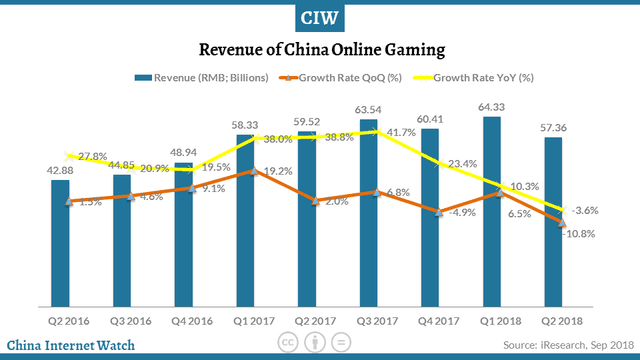

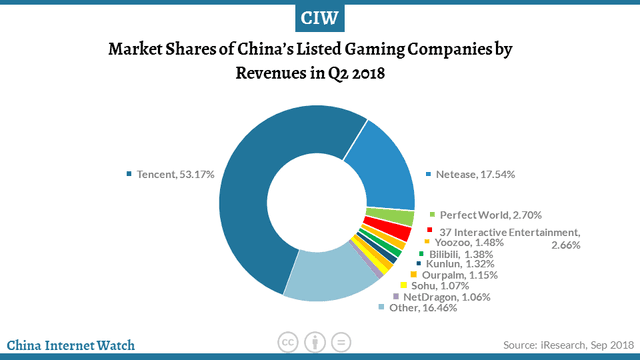

China’s online gaming market decreased by 10.8% YoY to US$8.29 billion in Q2 2018. Mobile games accounted for 65.1%. Tencent is the biggest player with a share of 53.17%.

China’s online gaming market totaled 57.36 billion yuan (US$8.29 bn) in Q2 2018, a negative growth of 10.8% year-on-year and 3.6% quarter-on-quarter.

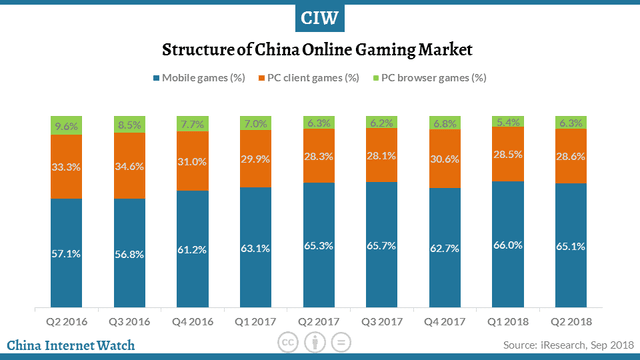

Mobile games contributed 65.1% to the total online gaming revenue in Q2 2018, a slight drop compared with the previous year. PC games show a growing trend as e-sport increasingly gains popularity and becomes an official item of the international sports events.

Tencent remained its leadership position with the largest share of 53.17% in Q2 2018. Netease and Perfect World took the next two places with a share of 17.54% and 2.7%, respectively. Bilibili moved up to sixth place with a share of 1.38%.

]]>

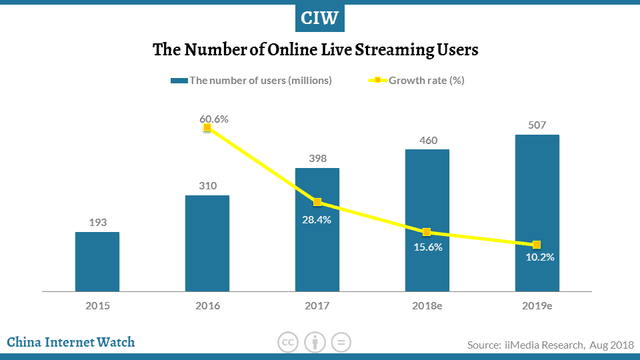

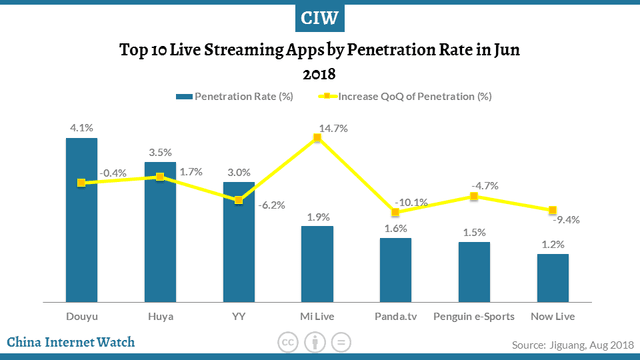

Online live streaming market obtained a total of 398 million users in 2017, an increase of 28.4%, which is estimated to reach 460 million in 2018 and 507 million in 2019. This market showed signs of a slowdown since 2017.

Within China’s live streaming market, Douyu took the lead with a penetration of 4.1%, a negative growth of 0.4%, followed by Huya (3.5%) and YY (3.0%).

On average, Douyu and Huya both saw rises in daily active users to 7.616 million and 5.705 million, respectively. While YY suffered loss from 5.325 million to 4.552 million.

Get an overview of China’s online video market here, short video apps market here, or top mobile apps here.

Related CIW Dossiers: Dossier: China Online Videos, mobile apps

]]>

Pinduoduo, founded by an ex-Googler, reported GMV of 262.1 billion yuan (US$39.6 bn) in the twelve-month period ended June 30, 2018, an increase of 583% from last year.

Active buyers grew by 245% to 343.6 million and annual spending per active buyer was 762.8 yuan (US$115.3), increased by 98% year-on-year. Average monthly active users reached 195 million in Q2 2018, up by 495% year-on-year.

Total revenues of Pinduoduo was 2,709.0 million yuan (US$409.4 million) in Q2 2018, increased by 2,489% year-on-year and 96% quarter-on-quarter.

- Revenues from online marketing services were 2,371.0 million yuan (US$358.3 million), a significant increase from 32.1 million yuan in Q2 2017, and an increase of 114% sequentially from 1,108.1 million yuan in Q1 2018.

- Revenues from commission fees were 338.1 million yuan (US$51.1 million), an increase of 366% from 72.5 million yuan in Q2 2017, and an increase of 22% sequentially from 276.5 million yuan in Q1 2018.

Total operating expenses were 8,957.4 million yuan (US$1,353.7 million) in Q2 2018, compared with 119.8 million yuan in Q2 2017.

Sales and marketing expenses were 2,970.7 million yuan (US$448.9 million), a significant increase from 88.9 million yuan in Q2 2017, mainly due to an increase in branding campaigns and online and offline advertisement and promotions.

General and administrative expenses were 5,800.7 million yuan (US$876.6 million), a significant increase from 6.0 million yuan in Q2 2017, primarily due to an increase in headcount and share-based compensation expenses.

Research and development expenses were 186.0 million yuan (US$28.1 million), an increase of 648% from 24.9 million yuan in Q2 2017. The increase was primarily due to an increase in headcount and the recruitment of more experienced R&D personnel, as well as an increase in the R&D related cloud services expenses.

Operating loss was 6,636.2 million yuan (US$1,002.9 million), compared with operating loss of 122.7 million yuan in Q2 2017. Non-GAAP operating loss was 815.7 million yuan (US$123.3 million), compared with 119.9 million yuan in Q2 2017.

Net loss attributable to ordinary shareholders was 6,493.9 million yuan (US$981.4 million), compared with 109.5 million yuan in Q2 2017. Non-GAAP net loss attributable to ordinary shareholders was 673.4 million yuan (US$101.8 million), compared with 106.7 million yuan in Q2 2017.

Cash and cash equivalents were 9.0 billion yuan (US$1.4 billion) as of June 30, 2018, compared with 3.1 billion yuan as of December 31, 2017.

]]>

In Q2 2018, Xiaomi reported a high growth of 58.7% in smartphone revenues to 30.5 billion yuan (US$4.61 bn), accounting for roughly two-thirds of the total revenues. Smartphone sales volume reached 32.0 million units, up by 43.9% year-on-year. IoT and lifestyle products grew 104.3% year-on-year in revenues with the global sales volume of smart TVs grew over 350% year-on-year.

Xiaomi achieved 45.2 billion yuan (US$6.82 bn) in revenue, representing a growth of 68.3% year-on-year. Adjusted profit grew 25.1% to 2.1 billion yuan (US$317.1 mn) year-on-year, according to its first results as a public company since its IPO in July.

Smartphone

The smartphones segment recorded approximately 30.5 billion yuan in revenues for Q2 2018, representing year-on-year growth of 58.7%. This growth was driven by an increase in both sales volume and the average selling price (“ASP”). Smartphone sales volume reached 32.0 million units, up 43.9% on a year-on-year basis. Xiaomi is the fastest growing amongst the top five mobile phone companies globally, according to IDC.

In China, Xiaomi’s strategic focus for 2018 is to expand into the high-end smartphone market. Its smartphone ASP in mainland China increased over 25% year-on-year in Q2 2018. Its flagship phone series, Mi 8, which has an average ASP above 2,000 yuan (US$301.98), sold over 1.1 million units in the first month of sales.

IoT and lifestyle products

The IoT and lifestyle products segment grew 104.3% year-on-year in revenue to 10.4 billion yuan (US$1.57 bn) for Q2 2018. Global sales volume of smart TVs grew over 350% year-on-year in this quarter. Xiaomi became the No.1 TV brand in mainland China in Q2 2018. The smart TV was also launched in the India market in February 2018.

Xiaomi also continued to launch innovative IoT products, such as the Mi VR Standalone headset that it co-developed with Oculus, and Mi Band 3, which features a large touchscreen, 50-meter water resistance and battery life of up to 20 days. Mi VR Standalone headset was named one of the best inventions of 2017 by Time Magazine.

As of the end of Q2 2018, Xiaomi had about 115 million connected Xiaomi IoT devices, excluding smartphones and laptops, an increase of 15% quarter-on-quarter. There are close to 1.7 million users who own more than five Xiaomi IoT devices, excluding smartphones and laptops, increased by 19% quarter-on-quarter.

Internet services

Revenue from the internet services segment grew 63.6% year-on-year to 4.0 billion yuan (US$603.95 mn) in Q2 2018, driven primarily by increasing monetization in mainland China. Advertising revenue grew 69.6% year-on-year to 2.5 billion yuan (US$377.47 mn) driven by continued optimization of its recommendation algorithm and increased advertising spending from customers.

Revenue from internet value-added services also grew 54.1% year-on-year to 1.5 billion yuan (US$226.48 mn). Within internet value-added services, revenue from gaming accounted for 703.9 million yuan (US$106.28 mn), growing 25.5% year-on-year.

Monthly active users (“MAU”) of MIUI increased 41.7% from 146.0 million in June 2017 to 206.9 million in June 2018, driven by increasing smartphone sales volume and user adoption.

Average revenue per user (“ARPU”) this quarter increased 15.4% year-on-year to 19.1 yuan (US$2.88). Up until the end of Q2 2018, the internet services revenue was primarily generated in mainland China.

Artificial intelligence (“AI”) technology is a core part of Xiaomi’s strategy. Its AI assistant (” 小愛同學 “) won the “2018 Leading Scientific and Technological Achievement Award — Cool Technologies” and “2018 Leading Scientific and Technological Achievement Award — New Product” awards at the China International Big Data Industry Expo held in May 2018.

As of July 2018, its AI assistant (“小愛同學”) MAU exceeded 30 million. The AI speaker has accumulated over 2 billion activations within the first year of its launch.

To promote the development of the AI industry, in June 2018, Xiaomi announced that its Mobile AI Compute Engine (“MACE”), a prediction framework for a deep learning model optimized for mobile devices, would become a fully open source platform.

Using MACE, developers can more quickly and efficiently develop AI applications on mobile devices and significantly enhance the user experience of these applications. At present, application scenarios covered by MACE include scene recognition, image super-resolution, image stylization processing, intelligent speech, intelligent translation, etc.

International markets

Xiaomi’s international revenue grew 151.7% year-on-year to 16.4 billion yuan (US$2.48 bn), accounting for 36.3% of its total revenue.

Its smartphones continued to experience rapid growth in the Indian market and ranked first in terms of market share by shipment in Q2 2018, according to Canalys.

In Indonesia, Xiaomi also recorded impressive growth and ranked No.2 in terms of smartphone shipments in Q2 2018. In the Western Europe market, Xiaomi expanded into France and Italy in May 2018. Smartphone shipments in Western Europe grew over 2700% year-on-year. As of Q2 2018, Xiaomi was ranked top five in the smartphone markets in 25 countries and regions, according to Canalys.

Expansion of offline channels

As of June 30, 2018, Xiaomi Corporation had more than 400 Mi Homes in mainland China, mainly in first- and second-tier cities. To penetrate more rural parts of China, by the end of Q2 2018, Xiaomi had over 360 authorized stores and also had built a direct supply network covering more than 37,000 locations, spread across over 30 provinces, over 300 cities and over 2,500 towns.

In India, its offline smartphone sales achieved a market share of over 20% and ranked No 1. in 8 cities in Q2 2018, according to GFK. Its overall operation remained highly efficient with an operating expense ratio of 8.8% for Q2 2018.

]]>

Momo, one of the top mobile social networking platform in China, announced total net revenues of $494.3 million in Q2 2018 with an increase of 58% YoY, according to its unaudited financial results.

Net income attributable to Momo increased to $117.8 million in the second quarter of 2018 from $60.8 million in the same period last year. Non-GAAP net income attributable to Momo increased 90% to $140.2 million from $73.8 million in Q2 2017.

Live video service revenues continued its growth momentum and the total live video service revenues were $411.0 million in Q2 2018 (83% of total), an increase of 58% from $259.4 million during Q2 2017. The rapid growth in live video revenues was contributed by the increase in the quarterly paying users, which was 4.6 million for Q2 2018, as well as, the increase in the average revenues per paying user per quarter.

Momo’s Monthly Active Users (“MAU”) were 108.0 million in June 2018, compared to 91.3 million in June 2017. Total paying users of its live video service and value-added service, including 3.1 million paying users of Tantan in June 2018, were 11.6 million for Q2 2018, compared to 7.1 million in Q2 2017.

China social media users compared: Weibo vs WeChat vs Momo

]]>

Tencent saw its first decline in profit since Q3 2005. WeChat total MAUs grew about 10% to 1,057.7 million. Overall, both QQ and QZone saw a decrease in their MAUs in this quarter.

The first decline in profit since Q3 2005

Tencent’s total revenues were RMB73,675 million (USD11,135 million), an increase of 30% over Q2 2017 (“YoY”), driven primarily by payment-related services, digital content subscriptions and sales, social and others advertising, and smartphone games.

Its operating profit was RMB21,807 million (USD3,296 million), a decrease of 3% YoY. Operating margin decreased to 30% from 40% last year.

Profit for the period was RMB18,580 million (USD2,808 million), an increase of 2% YoY. Net margin decreased to 25% from 32% last year. Profit attributable to equity holders of the Company for the quarter was RMB17,867 million (USD2,700 million), a decrease of 2% YoY. Gaming has a huge impact on that.

Tencent’s Key Activities in Q2 2018

Tencent expanded the capabilities and usage of WeChat Mini-Programs, whose daily active users has exceeded 200 million, by integrating them with other digital tools, such as WeChat Pay, to provide customized solutions for a broader range of verticals.

Tencent has built up a sizable developer ecosystem with a large and expanding base of external developers and software integrators, as well as a consumer base of over 200 million DAUs.

Tencent views WeChat Mini-Programs as complementary to native mobile apps and believes it will contribute materially to their user experience, enterprise relationships, the development of their payment, advertising, and cloud businesses.

During Q2 2018, the total daily pageviews of QQ KanDian and Mobile QQ Browser together increased 55% year-on-year, while the total daily short video views of the two properties combined climbed over 3 times, year-on-year.

Users data on Tencent platforms

Monthly active user accounts (“MAU”) of QQ was 803.2 million, a decrease of 5.5% YoY. Smart device MAU of QQ was 708.6 million, an increase of 7.0% YoY.Click To TweetCombined MAU of Weixin and WeChat were 1,057.7 million, an increase of 9.9% YoY.

MAU of Qzone was 548.3 million, a decrease of 9.5% YoY. Smart device MAU of Qzone was 542.7 million, a decrease of 7.3% YoY.

Fee-based VAS registered subscriptions were 153.9 million, an increase of 30.3% YoY.

Tencent’s payment business had over 800 million active users as of end June 2018 with an increase of 40% in the average daily transactions. The offline payment transactions grew by 280% YoY.

WeChat Mini-Programs: top categories and referring sources 2018

]]>

Sogou achieved solid results in Q2 2018 with revenue increasing 43% year-on-year to US$301.4 million and non-GAAP net income up by 58% to US$38.2 million, according to its financial results. That was greatly driven by the twin growth engines – search and mobile keyboard – and AI-focused strategy.

Search and search-related revenues were $270.6 million, a 45% increase year-on-year. The increase was primarily due to the strong growth in auction-based pay-for-click services, driven by improved monetization and continued traffic growth in mobile search.

Auction-based pay-for-click services accounted for 84.7% of search and search-related revenues, compared to 83.0% in the corresponding period in 2017.

In search, Sogou differentiated services from Baidu in key verticals, such as healthcare. It also deepened its partnership with WeChat by providing more search services such as the encyclopedia and interactive Q&A platform.

Its AI-powered innovations drove broader adoption of the Sogou Mobile Keyboard, with DAU increasing by 36% year-on-year to 380 million in Q2 2018. Especially in June, Sogou Mobile Keyboard handled approximately 300 million voice inputs on average per day, up 54% year-on-year, and remained China’s largest voice mobile application.

Meanwhile, Sogou also applied its AI capabilities to enhance the competitiveness of the recently launched hardware products, such as Sogou Travel Translator and Sogou Smart Recording Translator.

Baidu also had a good quarter in Q2 2018. Check out China mobile internet market forecast 2018-2020 here.

]]>