The record-breaking 213.4 billion yuan gave this year’s Tmall Double 11 a good ending. Some turned their attention to the performance of top retailers and wanted to check out what they did to achieve such success.

Double 11, named after Singles’ Day (or Bachelor’s Day) in China on 11 November, is the biggest shopping festival of the year. The magic cannot happen in one day. Let’s see the marketing tactics deployed by the top players for Double 11.

Alibaba Taobao’s “Double 11 Partner”

Alibaba created new gameplay for social marketing, that’s Taobao “Double 11 Partner”. Alimama, Alibaba’s big data marketing platform, supported this with data and 3 million Taobaoke (affiliates). Under “Double 11 Partner” program, anyone could be a Taobaoke.

From October 20th to October 31st, as long as consumers set up the “Double 11 energy PK team” or was invited to one such team, what he need to do was to encourage others to like it. If his team wins, he will get a specific bonus. For instance, 100 energy points could exchange for 1 yuan.

Either inviting others or liking other teams, users connect to the gameplay of energy for red envelope. The gameplay is everywhere in Alibaba-affiliated apps and channels.

Red envelopes are gifts presented at social and family gatherings such as weddings or holidays such as Chinese New Year. The red color of the envelope symbolizes good luck and is a symbol to ward off evil spirits.

Users can generate energy points in all related apps, even in the offline Hema grocery/restaurant stores. All energy points made will become red envelope for shopping on the very day of Double 11.

Such gameplay not only brought traffic to Alibaba, more importantly, it also integrates all channels and makes them connected. In this way, Alibaba knows its consumers better.

Luckin Coffee sold 5.15 million cups of coffee by sending coupons

Consumers can get two coffee coupons after buying one coffee, which means they can get three coffees at one coffee’s price.

Luckin Coffee attracted lots of new consumers. It worked exceptionally well among the white collar who are likely to invite others to buy together to get more coupons and waive delivery fees. And, it also retains existing customers at the same time.

Driven by this marketing strategy, Luckin Coffee successfully sold 5.15 million cups of coffee on Double 11.

Weilong, a snacks brand, taking advantage of Tmall marketing tactics

Weilong took advantage of Tmall’s promotion for Double 11 “50 yuan off 400 yuan purchase” to make itself a good option when lots of consumers’ total purchase order didn’t reach 400 yuan.

It specially arranged an exclusive landing page for this promotion tactic making it very easy to be understood and adopted by online shoppers.

Viya, the top Taobao host socialized Taobao

Online celebrities’ Taobao shop has become an important force for Double 11.

The 33-year-old top Taobao streaming host Viya has 3.67 million followers on Taobao. She earned 30 million yuan last year, the number 1 host of Taobao. A week right before Double 11, Viya did one live streaming every day. On average, she introduced 60 products in every live streaming.

Besides live streaming, Viya also took advantage of Weitao, Tik Tok, and Weibo to make a 1,000 must-buy lists for her followers. She also interacted with her followers to choose a special one who wins the online lottery and gets a million yuan valued prize, sponsored by 100 brands.

Read the story of this Taobao celebrity who sold 300 million yuan products on Double 11.

Related eBook: 7 lessons from Double 11 marketing campaigns

]]>

The Fast Retailing Group generated rises in both revenue and profit in the first nine months of fiscal 2018 from 1 September 2017 to 31 May 2018.

Consolidated revenue totaled ¥1.7041 trillion Japanese yen (US$15.66 billion), up by 15.3% year-on-year and operating profit reached ¥238.8 billion, increased by 32.3% year-on-year. The profit attributable to owners of the parent increased to ¥148.3 billion, an increase of 23.5% year-on-year.

Within the UNIQLO International segment, revenues from Greater China (Mainland China, Hong Kong, and Taiwan) overtook the total income of the other overseas market. It also exceeded its domestic income.

China has become the second largest market for Uniqlo only after Japan for two years running. Uniqlo derived 70% of its overseas revenues from China.

Apart from strong supply chain management, fast product innovation, precision marketing is also the main factor for Uniqlo’s fast-growth in China.

During the March-to-May quarter, same-store sales at UNIQLO Greater China attained double-digit year-on-year growth following a strong launch of new Spring Summer ranges, and effective news generated by popular new UT brand contents, Kando pants, jackets, and other ranges.

Generally, Uniqlo tends to cooperate with the designer and international IP to promote its products. For example, Uniqlo cooperated with Manwei Company to launch a new superhero UT brand, which attracted a lot of consumers to the store.

To keep up with the current new retail trend in China, Uniqlo makes some adjustments to outlet experience and stock.

For example, Uniqlo makes it convenient for consumers to order online and in-store pick-up in any outlet. Uniqlo uses RFID electronic tags to enhance stock management. Moreover, given the large market order and uneven area distribution, Uniqlo adopts a weekly calculation scheme to check the stock.

Such changes promote sales. Uniqlo reported that sales directly promoted by in-store pickup service in Double 11 period this year is five times more than that of last year.

In the future, Uniqlo aims to overtake Zara and H&M to be the world’s largest clothing retailer. Tadashi Yanai, the president and CEO of Uniqlo’s parent Fast Retailing Group, has set a new target for the Greater China. It plans to expand stores to 1,000 by the end of 2021 and achieve a ¥62.5 billion turnover and a ¥12.5 billion operating profit. That means Uniqlo will open 100 new stores in China annually.

]]>

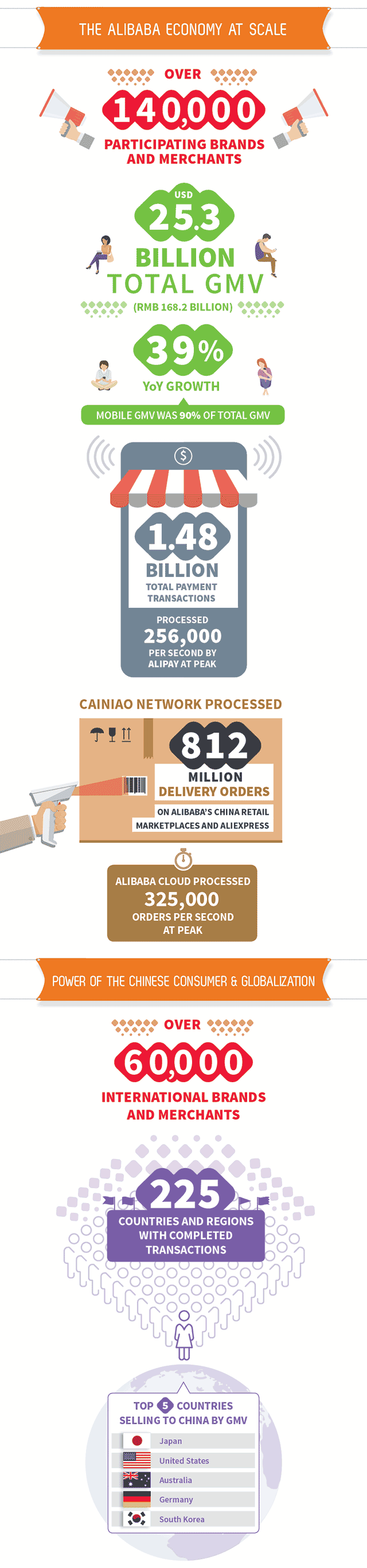

In the ninth year of the world’s largest 24-hour shopping event, this year’s Tmall Double 11 2017 will showcase:

Alibaba Economy at scale. 11.11 will demonstrate the technological innovation and global scale of the entire Alibaba Economy. More than 140,000 brands and hundreds of millions of consumers will participate in 11.11 this year. This shopping festival will be supported by Alibaba’s global cloud, payment and logistics infrastructure.

Consumers will enjoy seamless payment and consumer loan services provided by Ant Financial. Alibaba Cloud will serve as the core technology and computing backbone to ensure the best consumer experience throughout the festival. Cainiao Network expects over 3 million logistics personnel to facilitate the hundreds of millions of packages that will be generated from the festival.

The number of annual active consumers on Alibaba’s China retail marketplaces reached 488 million, an increase of 22 million from the 12-month period ended June 30, 2017. See the performance highlights of Alibaba in Q3 2017 here.

Power of the Chinese consumer. Alibaba expects that hundreds of millions of Chinese consumers who visit its platforms on November 11 will have access to over 60,000 international brands and merchants to satisfy their increasing demand for goods and products from around the world. This year, Tmall will, for the first time, leverage its popularity outside China to bring over 100 domestic Chinese brands to international markets, targeting millions of overseas Chinese consumers in Asia and the rest of the world.

New Retail implementation. Alibaba’s New Retail model with integrated online-offline customer offerings will be showcased in store locations across China. More than 1,000 brands will convert nearly 100,000 physical locations into “smart stores” and our channel distribution solutions make it easy for more than 500,000 local neighborhood stores and Rural Taobao service centers to sell to consumers in lower-tier cities and rural villages.

Tmall Double 11 Sales Stats 2017

Total sales on Tmall Double 11 Shopping Festival reached 168.2 billion yuan in 2017 from 225 countries and regions, 90% from mobile.

167 merchants each has total transactions of over 100 million yuan. Nike store became the first one with over 1 billion yuan in apparel category.

Top 50 Tmall Stores on Double 11 2017

- Suning

- Xiaomi

- Honor (Huawei)

- Haier

- Nike

- Uniqlo

- Sharp

- Adidas

- Linshimuye (furniture)

- Midea

- Quanyou (furniture)

- GREE

- Huawei

- Gujia (furniture)

- Heilan Home

- PurCotton

- Sanzhi Songshu (snacks)

- P&G

- Dyson

- GXG

- Balabala (children apparel)

- New Balance

- Semir

- Peacebird

- Jack Jones

- Pechoin

- Veromoda

- ecovacs

- Lancome

- Zara

- ONLY

- Estee Lauder

- Hisense

- Anta

- Philips

- Gap

- Chando

- Eifini

- Fotile

- HSTYLE

- Vivo

- SK-II

- Olay

- Skyworth

- Little Swan

- Meters/bonwe (Apparel)

- Xilinmen

- Li Ning

- Siemens

- Bosideng (Apparel)

Top Smartphone Stores

- Apple

- Xiaomi

- Honor

- Huawei

- Vivo

- OPPO

- Meizu

- Samsung

- Meitu

- Nubia

Home Appliances

- Midea

- Philips

- ECOVACS

- Dyson

- Joyoung

- SUPOR

- Xiaomi

- Panasonic

- Haier

- Galanz

Large Home Appliances

- Haier

- Midea

- Sharp

- Siemens

- GREE

- Xiaomi

- Hisense

- TCL

- AUX

- LittleSwan

Men Apparel

- HLA

- Uniqlo

- GXG

- Peacebird

- Jack & Jones

- Playboy

- Semir

- Mark Fairwhale

- Meters Bonwe

- Bosideng

Women Apparel

- Uniqlo

- Vero Moda

- ONLY

- Eifini

- HSTYLE

- Peacebird

- Bosideng

- Leting

- Ochirly

- Teenie Weenie

Makeups

- Pechoin

- Chando

- Lancome

- Estee Lauder

- SK-II

- Olay

- L’Oreal

- One Leaf

- Innisfree

- Shiseido

Outdoor sports

- Nike

- Adidas

- Anta

- New Balance

- Li Ning

- Sketchers

- Puma

- Xstep

- Under Armour

- Camel

Tmall Sales Progress on Double 11 2017

- 1 billion yuan: 28 seconds (vs. 52s in 2016)

- 10 billion yuan: 3 mins 1 seconds (vs. 6m 58s in 2016)

- 19.1 bn yuan: 5 mins 57s (exceeds total Double 11 sales in 2012)

- 36.2 bn yuan: 16 mins 10s (exceeds total Double 11 sales in 2013)

- 50 bn yuan: 40 mins 12s (vs. 2 hrs 30m 20s in 2016)

- 57.1 bn yuan: 1 hours 49s (exceeds total Double 11 sales in 2014)

- 91.2 bn yuan: 7 hours 22m 54s (exceeds total Double 11 sales in 2015)

- 100 bn yuan: 9 hours 4s(vs. 18 hrs 55m 36s in 2016)

- 120.7 bn yuan: 13 hours 9m 49s (exceeds total Double 11 sales in 2016)

- 168.2 bn yuan at 24:00

Alibaba Cloud processed 325,000 orders per second at peak. Alipay processed 1.5 billion payment transactions in total, up 41% from 2016, and processed 256,000 transactions per second at peak.

Other E-Commerce Platforms Double 11 Stats 2017

Total orders from 1 Nov till 7:46:58 on 11 Nov exceeded 100 billion yuan on Jingdong (JD). Total transactions on JD during the eleven days’ online sales reached 127.1 billion yuan with over 50% growth.

Netease Kaola total Double 11 sales value reached 4 times as much as last year’s. It reached the total transactions of last year’s Double 11 in the first 28 minutes. Kaola has 25.6% market share in China’s cross-border e-commerce market in Q3 2017 ranking first according to iiMedia.

Total orders on AliExpress exceeded 10 million as of 19:50 on Double 11 2017. It covers 184 countries and regions in the first two hours.

]]>

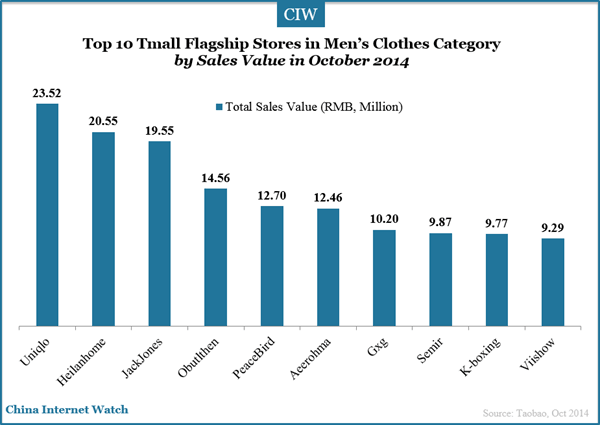

In October 2014, Uniqlo ranked top among Tmall flagship stores in Men’s clothes category by sales value of RMB23.52 million ($3.82 million), followed by Heilanhome and Jack & Jones Tmall flagship stores.

On Tmall/ Taobao, Jack & Jones’s total sales value was RMB25.05 million ($4.07 million) in September 2014 and it also ranked 5 on the list of top brands men’s clothes category.

Also read: Tmall Targets to Generate RMB 50 Bln Revenue on Double 11 2014

]]>