On May 3rd, the Ministry of Culture and Tourism released travel data for the holiday period, showing that domestic tourists reached 274 million and the domestic tourism revenue hit 148.06 billion yuan (US$21.41 billion), both surpassing the same period in 2019.

Online travel platforms, including Ctrip, Tongcheng, Tuniu, and Fliggy, also reported record-breaking data for the Labor Day holiday.

Scenic spots saw a 9-fold increase in ticket sales compared to last year.

According to Ctrip’s “2023 Labor Day Travel Data Report,” the top five popular scenic spots were Shanghai Disneyland Resort, Humble Administrator’s Garden, Huangshan Scenic Area, Mount Emei, and Mount Hua.

Family tourists, particularly those with children, contributed significantly to the surge in visitors, with theme parks, zoos, and museums accounting for more than half of the top ten popular spots.

The preference of tourists diversified during this year’s Labor Day holiday, with a more robust demand for high-level cultural products. Museums such as the Palace Museum, the National Museum of China, Shaanxi History Museum, and others saw their ticket sales fully booked for several consecutive days. Immersive performances, river cruises, and intangible cultural heritage shows were also in high demand.

Cross-provincial travel accounted for more than 70% of hotel bookings, with the average distance traveled by tourists increasing by 25% compared to last year. This year’s holiday saw a trend towards longer trips, with group tours lasting five days or more making up 30% of bookings, up from 20% in 2019.

Besides traditional popular destinations like Beijing, Shanghai, and Hangzhou, smaller destinations like Zibo also witnessed a surge in popularity.

Driven by the phenomenal popularity of “Zibo Barbecue,” hotel bookings in Shandong Province increased nearly threefold compared to the same period in 2019, with Zibo’s hotel bookings increasing more than tenfold.

Experts predict that while the domestic tourism market will stabilize after the Labor Day holiday, the summer peak season will see another surge in student and family travel. However, as some tourists opt for outbound travel during the summer, the domestic tourism heat is expected to be less intense compared to this Labor Day holiday.

To maintain the positive momentum in tourism consumption, local authorities must continue to innovate their offerings, implement more precise branding and marketing strategies, and continuously upgrade their service levels to promote the role of tourism consumption in economic growth.

Gen-Z Insights: capturing attention of China’s post-95s consumers

]]>

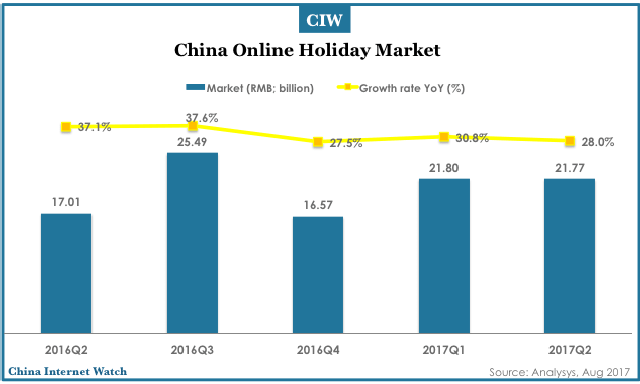

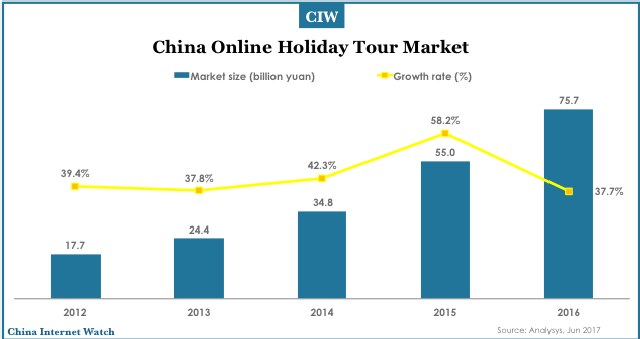

While China’s more affluent consumers increasingly favor independent travel, the online holiday and group tour booking market is still showing rapid growth, likely driven by continued expansion of the middle class in China.

In the second quarter of 2017, China’s online holiday booking market grew to 21.77 billion yuan (US$3.26 billion), equating to year-on-year growth of 28%.

While this figure is slightly lower than that for Q1 2017, this is common as the second quarter in China lacks any long public holidays and opportunities for travel are more limited; traditionally, the first and third quarters are peak season for group tour bookings.

During 2017, the National Tourism Administration has taken measures to combat group tours with unrealistically low prices, believing that these are likely to be low-quality and rely on forcing tourists to engage in activities and shopping for added fees in order to recoup costs.

This policy has come as part of a comprehensive effort to revamp and improve the quality of group tours in China and make high-quality travel more accessible to the burgeoning middle-class, as well as to restrain monopolistic practices and anti-competitive pricing.

Travel e-commerce platforms including Tuniu and Ctrip have responded with their own efforts to increase quality and standardize customer experiences. Ctrip released a new “diamond standard” rating system and released a new high-end line of tours.

Lvmama’s “Happy Donkeyback Travel” line also received an upgrade, wherein the platform began enforcing a “no forced shopping, no hidden costs” program and worked to make sure tour operators weren’t receiving kickbacks and commissions from local sites and retailers.

In addition, market trends towards independent travel are forcing tour providers to move in the direction of greater personalization and more authentic experiences for tourists. Themed tours are becoming more common, including food and minority culture tours.

Capital is continuing to flood the market, with startup “Travel Book” completing A round financing for more than 10 million yuan (US$1.5 million). Travel Book is a building a travel planner and tour guide platform which will help travelers put together optimized itineraries and daily plans for travel on tours and independent trips.

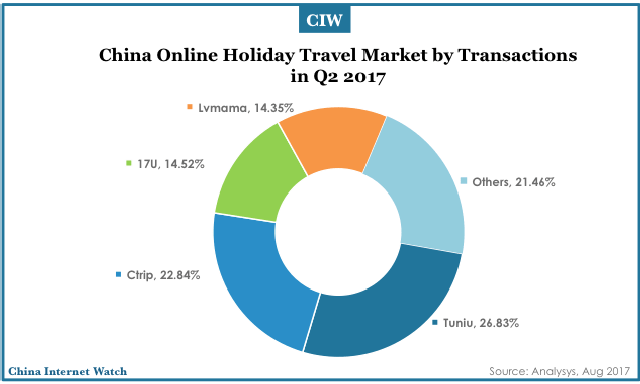

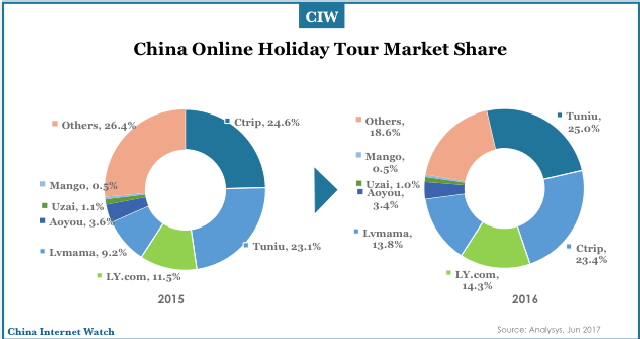

Regarding market share in the second quarter, Tuniu (with 26.83%) and Ctrip (with 22.84%) remain the top two players in the market, sharing half of the market between them. Tuniu has been able to strengthen its supply chain and improve member services, and has earned customer approbation with its strong customer service and professional tour guides.

It’s innovative review system allows customers to compare hotels, sites, and experiences from inside and outside packaged tours to better choose tour packages for themselves. Ctrip is leveraging its acquisition of Qunar to build a better e-commerce platform for tours, and totaled 4.92 billion yuan (US$ 737.6 million) in tour revenue in Q2.

Below the top two, LY.com and Lvmama maintained market shares of 14.52% and 14.35%, respectively. They, too, worked to improve quality and standardization, with Lvmama in particular trying to build a set of personalized and highly diverse tour packages for its customers.

Analysys analysts believe that online holiday market will continue to expand and customer habits continue to develop, as resort packages are being accepted by a wider range of markets.

Given the demand for personalization, enterprises are working to optimize operational efficiency, and continuously drive product and service segmentation and personalized upgrades. Enterprises are moving from business development towards a deeper cultivation of their customer bases, pointing towards a healthy trend of development within the overall market.

]]>

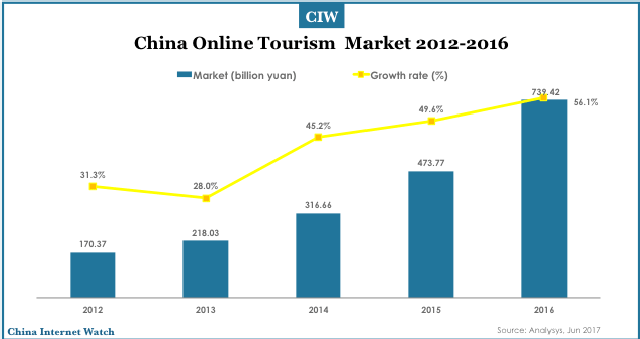

During 2016, the online tourism market in China maintained steady growth over the year prior, growing much more quickly than GDP growth while increasing its overall penetration into the tourism industry as a whole.

Overall, online booking of hotels and plane tickets maintained leading positions within online tourism sales, and individual travel bookings dominated the industry (as opposed to group tours). The trend towards individual, independent travel is beginning to dramatically affect the market, mostly in ways which are beneficial to the online travel booking industry.

Tourism industry revenue trends

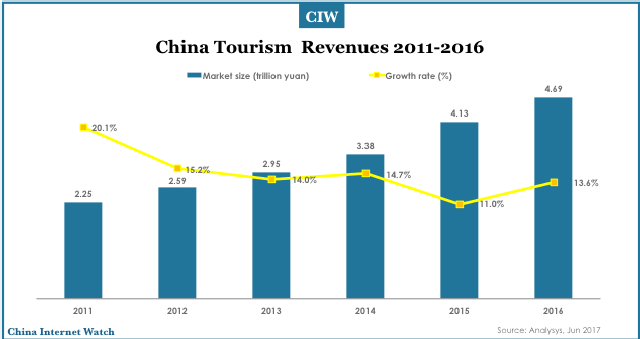

The tourism industry in China has maintained a growth rate far above GDP growth for several years, growing at over 10% year-on-year every year for the past five years. In 2016, the total market reached 4.69 trillion yuan (US$ 703 billion), having grown by 13.6% from 2015.

This growth rate is also slightly higher than 2015, when growth over 2014 was 11.0%. Tourism accounted for 6.3% of China’s GDP in 2016, also a slight increase over 2015 (6.0%).

Meanwhile, the online tourism market is growing much more rapidly than the tourism market overall; in 2016, online tourism revenue reached 739.42 billion yuan (US$110.85 billion), representing 56.1% growth over 2015. As a result, online tourism has increased its market share from 11.5% of the market in 2015 to 15.8% in 2016 (up from 6.6% in 2012).

Online tourism market overview

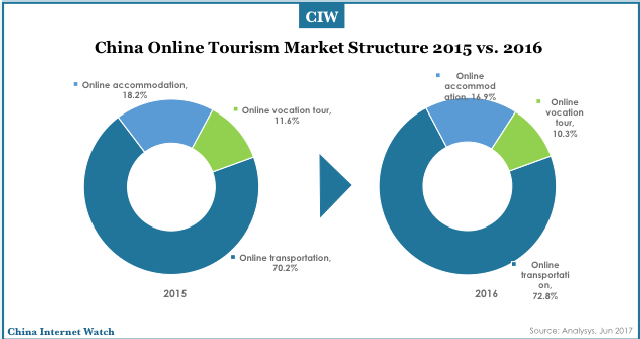

From 2015 to 2016, there were minor changes in the structure of the online tourism market in China. In 2016, as before, online booking of transportation (plane, high-speed rail, conventional rail) dominated the market, with total revenue of 538.5 billion yuan (US$80.7 billion), followed by accommodation booking with 125.1 billion yuan (US$18.8 billion).

Group tours and tour packages made up the remainder; market share shifted in favor of transportation, which rose from 70.2% to 72.8% of the market, taking equally from accommodation and tours, which both slid from 2015 by about 1.3%.

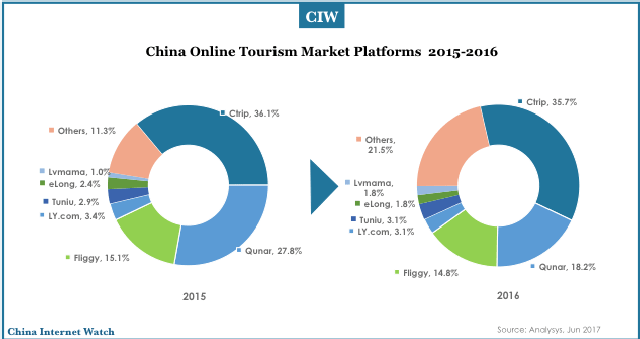

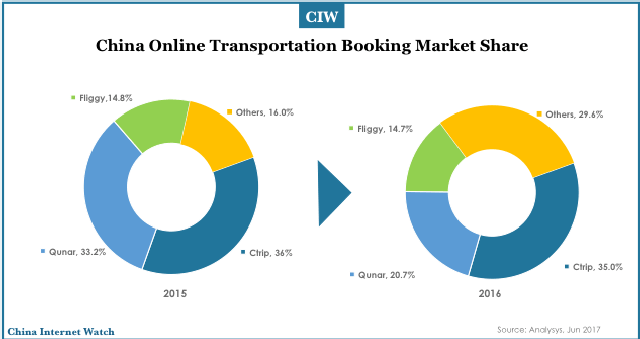

Within the online tourism market, there were three major players and a host of minor ones. The major players, Ctrip, Qunar, and Fliggy, collectively dominated the market in 2016, with 68.7% of market share. Ctrip maintained a commanding lead, holding 35.7% of the market (263.6 billion yuan or US$39.5 billion), a slight decline over the year prior in terms of market share.

Qunar, however, slid dramatically after being bought out by Ctrip; in 2015 it accounted for 27.8% of the online tourism market, but dropped to only 18.2% in 2016. Minor players stepped into the gap in a big way, moving on the backs of a market shift in favor of O2O and featuring several new players which combine tourism sales with Tripadvisor-like crowd-sourced advice and reviews.

Online tourism investment overview

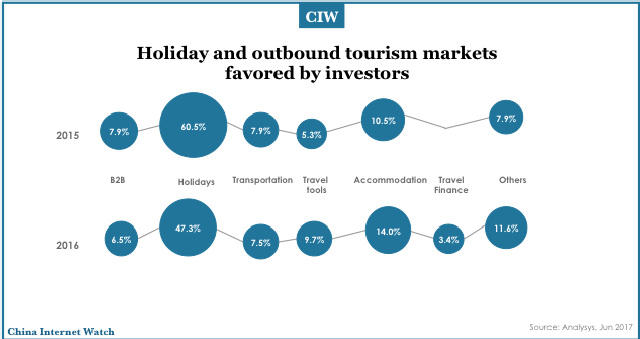

When it comes to investors, holiday and accommodation booking are still the two sectors which attract the most attention and capital. With Chinese tourism spending continuing to rise and holiday booking markets still in their infancy, there is significant room for online providers to make an impact and earn a return on investment in this sector.

Within the holiday booking industry, international travel continues to be a growth market and a driving force. While overall investment share declined significantly from 2015, holiday booking is still an under-served market and will continue to attract attention and financing going forward.

In addition, investment into travel finance is noteworthy; a new and much-watched market, with investment only appearing in 2016, it is driven by Chinese consumers’ increasing willingness to amortize major expenses beyond a home.

Online tourism markets: Sector breakdowns and analysis

Online transportation market

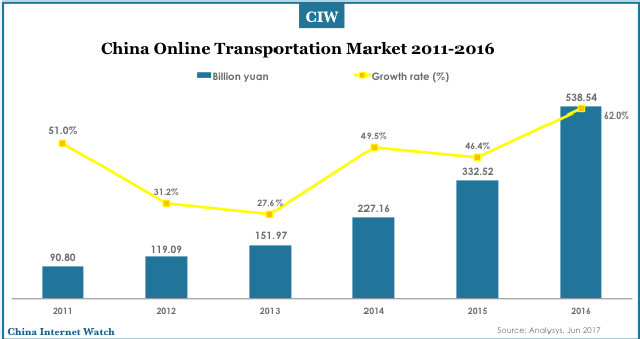

Of all sectors, transportation booking has the highest online market penetration rate, with online booking accounting for 54.6% of sector revenue. As consumers in China come to prefer independent travel over group tours, online booking has become the preferred way of buying train or plane tickets because of its convenience and economy. In 2016, the online transportation market grew by 62.0% to reach 538.5 billion yuan (US$80.7 billion).

The market share breakdown within the online transportation market mirrors the breakdown within the online tourism market as a whole, with the same three major players accounting for 69.4% of the market in 2016.

As with the overall market, Qunar has seen a dramatic fall in market share from 2015 to 2016, dropping by a whopping 12.5% to 20.5% following its purchase by Ctrip. Ctrip has maintained a commanding lead as the largest player in the market, especially with the addition of Qunar.

Minor players have stepped into the market in a big way, with sites such as Tuniu (which formerly focused on group tours and holiday packages) introducing transportation booking platforms.

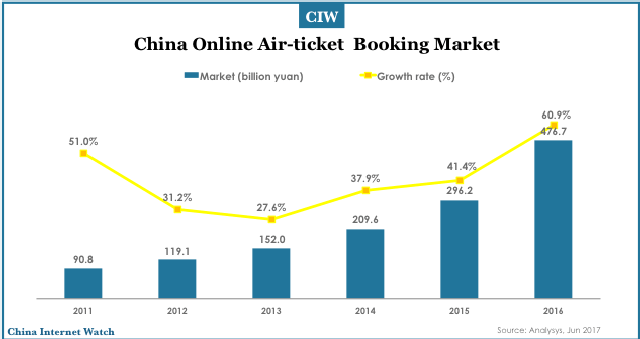

The most important component of online transportation booking, China’s online plane ticket booking market has grown in lock-step with (indeed, been the primary driving factor behind) growth in the online transportation booking market.

In total, plane tickets account for 88.5% of online transportation booking revenue, and 68.1% of all plane ticket revenue comes from online bookings. From 2015 to 2016, this market has grown by 60.9% to 476.7 billion yuan ($US 71.5 billion). By comparison, train and bus tickets are a small portion of the online transportation booking market, and online booking’s penetration into these areas is quite low.

Online accommodation market

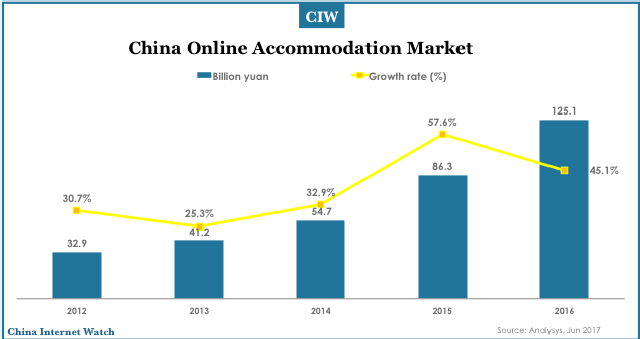

The market for online accommodation booking in China is the second largest component of the online tourism industry, with a value in 2016 of 125.1 billion yuan (US$18.75 billion), and accounting for 32.6% of the accommodation booking sector within China. This market is also growing far more quickly than the tourism market in China, but u

This market is also growing far more quickly than the tourism market in China, but unlike the online transportation booking sector, its year-on-year growth fell markedly from 2015 to 2016, from 57.6% in 2015 to 45.1% in 2016.

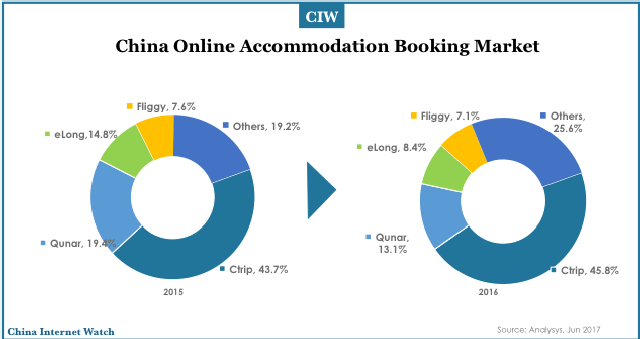

The four major players within the online accommodation booking market in China are Ctrip, Qunar, Fliggy, and eLong, which collectively account for 74.4% of the market. Qunar, as mentioned above, was acquired by Ctrip in 2016, as was eLong, meaning that that one holding company collectively controls 67.3% of the market for online accommodation booking.

Market share for both Qunar and eLong has fallen significantly from 2015 following their acquisition by Ctrip. Their market share has been eroded in part by the entry of Meituan (A Groupon analog) into the hotel booking market in a big way in recent months.

Online holiday and tour markets

The online holiday and tour booking market is simultaneously the smallest sector of the online tourism industry and the one in which online platforms have the least penetration, accounting for only 10.3% of the online tourism industry and 17.5% of holiday and tour booking.

Its comparatively small market penetration is one of the reasons that it has attracted significant attention and capital from investors in recent years, but in 2016 the sector saw markedly smaller growth (37.7%) compared to 2015 (58.2%), reaching a total revenue of 75.7 billion yuan (US$11.3 billion).

Analysis sees long-term, slow growth in the online side of the industry as it slowly increases market penetration relative to offline providers, but the industry as a whole may be falling out of favor with consumers who are increasingly interested in independent travel.

Analysts concluded that the industry may be entering a period of “deep plowing and careful cultivation” (a Chinese idiom roughly meaning “retrenchment”) in which more strategically-minded participants restructure their operations to suit changing consumer preferences and many participants are weeded out entirely.

As with the other sectors, the online holiday booking market is dominated by several major players (with a total market share of 76.5%), but excepting Ctrip none of the players are the same as in the other sectors, due to the wildly different conditions and requirements faced by the industry. Compared to 2015, market consolidation has increased; market share for the largest four players in 2015 was 68.4%.

Given the conditions faced by the market, market entrants increasingly focus on upscale tours rather than the economy group tours which were the mainstay of the industry, and the major participants are restructuring their operations accordingly.

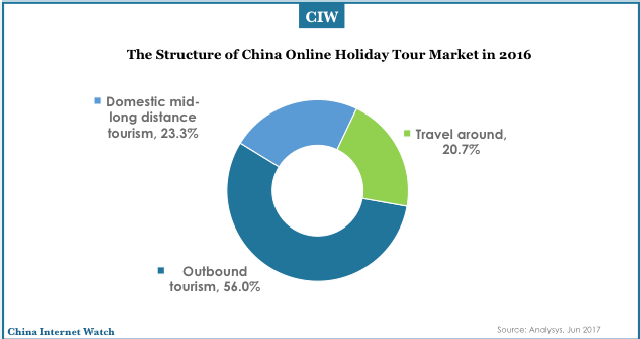

One bright spot within the online pre-packaged tour/holiday booking industry remains international tourism, which accounts for 56.0% of the market. Outbound tourism has been immune to many of the headwinds faced by the market for domestic group tours, buoyed by issues related to language, safety, and tourist visa access for Chinese traveling abroad.

However, the growth rate has slowed even for the international group travel market; Analsys analysts suggest that, as Chinese consumers become wealthier and more experienced internationally, and as foreign countries become more adapted to and comfortable with Chinese tourists, the same preference for independent travel which has already manifested itself for travel within China will come to do so for international travel as well.

]]>

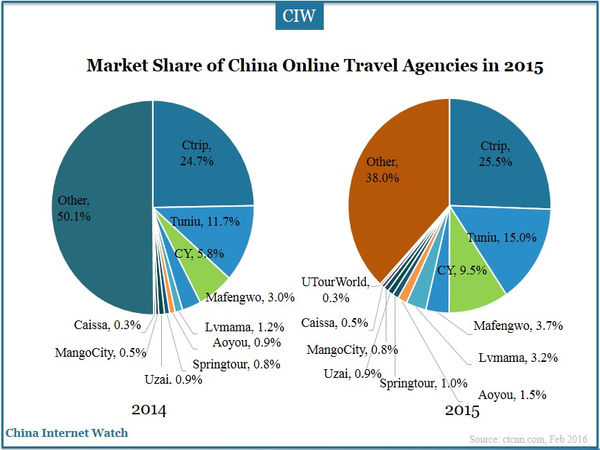

Transaction values of all Chinese travel agencies reached about 365.29 billion yuan (US$55.88 billion) and the online reached about 73.55 billion yuan (US$11.25 billion) in 2015 according to ctcnn.com.

Transaction values of Chinese travel agencies reached about 365.29 billion yuan in 2015 with an increase of 11.2% compared with 328.51 billion yuan (US$50.25 billion) in 2014. The online travel agency market reached 73.55 billion yuan with an increase of 71.4% in 2015 compared with 42.9 billion yuan in 2014.

The online penetration rate reached 20.1% with an increase of about 7 percentage points over 2014 (13.1%). Online penetration will continue to grow in 2016.

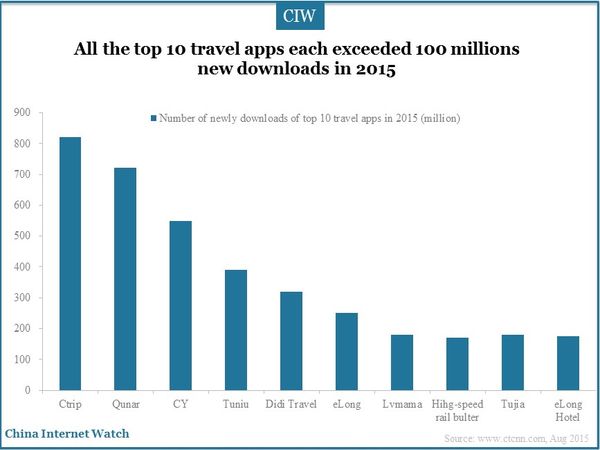

Ctrip, Tuniu, and CY were the top three largest OTAs by transaction values in 2015. The three accounted for 50% of total OTA market share. CY increased its market share in 2015 with 3.7 percentage points higher than 2014 and Tuniu increased by 3.3 percentage points compared with 2014.

]]>

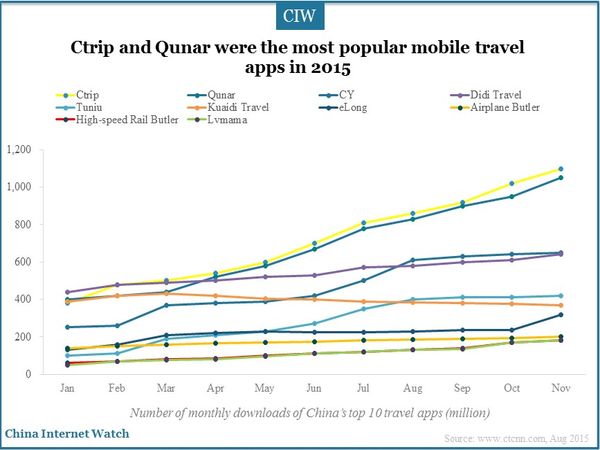

Top 10 travel mobile apps in China were Ctrip, Qunar, CY, Didi Travel, Tuniu, Kuaidi Travel, eLong, Airplane Butler, High-speed Rail Butler and Lvmama in 2015 according to www.ctcnn.com. More Chinese travelers are active on the mobile end than PC.

Moretravel products have been developed in China in 2015 including self-driving trips, budget travel, backpack travel and others according to Qunar.

Ctrip and Qunar maintained rapid growth in terms of monthly downloads in 2015. Users on mobile end increased by 400% YoY in Q3 2015. Orders on the mobile end accounted for over 60% of overall travel product orders on Double 11 shopping festival.

Qunar gained 975.5 million yuan (US$149.52 million) from the mobile app in Q3 2015 which accounted for 73.6% of overall revenues with an increase of 33.2 percentage points compared with 40.4% in Q3 2014.

Ctrip acquired Qunar in early 2015 and the two apps exceeded about 1.5 billion new downloads in 2015. Didi merged with Kuaidi in 2014 and promoted online travel services in the following year. Didi Travel app gained over 300 million new downloads in 2015.

The total number of orders from the mobile app of Tuniu accounted for more than 70% of the overall 1,668,325 trips in Q3 2015. CY had over 100 million yuan (US$56.31 million) generated on Double 11 and over 90% came from the mobile end. Lvmama accumulated about 200 million new downloads and became the tenth largest travel app in China in 2015.

Also read: China Hotel Search Behavior Overview 2015

]]>

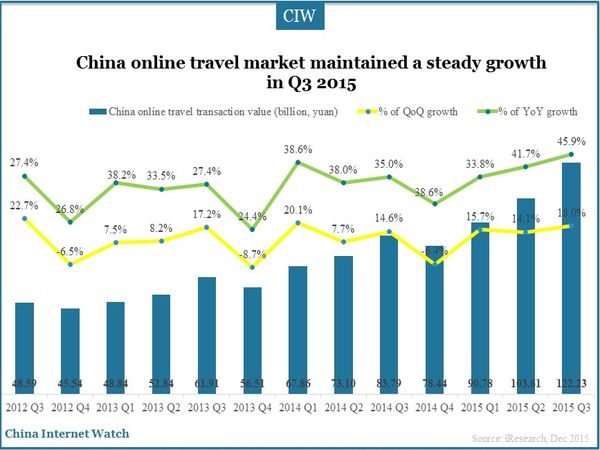

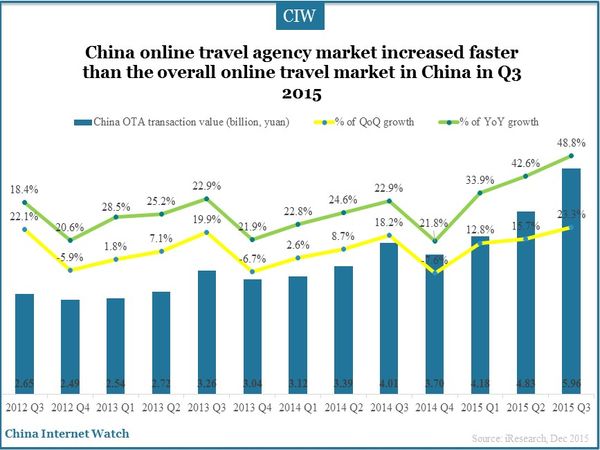

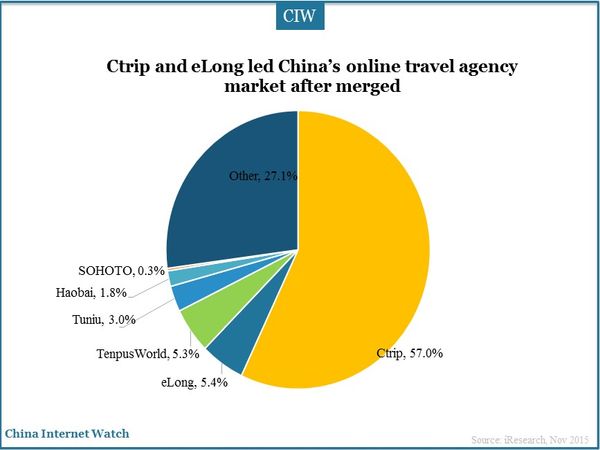

China’s online travel market reached 122.23 billion yuan (US$19.07 billion) with an increase of 18.0% QoQ and 45.9% YoY in the third quarter of 2015 according to iResearch. The OTA market in China reached 5.96 billion yuan (US$0.93 billion) in Q3 2015 with an increase of 48.8% compared to the same period last year, led by Ctrip and eLong.

Related: China Online Travel Booking Users Overview Q3 2015

China’s online travel market reached 122.23 billion yuan (US$19.07 billion) in the third quarter this year with an increase of 18.0% compared to the previous quarter of this year and 45.9% compared to the same quarter last year according to iResearch.

The growth mainly resulted from the increasing subdivision travel products such as parent-child travel, cruise travel, free and easy travel and so on. The maturing online travel market and peak travel season from September to November also drove the growth.

China OTA market reached 5.96 billion yuan (US$0.93 billion) in Q3 2015 with an increase of 48.8% compared to the same period last year. OTA ticket revenues grew by 41.7% YoY in the third quarter of 2015 compared to 31.0% in Q2 2015.

Hotel revenues of China’s OTA market grew 55.7% YoY in the third quarter this year compared to 51.1% in the previous quarter. Business holiday travel revenues increased 58.4% YoY in the third quarter this year.

China’s OTA market remained stable in Q3 2015. After the merger, Ctrip shared hotel resources with eLong and promoted the outbound train ticket booking service that they accounted for 62.4% of China’s OTA market.

Net revenues in the third quarter of 2015 of Tuniu increased by 127.5% year-over-year to US$469.4 million. The total number of trips from organized tours (excluding local tours) increased by 142.1% year-over-year and the total number of trips from self-guided tours increased by 181.8% year-over-year on Tuniu in the third quarter of 2015.

Also read: China Short-term Accommodation Market Overview 2015

]]>

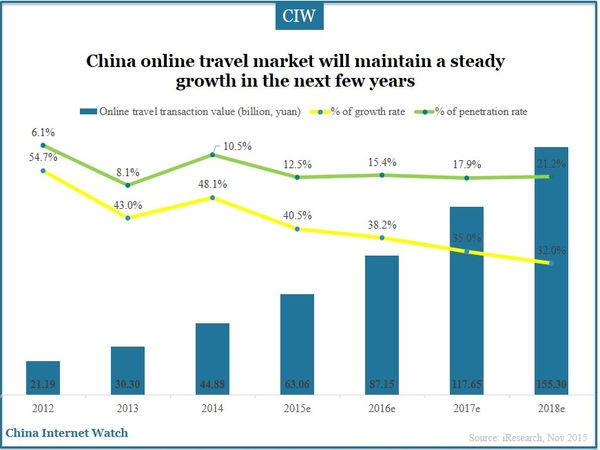

China online travel market reached 44.88 billion yuan (US$7.00 billion) an increase of 48.1% YoY in 2014. And, China’s online travel market is expected to total 63.06 billion yuan (US$9.84 billion) in 2015, an increase of 40.5% compared to the previous year estimated by iResearch.

China’s online travel market is expected to total 63.06 billion yuan (US$9.84 billion) in 2015 with an increase of 40.5% compared to the previous year. 12.5% internet users will buy travel products online. China’s online travel will maintain a steady growth rate in the next several years with an annual growth rate over 30%.

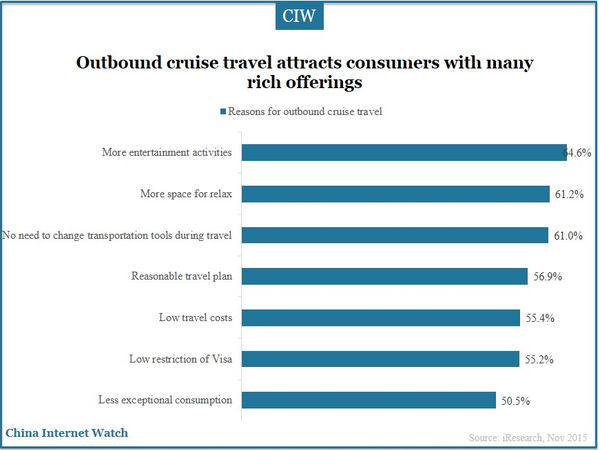

Outbound travel by cruise in China has become fashionable in large and developed cities in recent years. Compared to other outbound travel means, cruise travel could offer more activities for entertainment and relaxation, and travelers won’t need to get on and off trains or planes during trips which can save a lot of money for travelers.

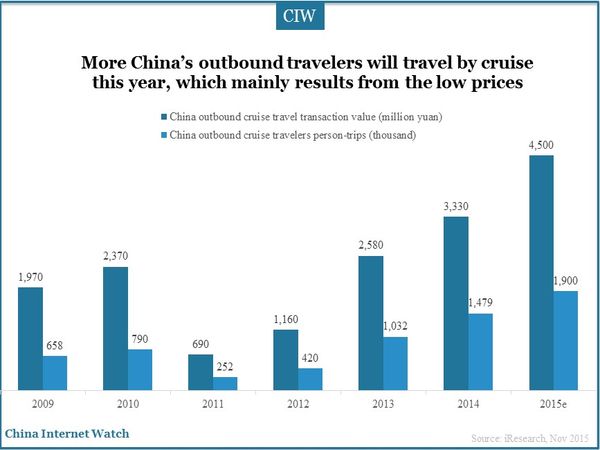

China’s outbound cruise travelers increased to 1.48 million person-trips in 2014 and the number is predicted to reach 1.9 million person-trips in 2015, gaining 4.5 billion yuan (US$0.70 billion) for China’s online travel market. More outbound travelers will travel by cruise in the future.

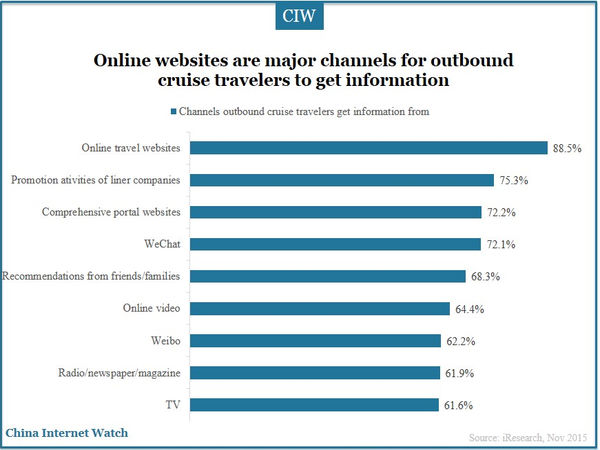

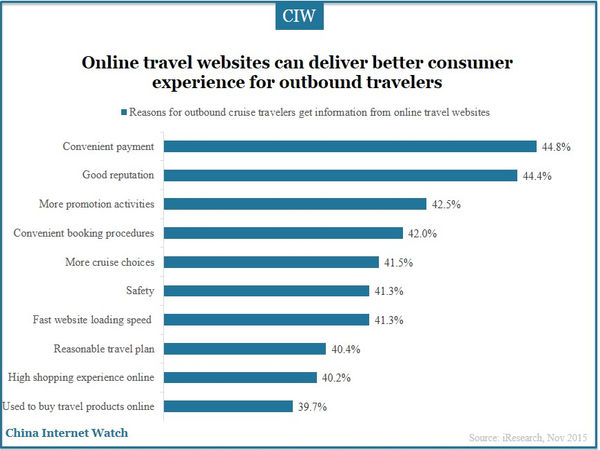

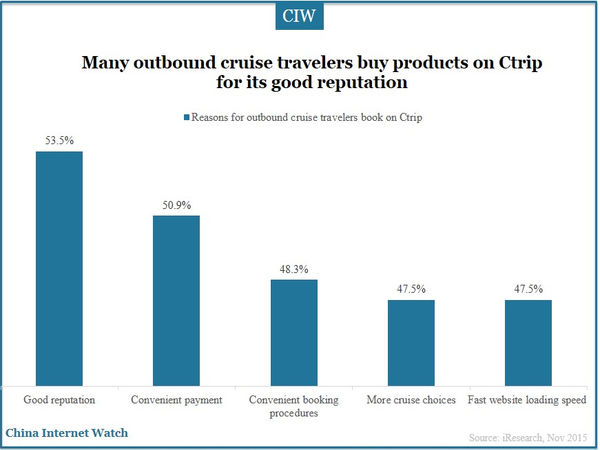

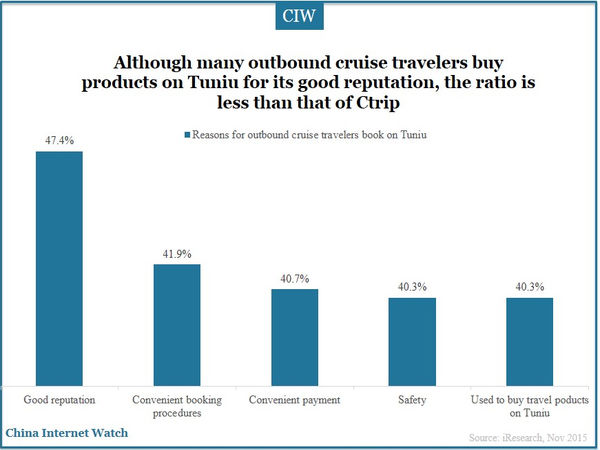

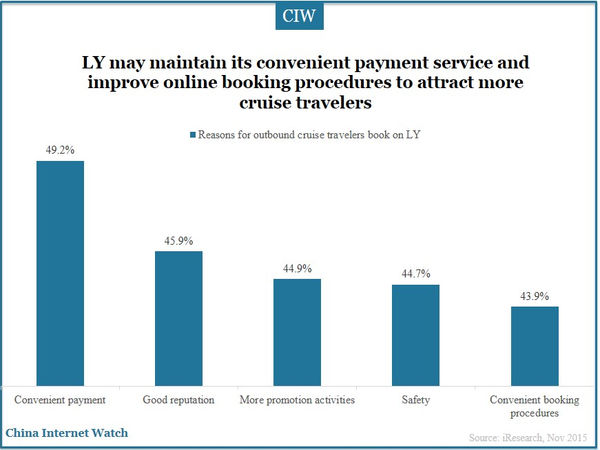

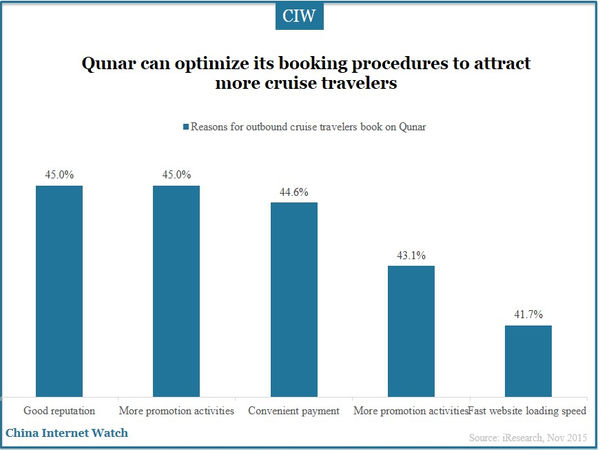

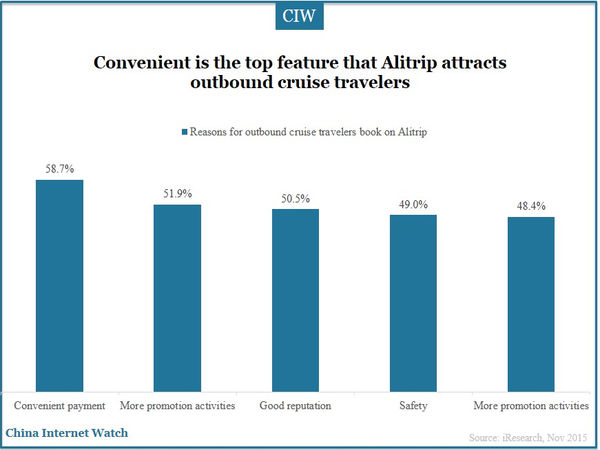

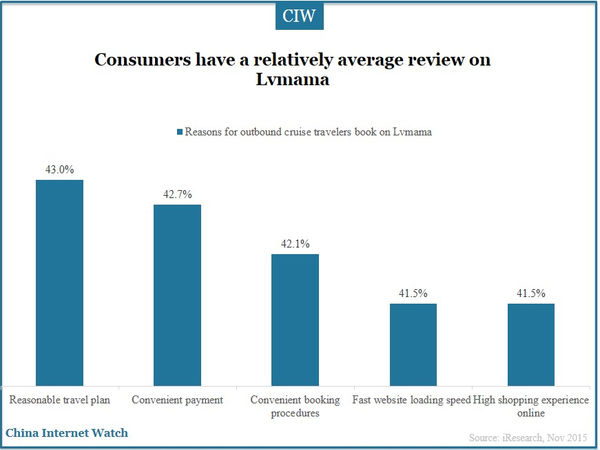

Online travel websites are the main channel for travelers to receive cruise travel information. Promotion activities of cruise travel and information on comprehensive portal websites can attract more travelers. A large number of cruise travelers will order on online travel websites mainly owing to the convenient payment, good public reputation and more promotion activities.

The online travel agencies and online travel websites have made a large contribution to China’s online travel market. Ctrip, Tuniu, LY, Lvmama, Alitrip and Qunar are major online cruise travel webites in China.

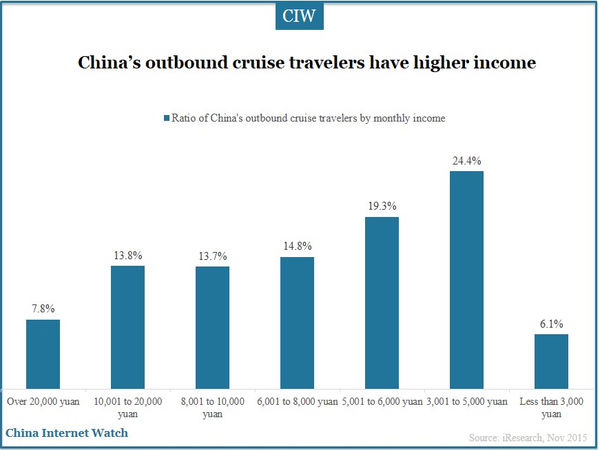

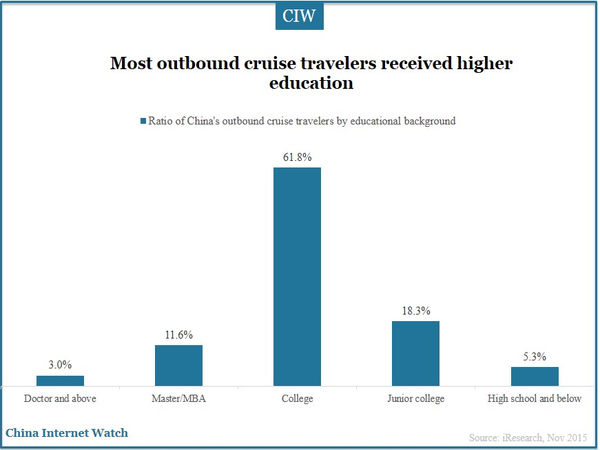

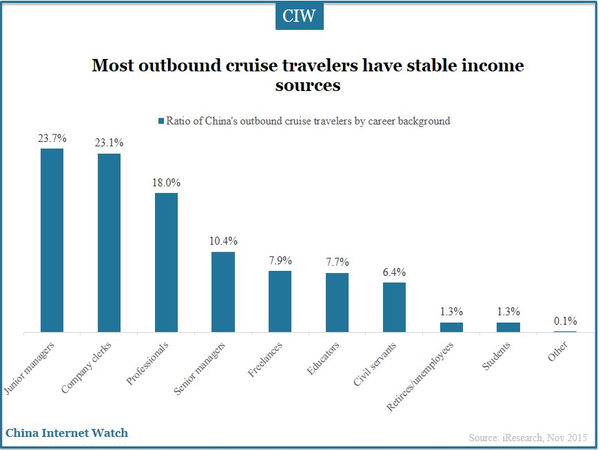

Most of China’s outbound cruise travelers are citizens in large and developed regions such as Beijing, Shanghai and Guangdong. 42.7% gain the monthly income between 3,000 (US$467.94) to 6,000 yuan (US$935.88). The majority of cruise travelers are bachelors who can soon get aware of this new travel method and willing to try it. Travelers with stable income resources account for the bulk.

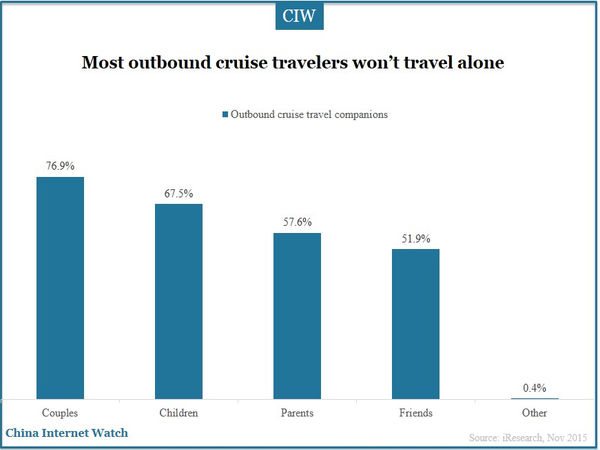

Generally speaking, outbound cruise travelers won’t travel alone which is distinct from free and easy travelers. 76.9% cruise travelers will travel with lovers, 67.5% will travel with children, 57.6% with parents, and 51.9% with friends.

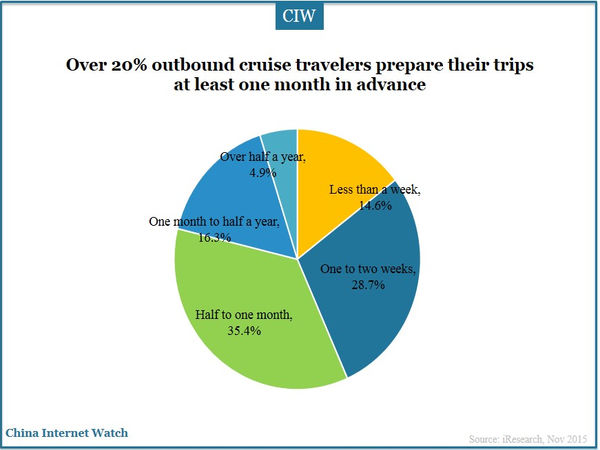

Outbound cruise travelers usually spend much time in preparing for the trips. 35.3% will prepare for travel half to one month in advance.

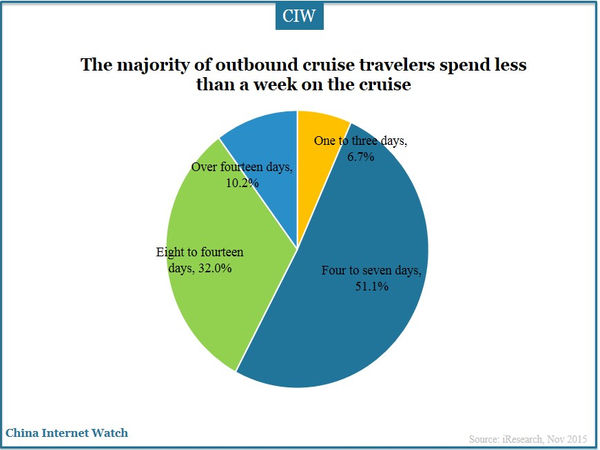

About 57.8% cruise travelers don’t spend more than one week on the cruise. 32.0% tend to spend 8 to 14 days on trips and 10.2% spend over 14 days.

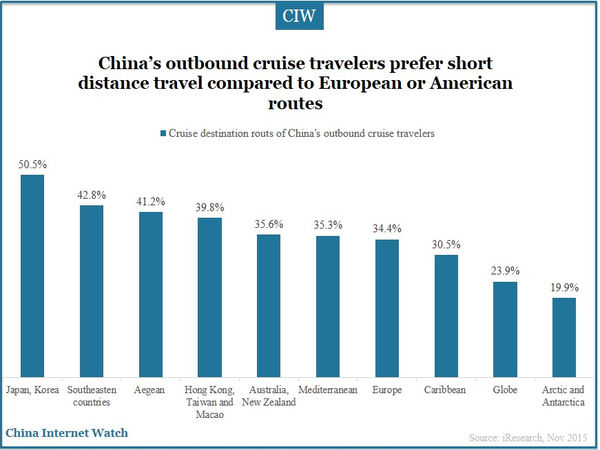

China’s outbound cruise travelers prefer short-distance journeys compared to long-distance trips. Neighboring destinations such as Japan and Korea, Southeastern countries, Aegean, Hong Kong, Taiwan and Macao have a heavy passenger flow volume.

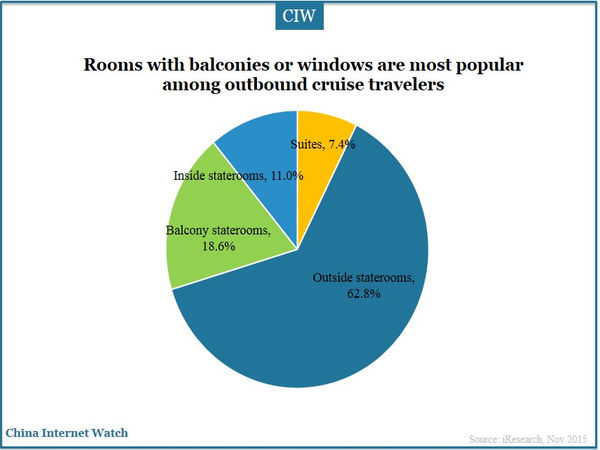

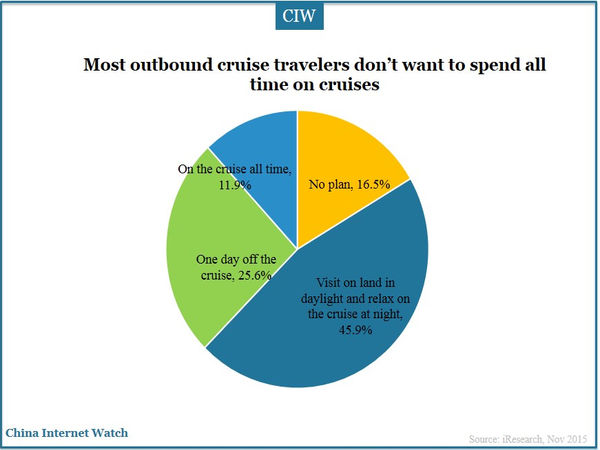

62.8% travelers like outside staterooms where they can see the sea view. The majority don’t want to spend all time on the cruise. Nearly half cruise travelers are inclined to visit on land in daylight and relax on the cruise at night.

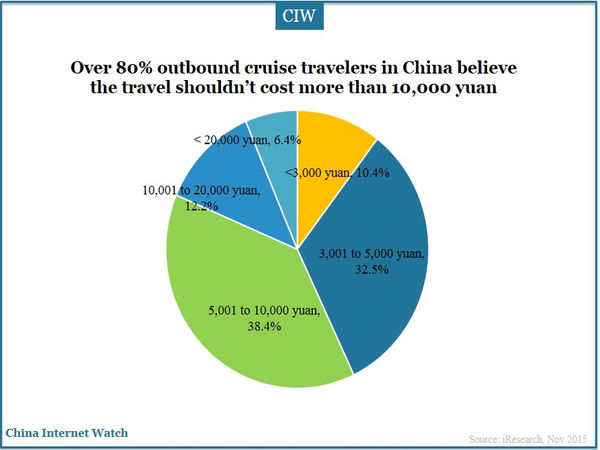

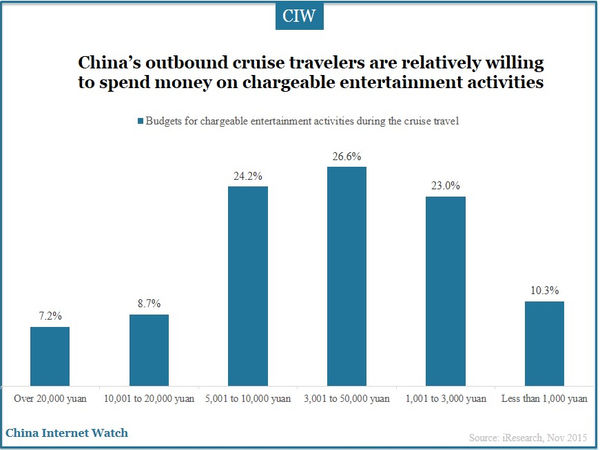

Over 80% outbound cruise travelers plan to spend less than 10,000 yuan (US$1,559.79) on the trips while about 84% are prepared to spend less than 10,000 yuan on chargeable entertainment activities during the travel.

Apart from enjoying the beautiful sea sceneries, outbound cruise travelers also would like to shop at duty-free shops, enjoy delicious foods, and land to watch local sceneries.

China’s online travel market reached 122.23 billion yuan (US$19.07 billion) with a QoQ growth of 18.0% and YoY growth of 45.9% in the third quarter of 2015, among which the online travel agencies gained 5.96 billion yuan (US$0.93 billion) according to iResearch.

A total of 109 million Chinese person-trips visited foreign countries in 2014 according to the World Urban Tourism Federation (WTCF). With the outbound travel and outbound cruise travel penetrated into more China’s users by government’s support and online travel agencies’ favor, the market in China will be further broadened.

]]>

Tuniu reported net revenues of 127.5% YoY to 3.0 billion yuan (US$469.4 million) and gross bookings of 122.2% YoY to 4.0 billion yuan (US$621.7 million) in the third quarter of 2015. By providing high-quality products and services to customers, Tuniu expects to generate 1,811.0 million yuan to 1,857.4 million yuan of net revenues which represent 95% to 100% growth year-over-year in the fourth quarter of 2015.

The number of trips sold on Tuniu increased by 110.4% to 1,668,325 in the third quarter of 2015 from 792,938 in the third quarter of 2014 including organized tours (635,555) and self-guided tours (369,719), and over 70% of orders came from mobile.

Revenues from organized tours were US$454.2 million in the third quarter of 2015, representing a year-over-year increase of 124.5%. The increase was primarily due to the rapid growth in demand for travel to certain international destinations, such as North America, Japan, Australia, Middle East, Africa and Europe, and domestic tours. Revenues from self-guided tours were US$10.5 million in the third quarter of 2015, representing a year-over-year increase of 165.8% which was promoted by the growth in travel to certain islands and domestic destinations.

Tuniu Third Quarter 2015 Highlights

- Net revenues increased by 127.5% year-over-year toUS$469.4 million in the third quarter of 2015;

- Gross bookings increased by 122.2% to US$621.7 million year-over-year in the third quarter of 2015;

- Total number of trips from organized tours (excluding local tours) increased by 142.1% year-over-year and the total number of trips from self-guided tours increased by 181.8% year-over-year in the third quarter of 2015;

- Mobile orders contributed to over 70% of total online orders in the third quarter of 2015;

- Sales and marketing expenses were US$53.2 million in the third quarter of 2015, representing a year-over-year increase of 180.0%;

- Net loss attributable to ordinary shareholders was US$68.2 million in the third quarter of 2015, compared to a net loss attributable to ordinary shareholders of US$16.16 million in the corresponding period in 2014; and

- 55 regional service centers were added in the third quarter of 2015 and Tuniu had 130 regional service centers throughout China as of September of 2015.

Also read: China Outbound Travelers Shopping Overview 2015

Source: Tuniu

]]>

The total number of China’s tourists is estimated to exceed 4.1 billion person trips in 2015, and reach a total revenue of 3840 trillion yuan (US$617.40 billion), according to China Tourism Academy.

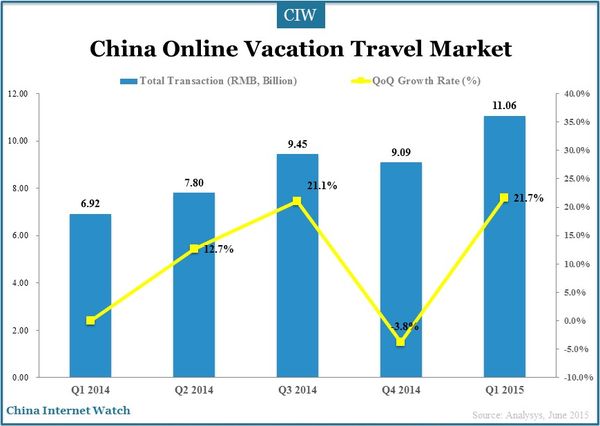

In Q1 2015, the total transaction value of China online vacation travel market reached 11.06 billion yuan (US$1.80 billion), an increase of 59.8% year-on-year and 21.7% QoQ; and the total transactions of China online travel market reached 94.76 billion yuan (US$15.28 billion) in Q1 2015, an increase of 51.3% YoY and 9.4% QoQ.

In the first half of 2015, online travel business contributed a lot in China’s travel market, and many big online travel operators received investment from enterprises domestic and abroad. Jingdong invests US$500 million funds in Tuniu; Ctrip, after acquired eLong, received US$250 million investment from Priceline, which was the largest international online travel company. And, Lvmama received 500 million yuan (US$80.39 million) strategic investment from Jin Jiang International Holdings Limited Company.

The outbound tourism also maintained a steady growth in H1 2015. The total number of outbound and inbound tourism reached 127 million, with an increase of 9.8% year over year and the number of outbound tourists reached 61.9 million visitors. Japan, the United States and some European countries were hot travel places. Most people would book tickets or flights through mobile apps. Read more about China’s tourists travel intention in 2015 here.

Under the proactive fiscal policy and relatively easy monetary conditions, tourism consumption and industrial investment would have further promotion. Travel agencies, online travel companies, and other areas of the field would have more room for development. Besides, with the penetration of China mobile travel apps and Chinese citizens’ trend to travel, 2015 is forecasted to be a fruitful year for tourism industry.

Also read: Baidu Revenues Reached US$2.67B in Q2 2015

]]>

In Q1 2015, the total transaction value of China online vacation travel market reached RMB11.06 billion (USD$1.80 billion), an increase of 59.8% year-on-year, and 21.7% QoQ according to the data of Analysys EnfoDesk.

-

Online vacation travel business extends to destination service.

In January. 2015, Ctrip released Local Play channel, Qunar set up Tourism Destination Bureau; in April, Tuniu began its online Local Play channel, and supported sighting, show tickets, wifi communication, foods, outdoors activities and others in many cities all over the world. The new measures of several major tourism companies show that destination service would be the most important part in 2015 online travel market.

-

Online vacation travel market penetrates into the upper section of industrial chain, online and offline services integrate further.

Tuniu increased its resource direct mining share to improve its supply chain, merged Zhongshan Travel and Classic Holiday Travel Agency to put forward some projects and at the same time ran its special projects to meet different needs of consumers.

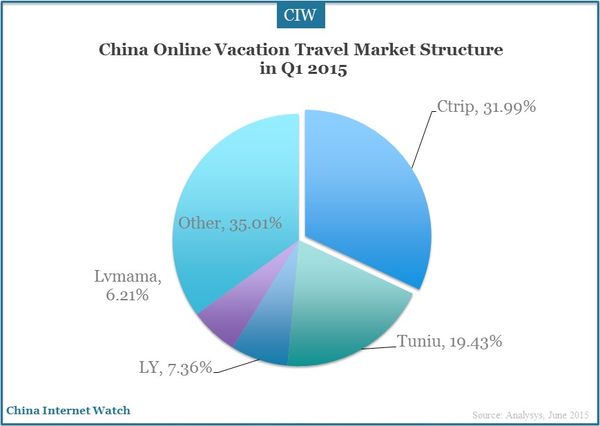

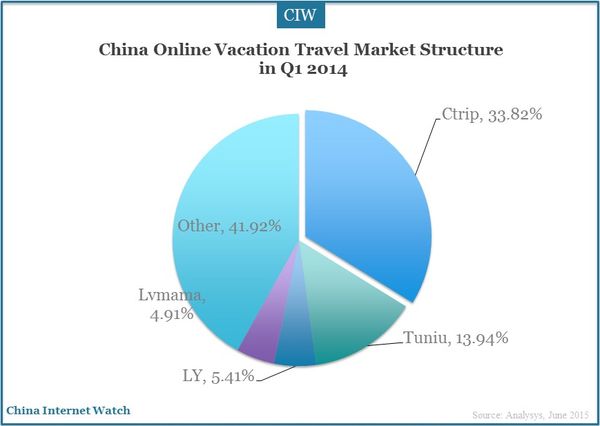

Ctrip and Tuniu accounted for 31.99% and 19.43%, far more higher than other companies. Market share of the two companies made up 51.42% in Q1 2015, 3.66% higher than that in 2014.

The transaction scale of Tuniu reached 2.15 billion RMB in Q1 2015, with 122.8% higher than Q1 2014. LY and Lvmama respectively had 0.81 and 0.69 billion RMB, with an increase of 1.95% and 1.3% compared with the same period last year.

Also read: Chinese Luxury Traveler Insights 2015

]]>

Sootoo.com estimated that the total transaction value of China online travel market would be RMB76.92 billion (US$12.52 billion) with increase of 35.2% YoY and 5.9% QoQ in Q4 2014. China’s core online travel enterprises are making attractive promotions to compete for the market share which stimulates people’s travel needs.

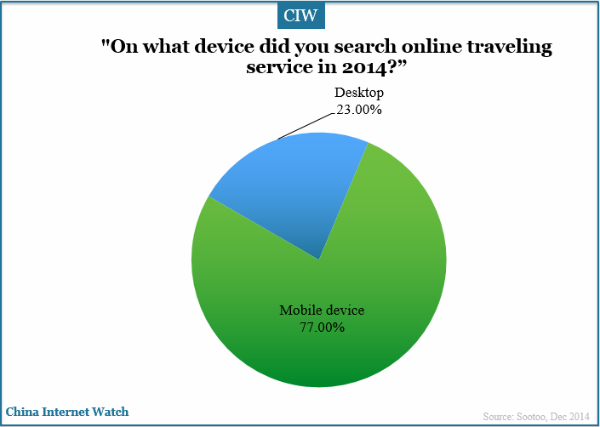

77% online travelers would search online travel service on mobile device which indicated there is great potential in mobile travel market. More and more users accept booking system for air-ticket, hotel and scenic attraction ticket on mobile device. According to Tencent’s research, 57% Chinese made travel booking online.

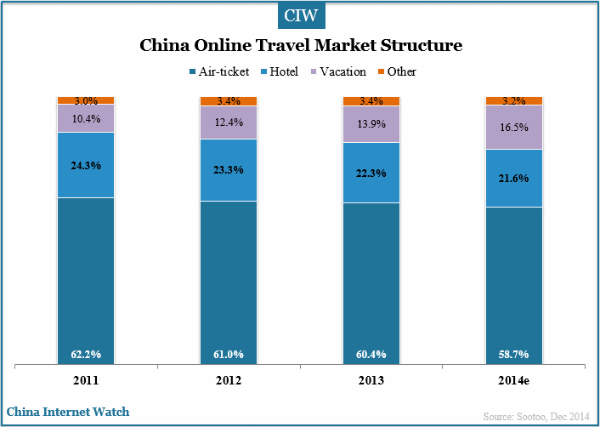

The major revenue of China online travel market is from air-ticket and the data shows the revenue had decreased by 1.7% in 2014. Revenue from hotel booking service decreased by 0.7% mainly due to fewer promotions for hotel booking. Chinese young group tend to travel as they like stimulates the need for online vacation market in 2014.

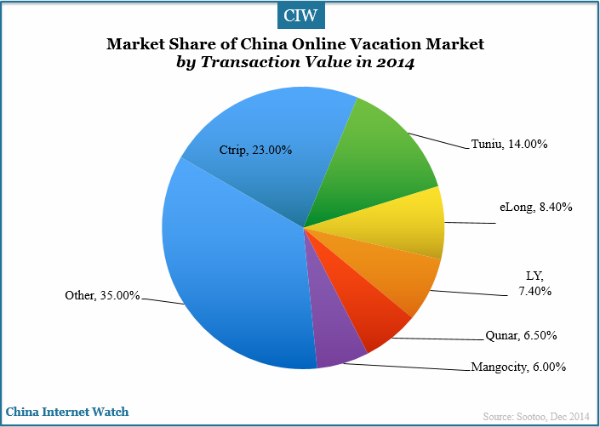

Ctrip, as one of the earliest brand in China online vacation market. represented 23% market share, ranking top, followed by Tuniu and eLong in 2014.

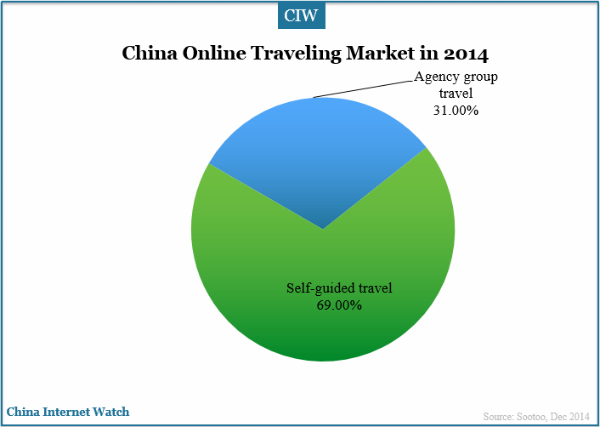

Self-guided travel accounted for 69% in China vacation market while agency group travel accounted for 31% in 2014. Agency group travel is more suitable for middle aged and the elderly while self-guided travel is now powerful in China online travel market.

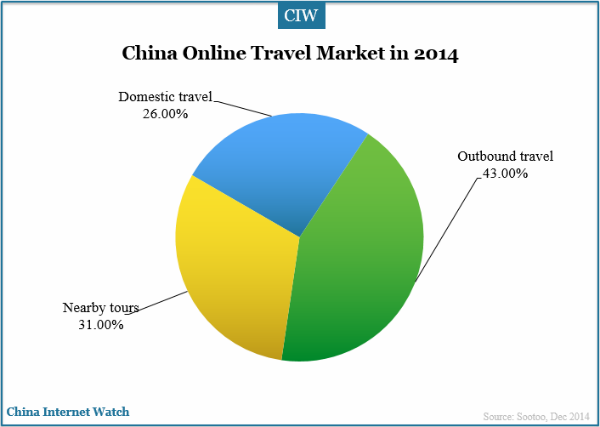

In 2014, outbound tourism was the major part in China online travel market, representing 43%, followed by nearby tour (31%) and domestic travel (26%). Nearby tour although had low consumption, its users now are growing rapidly with high consumption frequency which indicates it will gradually become the first choice to travel on weekends.

70% rural residents in China would like to go traveling and Beijing is the first choice for them according to China Tourism Industry Report in 2014 released by China Tourism Academy.

Also read: China Online Traveling UGC Users to Exceed 360M in 2015

]]>

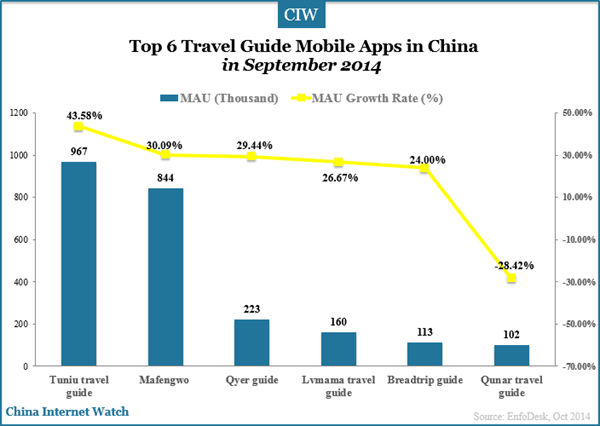

The travel guide app helps travelers make their travel plan in destinations. The top 3 travel guide mobile apps in China were Tuniu travel guide, Mafengwo, and Qyer guide in September 2014.

Tuniu travel guide app had 967 thousand monthly active users in September 2014, ranking top, followed by Mafengwo and Qyer guide app. Qunar travel guide app’s MAUs had a decrease of 28.42% according to data of EnfoDesk. While Qunar’s total revenues for Q3 2014 more than doubled YoY to US$81.6 million and its mobile revenues was US$33 million an increase of 445.1% YoY.

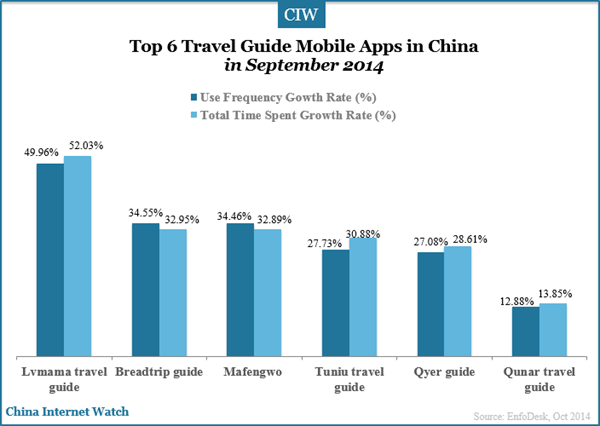

The top 6 travel guide mobile apps in China all had stable growth in use frequency and total time spent in September 2014. With China’s inbound and outbound tourism booming, the demand for travel guide mobile apps with good service will be much stronger.

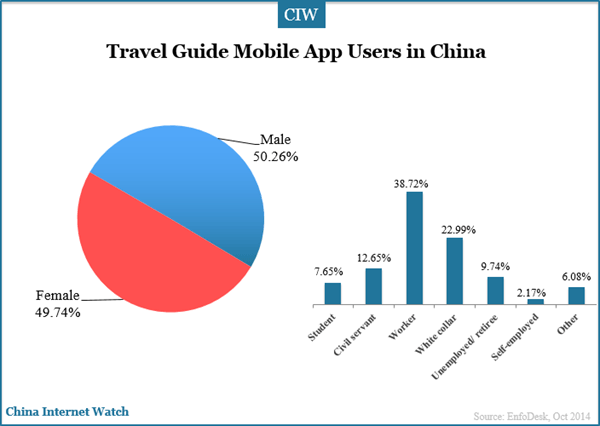

The workers in China accounted for 38.72% among the respondents in September 2014.

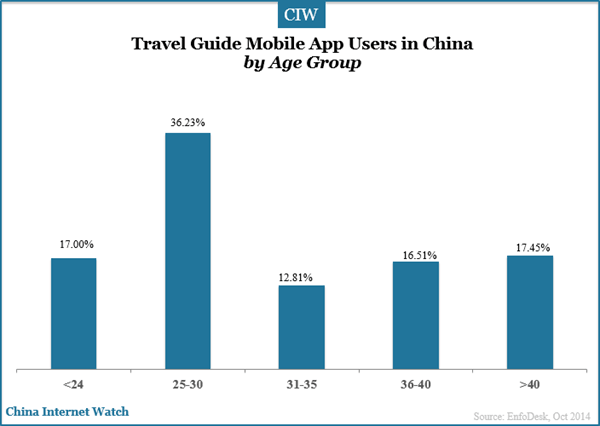

Chinese young people who were between 25 and 30 years old accounted for 36.23% of all travel guide mobile app users. These young ones tend to accept news and explore fresh things much more than the other age groups in China. Over 56% of China outbound travelers are post-80s, followed by post-70s (26.4%) and post-90s (11.3%) according to data released at Beijing Fragrant Hills Tourism Summit.

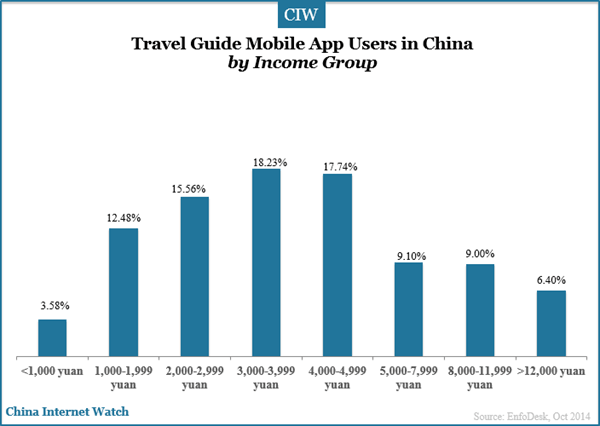

The travel guide mobile app users with income between 3,000 and 4,999 yuan accounted for 35.94%, which was the main income group in September 2014.

]]>

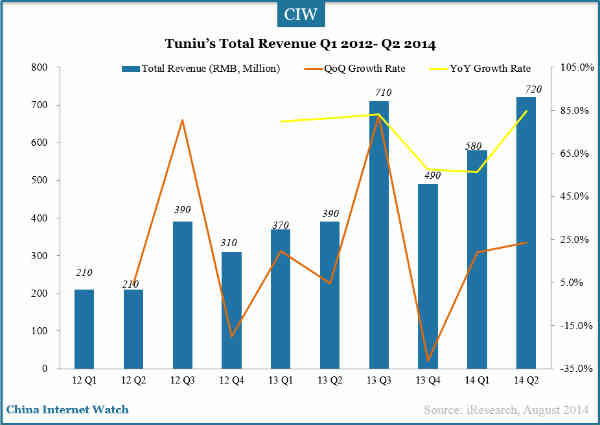

Tuniu’s net revenues in the second quarter of 2014 increased by 84.9% year-over-year to RMB716.4 million (US$115.5 million) according to its official financial results.

Tuniu is an online leisure travel company in China that offers a large selection of packaged tours, including organized and self-guided tours, as well as travel-related services for leisure travelers through its website tuniu.com and mobile platform.

Total number of trips from organized tours (excluding local tours) on Tuniu increased by 98.9% YoY and total number of trips from self-guided tours increased by 104.5% YoY in Q2 2014.

Mobile traffic contributed over 35% of total online traffic and 30% of total orders in the second quarter; like other online travel companies like Qunar and Ctrip, Tuniu captured the mobile traffic and converted them well.

However, Tuniu’s net loss in the second quarter of 2014 was RMB113.6 million (US$18.3 million), compared to a net loss of RMB7.4 million in the second quarter of 2013 according to its released financial results.

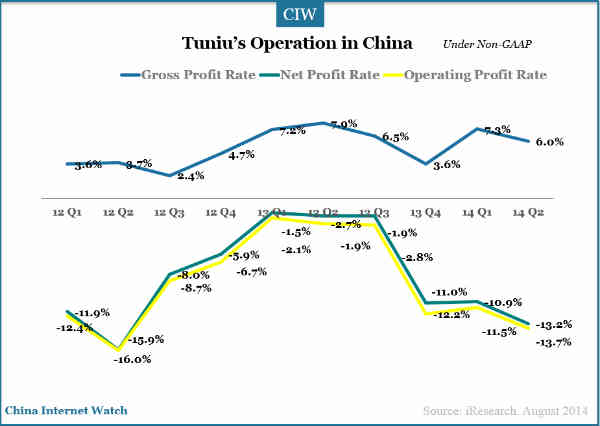

In Q2 2014, Tuniu’s net profit was RMB42.7 million ($6.9 million) with an increase of 40.1% from prior year. Its net profit rate was 6.0% with a decrease from prior quarter. iResearch believed that due to Tuniu’s radical marketing pricing strategy as well as loss on product with discounted price, its net profit rate decreased in Q2 2014.

Tuniu’s total revenue in Q2 2014 was RMB120 million ($19.5 million) with an increase of 8.4% from prior year.

Mr. Donald Yu, Tuniu’s co-founder and Chief Executive Officer, said,

After our successful IPO in May, we are capitalizing on the IPO by strengthening our leading position in terms of market share and brand recognition. Despite the short-term impact of political instability in Southeast Asia and the tragic Malaysia Airline accident, we delivered a strong top line growth of 84.9% year-over-year in the second quarter. Our wide coverage of travel destinations and the professional guidance provided by our tour advisors enabled us to better serve a growing number of Chinese leisure travelers.

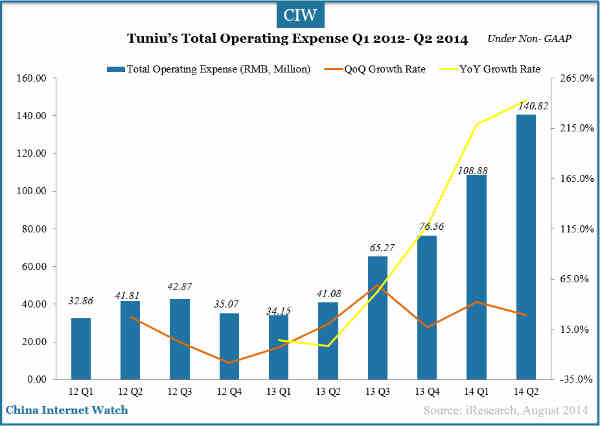

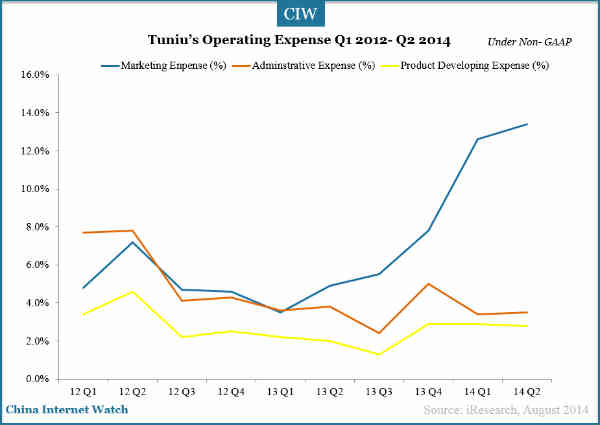

Tuniu’s total operating expense was RMB140 million ($22.8 million) with a great increase of 242.8%. Marketing expense accounted for 13.4% of the total operating expense with an increase of 399.9% from prior year. It is estimated that the growth rate of marketing expense is about 200% in Q3 2014 in China.

China Tourism Academy estimates total revenue generated from China’s travel industry is going to reach RMB 3.3 trillion (USD 530 billion) this year with 3.76 billion person trips.

Read more: Top 12 Most Interested Topics of Chinese Online Travellers

]]>