The company, a leading internet and technology conglomerate in China, has reported substantial improvements in gross profit and net profit, reflecting its strategic focus on high-quality revenue streams and innovative technological advancements.

Strategic Initiatives and Business Review

Tencent’s latest quarterly results highlight the company’s dynamic approach to growth and innovation. The tech giant has focused on enhancing its core business segments while venturing into new revenue streams, leveraging its technological prowess and market leadership.

In the gaming sector, Tencent continues to solidify its dominance both domestically and internationally. Several flagship titles, including “Fight of the Golden Spatula” and “CrossFire Mobile,” achieved record-high gross receipts. Meanwhile, international hits like “PUBG Mobile” and Supercell’s “Brawl Stars” reported impressive gains in user engagement and revenue, underscoring Tencent’s global appeal in the gaming industry.

The company has also made significant strides in digital content. WeChat Video Accounts saw a dramatic increase in user engagement, with total user time spent rising by over 80% year-over-year.

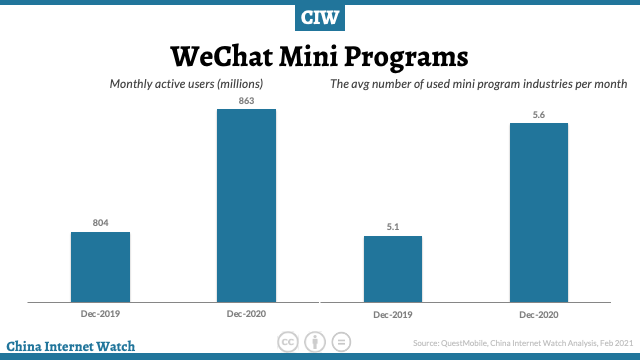

Similarly, Mini Programs, a staple feature of WeChat, reported a 20% increase in user engagement, reflecting Tencent’s ability to continuously innovate and expand its ecosystem.

Tencent’s advertising sector has benefited greatly from its advancements in AI technology. The introduction of generative AI-powered tools has revolutionized its advertising platform, resulting in higher engagement and more effective ad campaigns. This innovation has been particularly impactful for Video Accounts and Mini Programs, driving substantial growth in advertising revenue.

In the FinTech arena, Tencent’s wealth management business has shown robust growth, marked by a surge in user numbers and average fund investments. Tencent Cloud Media Services, a leader in the media and entertainment sectors, has maintained its strong market position, further demonstrating the company’s diverse and resilient business model.

Operating Metrics

- Combined MAU of Weixin and WeChat: 1,359 million, a 3% YoY increase.

- Mobile Device MAU of QQ: 553 million, a 7% YoY decrease.

- Fee-based VAS Registered Subscriptions: 260 million, a 12% YoY increase.

- Video Accounts Total User Time Spent: Increased over 80% YoY.

- Mini Programs Total User Time Spent: Increased over 20% YoY.

Financial Highlights

Tencent’s financial performance in Q1 2024 reflects its strategic focus and operational efficiency:

- Total Revenues: RMB 159.5 billion ($22.5 billion), a 6% year-over-year (YoY) increase.

- Gross Profit: RMB 83.9 billion ($11.8 billion), up 23% YoY.

- Non-IFRS Operating Profit: RMB 58.6 billion ($8.3 billion), a 30% YoY increase.

- Net Profit Attributable to Equity Holders: RMB 50.3 billion ($7.1 billion), up 54% YoY.

Segment Performance

- Value-Added Services (VAS): Revenue slightly decreased by 0.9% YoY to RMB 78.6 billion, with social networks and domestic games experiencing minor declines, while international games revenue grew by 3%.

- Online Advertising: Revenue surged by 26% YoY to RMB 26.5 billion, driven by increased engagement and enhanced AI-powered ad targeting.

- FinTech and Business Services: Revenue increased by 7% YoY to RMB 52.3 billion, with solid growth in cloud services and wealth management.

Tencent’s first-quarter results highlight its resilient business model and strategic adaptability. The company’s revenue growth, though moderate, is accompanied by a substantial increase in gross profit and operating margin, indicating improved operational efficiency.

Comparing these results with previous quarters and industry peers, Tencent stands out for its balanced growth across diverse revenue streams. The company’s focus on high-margin businesses, such as cloud services and digital content, is a strategic move that is paying off well.

]]>CIW Annual and Premium plan subscribers can download the related but much more comprehensive China Digital Landscape report here.

The internet penetration rate was 77.5%, up by 1.9 percentage points. Of these, 1.091 billion accessed the internet via mobile phones, accounting for 99.9% of internet users. Rural internet users constituted 29.8% of the total, amounting to 326 million, while urban users made up 70.2%, totaling 766 million.

The usage of mobile phones for internet access remained dominant at 99.9%, with desktop computers, laptops, televisions, and tablets being used by 33.9%, 30.3%, 22.5%, and 26.6% of the internet population, respectively.

The user bases for ride-hailing, online travel booking, online shopping, live streaming, and internet medical services grew by 90.57 million, 86.29 million, 69.67 million, 65.01 million, and 51.39 million respectively compared to 2022, with growth rates of 20.7%, 20.4%, 8.2%, 8.7%, and 14.2% respectively.

Following are the specific user demographics and their growth in various internet services as of December 2023:

- 📺 Video streaming users: 1.067 billion (up by 36.13 million, 97.7%)

- 📱 Short video users: 1.053 billion (up by 41.45 million, 96.4%)

- 💬 Instant messaging users: 1.060 billion (up by 21.55 million, 97.0%)

- 🏛️ Online government services users: 973 million (up by 47.01 million, 89.1%)

- 💳 Online payment users: 954 million (up by 42.43 million, 87.3%)

- 🛒 E-commerce users: 915 million (up by 69.67 million, 83.8%)

- 🔍 Search engine users: 827 million (up by 25.04 million, 75.7%)

- 🎥 Live streaming users: 816 million (up by 65.01 million, 74.7%)

- 🎵 Online music users: 715 million (up by 30.44 million, 65.4%)

- 🍔 Online food delivery users: 545 million (up by 23.38 million, 49.9%)

- 🚖 Ride-hailing users: 528 million (up by 90.57 million, 48.3%)

- 📚 Online literature users: 520 million (up by 27.83 million, 47.6%)

- ✈️ Online travel booking users: 509 million (up by 86.29 million, 46.6%)

- 🩺 Internet healthcare users: 414 million (up by 51.39 million, 37.9%)

Instant Messaging

By December 2023, China’s instant messaging user base reached 1.06 billion people, an increase of 21.55 million from December 2022, accounting for 97.0% of netizens.

In 2023, the development momentum of China’s instant messaging services was strong, with accelerated technology innovation and steady industry growth, contributing to the construction of a powerful internet nation.

This includes significant growth in internet advertising revenues, such as Tencent’s over 13 billion yuan increase in the first three quarters of 2023, a 23.5% growth rate. New areas like short video content within apps like WeChat and QQ saw rapid development, with WeChat Video Account’s total views and user watch time increasing by over 50% and nearly 100% year-on-year, respectively.

Alibaba’s business messaging app DingTalk integrates the “Tongyi Qianwen” large language model into its core functions such as group chats and video conferences, enabling users to activate artificial intelligence services through conversational interactions.

Meanwhile, ByteDance’s Feishu has launched a new product, “Feishu Intelligent Companion,” which offers innovative services such as smart translation and automatic Q&A in multiple scenarios, including content creation, data analysis, and system construction, effectively enhancing the level of intelligence in instant messaging products.

Search Engines

By December 2023, China’s search engine user base reached 827 million, an increase of 25.04 million from December 2022, accounting for 75.7% of Chinese netizens.

In 2023, the intelligent level of search engine products in China continued to improve, with applications becoming more enriched in both personal and business contexts.

China’s search engine companies are driving the integration of LLMs with the industrial sector, gradually enhancing the level of manufacturing intelligence and continuously enriching and expanding new application scenarios.

For example, Baidu’s “Kaiwu” platform, which is upgraded based on LLMs, currently serves 220,000 enterprises and has developed over 40,000 industrial models. It covers areas such as safe production, smart logistics, and smart quality inspection, helping enterprises reduce costs and increase efficiency.

Collaboration & Communication

By December 2023, China’s Collaboration and Communication Software user base reached 537 million people, accounting for 49.2% of China internet users.

The sector in China continued to introduce emerging technologies, achieving positive progress in enhancing product intelligence levels and user interaction experience.

Firstly, the level of product intelligence has been enhanced.

By incorporating artificial intelligence technology, the intelligence level of online office products has been effectively improved, aiding users in boosting their work efficiency.

For example, Kingsoft Office’s smart application “WPS AI” can generate texts such as weekly reports and job postings, and it can also create PowerPoint presentations with one click. DingTalk has transformed more than 20 product lines and over 80 scenarios with AI, promoting its application in over 700,000 enterprises.

Secondly, the interactive experience is continuously upgraded.

By introducing technologies such as naked-eye 3D and Augmented Reality (AR), online office products can help users view designs and manufacturing processes more intuitively and accurately, improving the interactive experience.

For instance, Tencent Meeting launched a naked-eye 3D video conferencing feature, allowing users to see three-dimensional content from different perspectives by moving left and right, offering a more realistic experience.

The domestic AR glasses company Rokid released the “Rokid AR Studio,” which enables immersive office scene interactions through gestures, voice, and other interaction modes.

Find out more (subscriber-only content):

- Demographic Dynamics and Clustering in China’s Mobile Internet Sphere

- New Trends among Chinese Mobile Users: Thriftiness, Health, and Experience Take Center Stage

- Digital Entertainment (online video, music, live streaming, literature)

- Ride-hailing

- Transactional Application Trends (online payments, shopping, delivery services, and travel booking)

Financial Highlights: A Glimpse into Growth

Tencent’s fiscal narrative for 2023 is one of notable achievements, underscored by a 10% year-over-year growth in total revenues, reaching an impressive RMB609.0 billion (USD86.0 billion).

This expansion is further emphasized by a 23% increase in gross profit, showcasing the company’s enhanced profitability in a fiercely competitive digital marketplace. Furthermore, the non-IFRS profit attributable to equity holders witnessed a substantial 36% increase from the previous year, indicating strong core earnings performance .

The final quarter of 2023 continued this trend, with revenues escalating by 7% year-over-year to RMB155.2 billion (USD21.9 billion), and gross profit and non-IFRS profit attributable to equity holders of the company experiencing significant increases of 25% and 44% respectively.

In 2023, Tencent’s revenue breakdown highlighted the diversity of its business portfolio, with significant contributions from various segments.

The FinTech and Business Services sector emerged as the largest revenue source, representing 31% of the total revenue and amounting to RMB189.0 billion. This segment’s leading position underscores Tencent’s stronghold in the FinTech industry and its successful foray into comprehensive business services.

Following the FinTech and Business Services sector, the Online Games segment was the second-largest contributor to Tencent’s revenue, accounting for 29% and totaling RMB177.0 billion. This demonstrates the continued vitality of online gaming within Tencent’s business model.

The fastest-growing segment in 2023 was Tencent’s Cloud Computing business, which experienced a remarkable 30% year-over-year revenue increase, reaching RMB109.0 billion. This growth outpaced the other segments, notably the Social Networks segment, and underscored Tencent’s effective strategy and execution in the competitive cloud services market.

Overall, Tencent’s 2023 financial performance showcased the strength of its FinTech and Business Services as the leading revenue generator, with the Cloud Computing segment leading in growth, reflecting the company’s adaptability and strategic positioning in China’s evolving digital landscape.

Strategic Endeavors and Innovation

2023 saw Tencent advance through strategic milestones:

Enhancing User Experience: Tencent’s WeChat Video Accounts doubled in user time spent, thanks to improved algorithms and creator support. Additionally, the Mini Games platform’s gross receipts soared by over 50%, reinforcing Tencent’s leadership in China’s casual gaming sphere .

Pioneering in AI: The launch of Tencent Hunyuan, an AI model of a trillion-parameter scale, marks a leap in Tencent’s technological prowess, solidifying its commitment to spearheading digital innovation .

Commitment to Society and Environment: Tencent’s digital philanthropy platform set a new record with RMB3.8 billion raised during the 99 Giving Day campaign, while its New Cornerstone Investigator Program supported 104 scientists, promoting scientific research .

As of the end of 2023, Tencent Music Entertainment Group (TME) reported a notable increase in its music subscribers. The total number of online music paying subscribers reached 90 million, marking an 18% year-over-year growth.

Market Engagement and User Dynamics

Tencent’s operational statistics reveal evolving trends in user engagement:

- The MAUs of Weixin and WeChat stood at 1,343 million by December 2023, a 2% increase year-over-year, highlighting the platforms’ expanding influence in social media .

- Despite a marginal decline in VAS revenues, Tencent’s strategic emphasis on content diversity and innovative services positions it for sustained growth amidst market challenges .

Tencent’s 2023 saga is one of strategic brilliance and financial vigor, positioning it at the forefront of China’s digital transformation. With its commitment to innovation, user-centricity, and societal impact, Tencent is poised to continue shaping the contours of China’s digital future.

Mobile reach in China: Tencent, Alibaba, Baidu, ByteDance, vs. Kuaishou

]]>CIW Dossier China Digital Insights (DCDI) is compiled to provide statistical information about China digital insights on the internet economy, digital trends, online users, mobile apps, and e-commerce. Click here to download.

Archive

E-commerce Market

Jul 2021

CIW Dossier “China E-Commerce” is compiled to provide statistical information about China’s e-commerce market including online retail, cross-border e-commerce, e-commerce users, and mobile shopping apps. If you need an overall insight into China’s e-commerce market, this is what you should read.

China 618 Shopping Festival

Jun 2021

CIW Dossier “China 618 Shopping Festival” provides a perspective of the merchants regarding the performance, advertising budget, and sales expectations from the top e-commerce platforms for 618 shopping festival.

China Social E-Commerce

Apr 2021

CIW Dossier “China Social E-Commerce” is compiled to provide four business models and statistical information about China’s social e-commerce market. Four social e-commerce models: group buying, membership, community-based, content-driven.

China Pets Retail Market

Jan 2021

CIW Dossier on China Pets Market provides an overview of China’s pet retail market as long as the characteristics of internet users in the corresponding segment.

Double 11 (Singles Day)

Nov 2020

CIW Dossier Double 11 is compiled to provide statistical information about China’s largest shopping festival led by Alibaba Tmall platform including pre-sale data, top retailers’ performance by GMV, and top brands on Double 11 by categories, etc.

Payment

Oct 2020

CIW Dossier Payment is compiled to provide statistical information about China’s payment market on online payment, mobile payment, third-party mobile payment, and users’ preference for payment method in different usage scenarios. If you need an overall insight on China’s payment market, this is what you should read.

Top Mobile Apps

Jun 2020

China’s mobile apps market, including mobile internet overview, mobile apps market, top mobile apps, select mobile apps, and mini programs.

Taobao Live

Apr 2020

CIW Dossier Taobao Live – is compiled to provide statistical information about Alibaba’s live streaming platform.

China Outbound Tourism

Nov 2019

Statistical information about China’s outbound travel market.

China Online Travel Market

Nov 2019

CIW Dossier China Online Travel Market is compiled to provide statistical information about China’s online travel market including market overview, online air ticket booking, online accommodation booking, online vacation booking, outbound travel, and high-end travel.

China Media Ad Spending

Feb 2019

China’s overall media advertising market growth and the top advertisers in China in 2018.

Luckin

June 2019

Luckin is China’s second largest and fastest-growing coffee network, in terms of the number of stores and cups of coffee sold, according to the Frost & Sullivan Report. While operating three types of stores, Luckin strategically focus on pick-up stores, which accounted for 91.3% of their total stores as of March 31, 2019.

China Internet Users in Tier-3 to Tier-5 Cities

Jun 2019

Quick view of China’s internet users’ time usage and expenditure in lower-tier cities (tier-3, 4, 5).

WeChat Official Account

July 2019

CIW Dossier “WeChat Official Account” is compiled to provide a quick view of Tencent’s WeChat content ecosystem Official Account.

Cross-border E-Commerce Female Shoppers

Jan 2019

Statistical overview of China’s female shoppers purchasing overseas consumers goods.

China Advertising Market

Dec 2018

Statistical information about China’s advertising market on traditional advertising market, online advertising market, invalid traffic of digital ads, and mobile e-commerce ads. If you need an overall insight on China’s advertising market, this is what you should read.

China Smartphone

Dec 2018

CIW Dossier China Smartphones is compiled to provide statistical information about China’s smartphone market including smartphone shipments, sales, and market share information as well as top smartphone brands and user profiles.

Weibo Online Shoppers

Nov 2018

CIW Dossier Weibo Online Shoppers is compiled to provide statistical information about Weibo users who are interested in online shopping. If you need an overall insight on the demographics, purchasing behavior, and engagement, etc. of Weibo online shoppers, this is what you should read.

China’s High-end Travelers

Aug 2018

CIW Dossier “China’s High-end Travelers” is compiled to provide an overview of China’s high-end travelers, including their travel choices, demographics, and travel habits.

WeChat Intro

July 2018

CIW Dossier on WeChat is compiled to provide an introduction of this digital ecosystem and statistical information about China’s top mobile social application. It provides insights on WeChat Official Accounts, WeChat Pay, Mini-Programs, and advertising channels.

Online video market

Sep 2018

CIW Dossier China Online Videos is compiled to provide statistical information about China’s online video market including online video apps, mobile video users, paid video users, short video apps, and live streaming apps. If you need an overall insight on China’s online video market, this is what you should read.

Pinduoduo (PDD)

Sep 2018

CIW Dossier Pinduoduo is compiled to provide statistical information about Pinduoduo on group purchase model, app ranking, financial performances, user profile, IPO, and counterfeit problems.

Golden Week Tourism

Oct 2018

CIW Dossier Golden Week (National Day) Tourism is compiled to provide statistical information about China’s tourism market for the peak travel period – Golden Week / China’s National Day holidays.

Sports & Fitness Mobile Apps

Nov 2018

CIW Dossier China Mobile Fitness & Sports Apps is compiled to provide statistical information about China’s sports & fitness mobile app market.

]]>Ant Group, the official payment partner for the Hangzhou Asian Games, announced that Alipay had completed the support for overseas users to use mobile payment services in China.

Athletes and tourists from around the world can now enjoy various convenient services across the country using Alipay, including shopping, hailing a taxi, taking the subway, and visiting tourist attractions.

To use these services, users must download the Alipay app, click “Register Account”, and select the “International Version”. After completing the registration, users can click on “Add Now” to enter the card binding page and follow the prompts to complete the card binding operation.

Alipay now supports international card organizations such as Visa, Mastercard, and Discover Global Network (including Diners Club). Furthermore, the usage of Alipay after binding an international card is no different from using a domestic bank card, supporting both QR code payment and payment code payment.

Similarly, Tencent announced a deepened cooperation with international card organizations such as Visa, Discover Global Network (including Diners Club), JCB, and Mastercard.

This collaboration aims to systematically open up WeChat Pay’s merchant network in various cities in China. Inbound individuals can activate WeChat Pay by using their passport, Hong Kong and Macau Residents Travel Permit (Home Return Permit), Taiwan Residents Travel Permit (Taiwan Compatriot Permit), Hong Kong and Macau Residents Residence Permit, Taiwan Residents Residence Permit, and Foreign Permanent Resident ID.

After binding an international bank card, they can conveniently consume at millions of small and medium-sized merchants.

These developments mark a significant step towards making mobile payments more accessible to foreigners in China, providing them the same convenience that local residents enjoy. It is expected to significantly enhance the experience of foreign visitors in China, especially in the context of the upcoming Hangzhou Asian Games.

]]>

In 2022, the total views of the original content on WeChat Channel (video account) increased by 350% year on year, and the scale of live broadcast increased by 300%, according to WeChat’s data released on 10 January 2023.

The commercial potential of live video broadcasting continues to be released, and the corresponding e-commerce sales increased by more than eight times year on year.

In 2022, the number of daily active creators and the average number of videos uploaded by the video account increased by more than 100% year on year, the number of creators with at least 10,000 fans increased by 308%.

The number of video account earners increased by 101%, and the total income of live video anchors increased by 447%.

Live video GMV increased by more than 8 times year on year in 2022, and the average selling price exceeded 200 yuan. Among them, the top three categories of consumption are covered by clothing, food, and beauty.

The monthly active users of WeChat Search have increased to 800 million, and the total search volume increased by 54%. Mini Programs are widely used in scenic spots, hotels, airports, and other fields, and the number of WeChat Mini Programs has increased by 183%.

WeChat Search contributed to 27% of Official Account follower growth and 20% of Mini Program’s new daily active users. Its contribution to WeChat Channel follower growth has increased by 120%.

WeChat MAU

Over 330 million of WeChat’s (known as Weixin in China) 1.2883 billion monthly active users use video calling. 780 million users are on the social networking section WeChat Moments and 120 million publish updates. The content network WeChat Official Account has 360 million users.

WeChat has evolved from an instant messaging app to a service meeting the digital needs of over 1.27 billion MAU in Q4 2021. Each day, more than 120 million active users post in social networking Moments, 360 million users read Official Accounts articles, and 500 million users access Mini Programs (Q1 2022) daily.

For Q4 2021, WeChat daily active advertisers expanded by over 30% year-on-year. Over one-third of Moments’ advertising revenue was generated from advertisements using Mini Programs as landing pages and advertisements connecting users to customer service representatives via WeCom.

WeChat Video Accounts’ time spent per user and total video views more than doubled year-on-year as Tencent enriched content diversity and enhanced the product experience.

WeChat Mini Programs

The daily active users on WeChat Mini Programs reached 450 million according to WeChat official data in January 2022. The transaction volume of catering, tourism, and retail increased by 100% year-on-year. Mini Program DAU reached 500 million (Q1 2022).

The number of Mini Program developers has exceeded 3 million.

In 2020, the daily active users of WeChat Mini Programs exceeded 400 million, according to its official data shared at its annual event WeChat Public Lecture.

The number of mini programs used per user increased by 25%, the average transaction value per user grew by 67%, the number of programs with transactions increased by 68%, and the annual transaction volume of more than doubled in 2020.

In 2020, more than 100 million people purchased in shopping malls and department stores on WeChat Mini Programs. With the help of mini program pre-sale + offline self pick-up mode, more than 300 million users purchased fresh fruits and vegetables.

WeChat Games

In 2020, the commercial realization of WeChat mini games increased by 20%.

Last year, the proportion of male and female users in the distribution of mini games accounted for 50% respectively. 40% of the users in the first and second-tier cities, and 65% of the users aged 30 and above.

Compared with 2019, the per capita game duration of mini games increased by 50%, and the average number of games played increased by 20% in 2020.

China game live streaming revenues to double by 2021

WeChat Search

The number of monthly active users of WeChat search has reached 700 million according to WeChat official data released in January 2022.

WeChat search staff said that in the mobile Internet era, search should not be limited by the search box, but need to be accessible by the touch. Users can search while chatting.

WeChat search will screen out the high-quality content of WeChat and produce a more accurate connection with users.

In the future, it can expand the search scope to the whole internet-based the needs of users. The search results are currently mostly provided by WeChat Official Account and Sogou.

WeChat Pay

In January 2022, WeChat shared the latest progress on WeChat Pay:

- 23 thousand monthly service providers

- Over 10 million merchants

- More than 1800 banks and Payment institutions

- 23 thousand monthly merchants

- In the next three years, WeChat Pay will continue to carry out digital upgrading of WeStore, with a planned investment of more than 10 billion yuan

In 2020, Zhifufen, a credit score on WeChat Pay, saw more than 240 million users. It boosted the conversion rate of e-commerce orders by 14% and the repurchase rate of retail merchants by 73%.

In 2021, WeChat mini stores and Zhuanzhuan (a secondhand-goods marketplace) will integrate Zhifufen.

In the e-commerce industry, WeChat Pay’s Zhifufen enables post-payment after receiving the delivery and faster refund. Users can quickly receive a refund after submitting return logistics information.

As of January 2022, more than 50% of users have activated Zhifufen, whose solutions cover more than 3000 industries. WeChat Pay unit cooperates with the e-commerce industry on “buy first and pay later”, which has been used by more than 100 million users.

Zhifufen also announced the launch of audio and video members’ services such as “watch first and pay later”, which helped solve the problems that bothered audio/music and video users to deduct fees in advance and forget to terminate their contracts.

China’s online payment users penetration reaching 86%

Enterprise version of WeChat: WeCom

In 2020, there were 80,000 enterprise WeChat partners, with a year-on-year growth of 400%.

11.91 million applications connect to WeCom, with a year-on-year increase of 250%. Since COVID-19, there have been 5.5 million real enterprises and organizations on WeCom with 130 million active users reaching 400 million WeChat users.Click To TweetAcquire, convert, and retain customers through WeChat Ads + WeChat Work (WeCom)

]]>

60% of Generation Z said that “the way brands communicate with me” plays a major role in their purchase decisions, according to a survey conducted by Tencent.

“Reliable” & “honest” are the basic requirements for brand communication, Gen-Zs focus more on young lifestyles and surprises while older generations value more “professionalism”.

69% of Gen-Zs are willing to pay for products from brands that they identify themselves with and those who can help them “decorate” their personalities. Brands have become a way for young generations to identify themselves.

Compared with previous generations, Gen-Zs tend to buy more products with specific brand images to help build their own personal image.

Building characteristic communities

Private domain channels have become the main transaction scenario, quality services are highly valued.

61% of Generation Z have joined various types of shopping groups (14% brand membership group, 24% merchant membership group). These shopping groups have a major influence over their purchase decisions. Over 86% of those who joined these groups had purchasing intentions.

Apart from discounts, Gen-Zs also expect more soft experiences, in particular acquiring knowledge (44%), having readily available help (38%), and experiencing privileged treatments, more compared with older generations.

The effectiveness of discount promotions is fading; social media content has become the new major form of influence.

Compared with older generations, promotions through discounts are having less effect on the willingness to buy of the younger generation (Generation Z 44%; group born in 90-95 51%; group born in the 80s 53%).

Private domain channels are effectively capturing Generation Z’s attention. They often see the same brand repeatedly (28%), while social interaction can effectively encourage purchases.

Gen-Zs mainly get influenced by their friends (31%), acquaintances (25%), WeChat Moments (21%), KOLs (21%) through social media.

Creating quality content

Generation Z is spending their attention across multiple fields.

Gen-Zs love to indulge themselves and also love to explore possibilities. Hobbies are their major focus point (88%). In addition, they also pay attention to acquiring new knowledge (41%), enriching real-life experiences (37%).

Compared with previous generations, they pay more attention to product/service reviews (26%) and motivational content (22%).

Celebrities are effective in promoting brand awareness. 35% of Generation Z said that collaborations between brands and celebrities have great influence over their purchase decisions.

Brands collaborating with IPs can also effectively capture Gen-Z’s attention. 42% of them said that this type of collaboration has significant influence over their purchasing decisions.

]]>UnionPay Flash supports the top-up payment of QCoin, QQ Music, and Tencent Videos. WeChat Mini Programs will gradually support Flash Pay, being in beta test since 22 September.

On October 2nd, Alipay announced the progress in promoting interconnection with China UnionPay. it has opened online payment scenes to the UnionPay Flash app, covering the first batch of 85% Taobao merchants.

For offline, it has also implemented QR code scanning and mutual recognition with UnionPay Flash payment in multiple cities and plans to cover all cities in China by March 2022.

UnionPay, also known as China UnionPay or by its abbreviation, CUP or UPI internationally, is a Chinese financial services corporation headquartered in Shanghai, China. It provides bank card services and a major card scheme in mainland China.

Founded on 26 March 2002, China UnionPay is an association for China’s banking card industry, operating under the approval of the People’s Bank of China (PBOC, central bank of China).

It is also an electronic funds transfer at point of sale (EFTPOS) network, and the only interbank network in China that links all the automatic teller machine (ATMs) of all banks throughout the country.

In 2015, UnionPay overtook Visa and Mastercard in a total amount of value of payment transactions made by customers and became the largest card payment processing organization (debit and credit cards combined) in the world after the two.

China’s 3rd-party payment market 2021-2025e: mobile vs. internet

]]>