Renren’s monthly unique log-in users was about 35 million in September 2016, compared to 45 million in September 2015 with an decrease of 22% YoY. The login users’ monthly average time spent increased 17.5% year-over-year.

Renren.com and its Renren mobile application had approximately 238 million activated users as of September 30, 2016.

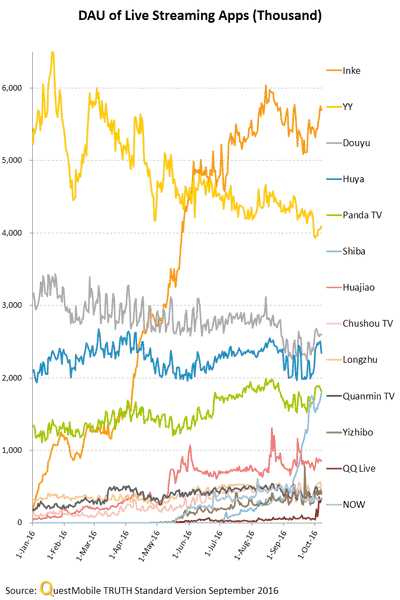

Renren reported total net revenues of US$17.9 million in Q3 2016, a 102.8% increase YoY. Advertising and IVAS net revenues were US$9.6 million, a 31.0% increase YoY. Internet Value-Added Services (IVAS) revenues were US$9.5 million, representing a 65.3% increase YoY. The increase was mainly due to the revenue from the new Renren mobile live streaming that started in the Q2 2016.

Renren’s gross profit was US$3.5 million in Q3 2016. Net loss attributable to Renren was US$22.8 million, compared to a net loss of US$73.1 million in the corresponding period in 2015.

]]>

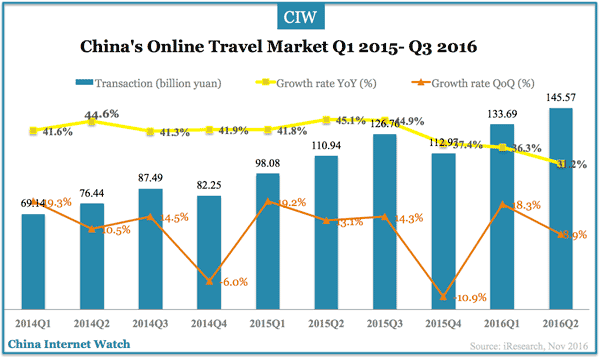

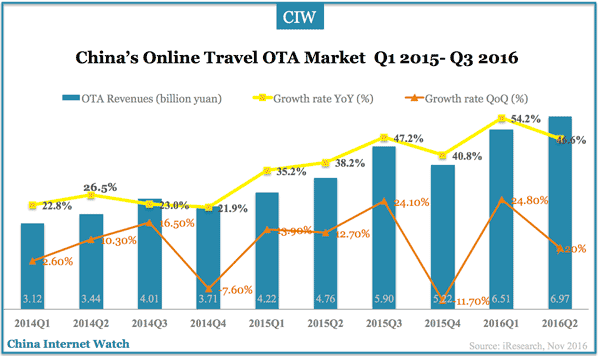

Total transactions of China’s online travel market reached 162.76 billion yuan (US$23.59 billion). OTA revenues totaled 8.19 billion yuan (US$1.19 billion).

China’s online travel market totaled 162.76 billion yuan (US$23.59 billion) with an increase of 11.8% QoQ or 28.4% YoY. Online travel transactions via mobile apps continued to grow to 62.2% in September 2016 from 59.2% in June 2016.

Total revenues in China’s OTA market reached 8.19 billion yuan with a growth rate of 38.7% YoY.

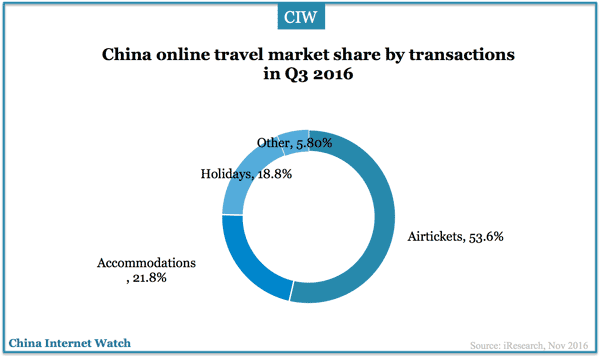

Air tickets booking accounted for 53.6% of China’s online travel transactions in Q3 2016; accommodations 21.8%; and, holiday booking 18.8%.

]]>

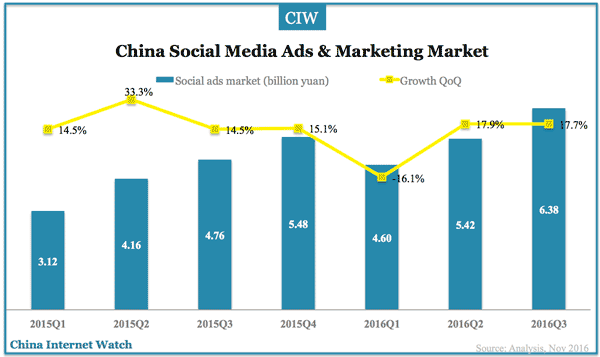

China social media advertising and marketing market reached 6.38 billion yuan, an increase of 17.7% QoQ.

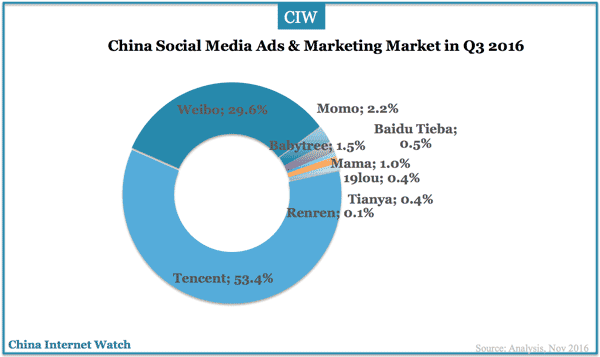

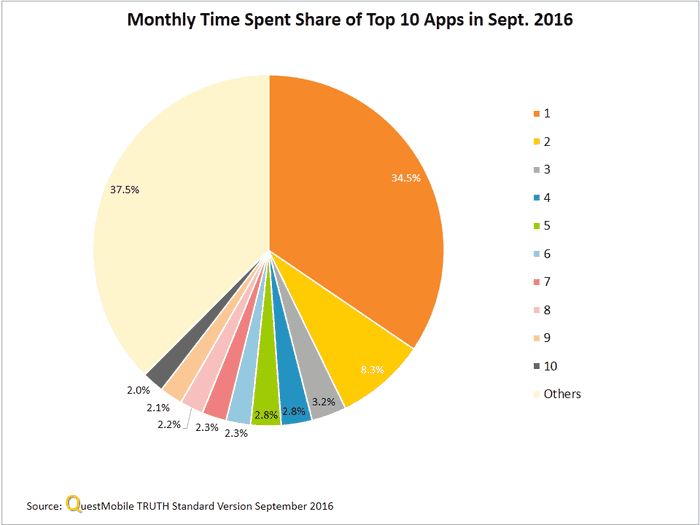

Tencent had 53.4% market share in China’s social advertising and marketing market in Q3 2016. WeChat MAU reached 846 million in Q3 2016; QQ 877 million; and, QZone 632 million.

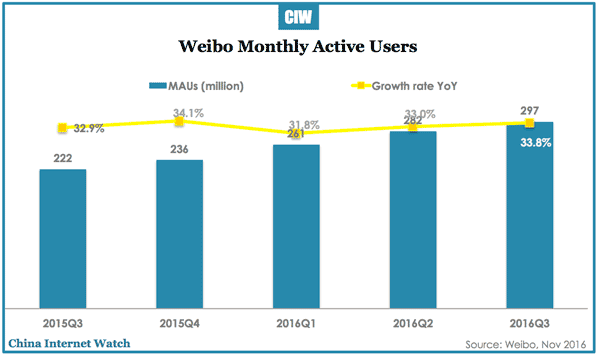

Weibo’s Monthly active users (“MAUs”) grew 34% year over year to 297 million in September 2016, 89% of which were mobile users. It had 29.6% share in China’s social ad market in Q3 2016.

INFOGRAPHIC: Every 60 seconds on China social media

]]>

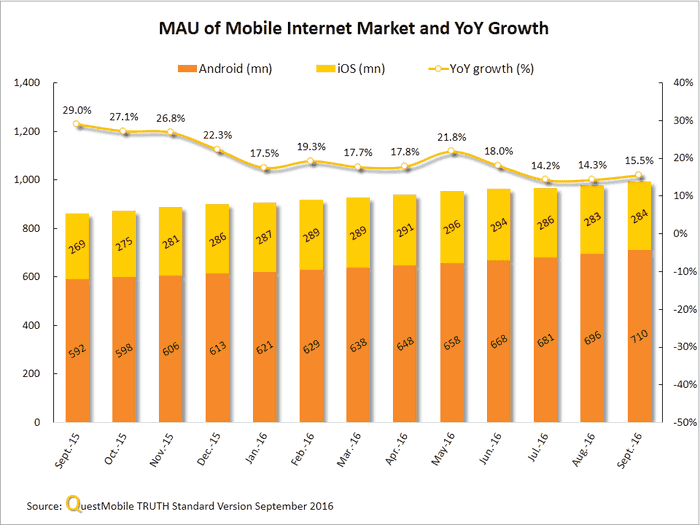

The number of monthly active users (“MAU”) of China’s mobile internet market has reached 1 billion as of September 2016 according to QuestMobile, among which Android and iOS exceeded 700 and 280 million respectively.

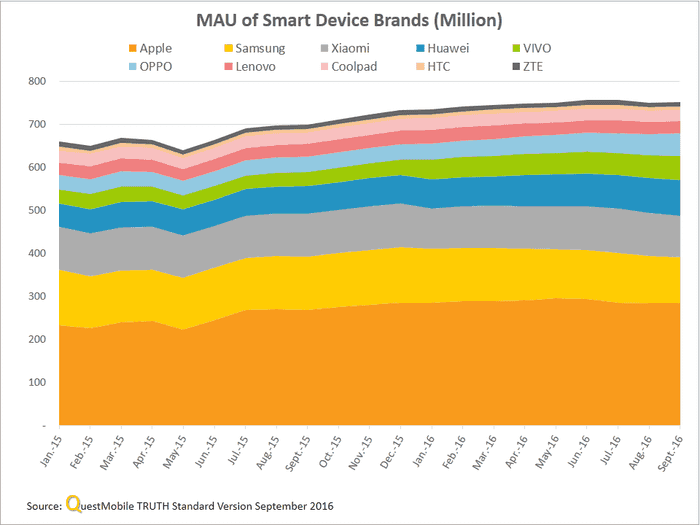

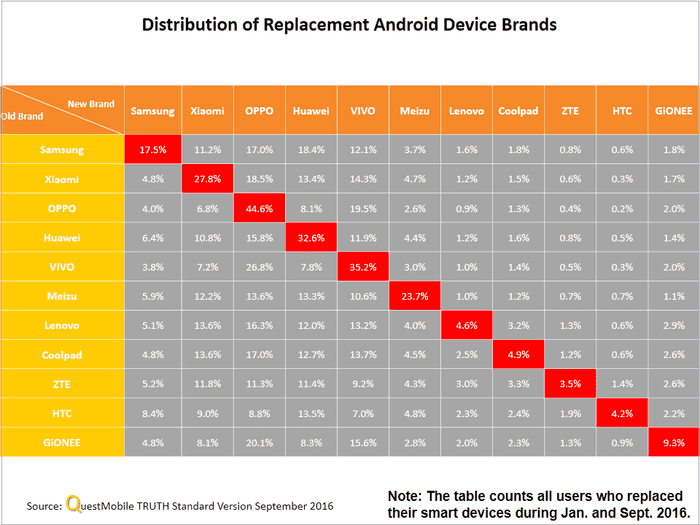

iPhone continued to increase MAU while Samsung and Xiaomi saw slightly declining MAUs. The MAUs of Huawei, VIVO and OPPO increased rapidly in Sep 2016.

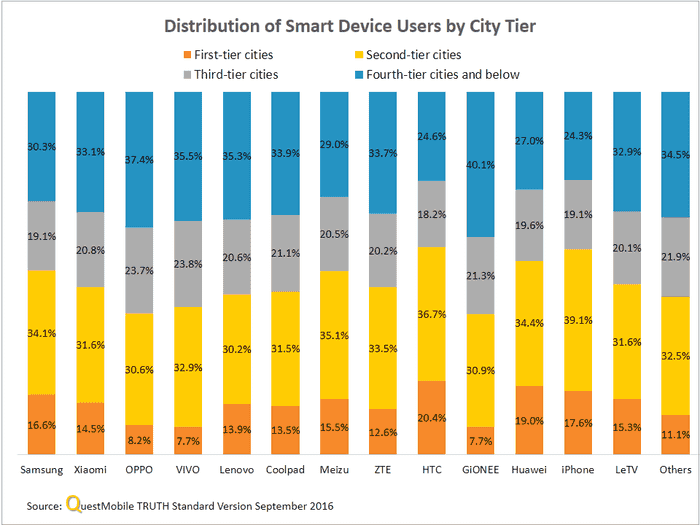

Huawei and iPhone performed well in the first and second tier cities while OPPO and VIVO have advantages in tier-2, 3, and 4 cities.

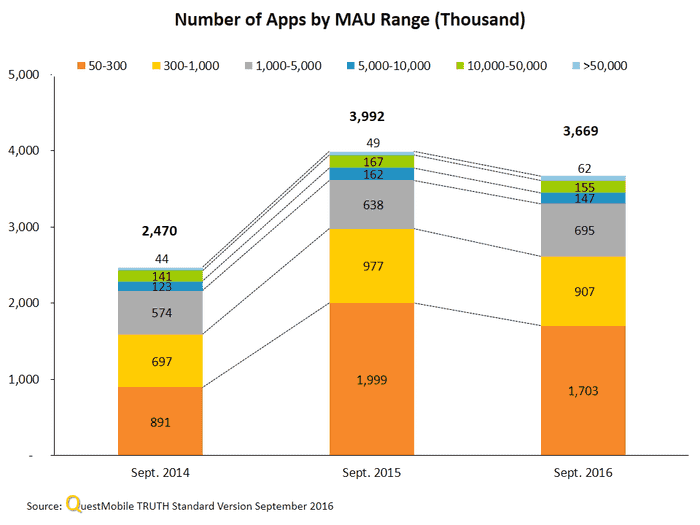

The number of apps in 1-5 million MAUs group and “over 50 million” group are still on growth in the 12-month period ending in Sep 2016. Apps in other MAU groups all dropped to varying degrees.

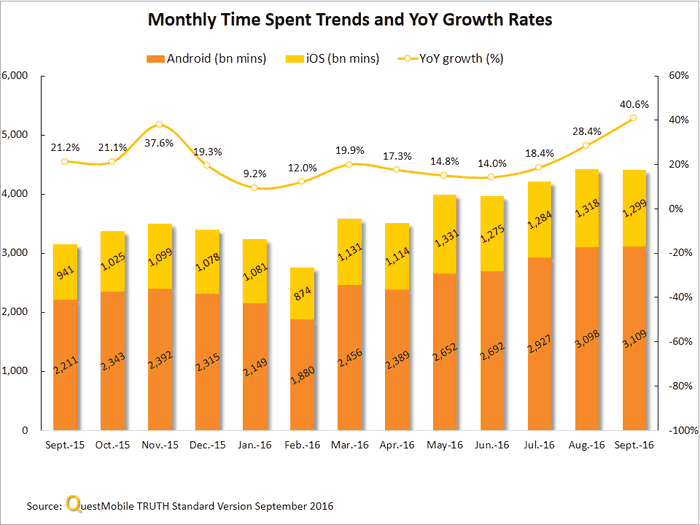

Total monthly time spent on Android apps had been growing rapidly from Sep 2015 to Sep 2016 while that on iOS apps had been fluctuating during the same period.

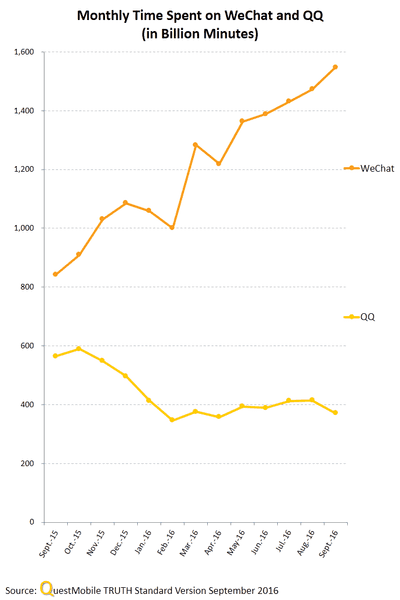

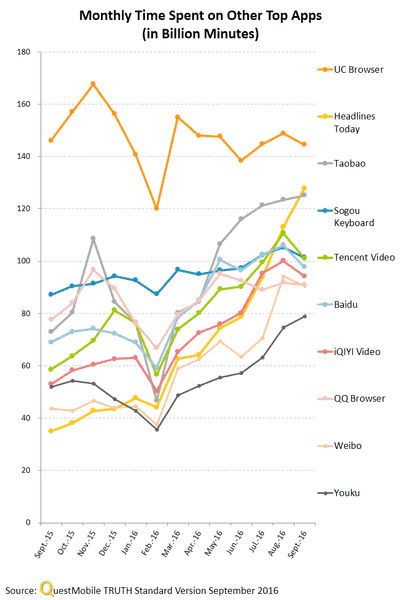

Monthly time spent on WeChat continued to grow in contrast to decreasing time spent on QQ.

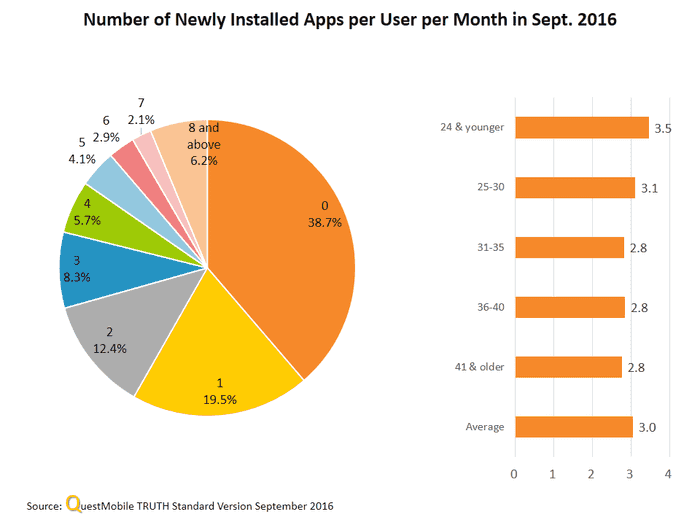

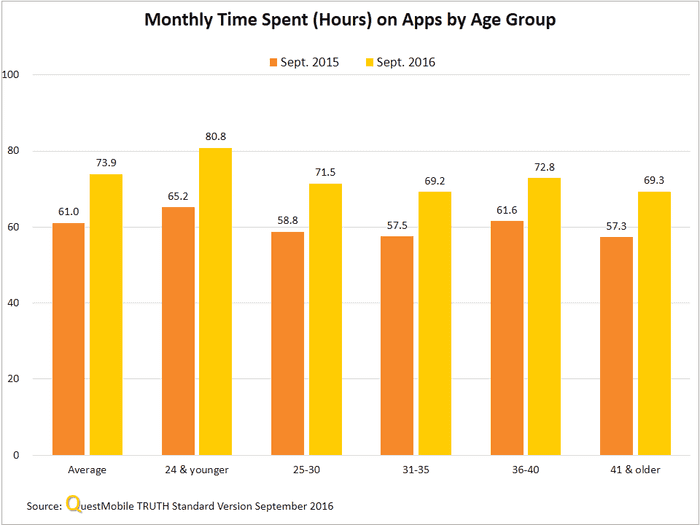

The average number of newly installed apps per user per month was 3 in Sep 2016, which was mainly driven by users under the age of 24. T

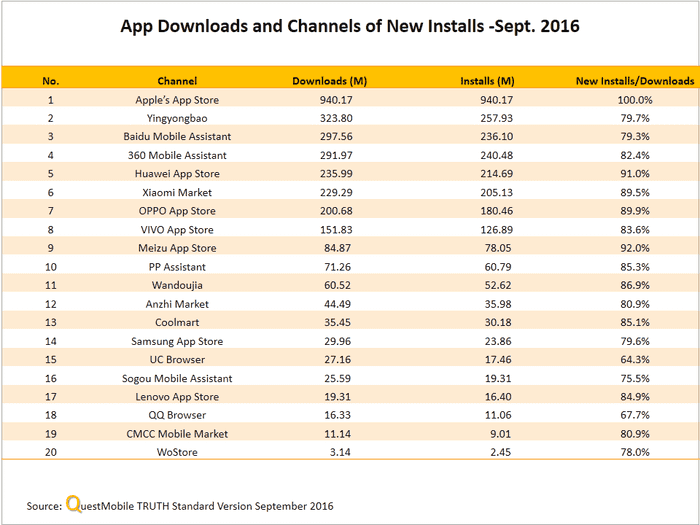

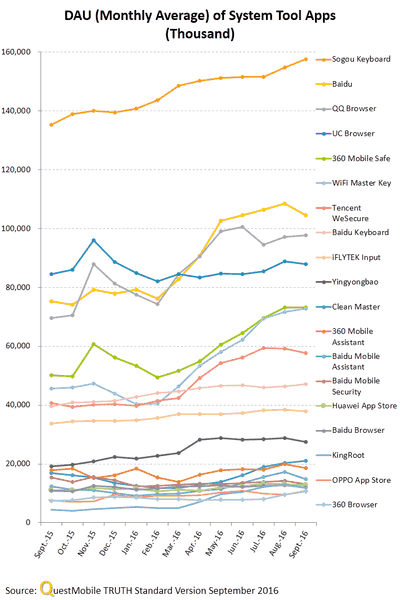

The top 5 app stores by app downloads in Sep 2016 are App Store, Yingyongbao (Tencent), Baidu Mobile Assistant, 360 Mobile Assistant, and Huawei App Store. Xiaomi App Store only ranks 6th.

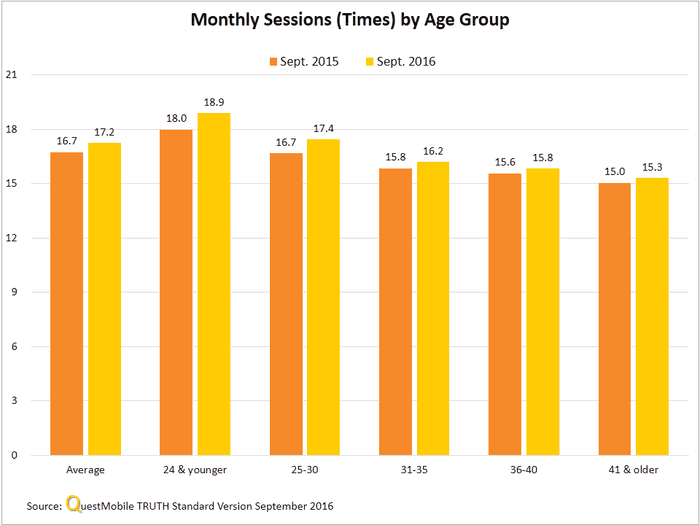

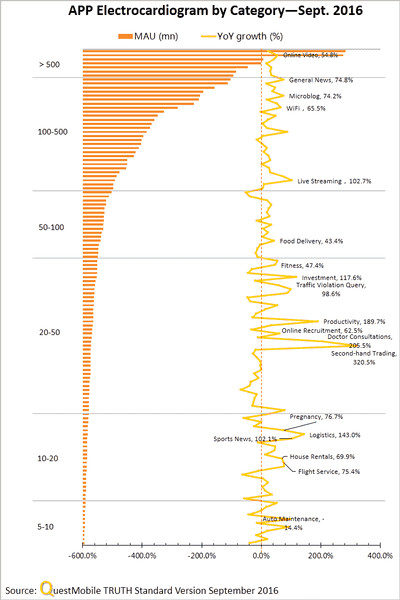

Among apps with MAUs of over 5 million, 7 mobile app categories saw over 100% YoY growth in Sep 2016.

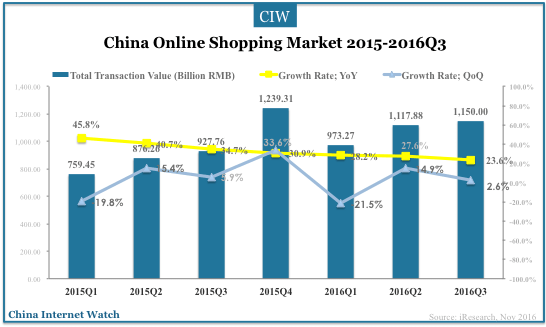

Total transaction value of China online shopping market reached 1.15 trillion yuan (US$166.85 billion) in Q3 2016, up 23.6% YoY or 2.6% QoQ, according to data from iResearch.

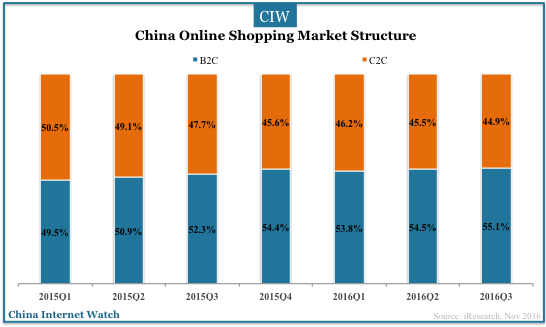

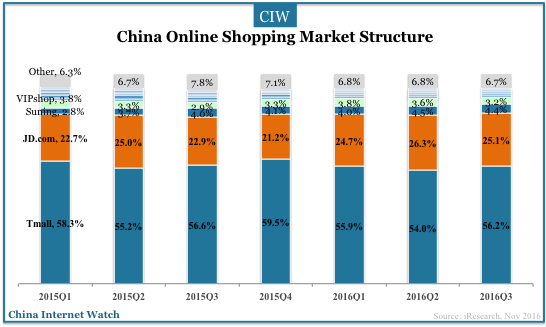

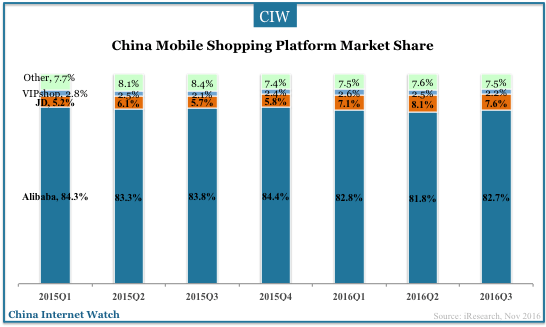

B2C (600 billion yuan) accounted for 55.1% of China online shopping market in Q3 2016, led by Tmall (56.2%), Jingdong (25.1%), Suning (4.4%), and VIPshop (3.2%).

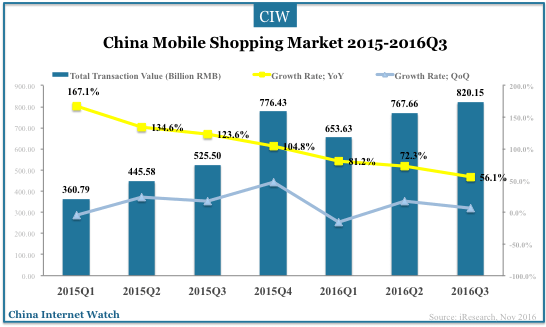

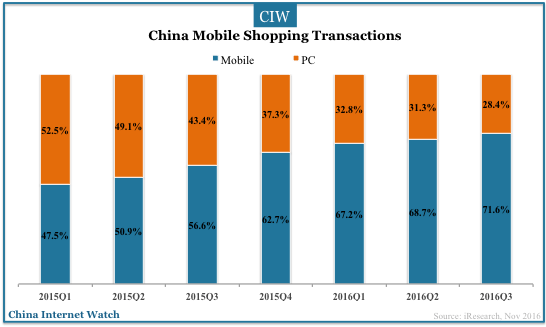

The total transactions of China mobile shopping market reached 820.15 billion yuan (US$), an increase of 56.1% YoY. Mobile accounted for 71.6% of China’s online shopping market, led by Tmall/Taobao with 82.7% market share.

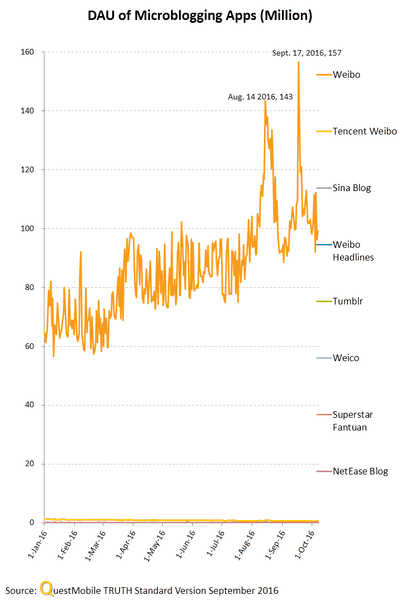

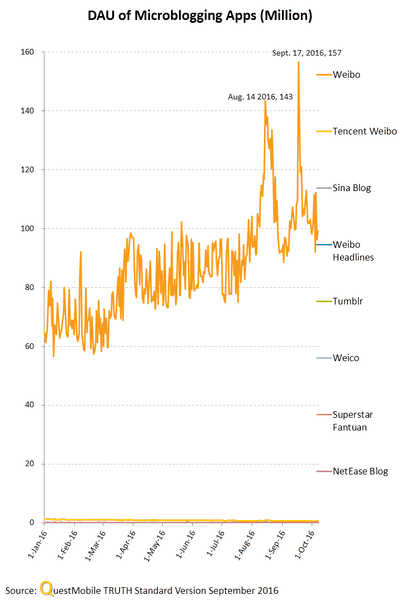

Weibo’s Monthly active users (“MAUs”) grew 34% year over year to 297 million in September 2016, 89% of which were mobile users.

Average daily active users (“DAUs”) on Weibo in September 2016 grew 32% year over year to 132 million.

Weibo reported net revenues of $176.9 million in Q3 2016, an increase of 42% YoY; and, advertising and marketing revenue increased 48% year over year to $156.7 million. Advertising and marketing revenue from key accounts and small & medium-sized enterprises (SME) was $147.4 million.

Net income attributable to Weibo increased 122% YoY to $32.1 million, and diluted net income per share was $0.14, compared to $0.07 for the same period last year.

Also read: Lessons from Stephen Hawking’s 1 Mn Weibo Fans in 5 Hrs

]]>

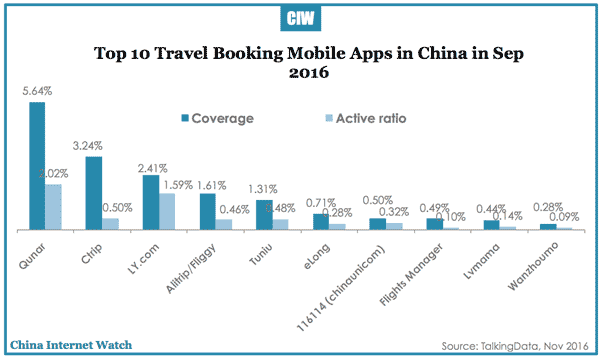

Qunar was ranked the top generic travel booking app by coverage in September 2016 according to data from TalkingData, followed by Ctrip and LY.com apps.

12306, China Railway’s official app, remains the top choice for train tickets booking. Spring Airlines made it to the top among airlines booking apps with 0.43% coverage, followed by apps from Eastern Airlines (0.27%), China Southern Airlines (0.2%) and Air China (0.15%).

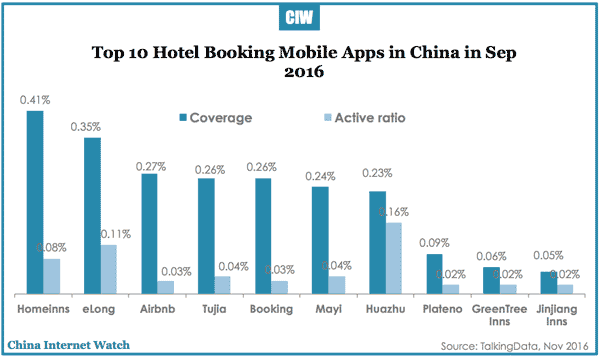

Among accommodation booking apps, Home Inns, eLong and Airbnb are the top 3 by coverage. Airbnb, Tujia and Mayi are the only three homestay network platforms in the top 10 while the rest are for hotel bookings.

Huawei, Samsung, and Xiaomi smartphones are the most popular Android brands among travelers during this year’s National Day holiday.

The top mobile apps for travel information by coverage are Mafengwo (0.58%), TripAdvisor (0.48%), Travel Translator (0.31%; by Mafengwo), Qyer (0.26%), and Breadtrip (0.22%).

]]>

Momo, one of the top mobile social networking app in China, had Monthly Active Users (“MAU”) of 77.4 million in September 2016, compared to 73.0 million in September 2015 according to its unaudited financial results.

Momo’s net revenues increased 319% year over year to $157.0 million. And, its net income attributable to Momo Inc. increased to $39.0 million in the third quarter 2016 from a net loss of $0.8 million in the same period last year.

Momo launched “Moments”, an interactive short video service in August 2016. Live broadcasting business continued to gain traction and boosted the acceleration in revenue and profit growth of Momo. The rapid growth in live video revenues is mainly because of the increase in paying users of live video service. Paying users of live video service for the third quarter of 2016 reached 2.6 million.

Membership subscription revenues were $18.1 million in the third quarter of 2016, an increase of 13% YoY. Momo VIP members were 3.4 million and 3.3 million as of September 30, 2016 and 2015, respectively.

For the fourth quarter of 2016, the Company expects total net revenues to be between $185 million and $190 million, representing a year-over-year increase of 369% to 381%.

]]>

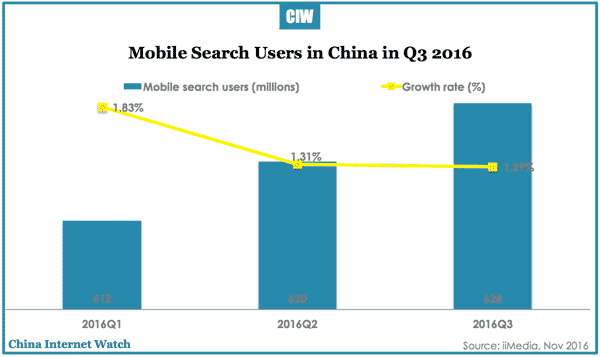

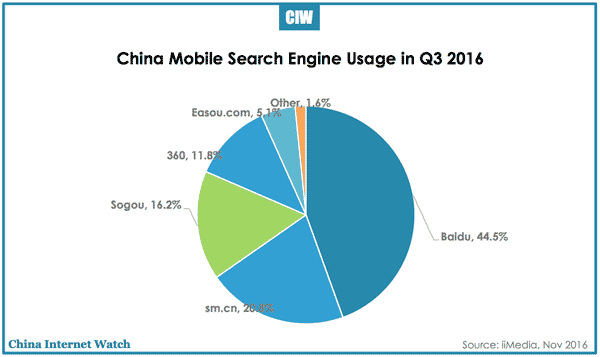

The number of mobile search users in China reached 628 million in Q3 2016, an increase of 1.29% QoQ according to iiMedia Research.

Baidu still led mobile search market in China with 44.5% usage ratio, followed by Shenma (sm.cn; 20.8%), Sogou (16.2%), 360 (11.8%). Shenma search is a joint venture set up by Alibaba and UC in 2013.

66.8% China online users conducted mobile search on mobile browsers; 24.6% on mobile search apps according to iiMedia. 35.3% and 33.9% users are interested in voice search and image search respectively.

]]>

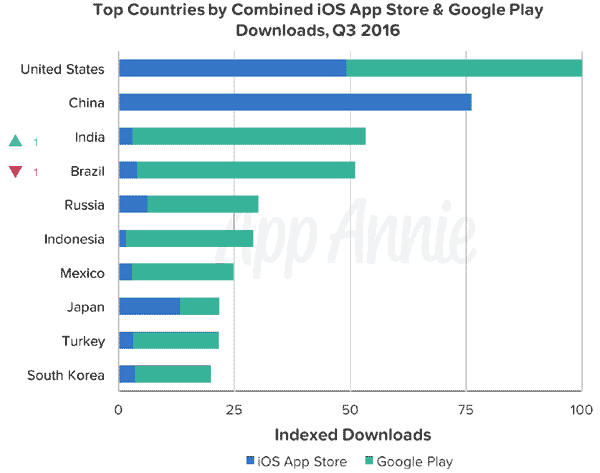

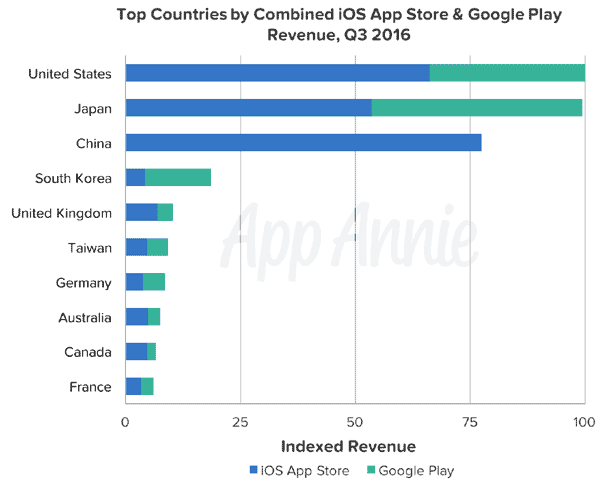

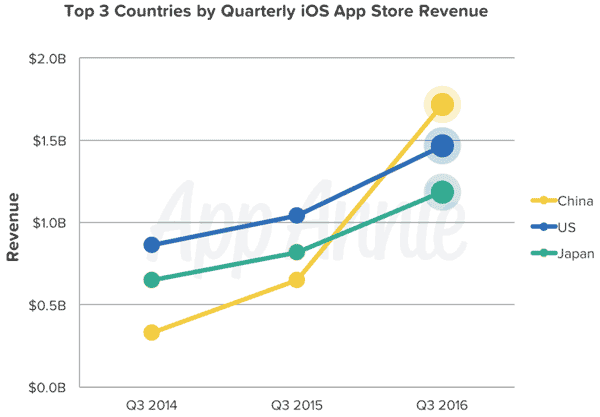

China has surpassed the United States as the largest market in the world for iOS App Store revenue earning over $1.7 billion in Q3 2016 according to App Annie.

China is leading the US by over 15%. In Q3 2016, Chinese consumers spent more than five times the amount they spent just two years prior in the iOS App Store. China is projected to drive the largest absolute revenue growth for any country by 2020.

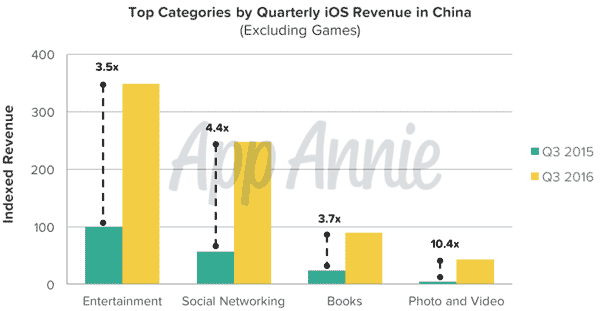

75% of apps in the iOS App Store may belong to non-gaming categories; but, 75% of revenue is still produced from games. Entertainment, social networking, books, and photo and video were the top-grossing categories outside of Games on iOS in China in Q3 2016, all of which have more than tripled in revenue year over year.