Strategic Moves: EV Sector and Smartphone Market

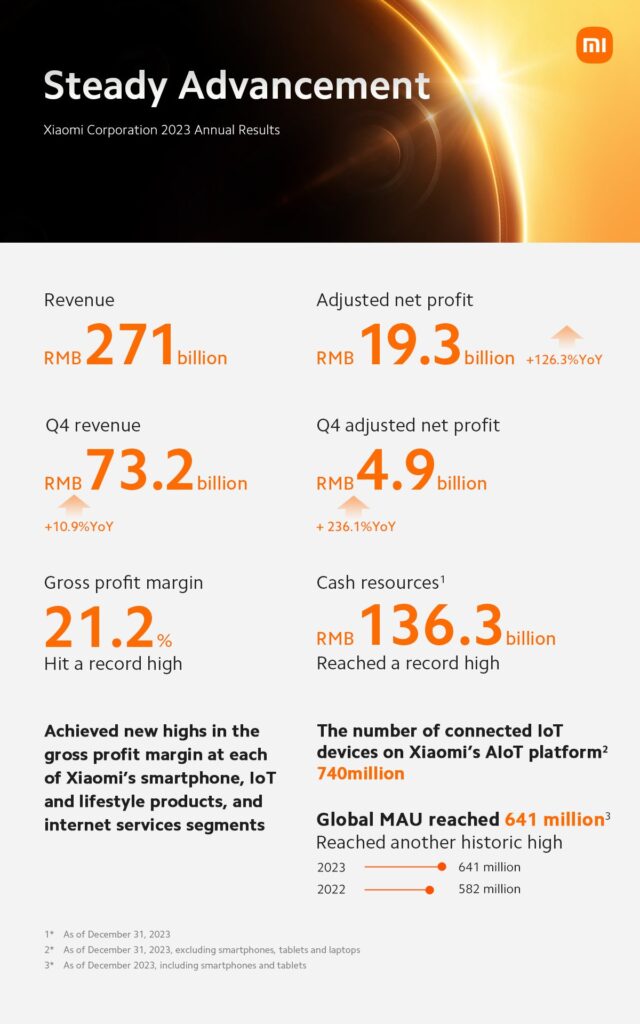

Xiaomi’s entry into the smart Electric Vehicle (EV) market and continuous innovation in the smartphone segment have been central to its financial success.

The company retained its position as the third-largest smartphone vendor globally, with a total shipment of approximately 145.6 million units.

A notable strategy was the premiumization of its smartphone offerings, which led to an over 19% increase in the average selling price in mainland China.

Growth in IoT and AIoT Platforms

Revenue from Xiaomi’s IoT and lifestyle products reached RMB 80.1 billion, with a gross profit margin of 16.3%.

The number of connected IoT devices on Xiaomi’s AIoT platform as of December 31, 2023, stood at 739.7 million, a 25.5% increase year-over-year.

This expansion is reflective of Xiaomi’s strong position not only in the domestic market but also internationally, with significant presence and market share growth in various regions including the Middle East, Latin America, Africa, and Southeast Asia.

Future Directions: R&D and Global Technology Leadership

Xiaomi announced its strategic goals for 2020–2030, emphasizing long-term investment in foundational core technologies to assert its leadership in global tech innovations.

The company’s R&D expenses for 2023 amounted to RMB 19.1 billion, a 19.2% increase from the previous year, highlighting its commitment to innovation.

About Xiaomi Corporation

Xiaomi Corporation was founded in April 2010 and listed on the Hong Kong Stock Exchange in July 2018. With its core in smartphones and smart hardware connected by an IoT platform, Xiaomi aims to create quality products that enhance global living standards through innovative technology.

]]>Apollo Go, Baidu’s autonomous ride-hailing service, is now authorized to collect fares for robotaxi rides – completely without human drivers in the car – in Chongqing and Wuhan, two of China’s largest megacities.

Amid increasing regulatory approval of the expansion of autonomous vehicles (AVs), the permits reflect regulatory authorities’ strong recognition and trust in the strength of Baidu’s autonomous driving technology.

They also mark a key turning point for the future of mobility in China, leading to an eventual expansion of driverless ride-hailing services to paying users across the country.

The permits were granted to Baidu by government agencies in Wuhan and Chongqing’s Yongchuan District. Both cities have been pioneering new approaches to intelligent transportation in recent years, from developing infrastructure to updating new regulations for AVs.

Having received the permits, Baidu will begin to provide fully driverless robotaxi services in the designated areas in Wuhan from 9 am to 5 pm, and Chongqing from 9:30 am to 4:30 pm, with five Apollo 5th gen robotaxis operating in each city.

The areas of service cover 13 square kilometers in the Wuhan Economic & Technological Development Zone, and 30 square kilometers in Chongqing’s Yongchuan District.

First Driverless Permits in China for Autonomous Ride Hailing Services

Baidu received the first-ever permits in late April this year in China authorizing the company to provide driverless ride-hailing services to the public on open roads in Beijing.

This regulatory approval marks a significant milestone for the autonomous ride-hailing industry in China, indicating a regulatory openness to taking a further step toward a fully driverless mobility future.

With these permits issued by the head office of the Beijing High-level Automated Driving Demonstration Area (BJHAD), ten autonomous vehicles without drivers behind the steering wheel will offer rides to passengers in a designated area of 60 square kilometers in Beijing.

These licensed cars will join an existing fleet provided by Apollo Go, Baidu’s autonomous ride-hailing service, in the capital city of China. Starting April 28, 2022, users will be able to hail a driverless ride using the Apollo Go mobile app in daytime from 10:00 to 16:00.

Currently, Baidu has the largest autonomous driving fleet in China. In expanding its driverless vehicle services, Baidu has worked to meet the unique technical challenges of Beijing’s complex traffic environment. The company plans to add 30 more such vehicles at a later stage, expanding its fleet to provide more convenient driverless services to the public.

Baidu has a proven track record of over 27 million kilometers (16 million miles) of road testing accumulated in the past 9 years with zero traffic accidents, including mileage recorded by driverless test cars in multiple cities across China as well as in California.

In September 2020, Baidu became the first company in Beijing to offer autonomous ride-hailing services. Starting in November of last year, Baidu has been charging fees for the Apollo Go autonomous services offered to the public under granted commercial permits, though safety operators are required in the driver’s seat.

Apollo Go has expanded to 9 cities in China since its first launch in 2020, including all first-tier cities (Beijing, Shanghai, Shenzhen and Guangzhou), and five other cities (Chongqing, Changsha, Cangzhou, Yangquan and Wuzhen). There have been 213,000 orders on Apollo Go in Q4 2021, making it the global leader by order volume.

Baidu released intelligent vehicle solutions for automakers in China

Baidu showcases Fully Automated Driving and 5G Remote Driving Service

Baidu displayed Fully Automated Driving during Baidu World 2020 on 15 September 2020, the company’s annual technology conference that was held in cooperation with CCTV.

With Apollo’s new Fully Automated Driving capability, the AI system can independently drive without a safety driver inside the vehicle, a breakthrough that will accelerate the large-scale deployment of autonomous driving technology across China.

Zhenyu Li, Corporate Vice President of Baidu and General Manager of Intelligent Driving Group (IDG), demonstrated the technology in Beijing’s Shougang Park with CCTV anchor Xiaofeng Bao.

“The three core components of Apollo’s Fully Automated Driving technology are pre-installed and mass-produced vehicles, the ‘experienced AI driver’, and the 5G Remote Driving Service,” said Zhenyu Li during the demonstration.

With pre-installed and mass-produced vehicles as the foundation, the AI driving system is now capable of operating the vehicles independently, and the 5G Remote Driving Service allows remote human operators to intervene in case of emergencies.

Apollo’s leading technology in pre-installed and mass-produced vehicles is a key precondition for Fully Automated Driving.

In 2019, Baidu partnered with FAW Group and jointly developed Hongqi EV robotaxi, the first pre-installed and mass-produced robotaxi in China, which has since been deployed in unmanned driving tests in multiple cities including Beijing, Changsha, G

Compared with modified models, pre-installed and mass-produced vehicles better guarantee consistency and safety.

Apollo has also released its fifth-generation autonomous driving kit, and the first pre-installed and mass-produced vehicles that meet the requirements for fully automated operations will be launched soon.

With each new generation of Apollo vehicles, the cost will be halved while performance will increase by tenfold, said Zhenyu Li.

The “experienced AI driver” refers to the capacity of the AI system to control the vehicle independent of a human driver. Apollo has completed over six million kilometers of road testing with a record low of zero accidents.

Having carried over 100,000 passengers across 27 cities around the world, Apollo’s “experienced AI driver” is well-trained. It is capable of handling various technological challenges of unmanned driving and solving the overwhelming majority of possible issues on the road.

The 5G Remote Driving Service is an indispensable complement to the “experienced AI driver” and allows human operators to remotely access vehicles in the case of exceptional emergencies.

Powered by smart transportation systems, vehicle-to-everything (V2X) technologies, and the high bandwidth and response speed of 5G networks, the 5G Remote Driving Service is engaged instantaneously to provide immediate assistance from remote human operators when the user or the system switches to parallel driving mode.

All remote human operators have completed over 1,000 hours of cloud-based driving training without any accidents, so they can ensure the safety of passengers and pedestrians under the non-autonomous driving mode.

As the “experienced AI driver” can handle most road conditions, extreme occasions that require human intervention are rare. Hence, one remote human operator will be able to manage multiple vehicles simultaneously, largely increasing efficiency compared to the traditional one operator per vehicle model.

With these advancements, unmanned driving will create a new ecosystem of shared transportation, and the autonomous driving industry will enter the stage of full commercialization in 2025, said Robin Li, Co-founder, Chairman and CEO of Baidu.

Apollo also announced new product and technological developments at the conference.

Vehicle manufacturer Weltmeister will launch a new model incorporating Apollo’s valet parking in 2021, which will be the first in China to be equipped with L4 autonomous valet parking technology.

It will be able to identify vacant parking slots in multistory parking garages and allow people to use the autonomous-parking and smart summons functions with one simple click.

In addition, DuerOS for Apollo with smart voice-interaction has been installed on over one million smart vehicles.

DuerOS for Apollo is partnering with over 60 major automotive brands and covers more than 500 vehicle models on the market.

According to IHS Markit’s latest “Report on Connected and Autonomous Vehicle (CAV) Development Trends in the Chinese Market”, DuerOS for Apollo is the world’s most installed system for CAV.

The Apollo smart transportation solution “ACE Transportation Engine” has been put in use in nearly 20 cities in China.

Robin Li estimates that by 2025 major Chinese cities will no longer need to limit vehicle purchases and usage, and by 2030 most traffic congestion issues can be solved by higher transportation efficiency.

Smart transportation infrastructure based on V2X technologies promises to improve traffic efficiency by 15% to 30% and boost the contribution to GDP by 2.4% to 4.8% in absolute value.

During the smart transportation sub-forum at Baidu World 2020, Baidu launched Apollo 6.0, the latest version of its open platform, adding multiple cloud services to make it more accessible for developers.

The Apollo open platform has now released 600,000 lines of open source code, gathering 45,000 developers and 210 ecosystem partners globally.

China’s automobile sales up 16% in July 2020; new energy vehicles up 19%

]]>MWC Shanghai 2021 offers an opportunity for delegates and visitors to hear expert insights and future trends, witness the latest technology and innovation, and discuss the issues that will affect the future of the mobile industry.

“MWC21 Shanghai is far more than just an event,” said John Hoffman, CEO, GSMA Ltd. “It’s a celebration of the power of intelligent connectivity and provides a platform for people to come together and push the industry and society forward. Bringing the MWC series of events back for 2021 has taken a superhuman effort, and we are looking forward to welcoming the mobile ecosystem back to Shanghai in February.”

The GSMA unlocks the full power of connectivity so that people, industry, and society thrive. Its MWC series has earned a world-class reputation as the place to get business done by providing unrivaled networking opportunities. In 2019, MWC Shanghai included more than 500 exhibitors and 65,000 attendees from companies across the world.

This year, MWC Shanghai will welcome international attendees and audiences, with a virtual platform to accompany the physical event. Online attendees will be able to access live conference and partner content online.

The theme for the MWC series of events in 2021 is Connected Impact.

The program will showcase how the entire digital ecosystem continues to transform our lives and significantly support global recovery with technology visionaries sparking conversation and imagination through keynotes and panel discussions.

Attendees to MWC Shanghai 2021 will experience the latest breakthroughs in technology including 5G, AI, IoT, smart home and more. Returning exhibitors include China Mobile, China Telecom, China Unicom, CICT, Ericsson , H3C, Huawei, Nokia Shanghai Bell and ZTE.

A host of new 5G-enabled devices and consumer services will be showcased by, Huawei Device, Nreal, Oppo, Qualcomm, Realme and vivo. Confirmed speakers include:

Keynotes speakers:

- Dr Zina Jarrahi Cinker, Director General, AMPT

- Yang Jie, Chairman, China Mobile

- Ke Ruiwen, Chairman, China Telecom

- Ken Hu, Rotating Chairman, Huawei

- Yang Yuanqing, Chairman & CEO, Lenovo

- Xu Chi, Founder & CEO, Nreal

- Xu Ziyang, CEO, ZTE

Session speakers include:

- Ilyas Khan, Founder & CEO, Cambridge Quantum Computing

- Edward Tian, Chairman, CBC Capital

- Oscar Ramos, Managing Director, Chinaccelerator

- Huang Haibo, Managing Director, China Mobile Fund Management Co.Ltd

- Alvin Foo, Co-Founder, Dao Ventures

- Eric Miao, Founder, Elevoc

- Michael Currie, Founder and CEO, Fling

- Jiin Joo Ong, Chief Technology Officer and Co-Founder, Garuda Robotics

- Pedro Ruao, Founder & CEO, Omniflow

- Max Peiro, CEO, Rehub

- Enrique Blanco, CTIO, Telefonica

- Huang Enshen, Founder & CEO, Xeniro

Leading 5G INnovation

With almost 700,000 5G cell sites and over 150 million compatible handsets now sold, China has established itself amongst the global 5G leaders and will feature strongly at MWC Shanghai 2021 with the 5G IN Summit and 5G INnovation Zone.

GSMA 5G IN, seeks to uncover disruptors and new business models, as well as celebrate pioneers and innovators in the 5G field.

The experience spans five themed zones; Better Future, Entrepreneurs, Industrial Applications, 5G mmWave, and XR. Attendees will experience leading-edge technology and revolutionary commercial, industrial applications, as well as the most forward-looking trends and insights.

“5G is shaping the future, and China will continue to be at the forefront of this change,” said Sihan Bo Chen, Head of Greater China for the GSMA. “Every sector is undergoing deep transformation, and connected progress will stimulate global recovery and help us overcome the effects of the pandemic.”

For further details on exhibiting at or attending MWC Shanghai 2021, please visit www.mwcshanghai.com

]]>Globally, the key benefits of 5G other than speed gains (e.g. network slicing, edge computing, and low-latency services) are not widely appreciated, with many companies believing 4G is ‘good enough’.

But China is a clear exception. Early partnerships and trials from local operators have paid dividends, as evidenced by the widespread intent among companies in the country’s industrial sector to utilize 5G.

Chinese operators are also leading the charge for standalone (SA) 5G, which will help deliver the key benefits of 5G for enterprises.

Awareness and knowledge of 5G are rising as hype makes way for reality.

Chinese consumers are among the most excited by the prospect of 5G. They are generally more optimistic than other markets about the benefits of 5G, with greater expectations of lower service costs, innovative services and new connected devices.

In addition, consumers in China are likely earlier adopters of 5G (versus the US, Japan, and Europe) and seem the most willing to pay more for 5G services – a key driver of potential 5G consumer revenue uplift.

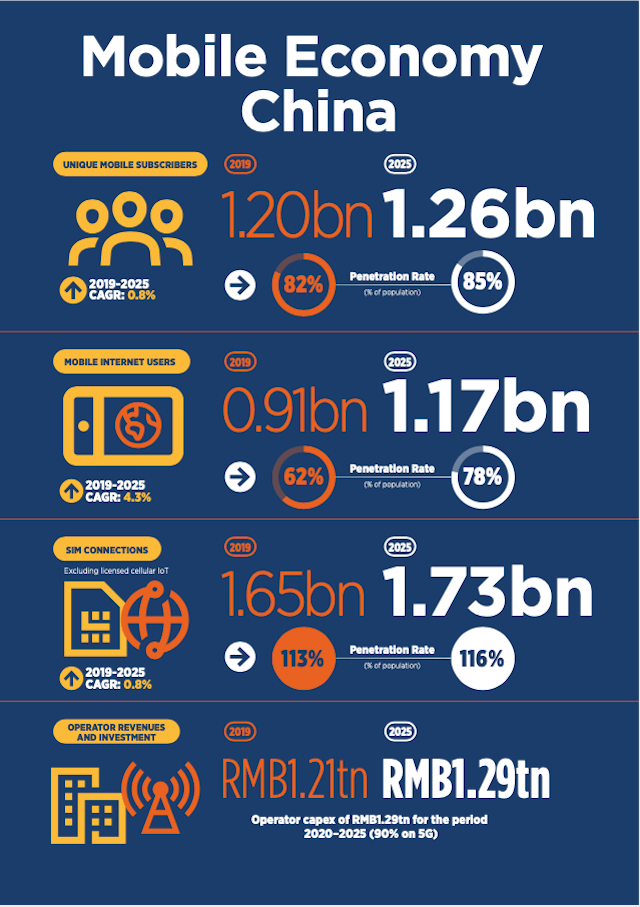

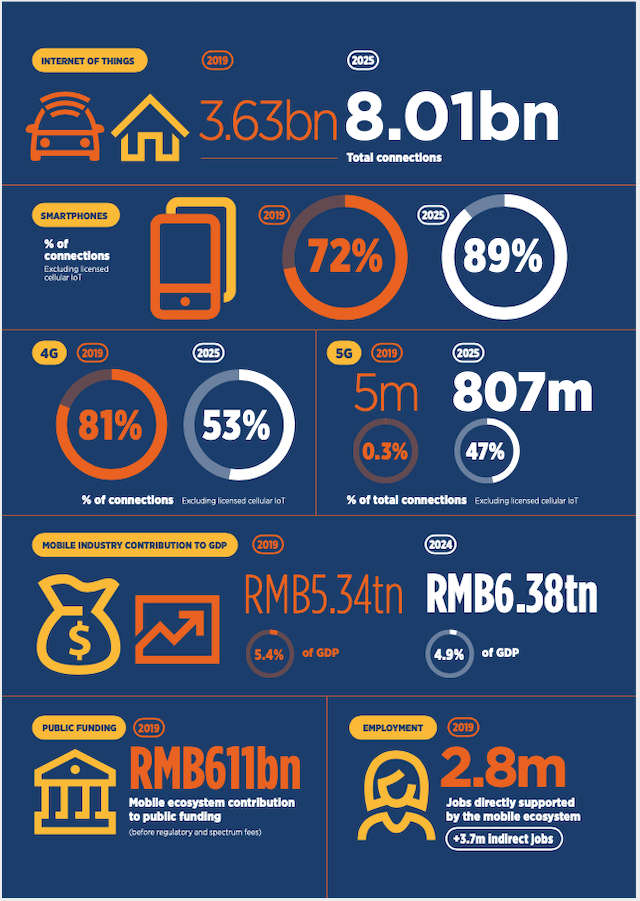

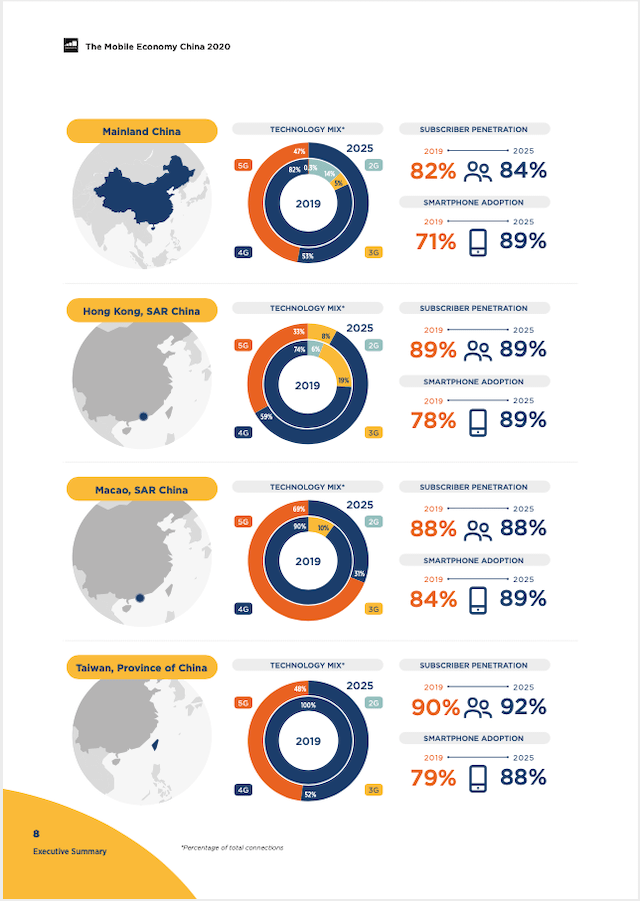

4G is by far the dominant mobile technology across China, accounting for more than 80% of total connections (excluding licensed cellular IoT). However, 4G’s share will peak in 2020 (at 82%) as 5G grows significantly.

Several 5G smartphones have been launched, many by local OEMs, and Chinese consumers are among the most keen to upgrade to 5G.

As a result, China will account for 70% of global 5G connections in 2020, and 5G adoption will grow to just under 50% by 2025, placing the country among the leading nations along with South Korea, Japan and the US.

To support this generational shift and drive consumer engagement, Chinese operators are expected to invest more than $180 billion between 2020 and 2025 in mobile capex, roughly 90% of which will be on 5G networks.

Despite some financial headwinds – including market saturation, increasing competition and the country’s ‘speed upgrade and tariff reduction’ policy – China’s mobile revenue remains stable.

Financials will recover in 2020 and 2021, and revenue will rise steadily at around 1% per year to 2025, largely because of growing revenues in enterprise IoT and new 5G services.

By the end of 2019, 1.2 billion people subscribed to mobile services across China.

This accounts for 82% of the region’s population and places China among the world’s most developed markets. As with all advanced markets, adding new subscribers is increasingly difficult, with the cost of reaching rural populations hard to justify against a challenging financial backdrop for operators.

Despite this, there will be around 60 million new subscribers by 2025.

Since 2012, the number of people subscribing to the mobile internet across China has doubled to more than 900 million. By 2025, nearly 260 million people will start using the mobile internet for the very first time, almost halving the unconnected proportion of the population to 22%.

Mobile continues to make a significant contribution to the Chinese economy.

In 2019, mobile technologies and services generated $759 billion of economic value added (5.4% of GDP) across China. This figure will surpass $900 billion by 2024 as the region increasingly benefits from the improvements in productivity and efficiency brought about by the increased take-up of mobile services.

Download the full report here (CIW annual subscribers) including key trends shaping the mobile industry, mobile contributing to economic growth and addressing social challenges, and policies to accelerate digital development. Subscribe here.

]]>

Mi 10 Pro achieved a score of 124 for camera and 76 for audio on DXOMARK, ranking the flagship smartphone first in both the camera and audio categories.

The Mi 10 series starts from RMB 3,999 (US$572), and will be available in mainland China starting February 24, 2020.

The Mi 10 series is powered by the Qualcomm Snapdragon 865. As the flagship mobile platform of the year, the Snapdragon 865 is the leading 5G platform to-date, offering staggering multi-gigabit 5G connectivity, it also delivers top-notch performance in terms of CPU, GPU, camera, and AI capabilities.

The Snapdragon 865 uses a three-cluster architecture and has a maximum clock speed of 2.84GHz. With the new Kryo 585 being based on the Cortex-A77 architecture, which is the latest generation of ARM processor architecture, CPU performance is increased by 25% compared to its predecessor.

The new Adreno 650 graphics processor also has a 25% upgrade in rendering speed, with a decreased energy consumption of 35%.

The fifth-generation AIE artificial intelligence engine enables AI capabilities that is 2x more powerful than the predecessor, which provides Mi 10 with better performance in videography, imagery, and AI processing applications.

Mi 10 series comes with the latest LPDDR5, supporting a maximum transmission rate of 5500Mbps, and boasting up to 50% improvement in performance while still remaining power efficient.

Paired with the industry’s fastest UFS 3.0 flash memory, and adopting the new Write Turbo technology, Mi 10 series can achieve a maximum sequential write speed of up to 730MB per second.

The series also uses the latest Wi-Fi 6 technology, with speeds up to 9.6Gbps which provides an 2.7x increase compared to Wi-Fi 5, also supporting 8×8 MU-MIMO technology, the download speed for multiple connected devices increases by 100%.

In terms of heat dissipation, Mi 10 series offers the most sophisticated cooling system to date: a 3000mm² super large vapor chamber, graphene, and 6-layer graphite structure. It also includes copper foil heat sinks and thermal gel to improve the overall cooling capability of Mi 10, and ensures the device stays cool for extreme performance and 5G high-speed download.

Mi 10 series features a 108MP main camera with a 1/1.33” ultra large sensor. It is also among the first to support 8K ultra-clear video recording in 7680×4320 ultra-high-resolution, users can also capture ultra-clear 33MP photos while recording in 8K by simply tapping on the screen. With both OIS and EIS support, Mi 10 series ensures stable video capture even in extreme conditions.

In addition to a 108-megapixel main camera, Mi 10 Pro also includes a classic 50mm portrait lens with 2x optical zoom, a telephoto lens with 10x hybrid zoom, and a 20MP ultra wide-angle lens, each of which is of flagship level, and with the camera system supported by dual OIS.

Aside from camera, Mi 10 series offers by far the strongest audio configuration and capabilities of any Xiaomi device. The audio system is equipped with symmetrical dual 1216 linear speakers with large 1.2cc sound cavity, which makes the output volume 100% higher than its predecessor.

Mi 10 series offers AI audio tuning to adapt to the different usage and playback scenarios for better sound quality, delivering an unmatched immersive audio experience.

Mi 10 series sports a 6.67 ”AMOLED curved DotDisplay, with up to 800nit typical and a peak brightness of up to 1200nit, and a contrast ratio of up to 5,000,000:1, which delivers lively and vivid images.

The display also supports 90Hz refresh rate and 180Hz touch sampling rate, delivering an unprecedented smooth experience.

Mi 10 Pro also offers the highest level of color accuracy in the industry, with a JNCD <0.55 and △E <1.1. Each device undergoes careful calibration with seventy-two color analyzers and two spectroradiometers in eighteen production lines prior to sales.

This ensures Mi 10 series displays can accurately reproduce colors as they are intended.

In addition, Mi 10 Pro comes with a 4500mAh high-capacity battery and features 50W wired fast charge, 30W wireless fast charge, and up to 10W reverse charging. The 50W wired fast charge supports charging to 100% in 45 minutes while the 30W wireless charging can charge to 100% in 65 minutes. A 65W charging adapter comes in-box.

Mi 10 comes in glossy black, blue, and gold, with a thickness of 8.96mm and bottom bezel as small as 3.32mm. Mi 10 Pro, on the other hand, features a matte design in blue and white with AG coating for a more premium hand feel and minimizes the chance of leaving fingerprints behind.

Other notable features on the Mi 10 series include in-screen fingerprint sensor for quick unlock, IR blaster for easy home appliances remote control, multifunctional NFC for swift payment, and a linear haptic motor for realistic touch response.

Mi 10 starts at RMB 3,999 and will officially launch on February 14 in three variants: 8GB + 128GB, 8GB+256GB, and 12GB+256GB. Mi 10 Pro starts at RMB 4,999 and will be available in three variants: 8GB+256GB, 12GB+256GB, and 12GB+512GB.

Mi AIoT Router AX3600: The first router to support Wi-Fi 6 and Qualcomm platform

The event also introduced Xiaomi’s first router that supports Wi-Fi 6 technology – the Mi AIoT Router AX3600.

Packed with Qualcomm’s quad-core processor, six-channel quality signal amplifiers, and an independent AIoT smart antenna, the Mi AIoT Router AX3600 provides blazing connection speeds of up to 3000 Mbps, leading the router products in the 5G era.

It also supports network connection in one simple click for Xiaomi smart products. Priced at RMB 599, Mi AIoT Router AX3600 is available for purchase at Xiaomi authorized channels, starting February 13.

Mi Bluetooth Speaker with Wireless Charging

Xiaomi introduced a Bluetooth speaker that combines wireless charging for smartphones and Bluetooth speakers.

The device incorporates a built-in wireless charging function and a 20° elevation design on its front, allowing users to charge their smartphones while consuming media with ease.

Aside from charging Mi 10, Mi 10 Pro, and Mi 9 Pro with a maximum 30W wireless charging, Mi Bluetooth Speaker is also capable of charging Qi compatible devices, such as Samsung S10 and iPhone 11.

Mi Fast Link Technology is also enabled to ensure smooth connection with NFC and MIUI smartphones. Moreover, when the device is charging Mi 10 or Mi 10 Pro, the smartphone will automatically switch on XiaoAi AI ambient display after the screen is locked, turning the smartphone and the speaker into a XiaoAi AI assistant with touch screens.

Priced at RMB 249, Mi Bluetooth Speaker with Wireless Charging will be available for purchase from mi.com and Mi Home beginning February 18.

]]>The GSMA MWC series (formally known as Mobile World Congress) is the world’s largest exhibition for the mobile industry and incorporates a thought-leadership conference featuring prominent executives representing global mobile operators, device manufacturers, technology providers, vendors, and content owners.

MWC Barcelona 2020 takes place Monday, 24 February – Thursday, 27 February, 2020. The 2020 event will be held at Fira Gran Via with selected events, including 4YFN, taking place at Fira Montjuïc.

Sort through the event topics in our agenda to find the conference keynotes, track sessions, partner events, tours, and seminars that are most relevant to you. Here is an overview of the topics:

AI

With a market projected to reach $70 billion by 2020, artificial intelligence is poised to have a transformative effect on consumers, enterprises, and governments around the world. AI will explore the real potential of AI, how we must manage such a profound technological revolution and its impact on our professional and personal lives.

Connectivity: The 5G Era – Sponsored by Deloitte

Connectivity: The 5G Era at MWC 2020 aims to highlight how next-generation networks will form the basis of wide-reaching value creation and economic impact. We will take a broad look at the enterprise connectivity ecosystem, from implementation, to use cases, scalable platforms, business models, spectrum, regulation, and investment to the business and cultural challenges of working with new and diverse markets/industries. Realising the full potential of global connectivity is both complex and challenging, but the opportunity is near limitless in its application and impact.

Customer Engagement

Customer engagement has been a key battleground for brands, service providers and governments for decades, but its evolution and importance have accelerated in recent years driven by the internet, mobile and then smartphones. Customer Engagement will look at examples across all industries, to understand how you can set the benchmark for customer engagement, retain and gain customers and grow revenue.

Industry X: IoT – Sponsored by Citi

Using a blend of new technologies like industrial IoT, big data, analytics, AI, robotics, 3D printing, and machine learning, industries can unlock new revenue and engagement models with customers, employees and partners. Industry X: IoT will examine the challenges, opportunities, scalability and limitless potential of Industrial IoT and Digital Transformation.

Media & Entertainment

As the appetite and expectation for AR, VR and other forms of richer immersive content grow, the impact on networks, event venues, and overall consumer engagement will grow, presenting huge challenges to everyone involved in these now intertwined industries. Media & Entertainment examines the challenges, the revenue models, as well as the relationship between consumption growth and network capacity.

Our Planet

The world needs, now more than ever, our sector to be a fundamental contributor to creating a safe, clean and equitable world for all. Our Planet will discuss the connected technology industries’ responsibilities to the environment and underserved people, including the unconnected and accessibility for the disabled, among others.

Security & Privacy

Recent scandals have eroded trust in the digital ecosystem. Coupled with the growing introduction and interest in legislation around privacy and the ethics of data usage as we enter the AI era, we are at a pivotal juncture in the evolution of the Internet. Security & Privacy analyses the growing responsibilities required to create the right balance with consumers, governments, regulators and industries.

Find out more: MWC Barcelona

]]>