CIW Dossier China Digital Insights (DCDI) is compiled to provide statistical information about China digital insights on the internet economy, digital trends, online users, mobile apps, and e-commerce. Click here to download.

Archive

E-commerce Market

Jul 2021

CIW Dossier “China E-Commerce” is compiled to provide statistical information about China’s e-commerce market including online retail, cross-border e-commerce, e-commerce users, and mobile shopping apps. If you need an overall insight into China’s e-commerce market, this is what you should read.

China 618 Shopping Festival

Jun 2021

CIW Dossier “China 618 Shopping Festival” provides a perspective of the merchants regarding the performance, advertising budget, and sales expectations from the top e-commerce platforms for 618 shopping festival.

China Social E-Commerce

Apr 2021

CIW Dossier “China Social E-Commerce” is compiled to provide four business models and statistical information about China’s social e-commerce market. Four social e-commerce models: group buying, membership, community-based, content-driven.

China Pets Retail Market

Jan 2021

CIW Dossier on China Pets Market provides an overview of China’s pet retail market as long as the characteristics of internet users in the corresponding segment.

Double 11 (Singles Day)

Nov 2020

CIW Dossier Double 11 is compiled to provide statistical information about China’s largest shopping festival led by Alibaba Tmall platform including pre-sale data, top retailers’ performance by GMV, and top brands on Double 11 by categories, etc.

Payment

Oct 2020

CIW Dossier Payment is compiled to provide statistical information about China’s payment market on online payment, mobile payment, third-party mobile payment, and users’ preference for payment method in different usage scenarios. If you need an overall insight on China’s payment market, this is what you should read.

Top Mobile Apps

Jun 2020

China’s mobile apps market, including mobile internet overview, mobile apps market, top mobile apps, select mobile apps, and mini programs.

Taobao Live

Apr 2020

CIW Dossier Taobao Live – is compiled to provide statistical information about Alibaba’s live streaming platform.

China Outbound Tourism

Nov 2019

Statistical information about China’s outbound travel market.

China Online Travel Market

Nov 2019

CIW Dossier China Online Travel Market is compiled to provide statistical information about China’s online travel market including market overview, online air ticket booking, online accommodation booking, online vacation booking, outbound travel, and high-end travel.

China Media Ad Spending

Feb 2019

China’s overall media advertising market growth and the top advertisers in China in 2018.

Luckin

June 2019

Luckin is China’s second largest and fastest-growing coffee network, in terms of the number of stores and cups of coffee sold, according to the Frost & Sullivan Report. While operating three types of stores, Luckin strategically focus on pick-up stores, which accounted for 91.3% of their total stores as of March 31, 2019.

China Internet Users in Tier-3 to Tier-5 Cities

Jun 2019

Quick view of China’s internet users’ time usage and expenditure in lower-tier cities (tier-3, 4, 5).

WeChat Official Account

July 2019

CIW Dossier “WeChat Official Account” is compiled to provide a quick view of Tencent’s WeChat content ecosystem Official Account.

Cross-border E-Commerce Female Shoppers

Jan 2019

Statistical overview of China’s female shoppers purchasing overseas consumers goods.

China Advertising Market

Dec 2018

Statistical information about China’s advertising market on traditional advertising market, online advertising market, invalid traffic of digital ads, and mobile e-commerce ads. If you need an overall insight on China’s advertising market, this is what you should read.

China Smartphone

Dec 2018

CIW Dossier China Smartphones is compiled to provide statistical information about China’s smartphone market including smartphone shipments, sales, and market share information as well as top smartphone brands and user profiles.

Weibo Online Shoppers

Nov 2018

CIW Dossier Weibo Online Shoppers is compiled to provide statistical information about Weibo users who are interested in online shopping. If you need an overall insight on the demographics, purchasing behavior, and engagement, etc. of Weibo online shoppers, this is what you should read.

China’s High-end Travelers

Aug 2018

CIW Dossier “China’s High-end Travelers” is compiled to provide an overview of China’s high-end travelers, including their travel choices, demographics, and travel habits.

WeChat Intro

July 2018

CIW Dossier on WeChat is compiled to provide an introduction of this digital ecosystem and statistical information about China’s top mobile social application. It provides insights on WeChat Official Accounts, WeChat Pay, Mini-Programs, and advertising channels.

Online video market

Sep 2018

CIW Dossier China Online Videos is compiled to provide statistical information about China’s online video market including online video apps, mobile video users, paid video users, short video apps, and live streaming apps. If you need an overall insight on China’s online video market, this is what you should read.

Pinduoduo (PDD)

Sep 2018

CIW Dossier Pinduoduo is compiled to provide statistical information about Pinduoduo on group purchase model, app ranking, financial performances, user profile, IPO, and counterfeit problems.

Golden Week Tourism

Oct 2018

CIW Dossier Golden Week (National Day) Tourism is compiled to provide statistical information about China’s tourism market for the peak travel period – Golden Week / China’s National Day holidays.

Sports & Fitness Mobile Apps

Nov 2018

CIW Dossier China Mobile Fitness & Sports Apps is compiled to provide statistical information about China’s sports & fitness mobile app market.

]]>

What’s this “520 day” that intrigues many in China? The term 520, an abbreviation for May 20, denotes an unofficial Valentine’s Day in China. The number “520” phonetically resembles “Wo Ai Ni” or “I Love You” in Chinese.

While February 14 remains the globally recognized Valentine’s Day, the Chinese honor their affection on several other occasions as well, including May 20 (520 Day) and the Qixi Festival. These days are regarded as Chinese versions of Valentine’s Day, with the 520-day holding special significance as it symbolizes “I Love You.”

Despite not being an official holiday, 520 Day has garnered popularity among couples and singles as an opportunity to express romantic love.

Due to the ongoing pandemic in 2020, the “520 Day” celebration witnessed changes with fewer public gatherings. Nonetheless, businesses capitalized on the festival by initiating online engagement campaigns.

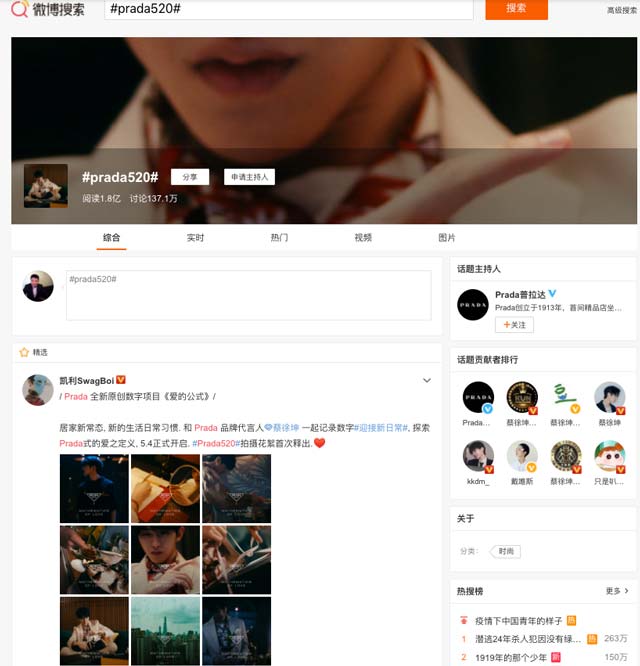

For instance, luxury brand Prada, created a campaign using the hashtag #prada520# on Weibo, one of China’s top social platforms. The campaign featured brand spokesperson Cai Xukun and garnered 180 million views as of May 5.

The “520 Day” traces its roots to Taiwanese singer Fan Xiaolan’s song “Digital Love,” where “520” symbolized “I love you.” Over time, “521” was also interpreted as “I am willing,” and “I love you” in China, earning various epithets like “Marriage Day,” “Love Expression Day,” and “Love Festival.”

These two dates, May 20 & 21, serve as annual internet Valentine’s Days in China, echoing the phrases “I (5) love (2) you (0/1)” in Chinese. While they lack historical roots, they are products of commercial promotions in the 21st century.

Despite not being official holidays, the evenings of these days see restaurants and cinemas bustling and prices surging due to Valentine’s Day celebrations.

May 20 is particularly crucial as men utilize this opportunity to express their romantic love for women, often presenting gifts or ‘hongbao.’ Some couples even choose this date for their wedding ceremony.

The difference between 520 and 521 is that the former is largely a day for women, while the latter caters to men. On May 20, men express “520” (I love you) to their significant other. The subsequent day, women reply with “521” to indicate their reciprocation of love.

For marketers in China, these days present lucrative opportunities for promotions. The rising orders of roses, surging sales of chocolates, and full-house hotels underscore the business potential of the “520-day festival.”

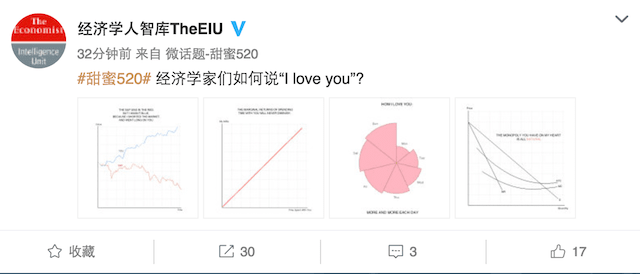

A few notable examples of this trend include the most retweeted photo on Sina Weibo on May 20, 2014, and a post by The Economist in 2017 asking “how do economists say ‘I love you’?” The topic #Sweet 520# witnessed almost 4 million discussions and over 1 billion views as of noon on May 20, 2017.

The characteristics of 520 Valentine’s Day include:

- Fashionable: “520” resonates with the younger generation who find creative ways to celebrate the day, even choosing this date for their wedding. It’s also a popular topic on WeChat Moments and QQ group chats.

- Younger: Those under 30 years old, who are quick to embrace new trends and spend much of their free time on the internet, are the primary followers of 520 day.

- Spiritual: Gifts exchanged on May 20 and 21 lean more towards the “spiritual.” It could be a coded message of love sent over the internet or mobile phone.

- Implicit: Unlike the globally recognized Valentine’s Day, which is for established couples, the 520 Internet Valentine’s Day is preferred by men and women to subtly express their love using digital codes.

5 key trends shaping the Chinese economy, accelerated by COVID-19

]]>

Total paying users of Momo live video service and value-added service, without double counting the overlap and including 3.9 million paying users of a Tinder-like app Tantan, were 12.8 million for the second quarter of 2020, compared to 11.8 million for Q2 2019, which included 3.2 million paying users of Tantan.

Tantan has been accelerating the testing of its live video service since the middle of April, and live video service revenues from Tantan were 191.7 million (US$27.1 million) in Q2 2020.

Fake fans and manipulations on China social media

Momo Financial Results

Net revenues decreased by 6.8% year over year to RMB3,868.3 million (US$547.5 million) in Q2 of 2020.

Net income attributable to Momo Inc. decreased to RMB456.4 million (US$64.6 million) in Q2 of 2020 from RMB731.8 million in the same period of 2019.

Non-GAAP net income attributable to Momo Inc. (note 1) decreased to RMB669.8 million (US$94.8 million) in Q2 of 2020, from RMB1,242.5 million in the same period of 2019.

Diluted net income per American Depositary Share (“ADS”) was RMB2.11 (US$0.30) in Q2 of 2020, compared to RMB3.33 in the same period of 2019. Non-GAAP diluted net income per ADS was RMB3.05 (US$0.43) in Q2 of 2020, compared to RMB5.60 in Q2 2019.

For the third quarter of 2020, Momo expects total net revenues to be between RMB3.7 billion to RMB3.8 billion, representing a decrease of 16.9% to 14.6% year over year.

Burberry launched its first luxury social retail store, empowered by WeChat

]]>

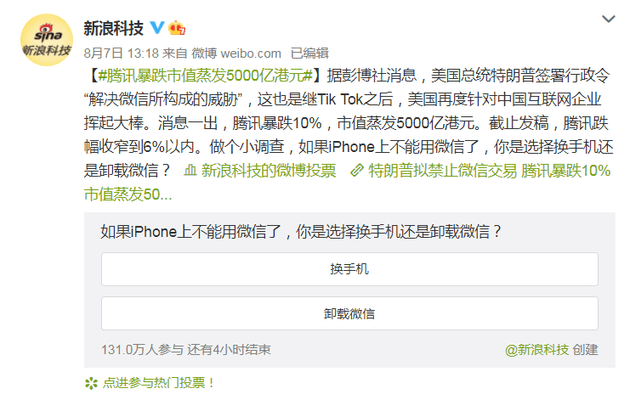

US President Donald Trump issued an executive order last week prohibiting US companies from any transaction that is related to WeChat.

Chinese consumers believe that without WeChat, the iPhone will become “expensive e-waste”. Following Trump’s executive order last week, iPhone fans across China are now rethinking their dependence on the iPhone.

More than 1.2 million users on China’s leading social platform Weibo have responded in the poll conducted by Sina Technology, a news media in China, asking users to choose between replacing the smartphone and uninstalling WeChat if WeChat can no longer be used on iPhone.

About 95% of the participants said they would rather change their smartphones than uninstallingWeChat. Trump’s ban will force many Chinese users to switch from iPhones to other brands because WeChat is so important to Chinese users.

With more than 1.2 billion monthly active users, WeChat is one of the most important applications in China. If WeChat is no longer supported, the iPhone will become useless for most Chinese users.

The scope of application of the Trump’s order is unclear. The most important thing is whether it will apply only to the U.S. territory or to the global business transactions of U.S. companies. If it is the latter, Chinese consumers will no longer buy iPhones in the future, resulting in Apple losing 30% of its global sales.

Apple has also warned the White House that Trump’s order will put the company at great risk. Disney, Ford, Intel, Morgan Stanley, UPS and Wal Mart have also informed the White House that U.S. companies may face serious consequences.

]]>Weibo’s average daily active users were 241 million in March 2020, a net addition of approximately 38 million users on year over year basis. WeChat MAU up 8% to 1.2 billion.

Weibo Financial Results in Q1 2020

For Q1 2020, Weibo’s total net revenues were $323.4 million, a decrease of 19% compared to $399.2 million for Q1 2019.

- Advertising and marketing revenues for Q1 2020 were $275.4 million, a decrease of 19% compared to $341.1 million for Q1 2019.

- Advertising and marketing revenues from key accounts (“KAs”) and small & medium-sized enterprises (“SMEs”) were $247.9 million, a decrease of 24% compared to $324.5 million for Q1 2019.

- VAS revenues for Q1 2020 were $48.0 million, a decrease of 17% year-over-year compared to $58.0 million for Q1 2019, primarily due to the decrease of revenues from live streaming business and was partially offset by the increase of membership revenues

Costs and expenses for Q1 2020 totaled $265.4 million, compared to $276.1 million for Q1 2019. Non-GAAP costs and expenses were $249.3 million, compared to $262.4 million for Q1 2019.

Income from operations for Q1 2020 was $58.0 million, compared to $123.1 million for Q1 2019. Non-GAAP income from operations was $74.1 million, compared to $136.8 million for Q1 2019.

Non-operating income for Q1 2020 was $10.0 million, compared to $48.6 million for Q1 2019. Non-operating income for Q1 2020 mainly included

- a $12.9 million net interest and other income;

- a $2.9 million net loss on the sale of investments and fair value changes on investments, which is excluded under non-GAAP measures.

Income tax expenses were $15.9 million, compared to $21.1 million for Q1 2019. The decrease was primarily resulted from reduced earnings and was partially offset by the estimated increase of effective tax rate for China operations primarily due to the expiration of the preferential tax treatment of one of the Weibo’s PRC subsidiaries in 2020.

Net income attributable to Weibo for Q1 2020 was $52.1 million, compared to $150.4 million for Q1 2019. Diluted net income per share attributable to Weibo for Q1 2020 was $0.23, compared to $0.66 for Q1 2019.

Non-GAAP net income attributable to Weibo for Q1 2020 was $67.4 million, compared to $128.5 million for Q1 2019. Non-GAAP diluted net income per share attributable to Weibo for Q1 2020 was $0.30, compared to $0.56 for Q1 2019.

As of March 31, 2020, Weibo’s cash, cash equivalents, and short-term investments totaled $2.35 billion. for Q1 2020, cash provided by operating activities was $63.6 million, capital expenditures totaled $7.3 million, and depreciation and amortization expenses amounted to $6.8 million.

For the second quarter of 2020, Weibo estimates its net revenues to decrease by 7% to 12% year-over-year on a constant currency basis. This forecast reflects Weibo’s current and preliminary view, which is subject to change.

]]>

In 2019, mobile continues to lead China internet. The top mobile apps in China by total MAUs are still led by WeChat, Alipay, QQ, Taobao, iQiyi, and Tencent Video while TikTok continues fast growth and ranks the 7th. Tencent has the highest internet user penetration of 97.3% in China in September 2019, followed by Alibaba, Baidu, and ByteDance. Find a comparison of the four here.

Leading Chinese internet companies are building their own mini-program ecosystem; Tencent’s WeChat, Alibaba’s Alipay, and Baidu’s smart program in the leading positions. ByteDance’s also building on its own ecosystem on TikTok and Toutiao.

China has issued new regulations banning online video and audio providers from using artificial intelligence (AI) and virtual reality technologies to create fake news and content.

The shipment of China’s smartphone market was about 98.9 million units in Q3 2019, down 3.6% year-on-year. Huawei leads China’s smartphone market in Q3 2019 with 41.5 million units in shipment, an increase of 64.6% YoY. Vivo, Oppo, Xiaomi and Apple rank the second to the fifth.

Awareness of Chinese brands in international markets has declined over the past three years. The “Brand Power” of leading Chinese brands is up 15% year-on-year, compared with 5% growth last year. “Brand Power” is rising fastest in Japan, France, and Spain, representing emerging hubs of growth, according to the BrandZ™ Top 50 Chinese Brand Builders 2019 report.

Alibaba has been crowned the most valuable brand in China for the first time in the annual BrandZ™ Top 100 Most Valuable Chinese Brands ranking, having grown its brand value by 59% year-on-year to US$141 billion.

The total value of the Top 100 Most Valuable Chinese Brands increased by 30% to US$889.7 billion, the highest annual rise since the ranking launched in the year 2011.

By 2030, 58% of Chinese households are expected to be in or above the mass-affluent class, exceeding today’s 55% South Korean share according to McKinsey. Urban Chinese consumers’ spending profile converges with their counterparts’ spending profile in cities around the world.

Top articles on Chinese consumers include:

- Men’s beauty market in China looks to be more promising

- Chinese post-95s spent 80% more buying overseas

- Consumption habits of China’s post-90s generation

- 22 FMCG companies reaching over 100 million urban Chinese households in 2019

- China Generation Z overview 2019

Digital Media

Vlog has become the new theme of user growth competition on several video platforms in China. Vlog can be regarded as a kind of “video log” with popular themes of travel, food, pets and etc. Its production is relatively simple, the creator uses the camera to record what he sees and thinks in his daily life, and then through later editing, with music, text or stickers, can produce a Vlog.

China’s search engine companies’ revenue is estimated to reach 158.08 billion yuan (US$22.98 bn) in 2019 and 183.17 billion yuan (US$26.63 bn) next year. But Baidu fell to the third by digital advertising revenues following Alibaba and ByteDance.

Tencent launched several different social ads formats including the Nearby Ads for SME retailers on WeChat Moments.

China Social Media

As of Q3 2019, WeChat’s monthly active users reached 1.15 billion and Weibo’s were 497 million.

In 2019, the top rising social media is no doubt ByteDance’s short video leader TikTok. Short video penetration exceeded 70% in 2019 with 810 million active users in Sep.

WeChat launched its own version of “Facebook Stories”. WeChat launched two new sections -“Time Capsule” and “Top Stories”- and several news features for WeChat iOS 7.0 on December 21, 2018. That’s the biggest upgrade since version 6 four years ago and one big move into the short video market.

Xiaohongshu received most attention in 2018 but faced a rough year in 2019 with its app removed from every major app store” in July. It will launch live broadcasting feature next year. Read our latest insights on how Xiaohongshu successfully pivoted its growth and product strategies.

The most popular articles on social media:

- Stories behind China’s super app WeChat, told by its founder

- ByteDance: A Chinese Mobile App Factory

- Audi used competitor Infiniti’s creative in a video ad on WeChat Moments

- Top short video apps compared: Tik Tok vs. Kwai – Part 1 Platforms

- China social media users compared: Weibo vs WeChat vs Momo

China E-commerce & Retail

Taobao, Tmall, and JD have the broadest user reach than other e-commerce platforms in China. Nevertheless, Pinduoduo is the only platform with more low education background users. Both Amazon and Dangdang are much less popular among users with middle school education or lower. Read our online shopper trends for 2019 here.

In 2019, Pinduoduo has beat JD and become the second-largest e-commerce platform in China. Meituan also did very well.

This year’s Tmall 618, there were hundreds of domestic and foreign brands whose sales exceeded last year’s Double 11, with the highest growth rate exceeding 40 times.

Alibaba set a new record of Double 11 in 2019 again with full-day sales on Tmall of 268.4 billion yuan (US$38 billion), the largest annual shopping festival in China. There were 299 brands who reached RMB 100 million in GMV, including Apple, Nike, Estee Lauder and Giorgio Armani. Find out the best-selling brands here.

The number of mobile payment users has reached a saturation point in 2019, and the growth is drawing to a close. The penetration rate is 95.1%. The annual transaction volume of third-party mobile payments reached 183.79 trillion Yuan, an increase of about 20.3% over the previous period. The annual number of transactions reached 1.17 trillion, an increase of about 12.8%.

Following the adoption and popularity of mobile payment, China supermarkets are growingly more intelligent with technologies such as face recognition, IA, AR, O2O, etc. WeChat recently shared a vision of its technology integration with supermarkets in the future.

Live Broadcast for E-Commerce

Live broadcasting has become an important channel for e-commerce sales in 2019 and will continue to grow. A total number of 81 live rooms on Taobao Live reached 100 million yuan sales; a total of 5 organizations broke 1 billion yuan sales. Taobao Live aims to deliver 500 billion yuan sales in the next three years.

Tencent launched a live broadcasting tool for WeChat Official Account (OA) in March 2019, currently supporting audio and video broadcast. Influencing WeChat OA can utilize their fanbase on WeChat, in combination with quality live broadcasts, to drive e-commerce sales.

Though still in the testing phase, Tencent Live integrates live streaming with its mini program. Brands can embed HTML5 based products on its mini program as an entry to its live streaming. Followers and fans can click to open Tencent Live to watch live streaming.

Kuaishou, also known as Kwai, announced its daily active live broadcasting users exceeded 100 million. 56% of Kuaishou anchors are post-90s.

Social E-commerce & Mini Programs

Social e-commerce GMV reached 626.85 billion yuan in 2018 with an increase of 255.8%. It’s expected to continue the fast growth and exceed 1.3 trillion yuan in 2019 and 2.86 trillion in 2021.

Social e-commerce in China has much higher conversion rates than traditional ones. Social e-commerce providers recharge their trust through social currency, which means that product recommendations from WeChat friends naturally have a social trust foundation.

The number of e-commerce transactions on WeChat mini-programs increased by 27 times year-on-year in the first half of 2019,

In Becky’s initial WeChat e-commerce mini-program launch in December 2017, the transactions exceeded one million yuan in 7 minutes and nearly 3 million yuan sales in 113 minutes according to WeChat Advertising. Since then, it has been able to maintain a million transactions in the first minute of new product launches. Read her story here.

Short Video for E-Commerce

TikTok signed a 7-billion yuan agreement with Taobao including 6 billion yuan ads and 1 billion yuan commission according to leaked news online. TikTok denied the accuracy of those numbers but the news got the attention of many in the e-commerce market.

During China’s mid-year shopping festival 618, active TikTok shopping cart user ratio exceeded 68%. The top 30 users referred over 400 million yuan worth of products sales.

Top articles in e-commerce and retail:

- How Tmall played a vital role in China’s largest wool and textile enterprise

- Taobao to enable farmers to find new markets and customers

- Introduction to Xiaomi’s e-commerce platform Youpin

- Alibaba’s Hema penetrating low-tier cities with Hema Mini supermarket

- Huawei turning its smartphones to POS machines

- China’s cross-border e-commerce users overview 2019

Chinese travelers

The total number of online travel agency (OTA) users in China reached 145.6 million. Tier-2 cities in total saw the most number of OTA users (56.68 million), followed by tier-3 group and tier-1.

On average an outbound Chinese tourist plans to spend US$6,706 traveling overseas in 2019, up 15% from 2018. Product quality became the second most important factor to consider when shopping abroad. 69% of outbound Chinese tourists made purchases on their mobile phones in 2018.

China’s emerging Gen-Y’s complete travel experience journey has five stages: dream, plan, book, experience, and share. Get an overview of emerging Gen-Ys’ power, how they re-shape China’s travel market, stages of their travel journey, and how to get ready here.

Sightseeing (around 50%) and vacation (over 40%) were the two main driving force for traveling. Self-guided travelers spend less compared with travelers with guided tours. Self-guided (free and easy trips) travelers spend more on transportation and accommodation than those with guided tours.

Top articles in tourism:

- China Golden Week Tourism Trends & Insights 2019

- The emerging Gen-Y for China’s travel market

- Outbound Chinese tourists mobile payment usage 2019; average spend US$6,706

- Rising outbound travelers from lower tier cities in China

- China outbound tourism insights 2019

Annual subscribers can download McKinsey Consumer Trends Report 2020 here.

]]>

In the recent “Double 11 2019” shopping festival in China, Apple’s official flagship store on Tmall “Singles Day” transaction exceeded 7 times of last year’s full day sales in just 10 minutes. iPhone 11 broke 100 million yuan in sales in 1 minute.

Related: Double 11 Festival statistics 2019

This year is Apple’s first participation in the Tmall “Double 11” promotion. The official Weibo of the Tmall spokesman said that during this year’s “Double 11”, Apple’s official flagship store participated in the Tmall “Double 11” 2019 platform subsidy, the highest straight off 1,111 yuan (about US$158).

On November 9, Tmall announced an additional budget of 100 million yuan to subsidize Apple’s official products.

On the “Double 11” day, Apple’s official flagship store, including iPhone, iPad, Mac, Airpods and other in-store products, participated in the 24-month interest-free installment payment, iPhone 11 buyers could save 300 yuan after the receipt of the coupon and Airpods Pro 60 yuan off. In this way, Airpods cost less than 3 yuan a day; and, iPhone 11 less than 8 dollars a day.

JD (Jingdong) also introduced a super-billion subsidy (10 billion yuan).

After entering the corresponding interface of JD platform, users could receive corresponding coupons. Among them, iPhone XS and iPhone XS Max offered 3,000 for over 8,000 yuan spend, or 1,800 yuan off 3,000 yuan spend.

iPhone 11 Pro / Pro Max offered 500 yuan discount for over 8,000 yuan spend , iPhone 11 300 yuan off 5,000 yuan spend. At the same time, the purchase of some iPhones could enjoy 12-month interest-free installment plan applying JD Credit Coupons.

According to the “Double 11” report data released by Jingdong, Apple’s sales ranked first on November 11th. At the same time, Apple was also the cumulative best-selling brand from November 1st to 11th, followed by Huawei, Honor (Huawei), Xiaomi, Vivo and Oppo.

The fast rising social e-commerce platform Pinduoduo also provided heavy subsidies for iPhone buyers.

iPhone demand is strong in China. From a note to clients by UBS:

Monthly government data suggests overall iPhone demand in China was strong in the month of September, up ~230% vs. ~110% monthly growth last September. This is wholly consistent with recent procurement data/estimates from the UBS Asia Hardware team.

In the week ahead of this year’s Double 11 (4 Nov – 10 Nov), iPhone was ranked first by search volume on Baidu in the smartphone category, followed by Huawei and Xiaomi. iPhone’s media coverage was ranked second after Huawei in the same period according to data from Baidu.

In preparation for the “Double 11”, Changshuo Technology, an Apple foundry in Pudong, Shanghai, worked overtime to ensure the “Double 11” supply of the iPhone 11.

The level of marketing and advertisement put into new products by Apple is probably the largest.

In my visits to several tier-2 to tier-3 cities in China, iPhone 11, 11 Pro, and iWatch video ads were all over Chinese digital media across both desktop and mobile. Review articles on WeChat content network (Official Accounts) and Weibo were hard to miss.

Top Mini-Programs in Oct 2019; China’s mini-apps war led by online shopping

]]> In addition to Tencent’s WeChat, Baidu, and Ant Financial’s Alipay, many other large Chinese Internet companies have been taking actions in building their mini-program ecosystems.

In addition to Tencent’s WeChat, Baidu, and Ant Financial’s Alipay, many other large Chinese Internet companies have been taking actions in building their mini-program ecosystems.

QQ (Tencent) introduced the “One-click Comment” function and managed to explored new sources of traffic. Alipay introduced the “Comment after Payment” function. WeChat (Tencent) introduced the Notification Subscription and Industry Assistant functions to support its mini-apps. TikTok launched a dedicated page for mini-apps, and at the same time introduced its Karaoke mini-app, further complementing ByteDance mini-program ecosystem.

Meituan, as a late-comer, also launched its own mini-program platform in October this year, further heating up the competition.

According to anlaytics company Aladdin’s October ranking of mini-apps, distribution of top mini-programs by category witnessed a significant change.

Online shopping mini-programs have reclaimed the top places on the list. Life services mini-programs showed outstanding performance while mini-apps in the video and travel categories dropped significantly in terms of ranking.

In the vertical markets, the Golden Week long holiday boosted the demand for portable power bank, leading to a significant climb on the list of phone charging related mini-apps.

The distribution by category of the newcomers on the list showed an apparent trend of pre-heating of the Double Eleven Festival 2019: the number of new or updated online shopping mini-apps increased significantly.

Please log in below or subscribe to see the full content.

]]>