in 2019. eLong’s paying ratios also increased from 11.4% in 2018 to 13.1% in 2019.

In 2019, Tongcheng-eLong’s total revenue increased by 21.4% from RMB 6,090.8 million in 2018 to RMB7,392.9 million in 2019.

Adjusted profit for the year increased by 35.4% from RMB1,140.7 million in 2018 to RMB1,544.3 million in 2019 and adjusted net margin for the year was 20.9% in 2019, representing an increase from 18.7% in 2018.

As of December 31, 2019, approximately 85.6% of its registered users resided in non-first-tier cities in China. About 62.4% of newly acquired paying users in WeChat were from tier-3 or lower-tier cities in China, which increased from 61.1% over the same period of 2018.

Currently, WeChat users can access its mini program within the WeChat ecosystem through:

1. WeChat Pay (Wallet) portal and a drop-down list of users’ favorite or most frequently used mini programs, which generated an average MAUs of 113.6 million in 2019, accounting for 65.7% of the total average MAUs of its Tencent-based platforms.

2. Interactive advertisements placed on the Tencent-based platforms, which generated an average MAUs of 37.7 million in 2019, accounting for 21.9% of the total average MAUs of its Tencent-based platforms.

3. The sharing and search functions in WeChat, which generated an average MAUs of 21.5 million in 2019, accounting for 12.4% of the total average MAUs of its Tencent-based platforms.

In addition, the average MAUs in its native apps recorded a faster growth than that in WeChat channel in the second half of 2019, mainly due to the expanding investments in marketing and R&D resources.

As of December 31, 2019, Tongcheng-eLong online platforms offered over 6,800 domestic routes and around 1.4 million international routes operated by more than 400 domestic and international airlines, over 2.0 million hotels selections and alternative accommodation options, approximately 346,000 bus routes, over 500 ferry routes and approximately 8,000 domestic tourist attractions ticketing services.

It has launched an accommodation upgrade service “WeChat Payment Point” with Tencent and an online seat selection service for international flights with China Southern Airlines with the implementation of NDC technology.

For the first quarter of 2020, it expects net revenue to decrease by about 42% to 47% year over year due to COVID-19.

In the first quarter and the whole year of 2020, the number of domestic tourists will decrease by 56% and 15.5% respectively according to China Tourism Academy. 2020 will see a decrease of 932 million person-trips. See the forecast here.

]]>

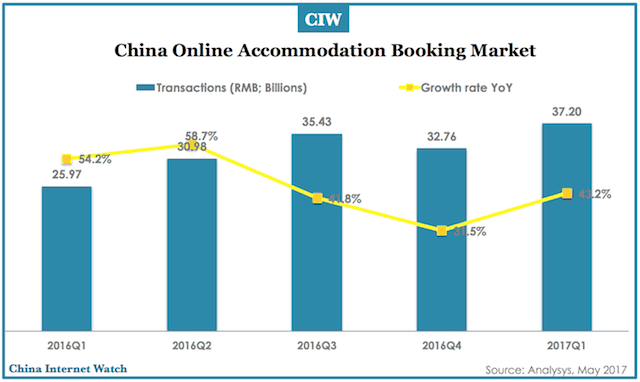

The transactions of China online accommodation market totaled 37.202 billion yuan in Q1 2017 with an increase of 43.24% YoY according to data from Analysis.

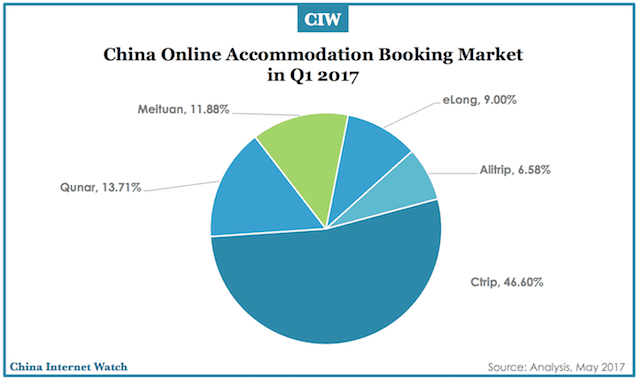

Ctrip leads the market with 46.6% market share, followed by Qunar, Meituan, eLong, and Alitrip.

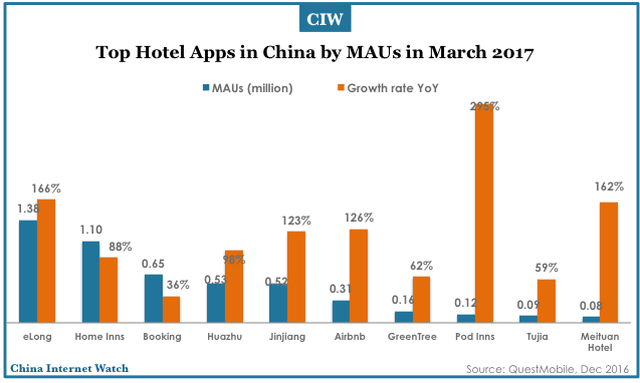

eLong, Home Inns, and Booking lead China’s mobile hotel booking apps market in March 2017. eLong and Home Inns both recorded over one million monthly active users. Airbnb also ranks the sixth with 126% growth YoY.

The MAU of China hotel service mobile apps is 4.35 million with a decrease of 25.9% YoY in March 2017. The majority of users (over 50%) in this mobile app category are 30 years-old or younger. The top three by growth rates are Pod Inns, eLong, and Meituan Hotel.

]]>

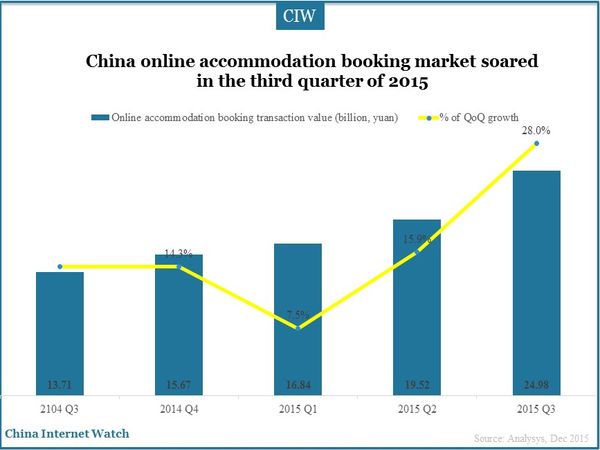

China’s online accommodation booking market reached 24.983 billion yuan (US$3.89 billion) representing a QoQ growth of 27.98% and YoY growth of 82.16% in the third quarter of 2015 according to Analysys.

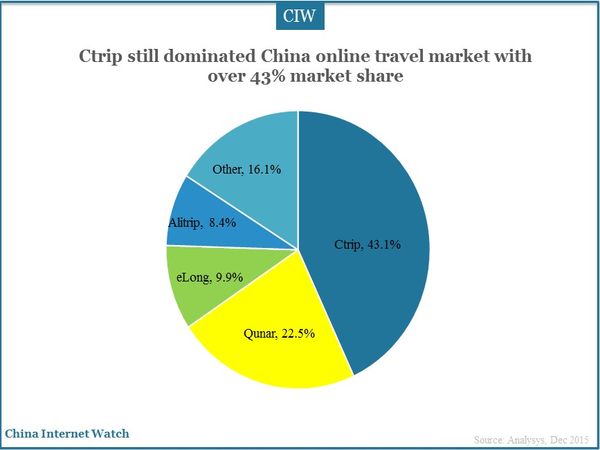

China’s online travel market reached 122.23 billion yuan (US$19.07 billion) with an increase of 18.0% QoQ and 45.9% YoY in the third quarter of 2015 according to iResearch. The OTA market in China reached 5.96 billion yuan (US$0.93 billion) in Q3 2015 with an increase of 48.8% compared to the same period last year, led by Ctrip and eLong.

The online accommodation market maintained a rapid growth in the third quarter of 2015 under the constant promotions of China’s online accommodation and online travel agencies. Overall transactions of online travel market totaled US$19.07 billion in the third quarter and the OTA market in China gained US$0.93 billion.

Ctrip reached revenues of 10.762 billion yuan (US$1.68 billion) with 43.08% market share. Transaction values of Qunar were 5.63 billion yuan (US$0.88 billion) accounting for 22.54% online accommodation booking market. Ctrip, Qunar, eLong and Alitrip combined account for almost 85% total market share, 4.14 percentage points higher compared to the previous quarter.

Continue reading on China online travel booking users in Q3 2015 here.

China’s online accommodation booking companies have attempted in exploring more effective cooperation modes and integration methods between the online and offline. By an increasing number of China’s tourists and promotion of industrial chains, the online accommodation booking market in China will continue to grow in the future.

Also read: China Short-term Accommodation Market Overview 2015

]]>

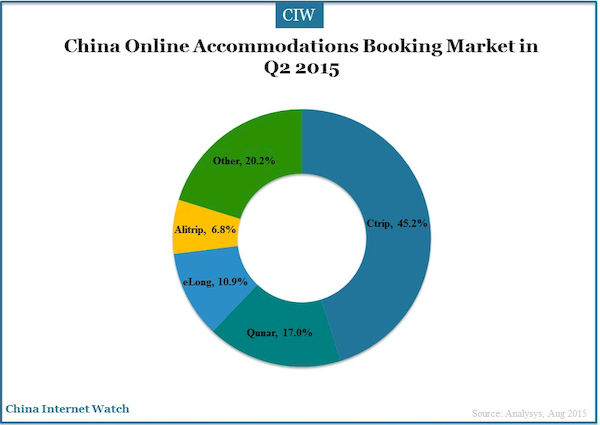

In Q2 2015, China’s online accommodations booking market reached 19.52 billion yuan (US$3.09 billion), with an increase of 15.9% QoQ and 63.5% YoY.

China’s online accommodations booking competition remained fierce among the several companies. Ctrip led the market with the transaction volume of 8.81 billion yuan (US$1.42 billion), followed by Qunar, with 3.31 billion yuan (US$0.53 billion). Ctrip had 45.15% market share; Qunar 16.9%.

In Q2 2015, Ctrip acquired eLong in May; and Alitrip built the hotel backend service by the cooperation with Ant Financial. The first four vendors made up 79.8% of the whole market. According to Ctrip, in Q2 2015 it reached US$100 million in operating profit which was the first positive quarter after long-term losses and was the only one vendor gaining profits.

Also read: China Online Vacation Market in Q1 2015

]]>

Ctrip announced its investment in eLong last Friday through acquiring eLong shares from certain selling shareholders, including Expedia together with several other investors. Ctrip acquired a 37.6% equity stake in eLong for a total purchase price of approximately $400 million.

Ctrip and Expedia have agreed to cooperate with each other to allow their respective customers to benefit from certain travel product offerings for specified geographic markets.

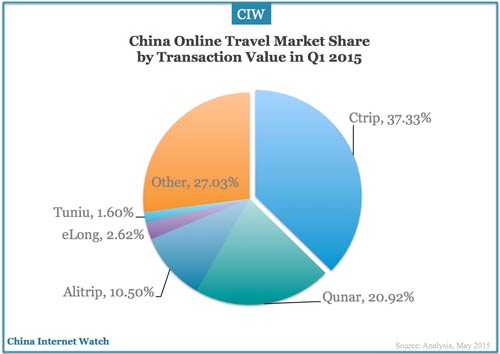

Ctrip has about 37% market share in China online travel market by total transaction value while eLong has about 2.6% in Q1 2015 according to Chinese research company Analysis.

Ctrip’s net revenues were RMB2.3 billion (US$373 million) for the first quarter of 2015, up 46% year-on-year, 82% of which came from accommodation reservation (US$154 million) and transportation ticketing (US$153 million) according to its Q1 finance results.

It suffered net Loss of RMB126 million (US$20 million) in Q1 2015, compared to net income attributable to Ctrip’s shareholders of RMB115 million (US$19 million) in Q1 2014.

Also read: China Outbound Travelers Spent Close to $500B Overseas in 2014

]]>

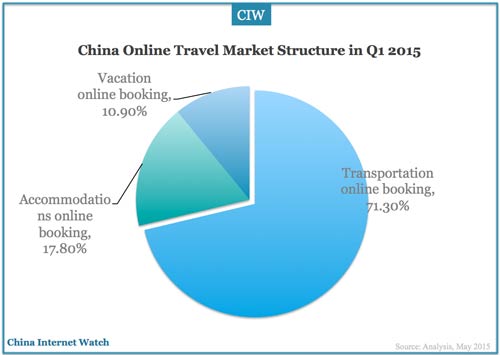

The total transactions of China online travel market reached 94.76 billion yuan (USD 15.28 billion) in Q1 2015, an increase of 51.3% YoY or 9.4% QoQ.

Offers from China online travel providers such as Ctrip and Qunar have extended to provide more on “things to do” in travel destinations. China online trave providers have also expanded to provide lifestyle offers such as food delivery, movie ticketing and car renting.

Ctrip and Qunar in total accounted for over half of China’s online travel market by total transaction values. Alitrip, Alibaba’s ambition in China online travel market only launched in October 2014, already grabbed over 10% of China’s online travel market.

71.3% of China online travel market transactions came from transportation online booking.

Also read: China Outbound Travelers Spent Close to $500B Overseas in 2014

]]>

eLong’s hotel room nights stayed in the fourth quarter of 2014 increased 27% to 9.4 million room nights compared to 7.4 million in Q4 2013 according to eLong unaudited financial results.

Mobile bookings comprised approximately 55% of eLong brand room nights, excluding room nights from non-eLong brand distribution partners and resellers, in the fourth quarter; and the cumulative downloads of eLong mobile apps reached 132 million.

Domestic hotel coverage network expanded 186% to over 200,000 domestic hotels as of December 31, 2014, compared to 70,000 as of December 31, 2013.

More than 28,000 properties have contracted to use the free, cloud-based, multi-device hotel property management systems, Yunzhanggui and Zhuzhe, produced by eLong investee companies.

eLong Business Results in Q4 2014

Total Revenues

Total revenues by product for the fourth quarter of 2014 as compared to the same period in 2013 were as follows (in RMB million):

|

Q4 2014 |

% |

Q4 2013 |

% |

Y/Y |

||||||

|

Total |

Total |

Growth |

||||||||

|

Hotel reservations |

210.1 |

79% |

224.4 |

80% |

(6%) |

|||||

|

Air ticketing |

28.2 |

11% |

32.5 |

12% |

(13%) |

|||||

|

Other |

27.1 |

10% |

23.5 |

8% |

15% |

|||||

|

Total revenues |

265.4 |

100% |

280.4 |

100% |

(5%) |

eLong net revenues for the fourth quarter decreased 6% to RMB246.2 million (US$39.7 million), compared to RMB261.0 million(US$43.1 million) in the fourth quarter of 2013.

Hotel Reservations

Hotel revenue decreased 6% in the fourth quarter of 2014 compared to the same period in 2013, primarily due to lower hotel revenue per room night, partially offset by higher volume. Room nights stayed in the fourth quarter increased 27% year-on-year to 9.4 million, and hotel revenue per room night decreased due to the growth of our coupon program and lower commission rate hotel room nights for which we recognize revenues on a net basis, partially offset by the growth of prepurchased hotel room night transactions for which we recognize revenues on a gross basis. Hotel revenue comprised 79% of total revenues, compared to 80% in the prior year quarter.

Air Ticketing

Air tickets booking segments increased to 1.0 million in the fourth quarter, an increase 23% compared to the prior year period. eLong air revenue decreased 13% in the fourth quarter, primarily due to a decrease in air revenue per segment. Air revenue decreased to 11% of total revenues from 12% in the prior year quarter.

Highlights of eLong’s performance in 2014

Total revenues by product for the full year 2014 as compared to 2013 were as follows (in RMB million):

|

2014 |

% |

2013 |

% |

Y/Y |

||||||

|

Total |

Total |

Growth |

||||||||

|

Hotel reservations |

938.8 |

81% |

858.2 |

80% |

9% |

|||||

|

Air ticketing |

125.4 |

11% |

135.0 |

12% |

(7%) |

|||||

|

Other |

99.9 |

8% |

85.9 |

8% |

16% |

|||||

|

Total revenues |

1,164.1 |

100% |

1,079.1 |

100% |

8% |

|||||

- Hotel room nights stayed in 2014 increased 32% to 34.2 million room nights compared to 25.8 million in 2013.

- Hotel revenue in 2014 increased 9% to RMB938.8 million (US$151.3 million), compared to RMB858.2 million (US$141.8 million) in 2013.

- Net revenues in 2014 increased 8% to RMB1,086.2 million (US$175.1 million), compared to RMB1,009.7 million (US$166.8 million) in 2013.

- Air segments increased 8% to 3.3 million for the full year 2014. Air revenue for the full year 2014 decreased 7%, primarily due to a 14% decrease in air revenue per segment. Air revenue decreased to 11% of total revenues from 12% in the prior year.

Our mobile lodging transactions have surpassed 100,000 per day on peak days; and our lodging network has grown to more than 200,000 properties in China and more than 400,000 properties worldwide. Facing fierce competition, we are innovating more quickly and investing more in our products, technology and people than at any time in our history. We will continue to invest in order to accelerate our growth in 2015

said Guangfu Cui, Chief Executive Officer of eLong.

]]>

Sootoo.com estimated that the total transaction value of China online travel market would be RMB76.92 billion (US$12.52 billion) with increase of 35.2% YoY and 5.9% QoQ in Q4 2014. China’s core online travel enterprises are making attractive promotions to compete for the market share which stimulates people’s travel needs.

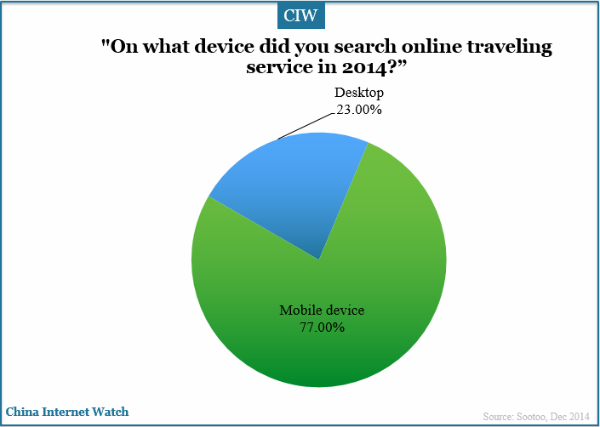

77% online travelers would search online travel service on mobile device which indicated there is great potential in mobile travel market. More and more users accept booking system for air-ticket, hotel and scenic attraction ticket on mobile device. According to Tencent’s research, 57% Chinese made travel booking online.

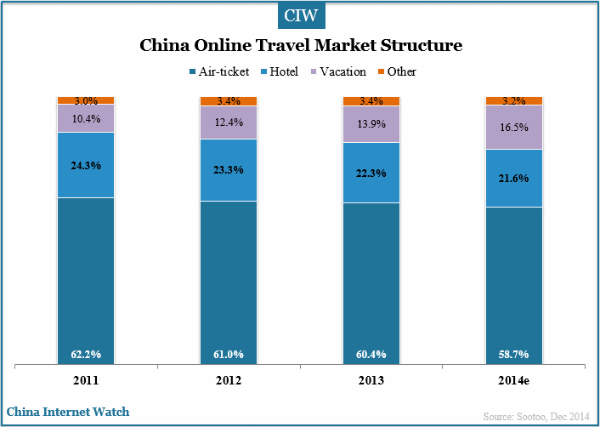

The major revenue of China online travel market is from air-ticket and the data shows the revenue had decreased by 1.7% in 2014. Revenue from hotel booking service decreased by 0.7% mainly due to fewer promotions for hotel booking. Chinese young group tend to travel as they like stimulates the need for online vacation market in 2014.

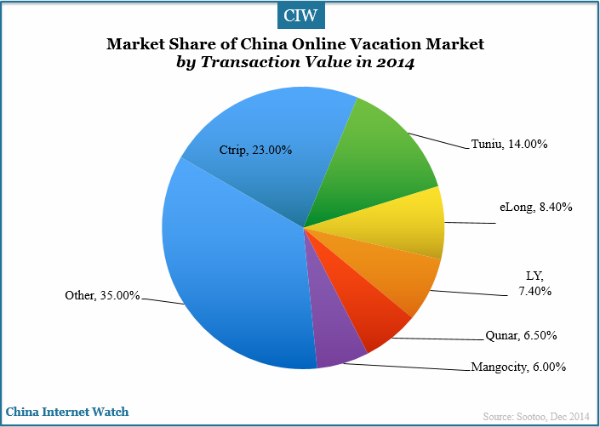

Ctrip, as one of the earliest brand in China online vacation market. represented 23% market share, ranking top, followed by Tuniu and eLong in 2014.

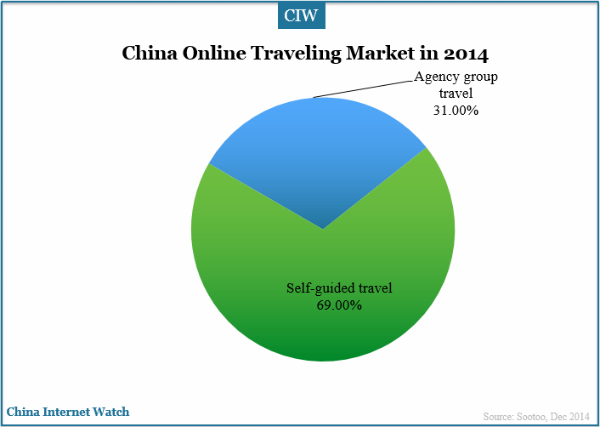

Self-guided travel accounted for 69% in China vacation market while agency group travel accounted for 31% in 2014. Agency group travel is more suitable for middle aged and the elderly while self-guided travel is now powerful in China online travel market.

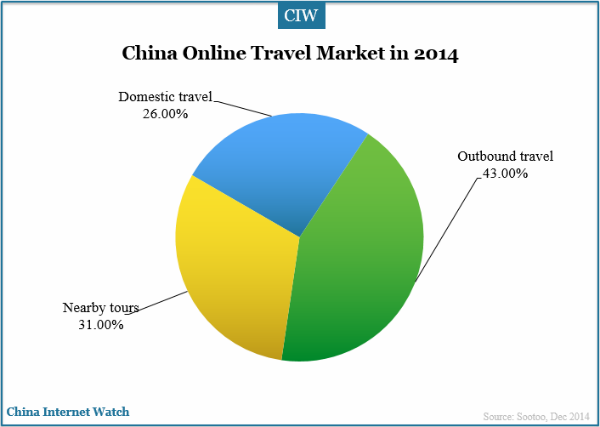

In 2014, outbound tourism was the major part in China online travel market, representing 43%, followed by nearby tour (31%) and domestic travel (26%). Nearby tour although had low consumption, its users now are growing rapidly with high consumption frequency which indicates it will gradually become the first choice to travel on weekends.

70% rural residents in China would like to go traveling and Beijing is the first choice for them according to China Tourism Industry Report in 2014 released by China Tourism Academy.

Also read: China Online Traveling UGC Users to Exceed 360M in 2015

]]>

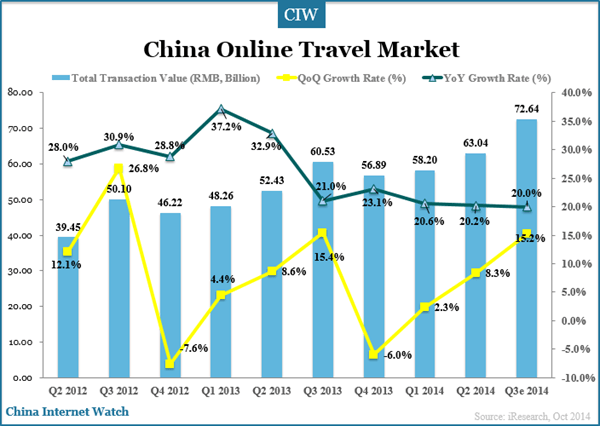

In Q3 2014, total transaction value of China online travel market exceeded RMB72.64 billion ($11.87 billion) with increase of 15.2% quarter on quarter and 20% year on year.

Chinese travelers’ increasing passion for outbound tourism and nearby travel stimulated China online vacation market which made its transaction value increase by 23.5% YoY in Q3 2014. There were also fierce competition among China’s core OTA enterprises which provides travelers better travel options.

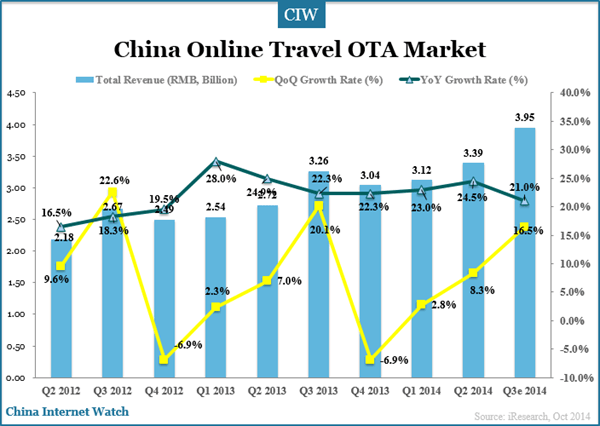

iResearch’s latest data shows total revenue of China online travel OTA market was RMB3.95 billion ($645.9 million) with an increase of 21% YoY. In China online travel OTA market, air-ticket, hotel and vacation service had different performance in Q3 2014.

Air-ticket

Airlines shrank commission of some online travel agencies which also had influence on Ctrip. The revenue from air-tickets increased by 16.9% YoY.

Hotel

China’s core online travel agencies fought for traffic on mobile devices. Chinese travelers favor lodges more than before and revenue from hotel had slow growth.

Vacation Service

Tickets price war stimulated area tourism and outbound tourism. Overall, revenue from vacation service was growing steadily.

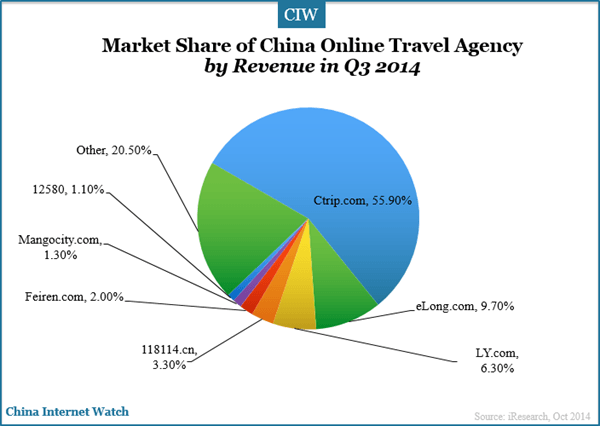

In China online travel OTA market, the revenue of Ctrip, eLong and LY accounted for 55.9%, 9.7% and 6.3% respectively in Q3 2014. The total market share of these three enterprises by revenue accounted for almost 72% in OTA market.

]]>

eLong revenue by product for Q3 2014 was 323.5 million yuan, an increase of 100% QoQ and 2% YoY according to its unaudited financial results.

Hotel room nights stayed in the third quarter increased 22% to 9.4 million room nights compared to 7.7 million in the prior year period. Hotel commission revenue for the third quarter increased 6% to RMB269.8 million (US$44.0 million), compared to RMB255.2 million (US$41.7 million) in the third quarter of 2013.

eLong’s net revenues for the third quarter increased 2% to RMB301.5 million (US$49.1 million), compared to RMB296.9 million (US$48.5 million) in the third quarter of 2013. Total revenues for the third quarter increased to RMB323.5 million (US$52.7 million).

eLong mobile bookings comprised 48% of eLong brand room nights, and cumulative downloads of eLong mobile apps reached the 100 million milestone, in the third quarter.

More than 20,000 properties have contracted to use the free, cloud-based, multi-device hotel property management systems, Yunzhanggui and Zhuzhe, produced by eLong investee companies, compared to over 10,000 in the second quarter.

Our mobile lodging transactions have now surpassed 100,000 per day on peak days during holiday periods; and our lodging network has grown to more than 155,000 properties in China and over 365,000 properties worldwide. Every day our mobile applications provide real savings to our customers with tens of thousands of discounted lodging products, including pre-paid, flash sale and last minute products,

said Guangfu Cui, Chief Executive Officer of eLong.

eLong’s total revenues by product for the third quarter of 2014 as compared to the same period in 2013 were as follows (in RMB million):

|

Q3 2014 |

% |

Q3 2013 |

% |

Y/Y |

||||||

|

Total |

Total |

Growth |

||||||||

|

Hotel reservations |

269.8 |

84% |

255.2 |

81% |

6% |

|||||

|

Air ticketing |

26.6 |

8% |

35.2 |

11% |

(24%) |

|||||

|

Other |

27.1 |

8% |

25.6 |

8% |

6% |

|||||

|

Total revenues |

323.5 |

100% |

316.0 |

100% |

2% |

Air ticketing commission revenue decreased 24% in the third quarter of 2014 compared to the prior year quarter, due to a 21% decrease in commission per segment and a 4% decrease in air segments. Decline in commission per segment was primarily due to the lowering by major Chinese airlines of the base air commission rate from 3% to 2% in July 2014. Air ticketing commission revenue decreased to 8% of total revenues from 11% in the prior year quarter.

eLong gross margin in the third quarter of 2014 was 70%, compared to 75% in the third quarter of 2013. Gross margin decline was primarily due to a decrease in hotel commission revenue per room night.

eLong operating expenses for the third quarter of 2014 as compared to the same period in 2013 were as follows (in RMB million):

|

Q3 2014 |

% of Net Revenue |

Q3 2013 |

% of Net Revenue |

Y/Y Growth |

||||||

|

Service development |

73.7 |

25% |

48.3 |

16% |

53% |

|||||

|

Sales and marketing |

178.9 |

59% |

211.7 |

72% |

(16%) |

|||||

|

General and administrative |

37.4 |

12% |

20.5 |

7% |

82% |

|||||

|

Amortization of intangible assets |

1.5 |

– |

0.9 |

– |

61% |

|||||

|

Total operating expenses |

291.5 |

96% |

281.4 |

95% |

4% |

Total operating expenses increased 4% for the third quarter of 2014 compared to the third quarter of 2013. Total operating expenses increased to 96% of net revenues in the third quarter of 2014 from 95% in the prior year quarter. Operating loss wasRMB79.5 million in the third quarter of 2014 compared to operating loss of RMB57.9 million in the prior year quarter.

Net loss for the third quarter of 2014 was RMB58.3 million, compared to net loss of RMB50.4 million during the prior year quarter.

eLong currently expects net revenues for the fourth quarter of 2014 to be within the range of a decline of 20% to an increase of 10% compared to the fourth quarter of 2013.

Read more: Guest Satisfaction Research of China Hotels

]]>

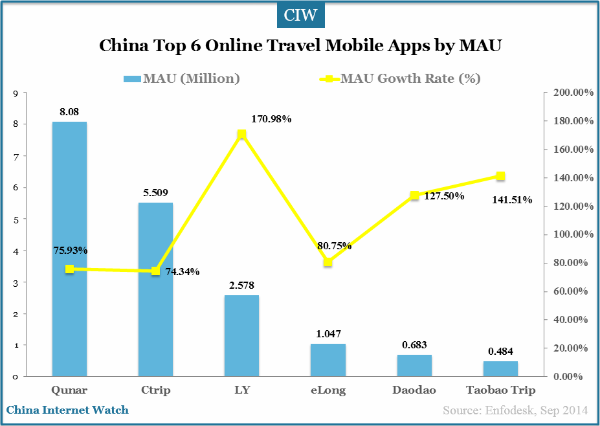

Qunar’s mobile app exceeded 8 million MAUs in August 2014 in China according to EnfoDesk, remaining the most popular mobile online travel app, followed by that of Ctrip, LY, eLong, Daodao and Taobao Trip.

The number of Ctrip Mobile App downloads has reached 200 million in Q2 2014 in China. On Android platforms alone, Qunar Travel apps had reached 105.716 million times by May 2014 being the first travel app exceeding 100 million downloads.

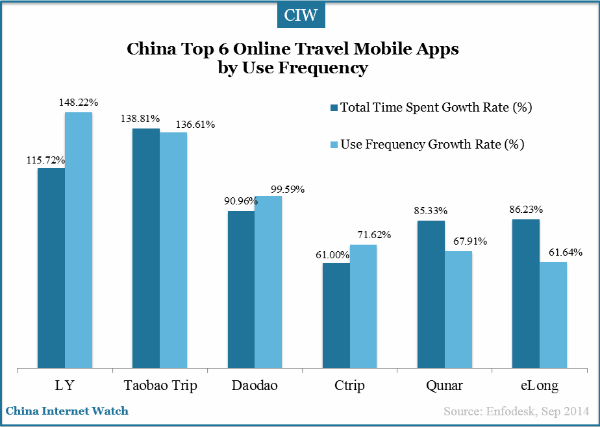

China top 6 online travel mobile apps all had rapid use frequency growth rate , especially the one from LY.com who had 148.22% growth rate in total use frequency growth rate in August 2014.

]]>

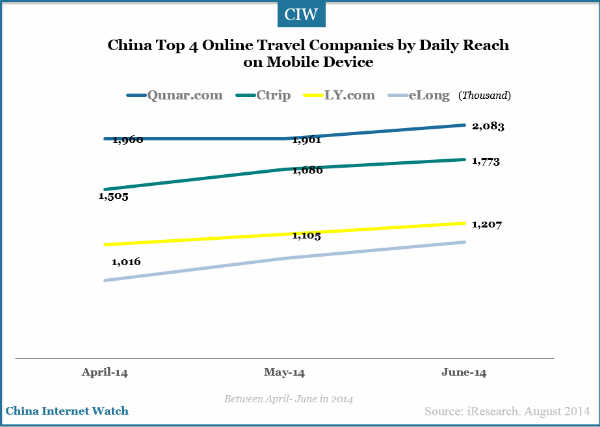

China’s traveling industry is booming these years. With various choices of travel companies, Chinese people are more enthusiastic about traveling ever than before. Among all online travel companies in China, Qunar.com, Ctrip, eLong and LY.com are the most popular ones by total number of reached users nowadays.

Qunar’s daily reach on mobile device exceeded 2 million in China online travel industry in June 2014, which made it top online travel company by mobile reach from April to June 2014, followed by Ctrip, LY.com and eLong according to data from iResearch.

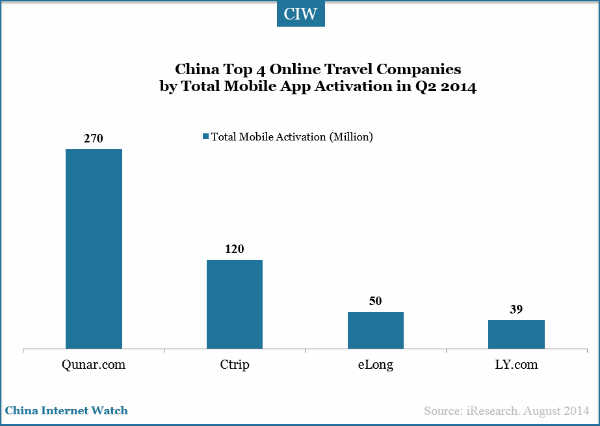

Qunar.com total revenues for the second quarter of 2014 were RMB400.4 million (US$64.5 million), an increase of 127.3% year-on-year; the number of total mobile app activation exceeded 270 million, which was much bigger than the number of any other online travel company in China.

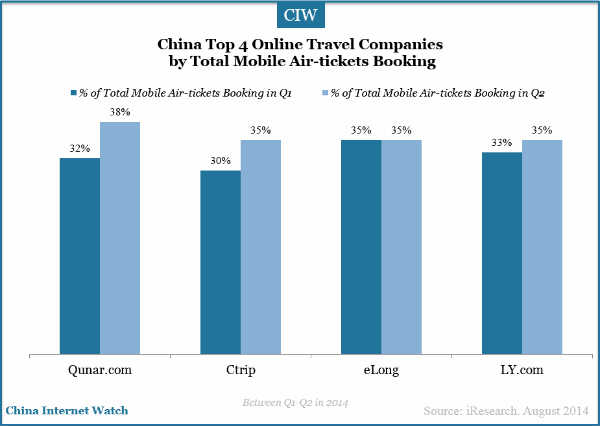

Most of the online travel companies had increased total number of air-tickets booking on mobile device in Q1 and Q2 2014. And Qunar.com accounted for 38% of air tickets booking in Q2 2014, which had a great growth rate from prior quarter in 2014.

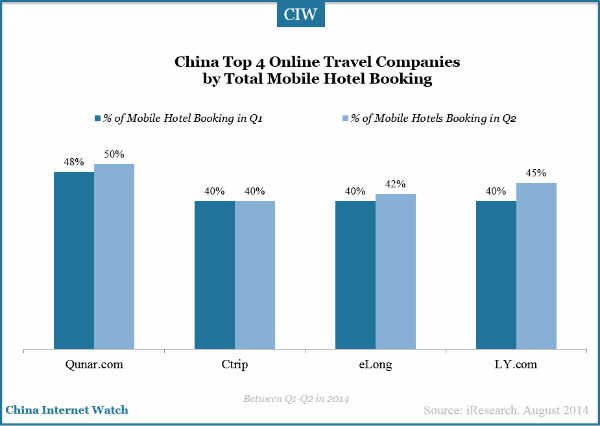

The rate of hotel booking on mobile device of online travel companies was over 40% which shows online travel company can stimulate hotel ‘s development.

]]>Hotel commission revenue for the second quarter increased 28% to RMB254.1 million (US$41.0 million), compared to RMB198.6 million (US$32.4 million) in the second quarter of 2013.

Net revenues for the second quarter increased 25% to RMB292.4 million (US$47.1 million), compared to RMB234.3 million (US$38.2 million) in the second quarter of 2013. Total revenues for the second quarter increased to RMB312.4 million (US$50.4 million).

Mobile bookings comprised 45% of eLong brand room nights in the second quarter. Cumulative downloads of eLong mobile apps now exceed 80 million.

In the second quarter, our lodging network grew to 120,000 contracted properties in China and nearly 325,000 properties worldwide. Every day our mobile applications provide real savings to our customers with tens of thousands of discounted lodging products, including pre-paid, flash sale, last minute and groupbuy products. With our broad range of accommodations products and attractive discounts, mobile has now become our largest booking channel, surpassing 60,000 transactions on peak days,

said Guangfu Cui, Chief Executive Officer of eLong.

eLong expects net revenues for the third quarter of 2014 to increase by 10% to 20% compared to the third quarter of 2013.

]]>

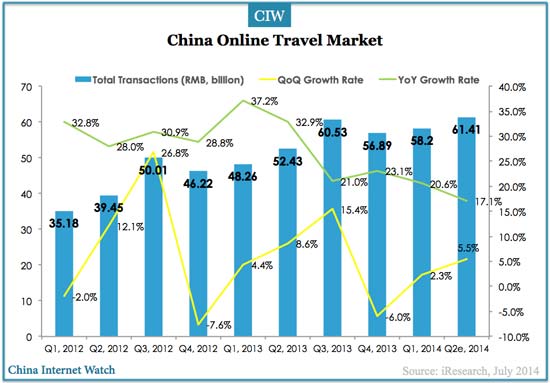

China online travel OTA market transactions reached RMB61.41 billion (US$9.94 billion) with a YoY growth rate of 17.1%; total revenue reached RMB 3.24 billion (US$520 million), a YoY increase of 19%.

Ctrip still dominates China’s online travel OTA market with 54.2% market share whose mobile application has been downloaded more than 160 million, followed by eLong and LY.com:

Also read: Chinese Women’s Travel Willingness Report in 2014

China Tourism Academy estimates total revenue generated from China’s travel industry is going to reach RMB 3.3 trillion (USD 530 billion) this year with 3.76 billion person trips.

Business travel in Asia Pacific, led by a dominant China, outpaces the rest of the world, according to the GBTA Foundation.

China online travel is a very competitive market; e-commerce giant Alibaba is also laying out its strategy through Taobao and Alipay.

Also read: Top 12 Most Interested Topics of Chinese Online Travellers

]]>

On Android platforms alone, Qunar Travel apps had reached 105.716 million times by this May being the first travel app exceeding 100 million downloads according to Jinlv Consulting, a research and consultancy firm for travel industry.

Qunar mobile client ranked the best travel booking app by total number of monthly active users (5.077 million), according to recent data from Analysis International, followed by Ctrip Travel (3.304 million), LY.com travel app (723 thousand), and eLong (702 thousand).

According to Yeepay, an online payment solution provider in China, 98% of mobile travelers used mobile payment.

With the deepening development of the online travel industry, increasingly sophisticated mobile client features, more consumers feel more and more at the time of traveling and enjoying the convenience of “Wireless Reservations”. At the same time, the industry giants have continued to launch wireless client promotions; “cheap + easy” is prompting tourists travel booking quickly shifting to the wireless client.

]]>

Early in the morning on April 10, 2014, Elong’s staff received an email from CEO announcing the strategic cooperation with 17u.

Baidu’s recent purchase in Ctrip’s shares aroused a great disturbance in the OTA industry, after all Ctrip and Qunar’s market share accounted for 33.9% and 22.1% respectively. The joint of Ctrip and Qunar would control about half of the billion dollar market.

The actual merge of Ctrip and Qunar will take a long time, facing a lot of challenges. Therefore, the strategic cooperation between Elong and 17u will be one step ahead of Ctrip and Qunar. However, the OTA leader and the biggest vertical travel search Qunar, plus China’s biggest search engine Baidu with huge traffic resource, the merge will be invincible. The though of it quickened the cooperation of Elong and 17u.

As the second leader in OTA market, Elong chose to work with 17u backed up by Tencent. Elong’s price war with Ctrip lasted over a year cost it consecutive six quarters’ net profit loss. Data showed that in online ticket booking market, 17u remained as the number one but Ctrip rose to the third place through price war. In 2013, 17u only accounted for 2.1% hotel booking market, while cooperating with Elong which owns plenty of hotel resources seems to be a better choice.

It’s natural Elong seeks cooperation with 17u. In 2011, Tencent purchased 16% Elong’s stake with $84.4 million. 17u also accepted two investments from Tencent, the recent $500 million was the biggest financing in OTA market.

]]>

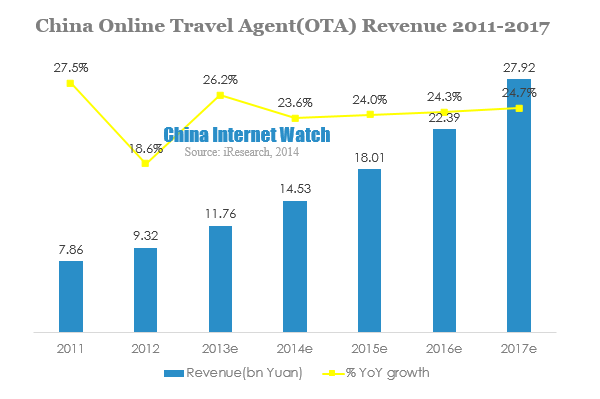

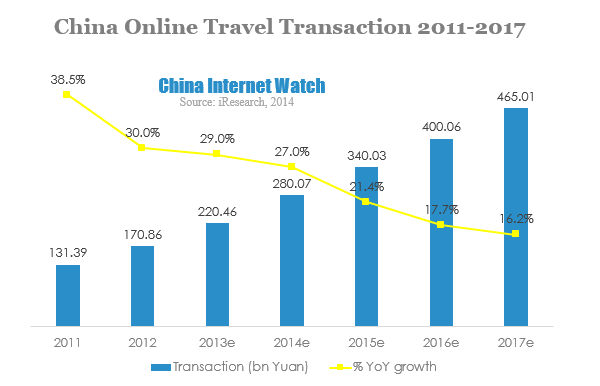

According to iResearch, China Online Travel transaction hit 220.46 billion yuan (USD 33 billion), with a 29.0% YoY growth. The revenue of China OTA (Online Travel Agency) market reached 11.76 billion yuan (USD 1.9 billion), up 26.2% compared with last year.

The compound growth rate was estimated to 20.5%, with a market size of 465.01 billion yuan (USD 76.15 billion). iResearch regarded the increasing transaction of online air ticket, hotel booking and package holidays were main causes for the growth of online travel.

As online air ticket business tended to become mature and had a high penetration in air ticket booking market, it would keep a slow growth rate in the future. In contrast, hotel booking and package holiday were expected to usher in explosive growth, affected by the rapid rise of online leisure travel. Moreover, the market share of package holiday in total online travel market increased year by year. In addition, the rise of online short-term rental, car rental and taxi booking might become new growth points of online travel market.

It’s predicted that the revenue of OTA market would maintain a steady growth of over 20% from 2014 to 2017.

Influenced by the extensive price war in the industry, the growth rate of OTA market was lower than the whole online travel market in 2013. Since Q3 2013, OTA companies represented by Ctrip and eLong launched a price war on mobile client. They increased promotion effort by more cash rebate and frequent promotion activities to capture market share. The price war led to commissions of hotel booking and air ticket decline directly. It’s predicted by iResearch that the price war targeted mobile travel and other segments would last, but in the long run, the revenue of OTA market would keep a strong growth.

The Tourism Law created a big impact on traditional offline travel agencies since published in Oct 2013. Because of the price transparency and product diversity advantages of OTA, tourists tended to shift from offline to online. Now OTA companies began entering the online package holiday market based on their advantages.

In the mean time, the yearlong price war escalated rather than slowed down at the end of 2013, owing to Double 12, a new tourism festival created for promotion. In Dec 2013, Ctrip set up a new division to develop ticket service of scenic spots. The competition between Ctrip and other leading OTAs in ticket market would intensify in the coming year.

The trend of mobile internet had changed almost every internet service business; to be the top, you just need to seize the mobile market. It’s the consensus in the online travel industry. The mobile travel market and travel apps were favored by investors. Online travel distribution giants increased mobile business input, and performed well in mobile travel market. The status of mobile travel was upgrading and becoming the core channel of travel booking.

]]>