Net income attributable to HUYA Inc. was RMB524.4 million (US$81.4 million) for the third quarter of 2021, compared with RMB253.0 million for the same period of 2020.

Non-GAAP net income attributable to HUYA Inc. was RMB180.0 million (US$27.9 million) for the third quarter of 2021, compared with RMB361.2 million for the same period of 2020.

The average mobile MAUs of Huya Live in Q3 2021 increased by 14.7% to 85.1 million, from 74.2 million in the same period of 2020. The total number of paying users of Huya Live in the third quarter of 2021 reached 6.0 million, compared with 6.0 million in the same period of 2020.

]]>Douyu’s quarterly average paying user count in the fourth quarter of 2019 increased by 70.8% to 7.3 million from 4.2 million in the same period of 2018.

Fourth Quarter 2019 Highlights

- Total net revenues for Q4 2019 increased by 77.8% to RMB2,062.9 million (US$294.9 million) from RMB1,160.2 million in Q4 2018.

- Live streaming revenues increased by 84.1% to RMB1,892.5 million (US$270.5 million) from RMB1,028.1 million in Q4 2018, primarily driven by the increase in both the number of paying users and ARPPU

- Gross profit increased by 934.6% to RMB375.2 million (US$53.6 million) from RMB36.3 million in the same period of 2018, implying a gross margin of 18.2% in Q4 2019, compared with 3.1% in Q4 2018.

- Net income was RMB157.4 million (US$22.5 million), compared with a loss of RMB271.4 million in Q4 2018, implying a net margin of 7.6% in Q4 2019.

- Adjusted net income was RMB186.4 million (US$26.6 million), implying an adjusted net margin of 9.0%, compared with an adjusted net loss of RMB232.5 million in the same period of 2018.

Full Year 2019 Highlights

- Total net revenues in the full year of 2019 increased by 99.3% to RMB7,283.2 million (US$1,041.1 million) from RMB3,654.4 million in the same period of 2018.

- Gross profit in the full year of 2019 increased by 692.0% to RMB1,196.2 million (US$171.0 million) from RMB151.0 million in the same period of 2018, implying a gross margin of 16.4% in the full year of 2019, compared with 4.1% in the same period of 2018.

- Net income in the full year of 2019 was RMB33.3 million (US$4.8 million), compared with a net loss of RMB876.3 million in the same period of 2018, implying a net margin of 0.5% in the full year of 2019.

- Adjusted net income in the full year of 2019 was RMB346.4 million (US$49.5 million), implying an adjusted net margin of 4.8%, as compared with an adjusted net loss of RMB818.5 million in the same period of 2018.

Huya expects its total net revenues to be in the range of RMB2,100 million to RMB2,160 million in the first quarter of 2020, representing year-over-year growth between 41.0% and 45.0%.

Check out its competitor Huya’s Q4 performance here.

]]>

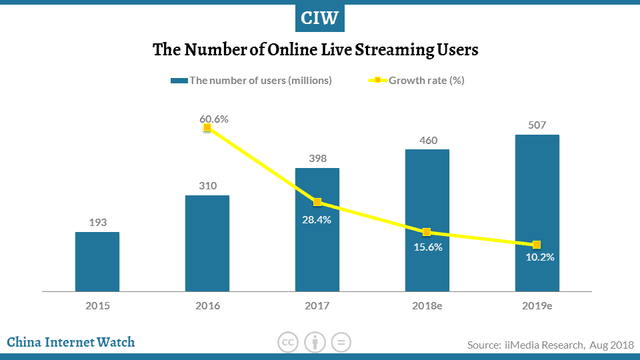

Online live streaming market obtained a total of 398 million users in 2017, an increase of 28.4%, which is estimated to reach 460 million in 2018 and 507 million in 2019. This market showed signs of a slowdown since 2017.

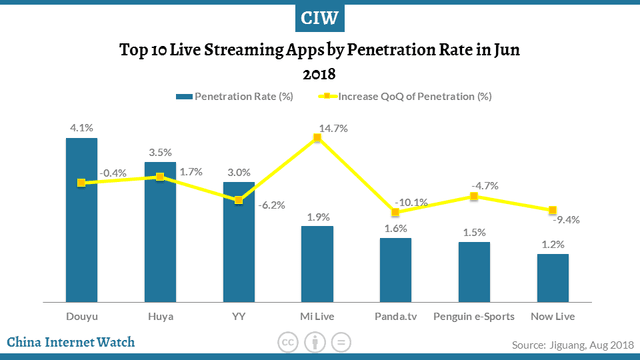

Within China’s live streaming market, Douyu took the lead with a penetration of 4.1%, a negative growth of 0.4%, followed by Huya (3.5%) and YY (3.0%).

On average, Douyu and Huya both saw rises in daily active users to 7.616 million and 5.705 million, respectively. While YY suffered loss from 5.325 million to 4.552 million.

Get an overview of China’s online video market here, short video apps market here, or top mobile apps here.

Related CIW Dossiers: Dossier: China Online Videos, mobile apps

]]>

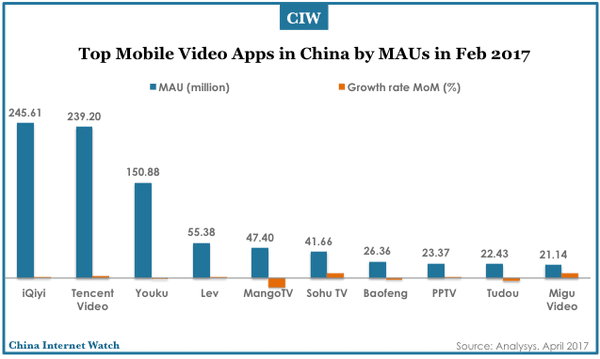

iQiyi ranks on top in China’s mobile video category with 245.61 million active users in Feb 2017, followed by Tencent Video, Youku, Letv, and Mango TV.

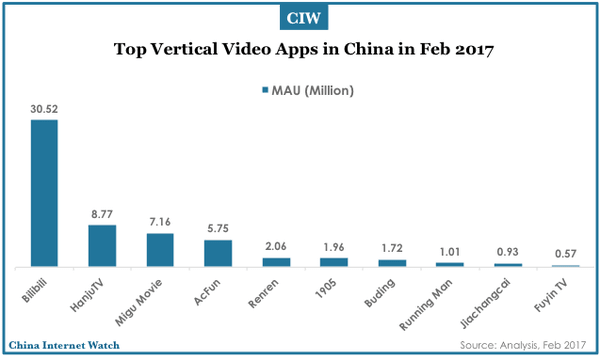

Sohu TV, Baofeng, PPTV, Tudou, and Migu Video apps are also in the top 10 video apps by MAUs in Feb 2017. Bilibili Cartoon ranks first in the vertical digital video mobile apps category with 30.52 million active users, followed by Hanju TV (Korean drama), Migu Movie, AcFun, Renren Movie, 1905 Movie, etc.

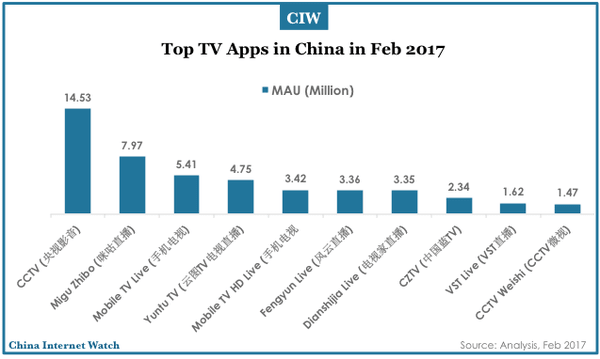

CCTV mobile app is the top one in TV programs category, followed by Migu, Mobile TV, and Yuntu TV.

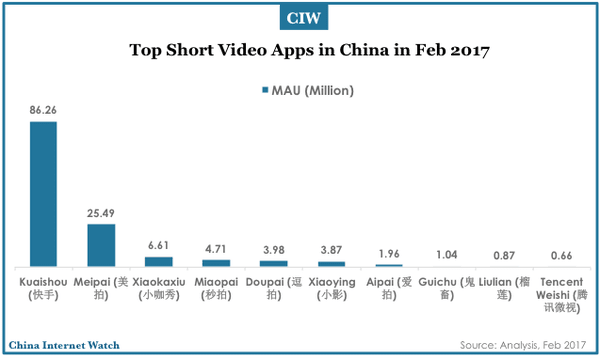

In the short videos category, Kuaishou mobile app ranks on top in China in Feb 2017 with over 86 million active users, followed by Meipai, Xiaokaxiu, Miaopai, and Doupai.

Douyu, Huya, Inke, YY Live, and Huajiao are the top 5 digital video broadcasting mobile apps by MAU in Feb 2017.