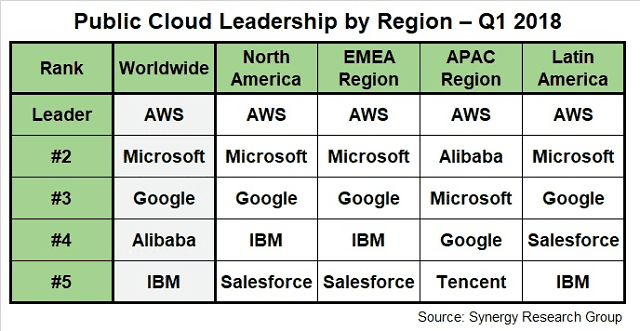

Within public cloud services market, Alibaba Cloud ranked second in the APAC region and fourth worldwide.

In China, the top five cloud providers are all local companies. China now accounts for a third of the total APAC market and its share of the regional total is increasing each quarter.

]]>

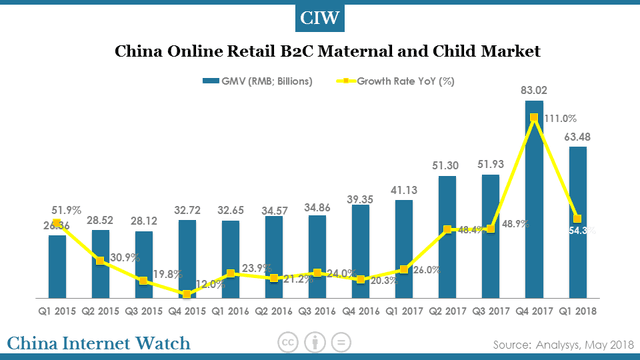

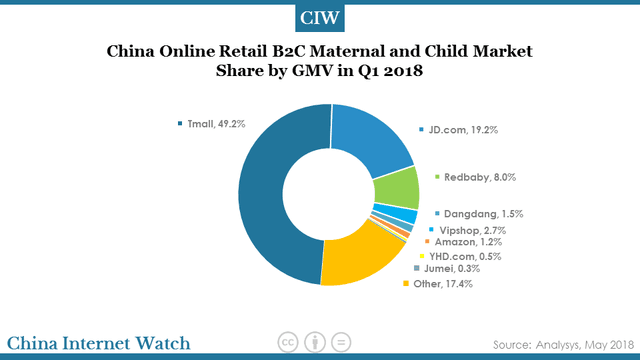

Within the online retail B2C market, maternal and child sector saw a high growth of 54.3% in GMV to 63.48 billion yuan in Q1 2018.

Tmall led this market with a lion’s share of 49.2%, followed by JD.com (19.2%) and Redbaby (8.0%).

Get an overview of China B2C online retail market for Q1 2018 here.

]]>

Momo announced its net revenues totaled US$435.1 million in Q1 2018, an increase of 64% from Q1 2017. Net income attributable to Momo Inc. increased by 59.6% to $129.9 million in Q1 2018 from $81.2 million in Q1 2017.

Momo obtained 103.3 million monthly active users in March 2018. Among which, total paying users of live video service and value-added service, without double counting the overlap, were 8.1 million.

Revenues from live video service totaled US$371.5 million, an increase of 74.8% from US$212.6 million in Q1 2017. The rapid growth in live video revenues was contributed by the increase in the quarterly paying users, which was 4.4 million for Q1 2018, as well as, the increase in the average revenues per paying user per quarter.

Value-added service revenues mainly include membership subscription revenues and virtual gift revenues. The revenues of total value-added service grew by 62% year-on-year to US$37.0 million in Q1 2018. Total paying users of our value-added service were 5.1 million.

Mobile marketing contributed US$18.7 million to total revenues in Q1 2018, a 5% increase year-on-year. While revenues derived from mobile games down by 43% from Q1 2017, which was $6.6 million in Q1 2018.

Momo closed the acquisition of 100% equity stake Tantan Limited in May by borrowing US$300 million bank loan from the domestic commercial bank.

By Q2 2018, the company expects total net revenues to be US$470.0 million and US$485.0 million, representing a year-over-year increase of 51% to 55%.

China social media users compared: Weibo vs WeChat vs Momo

Read more: WeChat Mini-Programs status report 2018

]]>

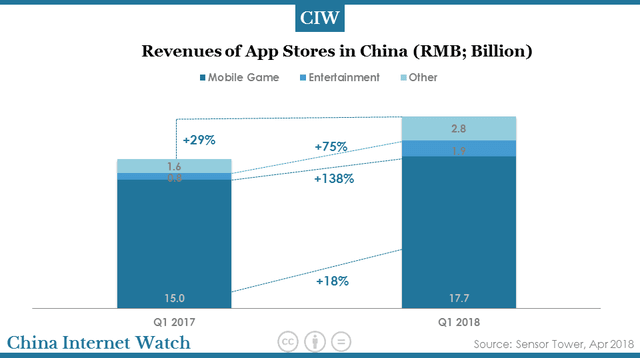

In Q1 2018, Apple App Store generated 22.4 billion yuan (US$3.49 bn) from China, up 29% over Q1 2017. Mobile gaming apps took the largest share of 79% in revenues, but only saw an 18% increase year-on-year, well off that of entertainment apps (138%). The total number of downloads reached 2.5 billion in Q1 2018, representing 32% of the global downloads.

Apple’s App Store derived 32% of its global revenue from China according to Sensor Tower. China had surpassed the US and Japan as the largest iOS App Store market in Q3 2016 and remained its leading position for over a year and a half.

In Q1 2018, the revenue growth was attributed primarily from mobile game apps. Entertainment apps saw an explosive growth in revenues in this period. Social networking apps accounted for 4% of the total with a revenue of 0.8 billion yuan while photo and video apps only accounted for 3% of the total with 0.7 billion yuan in revenues.

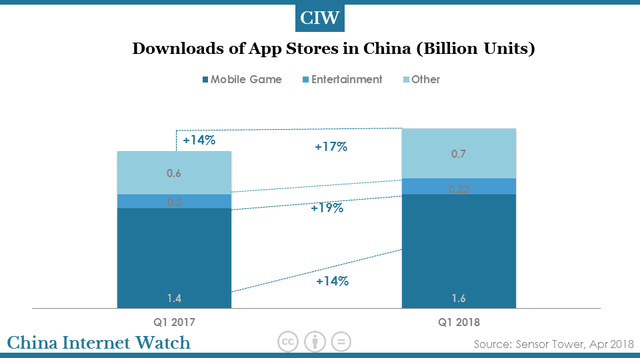

The total number of downloads on Apple’s App Store reached 2.5 billion in Q1 2018, up 14% over Q1 2017, representing 32% of the global downloads. Of which, mobile game apps generated near 0.7 billion downloads with a share of 29% while entertainment apps ranked second with 0.22 billion downloads, accounting for only 9% of the total.

Mobile apps belonging to non-mobile game and non-entertainment categories took a 64% share in total downloads, up 14% year-on-year. Of which, downloads of tool apps and photo and video apps were 0.2 billion and 0.17 billion respectively, both had a share of 7% in total.

Check out the top mobile apps in China in Q1 2018 here.

]]>

China’s growth of FMCG sales is weaker in Q1 2018 compared with previous quarters, while new retail accelerates the online and offline integration.

Kantar Worldpanel reports that the fast-moving consumer goods (FMCG) market in the first quarter of 2018 was relatively weak with value growing by just 2.3% in the latest 12 weeks compared to the same period in 2017. China’s GDP grew by 6.8% in the first quarter of 2018, which is consistent with the last two quarters in 2017.

In the full year of 2017, FMCG growth rate reached a three-year high of 4.3%.

Modern trade (including hypermarkets, supermarkets, and convenience stores) grew by only 0.9% in the first quarter of the year in China. Across city tiers, provincial capitals, prefecture-level cities, and county level cities enjoyed faster growth, up by 2.8% collectively. Across regions, the West region has seen the strongest growth, up by 4.6%.

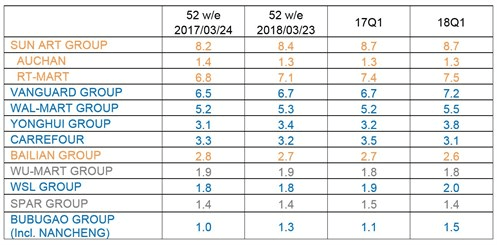

Leading Grocery Share of Modern Trade – National Urban China (%)

Note: Retailers in orange color are from Alibaba camp; retailers in blue are from Tencent camp.

Leading retailers taking sides either with Alibaba or Tencent

Among the top 5 retailers, Sun Art, Vanguard, and Walmart all strengthened their leading position and Yonghui surpassed Carrefour to be the No. 4 retailer in China.

As the only retailer in top 5 that enjoyed double-digit penetration growth, Yonghui’s share rose from 3.2% a year ago to 3.8% in the past 12 weeks in 2018. This performance has further been supported by the opening of 77 new stores in the first quarter of 2018. Yonghui has announced a bold plan to open 100 Yonghui Super Species and 1,000 Yonghui Life stores during 2018, with its O2O APP covering all its retail formats and 50% of overall business.

The first quarter of 2018 also witnessed the two Internet giants’ accelerated move into the offline world with various partnerships and acquisitions of key retailers.

The trend has continued into April when Vanguard Group announced its partnership with Tencent/JD. This would mean that the Tencent/JD camp would represent 21.7% share of the modern trade of FMCG. Further acquisitions are also being witnessed beyond the grocery sector, such as Alibaba’s full acquisition of Ele.me, the leading food delivery service, and investment into Easyhome, a home furnishing chain to broaden its offline reach and touch more areas of Chinese consumers’ lives.

E-commerce players trying to reinvent traditional trade

Kantar Worldpanel reported 26% growth in FMCG spends through e-commerce platforms in the first quarter of 2018. Both Tmall and JD.com are neck and neck in the B2C camp, yet YHD (acquired by JD.com in June 2016) experienced a continued loss of shoppers, with penetration falling from 1.5% last year to 0.6% in the latest quarter.

As e-commerce looks for new ways to drive traffic online, the key players are also turning to small format neighborhood stores and grocery stores.

In January, Tmall announced the opening of its first Tmall CVS in Hangzhou, transformed from a mom and pop shop. Alibaba applied big data and modern retail management system to help those traditional stores better optimize product procurement and assortment. JD.com also accelerated its pace in transforming the sector, with the ambitious plan in place to open 1,000 stores every day. Both are trying to extend their physical footprint to tap into lower-tier cities and rural areas where e-commerce penetration is still relatively low.

Check out new retail trend in China here or China’s luxury consumption trends in the new retail era.

This post was originally published on Kantar.com.

Tencent announced total revenue of USD11.693 bn for Q1 2018, an increase of 48% from Q1 2017. Monthly active user accounts (“MAU”) of QQ was 805.5 million, a decrease of 6.4% YoY. Smart device MAU was up by 2.4% year-on-year to 694.1 million. WeChat MAU exceeded 1 billion.

Tencent made record profit of RMB23.973 billion (US$3.812 million) in Q1 2018, up 65% over Q1 2017. Non-GAAP profit attributable to equity holders of the Company was RMB18.313 billion (US$2.912 billion), an increase of 29% year-on-year. Capital expenditure was RMB6.318 billion. Free cash flow was RMB13 billion, down 46% year-on-year.

Revenues from online games grew by 26% to RMB28.778 billion, mainly driven by smartphone games, including existing titles such as Honour of Kings, and newly launched titles such as MU Awakening and QQ Speed Mobile.

Communications and Social

QQ: Monthly active user accounts (“MAU”) of QQ was 805.5 million, a decrease of 6.4% YoY. Smart device MAU was up by 2.4% year-on-year to 694.1 million. QQ KanDian, the news feed service within QQ, achieved over 80 million DAU.

Weixin and WeChat: Combined MAU was 1,040.0 million, representing year-on-year growth of 10.9%. Tencent opened up the platform of Mini-Programs to third-party game developers in late March and over 500 Mini Games are now available. Check out WeChat Mini-Programs status report 2018 here.

REPORT: WeChat digital ecosystem 2018: WeChat Pay, Official Accounts, Mini-Programs

Online Games

Smartphone games achieved approximately RMB21.7 billion revenues, up 68% year-on-year, driven by in-house mobile titles such as Honour of Kings and QQ Speed Mobile. Honour of Kings remained as the highest grossing smartphone game in China’s iOS Top Grossing Chart. New title QQ Speed Mobile became the second-highest smartphone game in China’s iOS Top Grossing Chart during Q1 2018.

PC client games achieved approximately RMB14.1 billion revenues, flat compared with the prior year period. Active users declined due to the continued time shift to mobile devices while core user engagement remained largely stable.

Digital Content

Total fee-based VAS subscriptions grew by 24% year-on-year to 147 million, primarily driven by video and music streaming services. Tencent Video reinforced its industry leadership in China by mobile DAU and subscriptions. Mobile daily video views increased by over 60% year-on-year.

Total video revenues were up 75% year-on-year, in particular, video subscription revenues grew by 85% year-on-year.

Online Advertising

Online Advertising business achieved 55% year-on-year growth in revenues.

For media advertising, revenues grew by 31% year-on-year. Within which, video ad revenues increased 64% year-on-year due to more pre-roll ads benefiting from the growth in video views, and Tencent’s enhanced capability to develop creative ad formats within original productions. Video and news revenues decreased quarter-to-quarter due to the low seasonality for advertising activity in Q1 2018.

For social and others advertising, the 69% year-on-year increase in revenues was driven by an expanded advertiser base boosting ad fill rates in WeChat Moments, and higher CPC for Mobile Ad Network. The sequential decrease in revenues was mainly due to the low seasonality in Q1 2018. Amid the low seasonality, QQ KanDian revenues increased due to fast growth in traffic.

Weibo monthly active users reached 411M, 93% from mobile in Q1 2018

]]>

With ad budget in China shifting toward mobile, social and video, Weibo saw its revenues benefiting from this secular trend. Its business with advertising and marketing revenue grew 79% year over year in Q1 2018 to $302.9 million, accounting for 86.6% of its total net revenues ($349.9 million, an increase of 76% YoY) according to its unaudited financial results.

Check out WeChat, QQ MAU in Q1 2018 here.

Net income attributable to Weibo was $99.1 million, an increase of 111% YoY, and diluted net income per share was $0.44, compared to $0.21 for the same period last year. Non-GAAP net income attributable to Weibo was $112.6 million, an increase of 95% YoY, and non-GAAP diluted net income per share was $0.50, compared to $0.26 for the same period last year.

Monthly active users on Weibo had a net addition of approximately 70 million users year over year and reached 411 million in March 2018. Mobile MAUs represented 93% of MAUs. Average daily active users had a net addition of approximately 30 million users year over year and reached 184 million in March 2018.

]]>

Chinese smartphone brand Xiaomi, which is making debut in Europe, earned 4.4% of sales market share in five major European markets in Q1 2018, ranking No.4, according to latest smartphone OS data from Kantar Worldpanel ComTech.

The top three brands in the big five European markets, Samsung, Apple, and Huawei, made up 71% of smartphone sales in the latest quarter, but it is still very impressive for the newcomer Xiaomi to quietly take the fourth spot. Its growth has come predominantly from just two markets, Spain and Italy. It is also worth mentioning that these were also the markets that another Chinese brand Huawei had conquered first in Europe.

According to media reports, Xiaomi is scheduled to go public in Hong Kong this July and expected to raise as much as US$10 billion in the IPO. It plans to use 30% of the proceeds to fund for its overseas expansion, said its prospectus.

Dominic Sunnebo, Global Director for Kantar Worldpanel ComTech, comments: “Despite being a household name in China and India, Xiaomi has turned its attention to Europe late, and it has quickly proven to be a worthy opponent.

In Asia, Xiaomi’s business model has been focused online and while this remains an important factor in its European model, it is local partnerships with key players like Media Markt, Media World and Carrefour that has allowed it to accelerate sales so quickly.”

On Xiaomi’s home turf of China, it is also the best performing brand in Q1: in urban China, its market share grew 7 percentage points from a year ago to reach 17.9%.

Kantar Worldpanel ComTech carries out monthly panel surveys among Chinese urban mobile phone users to monitor the market share changes of various brands. In China, the panel size is 22,000.

Panelists were recruited from tier-1 to 5 cities and each year more than 260,000 surveys were conducted. The nature of the research methodology means it can cover the influence of smartphones sold in other countries ended up in China and avoid the confusion caused by unsold phones stocked at warehouses of distributors.

In Q1, urban Chinese consumers’ loyalty towards smartphone brands continued to decline: it had slid to 26.6 in the three months from 28.3 a year ago. People are considering more features of a phone when buying a new one – it reached a record high of 4.5 per person, compared with only 3 in the same period of 2015. Among them, “reliability” has overtaken “screen size” and “quality of camera” to become the highest priority for Chinese consumers.

In fact, this trend will be music to Apple’s ears, because our survey has shown that Apple enjoys the highest satisfaction rating among Chinese consumers for “reliability”. For Android brands, Huawei is the highest in this aspect.

This could partly explain why iPhone X is not only Apple’s best-selling model in China but also the best-selling model among all smartphone models in Q1 2018. This has fuelled iPhone’s market share to 22.1%.

Back to Europe, with Huawei’s entry to the US market effectively blocked by the government, the business has increased the focus and resources it is aiming at Europe. Despite the well-reviewed Huawei P20 flagship not being released until April, the results are already showing.

Huawei has managed to significantly increase its presence across the big five European markets and it now holds almost a fifth of sales in the three months to March 2018 – 19.0%, up from 14.4% a year earlier.

“Most encouraging for Huawei are the signs that progress is finally being made in Great Britain, with share rising to 5.9% – it needs to conquer this market if it’s going to realize its ambition of becoming a premium choice for consumers,” Dominic said.

In the United States, Apple and Samsung have managed to eke out year-on-year share gains, up 0.1 of one percentage point and 1.4 percentage points respectively. Google has achieved its highest ever quarterly sales share of 3.4%, up from 1.7% a year earlier, thanks to the success of its Pixel line. ZTE, also under pressure from the US government, saw its sales share fall to 2.5% in the latest quarter.

In the US and the European top five markets, iPhone 8 sold in marginally higher numbers than the flagship iPhone X, indicating that as early iPhone X demand is fulfilled, the price difference between the two devices is playing a notable role in consumers’ choices.

Find out here what Xiaomi reveals in its IPO filing.

This post was originally published on Kantar.com.

The gross domestic product (GDP) of China was 19,878.3 billion yuan (US$3,141 billion) in Q1 2018, a year-on-year increase of 6.8% at comparable prices according to the preliminary estimates of National Bureau of Statistics of China.

Agricultural Production was Sound.

The output of pork, beef, mutton, and poultry was 23.16 million tons, a year-on-year growth of 1.8%, among which the output of pork was 15.43 million tons, up by 2.1%. The number of pigs registered was 415.23 million, a year-on-year decrease of 1.2% and that of pigs slaughtered 199.83 million, a year-on-year growth of 1.9%.

How to use live streaming for successful marketing in China in 2018

The Industrial Production was Generally Stable.

The year-on-year real growth rate of total value added of the industrial enterprises above the designated size was 6.8%, 0.4 percentage point slower than the first two months, growing at the same speed as Q1 2017.

An analysis by types of ownership showed that the value added of the state holding enterprises went up by 7.9% year-on-year; collective enterprises up by 0.1%; share-holding enterprises up by 7.0%; and enterprises funded by foreign investors or investors from Hong Kong, Macao, and Taiwan up by 5.5%.

In terms of sectors, the value added of the mining grew by 0.9% on a year-on-year basis, the manufacturing grew by 7.0% and the production and supply of electricity, thermal power, gas, and water grew by 10.8%.

The new industries and new products grew rapidly. The value added of high-tech industry and equipment manufacturing industry grew by 11.9% and 8.8% year-on-year respectively, 5.1 percentage points and 2.0 percentage points faster than that of the industrial enterprises above the designated size as a whole. The production of integrated circuits, new energy vehicles, and industrial robots grew by 15.2%, 139.4%, and 29.6% respectively.

The sales-output ratio of the industrial enterprises above the designated size reached 97.9%, 0.3 percentage point higher than Q1 2017.In March, the total value added of the industrial enterprises above the designated size went up by 6.0% year-on-year, or up by 0.33% month-on-month.

In March, the manufacturing PMI was 51.5%, 1.2 percentage points higher than last month. In the first two months of 2018, the total profits made by industrial enterprises above the designated size was 968.9 billion yuan, up by 16.1% year-on-year. The profit rate from principal businesses of industrial enterprises above the designated size was 6.1%, 0.33 percentage point higher than that of the same period last year.

Service Industry Grew Fast.

The Index of Services Production increased by 8.1% year-on-year, 0.1 percentage point faster than the first two months, and 0.2 percentage point slower than Q1 2017. Specifically, information transmission, software and information technology services, rental and business services maintained high growth rates.

In March, the Business Activity Index for services was 53.6%, 0.2 percentage point lower than last month but still higher than the average of last year.

In terms of sectors, railway transport, air transport, postal services, telecommunication, broadcast, television and satellite transmission services, internet and software information technology services, monetary and financial services, capital market services, and insurance all kept within the expansion range of 55% and above. As regards market expectation, the Business Activities Expectation Index was 60.1%, maintaining above 60.0% for 10 months in a row.

Private Investment Grew Faster.

The investment in fixed assets (excluding by rural households) was 10,076.3 billion yuan, a year-on-year growth of 7.5%, 0.4 percentage point slower than the first two months, and 1.7 percentage points lower than Q1 2017.

Specifically, the private investment reached 6,238.6 billion yuan, up by 8.9%, 0.8 percentage point faster than the first two months, 1.2 percentage points faster than Q1 2017.

The investment in the primary industry was 290.0 billion yuan, up by 24.2% year-on-year; the secondary industry 3,581.3 billion yuan, up by 2.0%, among which the investment in manufacturing was up by 3.8%; the tertiary industry 6,205.0 billion yuan, an increase of 10.0%, among which the investment in infrastructure was up by 13.0%.

The investment in high-tech manufacturing industry increased by 7.9%, 0.4 percentage point faster than the total investment. In March, the investment in fixed assets (excluding by rural households) grew by 0.57% compared with last month.

The Floor Space of Commercial Buildings for Sale Continued to Decrease.

The total investment in real estate development was 2,129.1 billion yuan, a year-on-year growth of 10.4%, 0.5 percentage point faster than the first two months and 1.3 percentage points faster than Q1 2018. Among which, the investment in residential buildings went up by 13.3%.

The floor space newly started was 346.15 million square meters, up by 9.7% year-on-year. Among which, the floor space of residential buildings newly started went up by 12.2%.

The floor space of commercial buildings sold was 300.88 million square meters, up by 3.6%. Among which, the floor space of residential buildings sold was up by 2.5%.

The total sales of commercial buildings were 2,559.7 billion yuan, a growth of 10.4%. Among which, the sales of residential buildings were up by 11.4%.

The land space purchased for real estate development was 38.02 million square meters, up by 0.5% year-on-year.

By the end of March, the floor space of commercial buildings for sale was 573.29 million square meters, 11.38 million square meters less than that at the end of February. The funds in place for real estate development enterprises in the first quarter reached 3,677.0 billion yuan, up by 3.1% year-on-year.

Market Sales Maintained Active.

The total retail sales of consumer goods reached 9,027.5 billion yuan, a year-on-year rise of 9.8%, 0.1 percentage point faster than the first two months, and 0.2 percentage point slower than Q1 2017.

Analyzed by different areas, the retail sales in urban areas reached 7,709.6 billion yuan, up by 9.7%, and the retail sales in rural areas stood at 1,317.9 billion yuan, up by 10.7%.

Grouped by consumption patterns, the income of catering was 971.1 billion yuan, up by 10.3%; and the retail sales of goods were 8,056.4 billion yuan, up by 9.8%.

Upgraded consumer goods grew fast. The retail sales of enterprises above the designated size of cosmetics and household appliances and audio-video equipment went up by 16.1% and 11.4% respectively, 6.2 percentage points and 3.4 percentage points faster than Q1 2017.

In March, the total retail sales of consumer goods rose by 10.1% year-on-year, 0.4 percentage point faster than the first two months, an increase of 0.73% month-on-month

In Q1 2018, the online retail sales reached 1,931.8 billion yuan, a year-on-year growth of 35.4%, 3.3 percentage points faster than Q1 2017. Among which, the online retail sales of physical goods were 1,456.7 billion yuan, an increase of 34.4%, accounting for 16.1% of the total retail sales, a year-on-year increase of 3.7 percentage points, and the online retail sales of non-physical goods were 475.1 billion yuan, an increase of 38.7%.

The Trade Surplus was Narrowed Substantially.

The total value of imports and exports was 6,751.6 billion yuan, an increase of 9.4% year-on-year. Among which, the total value of exports was 3,538.9 billion yuan, up by 7.4%; the total value of imports was 3,212.7 billion yuan, an increase of 11.7%. The trade balance was 326.2 billion yuan in surplus, 21.8% less than Q1 2017.

The trade structure was further improved. The import and export of general trade increased by 13.2 %, accounting for 58.3% of the total value of the imports and exports, an increase of 2.0 percentage points compared with Q1 2017. The export of mechanical and electronic products still took the lead. The export of mechanical and electronic products increased by 9.5%, accounting for 59.4% of the total value of exports.

The foreign trade with the top three trade partners continued to grow. Specifically, the foreign trade with European Union, United States, and ASEAN went up by 8.2%, 6.3%, and 13.7% respectively. The foreign trade with the countries jointly building the Belt and Road gained momentum. The foreign trade with Russia, Poland and Kazakhstan increased by 20.5%, 16.6%, and 16.2%.

In March, the total value of imports and exports was 2,245.3 billion yuan, a year-on-year decrease of 2.5%. The total value of exports was 1,107.8 billion yuan, down by 9.8%, and the total value of imports was 1,137.5 billion yuan, up by 5.9%.

In Q1 2018, the export delivery value of industrial enterprises above the designated size reached 2,714.5 billion yuan, a year-on-year increase of 7.6%. In March, the export delivery value of industrial enterprises above the designated size reached 1,001.6 billion yuan, up by 4.0%.

The Market Prices Grew Mildly.

The consumer price went up by 2.1% year on year, 0.1 percentage point slower than the first two months, and 0.7 percentage point higher than Q1 2017. Specifically, the price went up by 2.2% in the urban areas and 2.0% in the rural areas.

Grouped by commodity categories, prices for food, tobacco and alcohol went up by 1.9% year-on-year; clothing up by 1.2%; housing up by 2.4%; articles and services for daily use up by 1.6%; transportation and communication up by 0.7%; education, culture and recreation up by 2.2%; medical services and health care up by 6.0%; other articles and services up by 1.4%.

In terms of food, tobacco and alcohol prices, prices for grain went up by 1.1%, pork down by 9.9%, fresh vegetables up by 6.6%. In March, the year-on-year consumer price was up by 2.1%, 0.8 percentage point slower than last month and down by 1.1% month-on-month.

In Q1 2018, the producer prices for industrial products went up by 3.7% year-on-year, 0.3 percentage point lower than the first two months, 3.7 percentage points lower than Q1 2017. In March, the producer prices for industrial products went up by 3.1% year-on-year, 0.6 percentage point slower than last month, and 0.2 percentage point slower month-on-month.

In Q1 2018, the purchasing prices for industrial producers were up by 4.4% year-on-year; In March the prices went up by 3.7% year-on-year, down by 0.3% month-on-month.

The Employment was Generally Stable.

From January to March, the surveyed unemployment rate in urban areas was 5.0%, 5.0%, and 5.1% respectively, which was 0.2 percentage point, 0.4 percentage point, and 0.1 percentage point lower than the same month last year.

The urban surveyed unemployment rate in 31 major cities were 4.9%, 4.8% and 4.9%, which was 0.1 percentage point, 0.2 percentage point, and 0.1 percentage point lower than the same month last year. At the end of the first quarter, the number of outside migrant workers reached 174.41 million, 1.88 million more than the same period last year, an increase of 1.1%.

The Resident Income Grew Steadily.

The nationwide per capita disposable income of residents was 7,815 yuan, a nominal growth of 8.8% year-on-year, or a real increase of 6.6% after deducting price factors.

In terms of permanent residence, the per capita disposable income of urban households was 10,781 yuan, a real growth of 5.7% after deducting price factors. The per capita disposable income of rural households was 4,226 yuan, up by 6.8% after deducting price factors. The per capita income of urban households was 2.55 times of the rural households, 0.02 less than Q1 2017.

The median of the nationwide disposal income was 6,580 yuan, a nominal increase of 8.5%.

The Supply-Side Structural Reform Produced Notable Results.

The industrial capacity utilization rate nationwide was 76.5%, 0.7 percentage point higher than the same period last year.

The efforts of reducing inventory made remarkable achievements. At the end of March, the floor space of commercial buildings for sale decreased by 16.7% year-on-year.

The effects of deleveraging continued to unfold. At the end of February, the asset-liability ratio of the industrial enterprises above the designated size was 56.3%, 0.8 percentage point less year-on-year.

The cost for the real economy continued to decrease. For the first two months, the cost for per-hundred-yuan turnover of principal business of the industrial enterprises above the designated size was 83.98 yuan, 0.33 yuan less year-on-year.

The investment in weak areas grew rapidly. In Q1 2018, the investment in the management of environmental protection and treatment of environment pollution, management of public facilities and agriculture increased by 34.2%, 13.4%, and 25.4% respectively, or 26.7 percentage points, 5.9 percentage points, and 17.9 percentage points higher than the total investment.

The value added of the tertiary industry contributed to 61.6% of the GDP growth, 25.5 percentage points higher than that of the secondary industry. The final consumption expenditure’s contribution to the economic growth reached 77.8%, 46.5 percentage points higher than the total capital formation.

New driving forces grew fast. In the first quarter, the number of newly registered enterprises was1.323 million, up by 5.4% year-on-year, an average of 14.7 thousand each day. The value added of industrial strategic and emerging industries went up by 9.6% year-on-year, 2.8 percentage points faster than that of the industrial enterprises above the designated size.

Green development was moving forward steadily. In the first quarter, the energy consumption per unit of GDP dropped by 3.2% year-on-year.

]]>