The top 5 smartphone vendors in the Chinese market in the fourth quarter of 2022 are Apple (20.6%), Vivo (17.5%), Honor (17.1%), Oppo (15.6%), and Xiaomi (11.6%).

In 2022, the top five smartphone vendors in the year are Vivo (18.6%), Honor (18.1%), Oppo (16.8%), Apple (16.8%), and Xiaomi (13.7%).

China smartphone shipment in Q3 2022; total shipments down 12%

In the third quarter of 2022, the Chinese smartphone market shipped approximately 71.13 million units, down 11.9% year-on-year, according to data from IDC.

Although the decline narrowed for the first time this year, market demand continued to be sluggish following the first half of the year; thanks to the early release of Apple’s iPhone 14 series and the return of Huawei’s Mate 50 series, the domestic smartphone market achieved a quarter-on-quarter growth of 6.0% in the third quarter.

In the third quarter, Vivo returned to first place in China’s domestic smartphone market in terms of shipments, with a market share of 20.0%. The sub-brand iQOO has been continuously recognized by the market with its good product strength and competitive pricing, and its market share has continued to increase, reaching 4.6% of the domestic market in the third quarter.

The Vivo X series continued the excellent performance of the previous quarter and maintained its leadership in the mid-to-high-end market of US$400-600

Honor and Oppo’s shipments ranked 2nd and 3rd in Q3 2022 with 17.9% and 16.3% market share respectively..

Apple’s ranking rose one place, and its market share increased month-on-month to 15.1%, the only top smartphone vendor to maintain year-on-year growth. Although the two models of the iPhone 14 Pro are still very popular, the iPhone 14 and the iPhone 14 Plus, which were only officially shipped in October, have limited appeal to consumers due to their small upgrades compared to the previous generation, while the iPhone 13 series is still favored.

Xiaomi smartphones shipped about 9 million units in the third quarter, accounting for 12.7% of the market.

In Q3 2022, China’s single-quarter shipments of foldable smartphones exceeded 1 million, a year-on-year increase of about 246%, the largest single-quarter shipment in history.

Strong brand and product power helped Huawei to remain in the first position in the domestic foldable screen smartphone market, with a market share of 44.9%.

Samsung’s two new products, Z Fold4 and Z Flip4, have significantly better sales than the previous generation, ranking second, accounting for 22.2% of the market share in the foldable smartphone segment.

The newly released X Fold+ series also helped Vivo to rise to third place in this market, with a market share of 11.9%. Xiaomi’s new MIX FOLD 2 has also won a better market reputation than the previous generation due to its thin and light appearance, and its market share has increased to 9.3%, ranking fourth.

China IoT market to account for 45% of global spend by 2025

China smartphone market share in Q2 2022

In the second quarter of 2022, China’s smartphone shipment reached about 67.2 million units, a year-on-year decrease of 14.7%, according to data from IDC. In the first half of the year, the domestic smartphone shipment totaled about 140 million units, a year-on-year decrease of 14.4%.

Honor ranked first in domestic market shipments in the second quarter, and Vivo ranked second. In the first half of the year, the domestic shipments of foldable smartphones exceeded 1.1 million, with a year-on-year increase of about 70%.

China smartphone market share in Q1 2022; Apple has 16.7% share

In the first quarter of 2022, China’s smartphone market saw about 74.2 million units shipment, a year-on-year decrease of 14.1%, according to data from IDC.

The impact of the continuous rebound of the epidemic on consumers’ budgets and the small upgrading range of new products have led to the continuous downturn of market demand.

The more uncertain overseas market prospect has led many mobile phone manufacturers to adopt more stable and conservative operation strategies, and the market will face great challenges throughout the year.

Oppo ranked first in terms of domestic smartphone shipment market share in the first quarter, followed by Honor, with a very high year-on-year increase, Vivo in the third place, Apple in the fourth place, and Xiaomi in fifth place.

At the same time, the negative impact of the current domestic epidemic on the logistics and supply side of the mobile phone market is relatively controllable, which brings about the delay in meeting part of the demand.

If there is no additional positive stimulus, the capacity of China’s smartphone market may fall below the 300 million mark in 2022, according to IDC.

Vivo has the largest market share of 19.7% by total smartphone sales, according to Counterpoint, followed by Oppo (18%), apple (17.9%), Honor (16.9%), Xiaomi (14.9%), and Huawei (6.2%). In the first quarter, domestic mobile phone sales fell 14% year-on-year to 74.2 million.

]]>

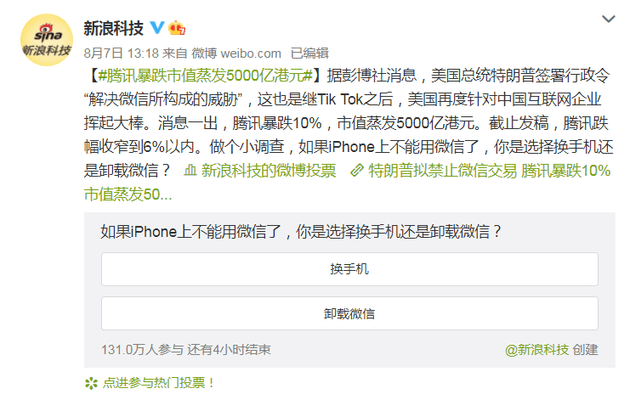

US President Donald Trump issued an executive order last week prohibiting US companies from any transaction that is related to WeChat.

Chinese consumers believe that without WeChat, the iPhone will become “expensive e-waste”. Following Trump’s executive order last week, iPhone fans across China are now rethinking their dependence on the iPhone.

More than 1.2 million users on China’s leading social platform Weibo have responded in the poll conducted by Sina Technology, a news media in China, asking users to choose between replacing the smartphone and uninstalling WeChat if WeChat can no longer be used on iPhone.

About 95% of the participants said they would rather change their smartphones than uninstallingWeChat. Trump’s ban will force many Chinese users to switch from iPhones to other brands because WeChat is so important to Chinese users.

With more than 1.2 billion monthly active users, WeChat is one of the most important applications in China. If WeChat is no longer supported, the iPhone will become useless for most Chinese users.

The scope of application of the Trump’s order is unclear. The most important thing is whether it will apply only to the U.S. territory or to the global business transactions of U.S. companies. If it is the latter, Chinese consumers will no longer buy iPhones in the future, resulting in Apple losing 30% of its global sales.

Apple has also warned the White House that Trump’s order will put the company at great risk. Disney, Ford, Intel, Morgan Stanley, UPS and Wal Mart have also informed the White House that U.S. companies may face serious consequences.

]]>

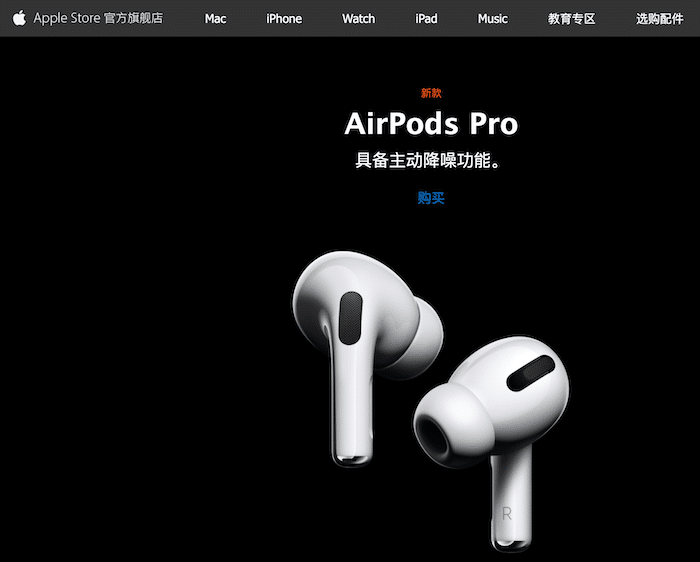

In the recent “Double 11 2019” shopping festival in China, Apple’s official flagship store on Tmall “Singles Day” transaction exceeded 7 times of last year’s full day sales in just 10 minutes. iPhone 11 broke 100 million yuan in sales in 1 minute.

Related: Double 11 Festival statistics 2019

This year is Apple’s first participation in the Tmall “Double 11” promotion. The official Weibo of the Tmall spokesman said that during this year’s “Double 11”, Apple’s official flagship store participated in the Tmall “Double 11” 2019 platform subsidy, the highest straight off 1,111 yuan (about US$158).

On November 9, Tmall announced an additional budget of 100 million yuan to subsidize Apple’s official products.

On the “Double 11” day, Apple’s official flagship store, including iPhone, iPad, Mac, Airpods and other in-store products, participated in the 24-month interest-free installment payment, iPhone 11 buyers could save 300 yuan after the receipt of the coupon and Airpods Pro 60 yuan off. In this way, Airpods cost less than 3 yuan a day; and, iPhone 11 less than 8 dollars a day.

JD (Jingdong) also introduced a super-billion subsidy (10 billion yuan).

After entering the corresponding interface of JD platform, users could receive corresponding coupons. Among them, iPhone XS and iPhone XS Max offered 3,000 for over 8,000 yuan spend, or 1,800 yuan off 3,000 yuan spend.

iPhone 11 Pro / Pro Max offered 500 yuan discount for over 8,000 yuan spend , iPhone 11 300 yuan off 5,000 yuan spend. At the same time, the purchase of some iPhones could enjoy 12-month interest-free installment plan applying JD Credit Coupons.

According to the “Double 11” report data released by Jingdong, Apple’s sales ranked first on November 11th. At the same time, Apple was also the cumulative best-selling brand from November 1st to 11th, followed by Huawei, Honor (Huawei), Xiaomi, Vivo and Oppo.

The fast rising social e-commerce platform Pinduoduo also provided heavy subsidies for iPhone buyers.

iPhone demand is strong in China. From a note to clients by UBS:

Monthly government data suggests overall iPhone demand in China was strong in the month of September, up ~230% vs. ~110% monthly growth last September. This is wholly consistent with recent procurement data/estimates from the UBS Asia Hardware team.

In the week ahead of this year’s Double 11 (4 Nov – 10 Nov), iPhone was ranked first by search volume on Baidu in the smartphone category, followed by Huawei and Xiaomi. iPhone’s media coverage was ranked second after Huawei in the same period according to data from Baidu.

In preparation for the “Double 11”, Changshuo Technology, an Apple foundry in Pudong, Shanghai, worked overtime to ensure the “Double 11” supply of the iPhone 11.

The level of marketing and advertisement put into new products by Apple is probably the largest.

In my visits to several tier-2 to tier-3 cities in China, iPhone 11, 11 Pro, and iWatch video ads were all over Chinese digital media across both desktop and mobile. Review articles on WeChat content network (Official Accounts) and Weibo were hard to miss.

Top Mini-Programs in Oct 2019; China’s mini-apps war led by online shopping

]]>

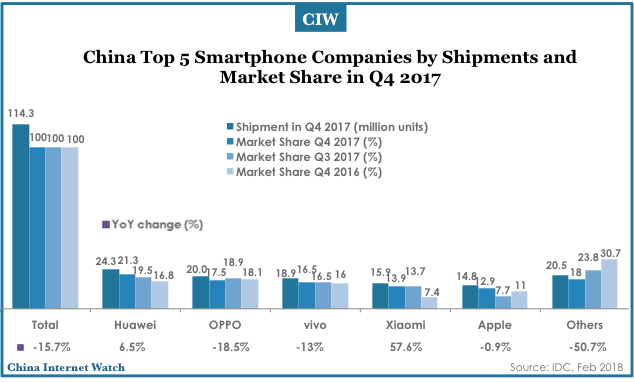

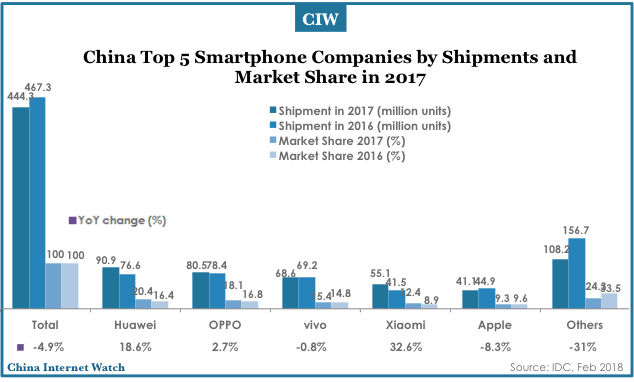

China smartphone market declined 15.7% year-over-year (YoY) in Q4 2017 and 4.9% for the whole of 2017 according to IDC.

Apple’s share increased YoY and QoQ in Q4 2017. Although the iPhone X was available in short supply initially at launch in early November 2017, the supply constraints for this model eased towards the end of the quarter. Apple’s ASP increased by 23.9% YoY in 2017Q4 largely due to the shipments of the iPhone X. Apple alone made up 85% of the overall shipments in >US$600 premium segment.

Huawei appears on the radar to compete with Apple in the >US$600 premium segment. Huawei grew in Q4 2017 largely due to the strong shipment for both its Honor and Huawei branded phones in the

With Samsung’s continued troubles in the China market, Huawei has successfully managed to break into the high-end Android vendor space, although price points of the flagship Huawei phones are carefully priced lower than the iPhone prices at launch.

OPPO and vivo are focusing more on the mid-range segment, with a higher share of their portfolio focused on the mid-range segment compared to a year ago. The reduction in the number of OPPO and vivo models in the low-end segment also contributed to their YoY decline in Q4 2017.

While focusing more on the mid-range segment has hurt its overall shipment growth, OPPO and Vivo’s overall ASPs have increased YoY. In terms of revenue, OPPO ranked second to Apple and was above Huawei. vivo follows at fourth place. Thus, while OPPO’s shipments may have declined, it is growing in terms of its overall revenue.

Leading smartphone brands have tightened their grip of urban China market. In the three months ending October 2017, the top five brands – Huawei (including sub-brand Honor), Xiaomi, Apple, Vivo and OPPO – made up 91% of smartphone sales in urban China, compared to 79% a year earlier, according to the latest smartphone OS data from Kantar Worldpanel ComTech.

China, a market once overrun with new challengers, is maturing.

“Chinese challenger brands like Meizu, LeTV, Coolpad, ZTE, and Lenovo were once on the same trajectory as like of Xiaomi, but any momentum they once had has abruptly stopped, with many struggling to get past a 1% share,” said Dominic Sunnebo, Global Business Unit Director for Kantar Worldpanel ComTech. “Samsung’s performance in China continues to deteriorate, with its share now down to just 2.2% of that market.”

Kantar Worldpanel ComTech carries out monthly panel surveys among Chinese urban mobile phone users to monitor the market share changes of various brands. In China, the panel size is 22,000. Panellists were recruited from tier-1 to 5 cities and each year more than 260,000 surveys were conducted. The nature of the research methodology means it can cover the influence of smartphones sold in other countries ended up in China and avoid the confusion caused by unsold phones stocked at warehouses of distributors.

Digging deeper into the data, we can see that Xiaomi and Honor both realized significant growth in August – October period. Xiaomi’s sales market share jumped to 20.1%, 1 percentage point higher than in the May – July circle. However, due to its previously lacklustre performance, currently only 13.8% of all urban smartphone users are using Xiaomi, 2.1 percentage points lower than a year ago.

Honor’s share was 11.7% in August – October, also 1 percentage point higher than in May – July circle. Among all urban smartphone users, 9.8% are using Honor, 1.3 percentage points higher than a year ago.

Among the top 20 best-selling models during August – October period, eight are from Xiaomi or Honor.

Even though “price” is the biggest advantage of both brands when people making their purchasing decision, Xiaomi and Honor have both managed to achieve higher selling prices. Between August and October, the average selling price of Xiaomi models is 1,640.32 yuan, 321.96 yuan higher than a year ago; that of Honor phones is 2,136.66 yuan, 506.53 yuan higher than a year ago.

It’s a bittersweet period for Apple. Urban China remained a bright spot for Apple, with its share edging up 0.5 percentage point in the latest three months to reach 17.4%.

But globally, iOS share fell in key markets, making clear the impact of the flagship iPhone X not being available to buy in the month of October.

Dominic said: “It was somewhat inevitable that Apple would see volume share fall once we had a full comparative month of sales taking into account the non-flagship iPhone 8 vs. the flagship iPhone 7 from 2016. This decrease is significant and puts pressure on the iPhone X to perform.

“Considering the complete overhaul that the iPhone X offers, consumers may be postponing their purchase decisions until they can test the iPhone X and decide whether the higher price, compared to the iPhone 8, is worth the premium to them,” he said.

He added: “As of October 2017, 35.3% of Apple’s installed base customers across Europe and the United States had owned their iPhones for more than two years – up from 30.1% a year earlier and signifying considerable pent-up demand within Apple’s base. In pure value terms, it is likely the iPhone X average selling price will more than make up for a dip in sales of older iPhone models.”

China smartphone market in Q3 2017; 4 out of 10 using Huawei or iPhone

]]>

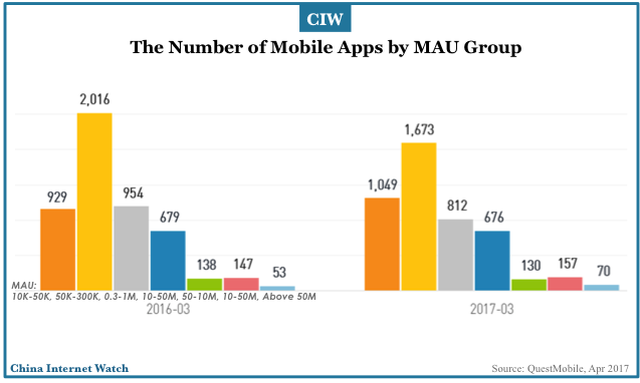

More mobile apps in China have more than 10 million monthly active users in Q1 2017. The number of installed apps and app usage hours both increased compared to a year ago.

70 mobile apps in China each has over 50 million monthly active users in March 2017, an increase of 32% YoY. 157 each has between 10 million and 50 million users with a growth rate of 6.8%.

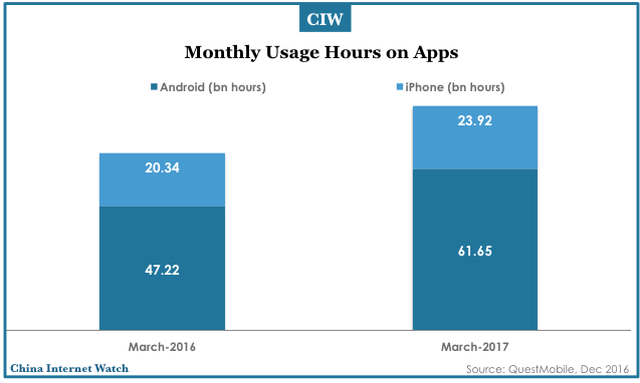

Monthly time spent on mobile apps totaled 85.57 billion hours in March 2017, up 26.7% from March 2016. Android users’ spent on apps saw faster growth than iPhone users’.

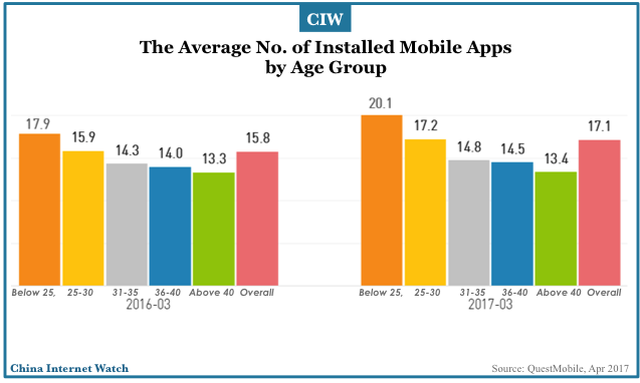

On average, the number of installed mobile apps grows to 17.1 in March 2017 from 15.8 in March 2016.

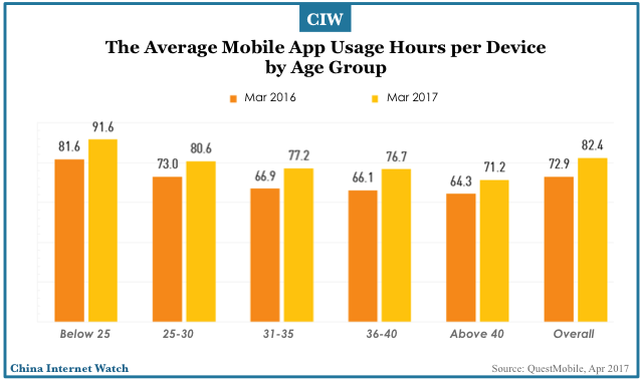

The younger users spent more time on mobile apps.

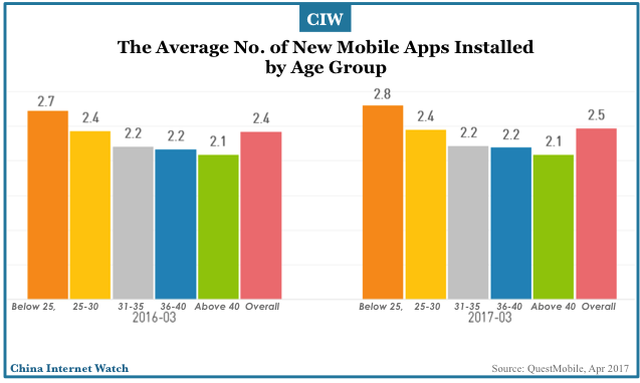

In march 2017, mobile users installed an average of 2.5 apps. The younger user group under 25 y-o installed the most, 2.8 apps.

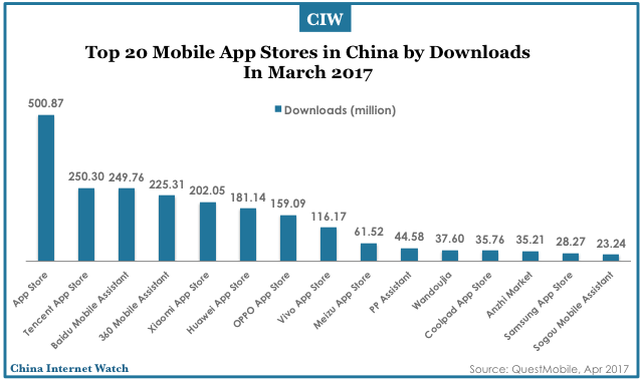

Apple’s App Store is the top mobile app store in China which recorded over 500 million downloads in March 2017, followed by YingYongBao (Tencent’s App Store), Baidu Mobile Assistant, and 360 Mobile Assistant.

Check out the updated e-book “Mobile Trend in China 2017“.

]]>

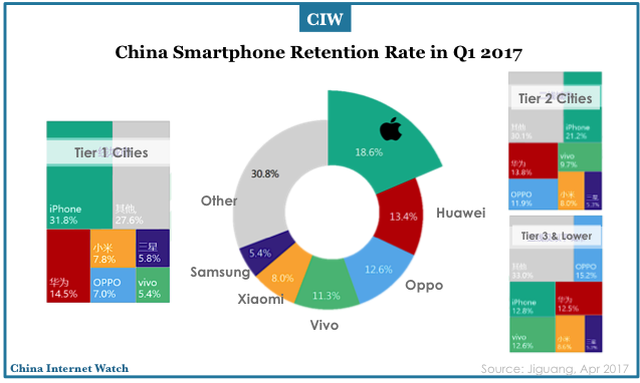

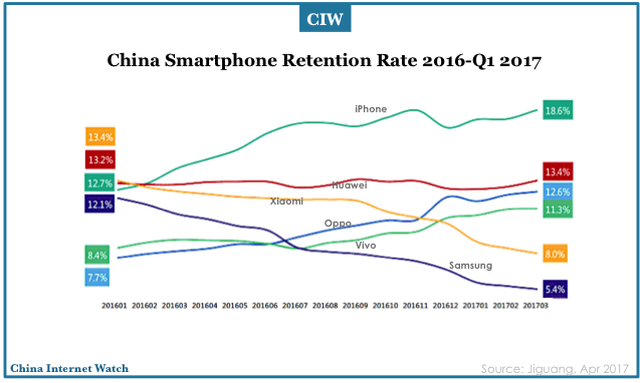

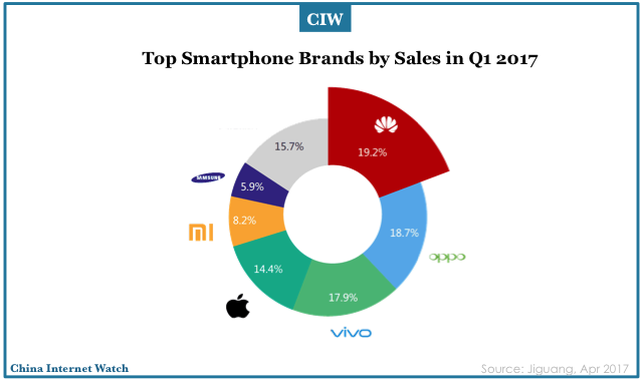

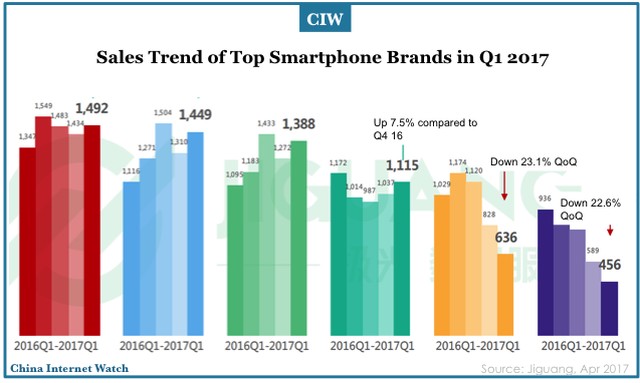

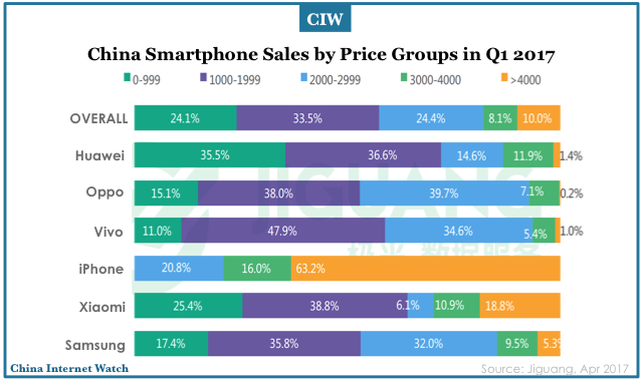

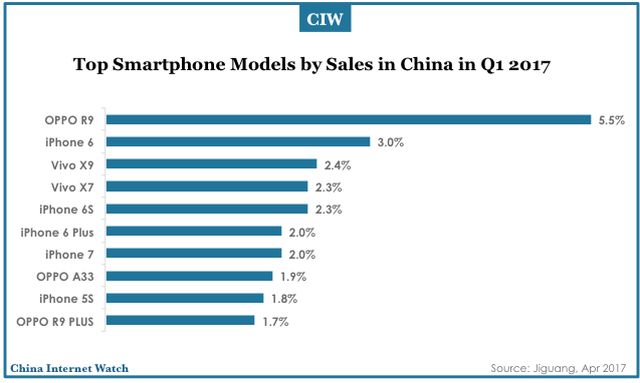

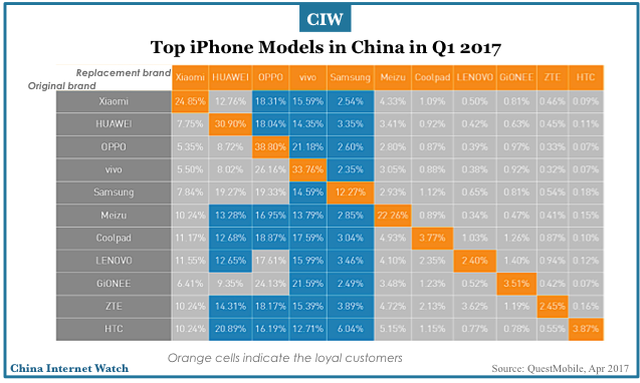

iPhone has the highest retention rate (18.6%) in Q1 2017, followed by Huawei (13.4%). However, Huawei is the top smartphone brand in China by sales (19.2%) in the first quarter of 2017, followed by OPPO (18.7%).

China Smartphone Retention in Q1 2017

Smartphone Sales in China in Q1 2017

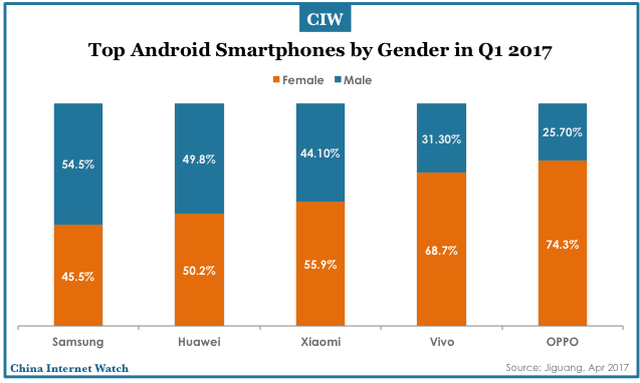

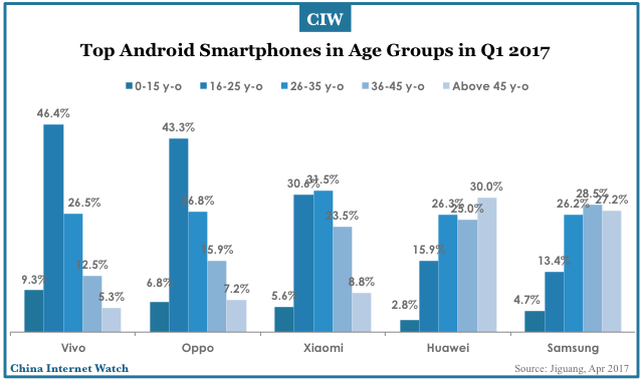

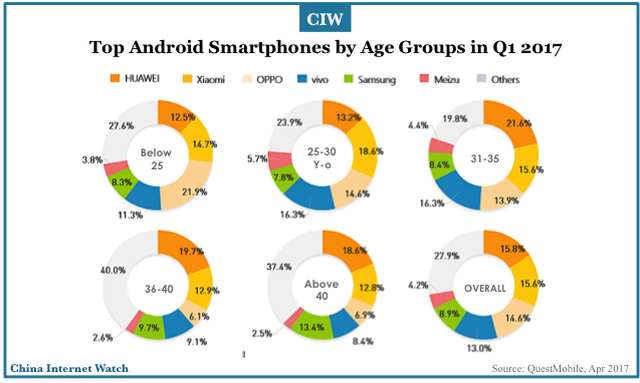

Top Android Smartphones

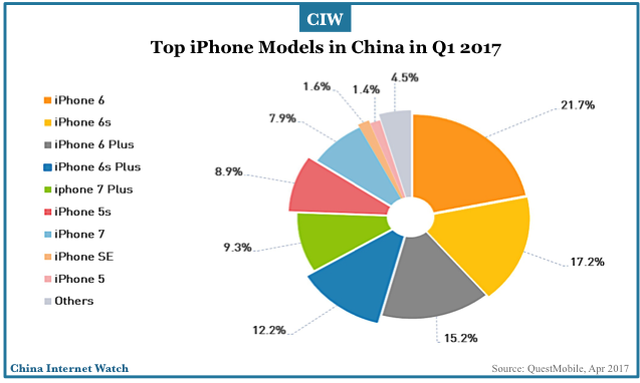

Top iPhone Models in Q1 2017

Related: E-Book: China Mobile Trends 2017

]]>

iOS market share dropped to 26.3% in China’s smartphone market from 29.1% in January 2017 according to a research company Newzoo.

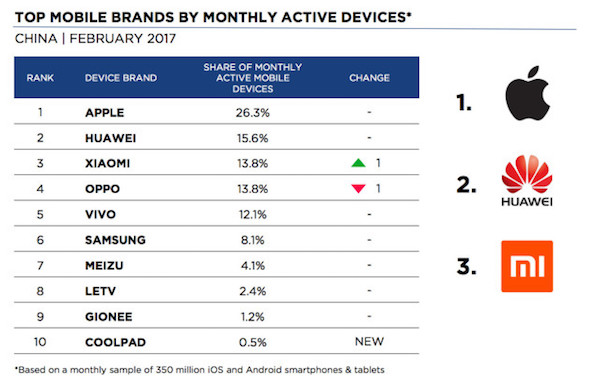

iPhone remains the top smartphone brand in China in February 2017 by the number of monthly active devices (26.3%), followed by Huawei (15.6%), Xiaomi (13.8%), OPPO (13.8%), and Vivo (12.1%). Xiaomi AppStore bypassed Baidu Mobile Assistant to be the third Android App Store in China in Feb 2017.

OPPO and Vivo are the top two smartphone brands in Feb 2017 by sales, primarily driven by offline sales. Xiaomi dropped to the sixth with only 3.3% market share in offline sales and 23% in onlinene sales according a Chinese research company Sino.

- OPPO sold 7 million units offline (13.5 billion yuan), 206 thousand units online (460 million yuan)

- Vivo sold 6.17 million units offline (11.1 billion yuan), 187 thousand units online (464 million yuan)

- Xiaomi sold 1.1 million units offline (1.24 billion yuan), 1,896 thousand units online (2,277 million yuan)

Huawei’s HONOR (1.904 million units; 2.6 bn yuan) and Xiaomi (1.896 mn units; 2.28 bn yuan) are the top two best selling smartphone brands in terms of total online sales.

]]>

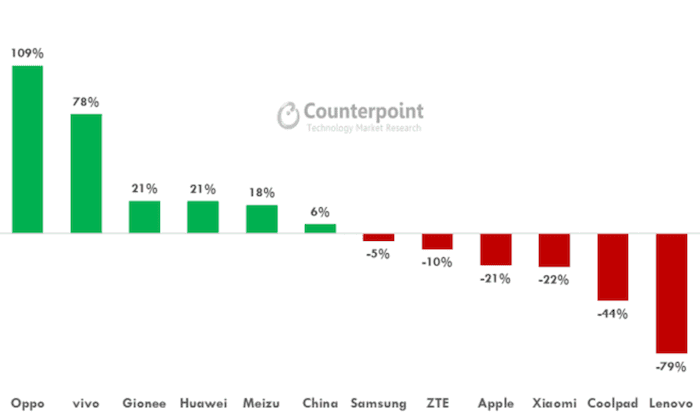

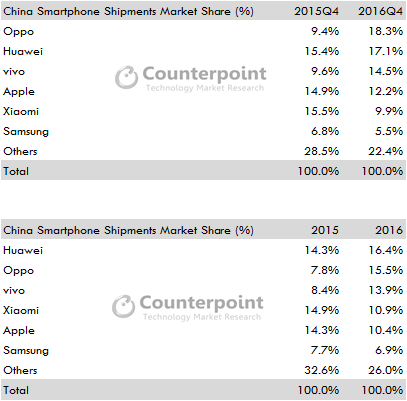

China smartphone shipments were up 9% in Q4 2016 and 12% in 2016 according to Counterpoint. Huawei, Oppo, and Vivo (HOV) emerged as clear winners in 2016.

Oppo, Huawei, vivo, Meizu, and Gionee captured a combined 58% of the total Chinese smartphone market in 2016. Demand for rest of the brands declined, especially Xiaomi and Apple.

Oppo and Vivo were the fastest growing brand and since June 2016 owing to strong omnipresent distribution channels from tier-1 to tier-4 cities across China. Xiaomi slipped to the fourth spot during the year as the demand for its smartphones declined 22% annually.

Best-Selling Smartphone Models Share in 2016

| Ranking | Best-Selling Models in 2016 | % Market Share |

| 1 | OPPO R9 | 4% |

| 2 | Apple iPhone 6S | 2% |

| 3 | Huawei HONOR Joy 5S | 2% |

| 4 | OPPO A33 | 2% |

| 5 | MI Redmi Note 3 | 2% |

| 6 | LeEco Le2 | 2% |

| 7 | vivo Y51 | 2% |

| 8 | Apple iPhone 6S Plus | 1% |

| 9 | vivo X7 | 1% |

| 10 | Huawei Mate8 | 1% |

| 11 | OPPO R9 Plus | 1% |

| 12 | Huawei P9 | 1% |

| 13 | MI Redmi 3S | 1% |

| 14 | MI Redmi 3 | 1% |

| 15 | OPPO A59 | 1% |

| 16 | Apple iPhone 7 | 1% |

| 17 | MI 5 | 1% |

| 18 | OPPO A37 | 1% |

| 19 | Meizu Blue Note 3 | 1% |

| 20 | Apple iPhone 7 Plus | 1% |

Oppo R9 rose to the best-selling smartphone in China in 2016 breaking Apple’s iPhone dominance streak as the best-seller for the first time since 2012.

Android accounted for 80.7% of urban China smartphone sales in Q4 2016, an increase of 9.3 percentage points year-over-year according to Kantar. iOS made up 19.1% of smartphone sales, down from 27.1% in the same period a year earlier. iPhone 7 remained the top-selling model in the Chinese market in the last quarter of 2016 at 6.8%.

Related: China Smartphone Usage Insights 2016

]]>

iOS accounted for 17.1% of smartphone sales in urban China during the three-month period ending in October 2016 due to iPhone 7 and iPhone 7 Plus’ strong performances according to Kantar Worldpanel ComTech.

iPhone 7 was the second best-selling phone in urban China in the period, capturing 3.8% of all smartphone sales. iPhone 7 Plus also cracked the top 10 at 1.9%… Oppo continues to gain footing in urban China, achieving 11.8% of smartphone sales, with the R9 remaining the top selling device in the region.

said Tamsin Timpson, Strategic Insight Director at Kantar Worldpanel ComTech Asia.

Huawei, Oppo and BBK Communication Equipment together accounted for 21% of the smartphones sold to end users worldwide in Q3 2016. Check out the top 20 smartphone models in China in Q3 2016 here.

]]>

Over 60% China smartphone users would not buy iPhone 7 according to a survey by Penguin Intelligence (part of Tencent).

70.9% Chinese male respondents said they would not buy iPhone 7 compared with 61.3% female respondents. After Apple’s 7 Sep event, over 25% smartphone users changed their decision, among which 20.2% gave up the purchase intention.

The main reason of not getting iPhone 7 is the demand (31%), followed by dissatisfaction in the upgrade (21.5%), pricing (13.6%), and quality (2.8%).

Huawei (38.3%) is the top choice for the next smartphone; and, the next version of iPhone came second (18%), followed by Oppo (10.1%).

The survey also found that among the iPhone 7 fans, large screen, longer battery life, and better camera lens are the top factors for purchase. And, over half users tend to buy 128G ones.

iPhone 7’s jet black is the top choice for male fans (62.2%); and, rose gold is the female’s favorite (51.2%).

Read more: China smartphone market insights 2016

]]>

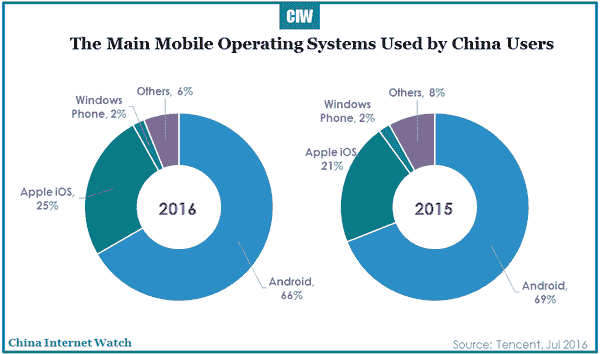

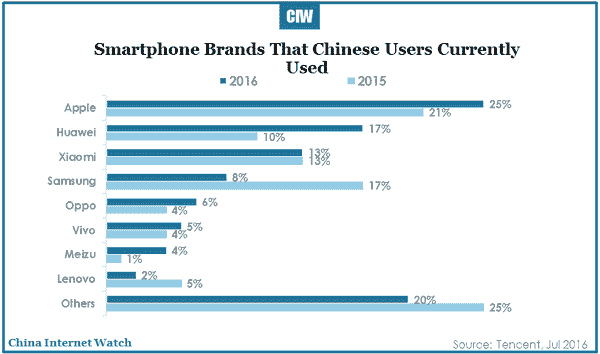

25% of China smartphone users use the iOS operating system in 2016, a slight growth compared to the past year which was 21%.

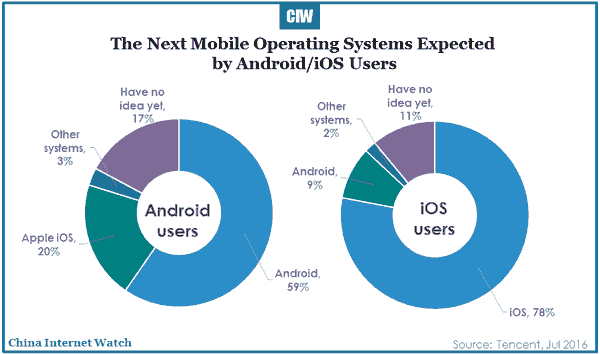

Although majority of China smartphone users use Android phones, 78% iOS users are loyal to their operating system and only 9% iOS users will select an Android smartphone as their next smartphone. As for Android users, 59% of them will continue using Android phones, which has increased 33% compared to 2015.

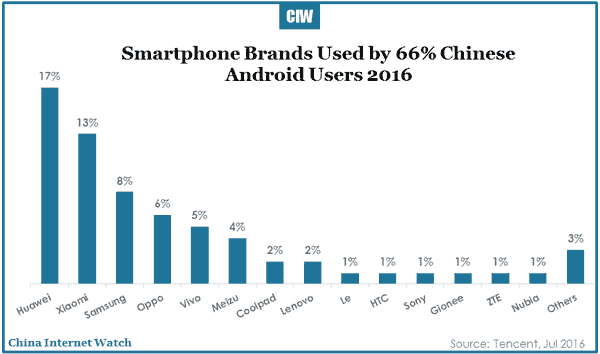

Apple iPhone is the most popular brand in China while Huawei becomes the most frequently used Android brand (17%), followed by Xiaomi (13%) and Samsung (8%).

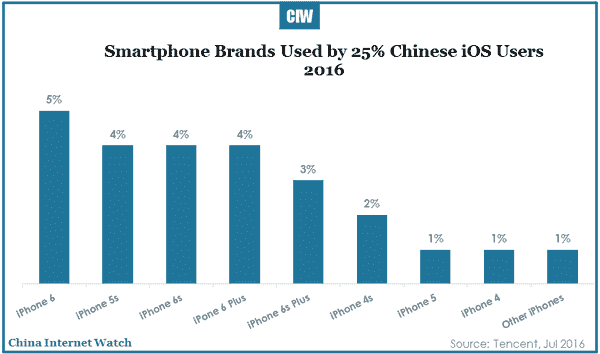

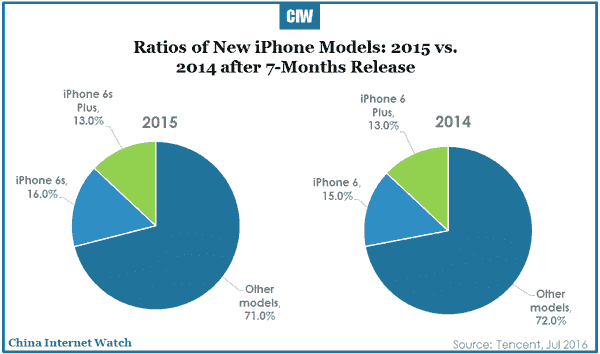

29% users use new iPhone models in 2015 and 28% in 2014 after a 7-months release.

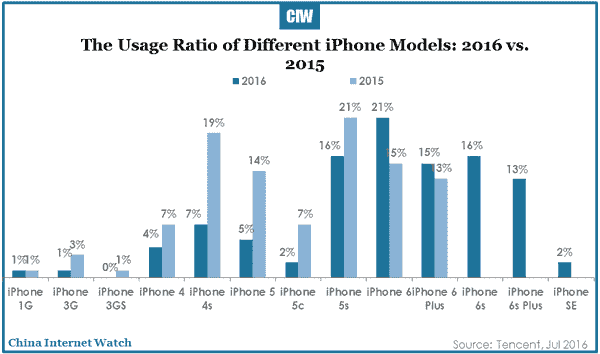

As for different iPhone models, 21% of users use iPhone 5s in 2015, followed by iPhone 4s (19%) and iPhone 6 (15%); in 2016, 21% of users use iPhone 6, followed by iPhone 6s (16%) as well as iPhone 5s (16%).

The most popular smartphone brands in China in 2016 are Apple (25%) and Huawei (17%). Huawei has increased seven percentage points while Apple has decreased 4. Samsung’s share dropped from 17% in 2015 to 8% in 2016.

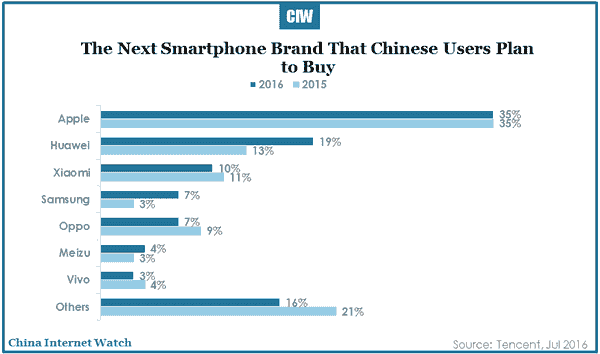

35% of Chinese users want to buy an iPhone as their next smartphone while 19% of them want to buy an Huawei smartphone.

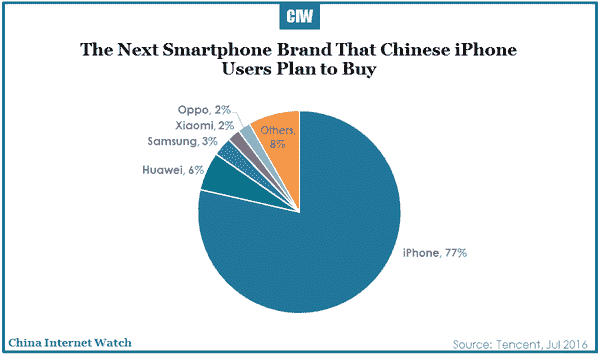

In terms of different smartphone users, most of Chinese iPhone users still plan to buy an iPhone in the future (77%), Huawei as the second option.

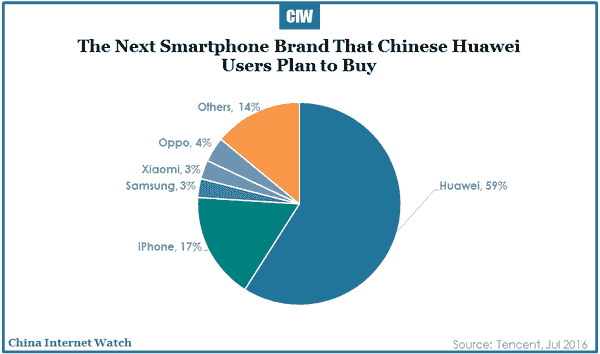

59% Huawei users show loyalty to their current brand, but 17% of them tend to switch to iPhone.

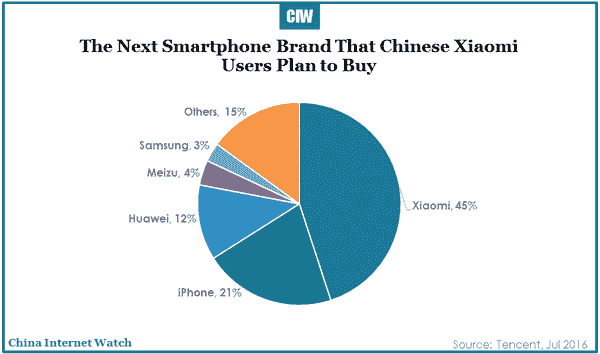

45% Xiaomi users will continue using Xiaomi smartphones; 21% will turn to iPhone and 12% to Huawei.

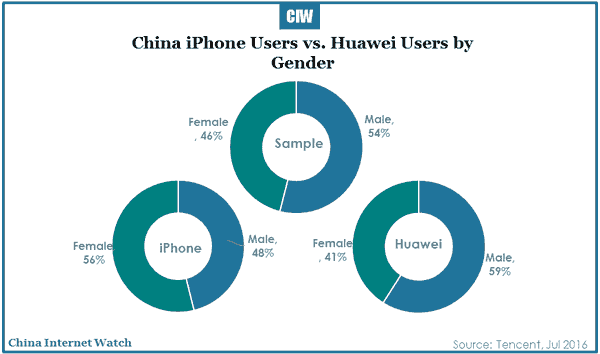

56% iPhone users are female while 59% Huawei users are male.

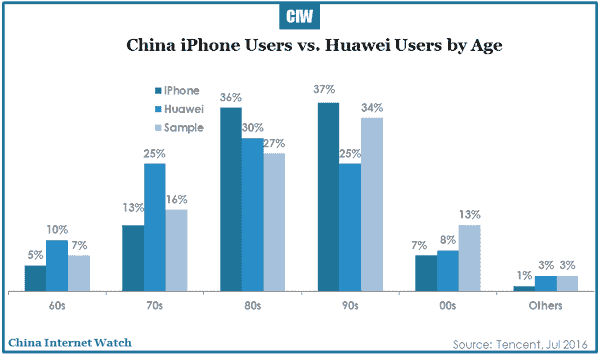

The 80s and 90s are drivers of the smartphone market; 37% of iPhone users are the 90s and 36% are the 80s; Huawei users are mainly the 70s (25%), the 80s (30%), and the 90s (25%).

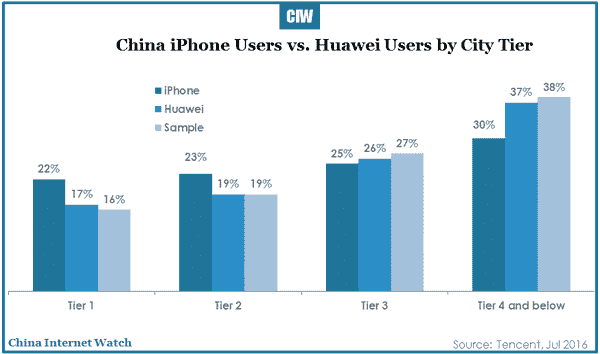

iPhone users in tier 1 and tier 2 cities are more than Huawei users; but, in tier 3, tier 4 and below, Huawei users are more than iPhone users.

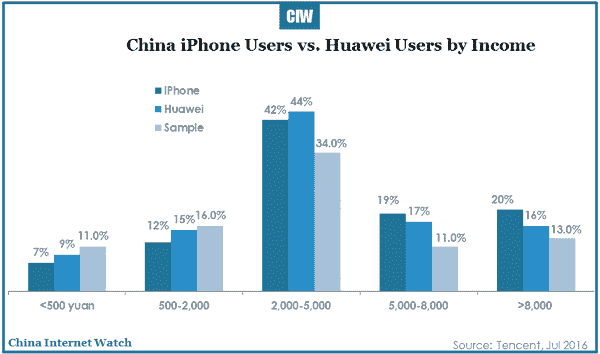

Near half of iPhone (42%) and Huawei (44%) users have the income of roughly 2,000 to 5,000 yuan a month.

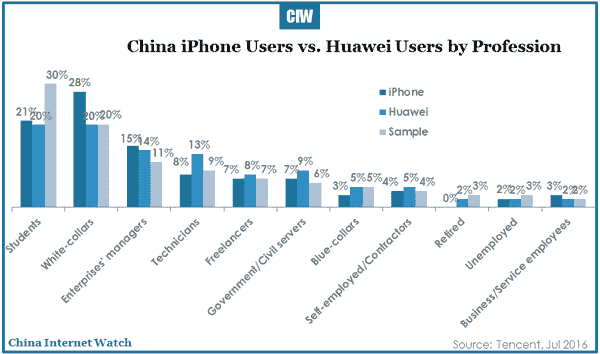

28% iPhone users are white-collars and 21% are students. Both white-collar employees and students account for 20% of Huawei users.

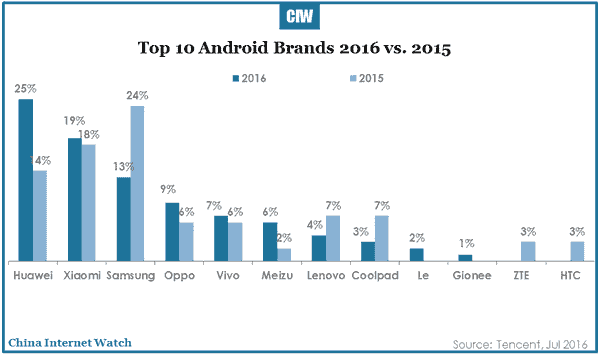

Top 10 Android brands in 2016 are Huawei, Xiaomi, Samsung, Oppo, Vivo, Meizu, Lenovo, Coolpad, Le smartphone, and Gionee.

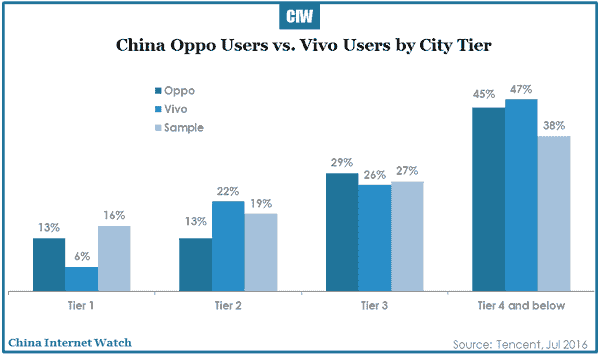

In tier 4 and below, Oppo users account for 45% and Vivo 47%.

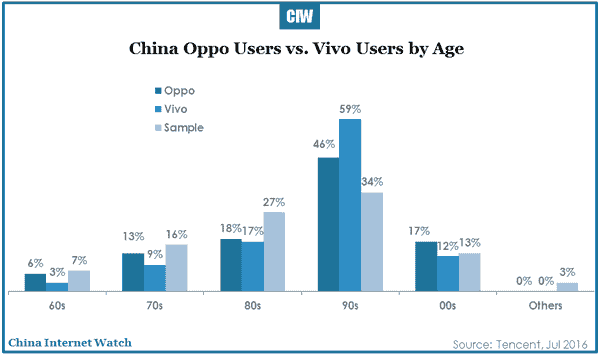

The 90s are the major users of Oppo and Vivo; 46% of the respondent 90s are Oppo users and 59% Vivo users.

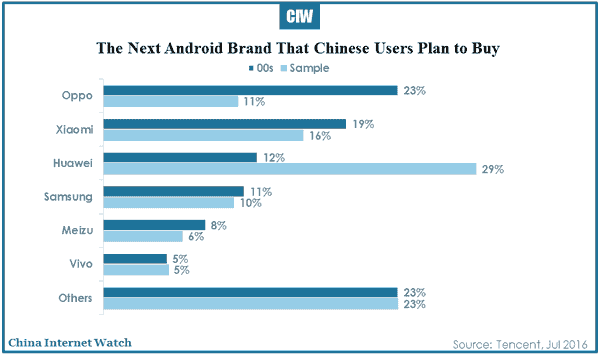

23% Chinese users plan to buy an Oppo smartphone as their next Android smartphone brand, followed by Xiaomi (19%) and Huawei (12%).

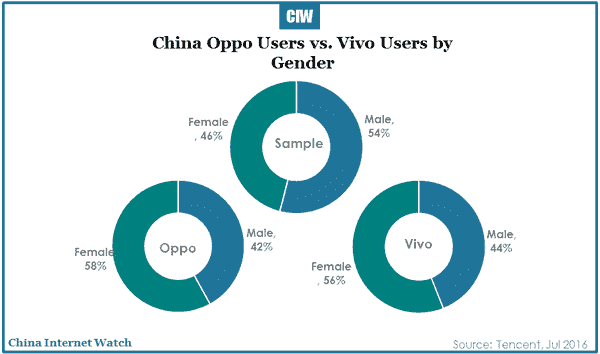

58% Oppo users and 56% Vivo users are female, which show that Oppo and Vivo smartphones are more popular for females.

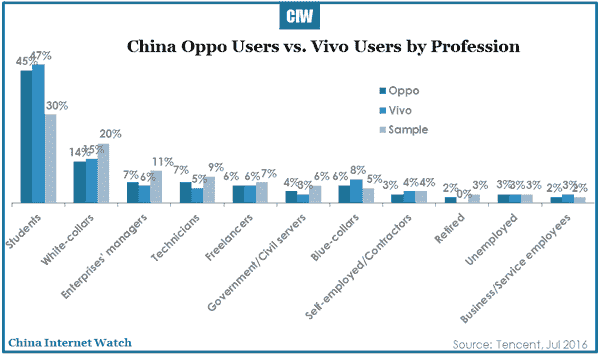

47% students use Vivo and 45% use Oppo.

In the second quarter of 2016, iOS continued to post year-over-year declines in urban China: 17.9% of smartphone sales in the period were iOS, a drop of 1.8 percentage points from 19.7% in the second quarter of 2015 according to Kantar.

iOS share decline has also pushed Apple behind Huawei (25.7%) and Xiaomi (18.5%) facing increased competitors from local smartphone models such as Huawei’s Mate 8, P9, Xiaomi’s RedMi Note 3 and Mi 5, and Oppo’s R9. iPhone SE only accounts for 2.5% of smartphone sales in Q2 2016.

Related: China Android App Stores Insights Q1 2016

iPhone only had 8.2% domestic smartphone market share by total shipments in April 2016 according to Sino Market Research.

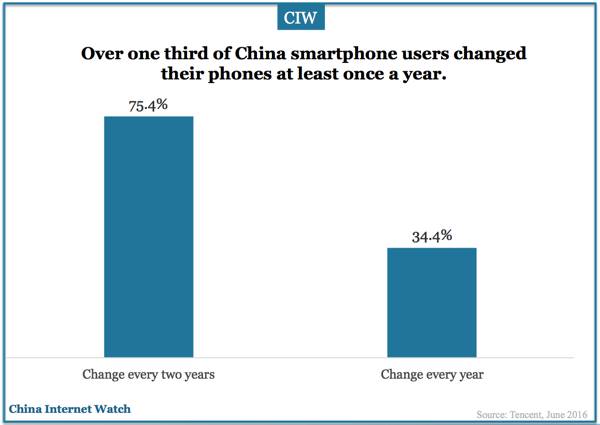

Over one-third of China smartphone users would replace smartphones for new ones at least once a year; over three-quarters of Chinese would do so every two years according to a Tencent survey. If an iPhone user is to replace his phone with an Android phone, Huawei is the top choice.

]]>

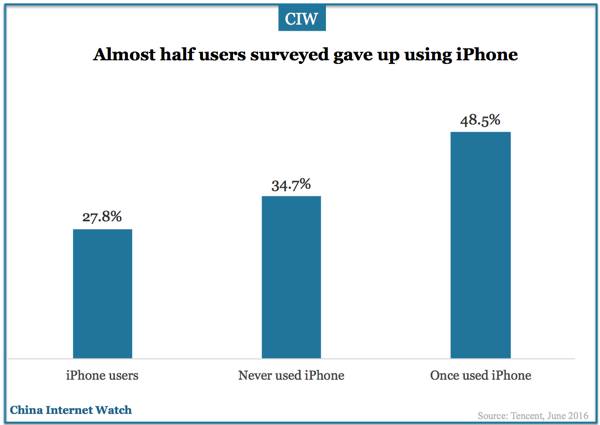

Penguin Intelligence, part of Tencent, recently conducted a survey on iPhone losing users in China.

Over one-third of China smartphone users would replace smartphones for new ones at least once a year; over three-quarters of Chinese would do so every two years according to the survey.

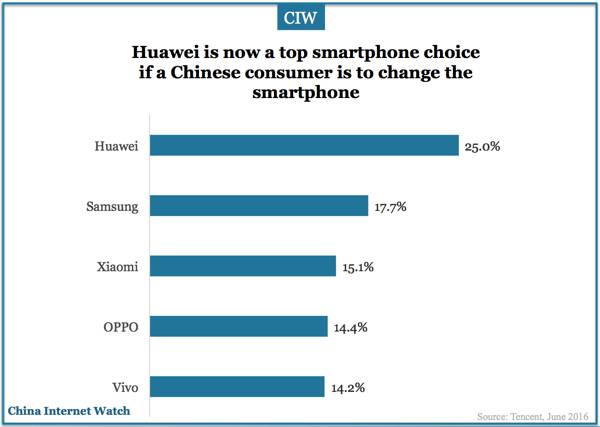

If an iPhone user is to replace his phone with an Android phone, Huawei is the top choice.

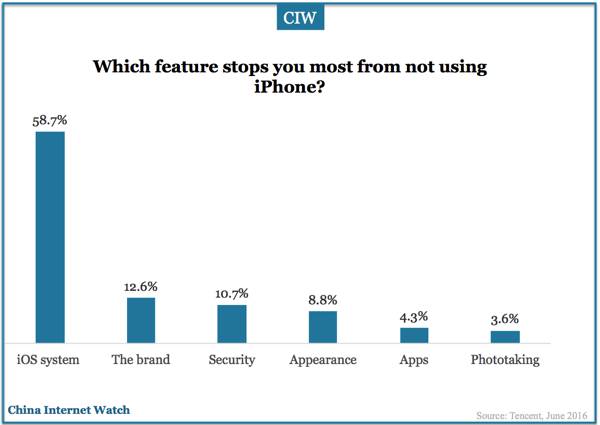

iOS operating system is the most addictive feature of iPhone.

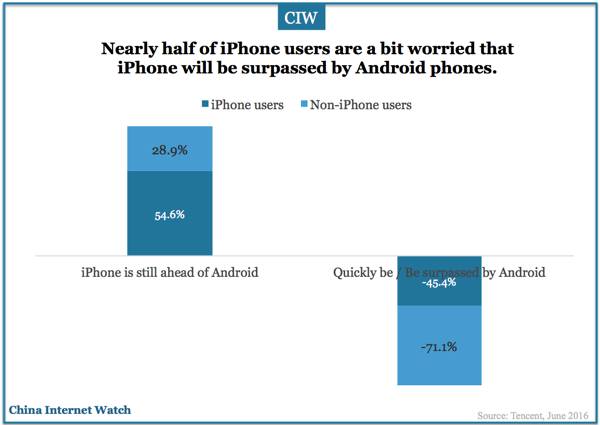

Nearly half of iPhone users are a bit worried that iPhone will be surpassed by Android phones.

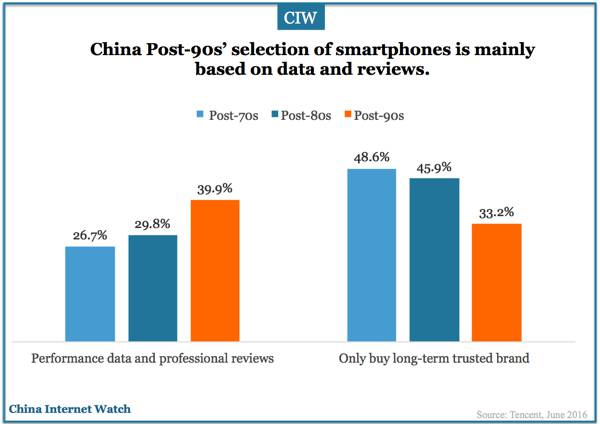

Post-90s generation in China relies more on performance data and professional reviews while choosing a smartphone, compared with post-70s and post-90s.