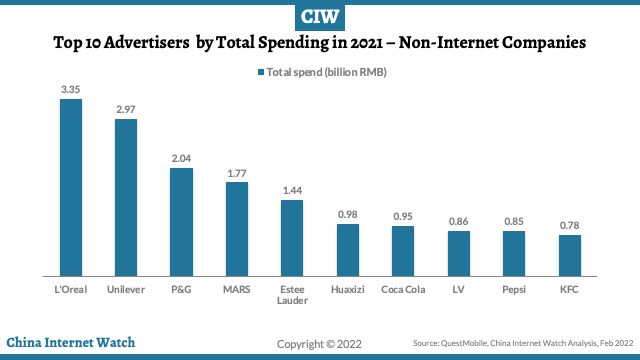

Among non-internet companies, the top three advertisers are L’Oreal, Unilever, and P&G in 2021 with a total ad spend of 3.35 billion yuan, 2.97 bn yuan, and 2.04 bn yuan respectively.

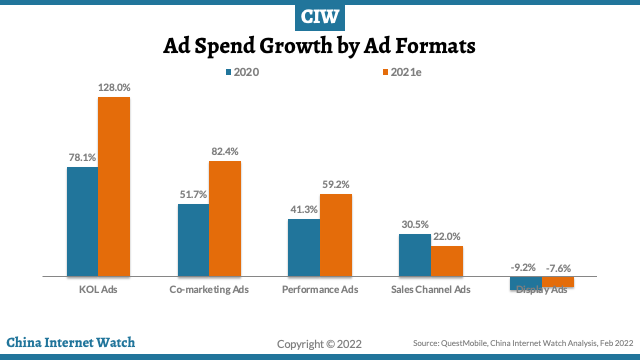

Total ad spend in display advertising decreased further in 2021 by 7.6% YoY.

Read more on China’s digital advertising insights here.

]]>

GroupM China publishes its Spring 2018 edition of This Year, Next Year: China Media Industry Forecast report, estimating that ad spending in China this year will grow 5.2% to reach 585.8 billion yuan.

GroupM China on April 25 published its Spring 2018 edition of This Year, Next Year: China Media Industry Forecast report. It forecasts that total ad spending in the Chinese market will reach 585.8 billion yuan in 2018, with growth rate rebounding to 5.2%.

This is partly due to stable upward trends in terms of macroeconomics and consumer confidence, combined with anticipated improvements in the structure of China’s economy and a rebound in the global economy, all of which will support continued growth in overall ad spending. Another key factor is that 2018 is a big year for sports marketing, drawing significant amounts of attention to TV screens and strongly guiding a flow back towards traditional live broadcasting.

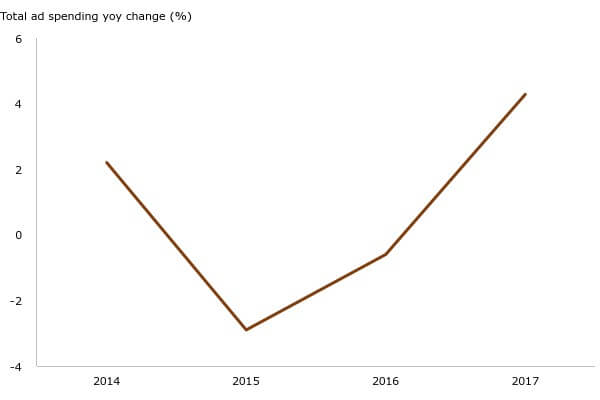

The report also estimated a 4.3% growth in total ad spending in 2017 in China. While the rate of growth in Internet ad spending had slowed down, the sector remained the main driver of growth in total.

This Year, Next Year: China Media Industry Forecast is part of GroupM’s media and marketing forecast research and uses data mainly sourced from its parent company, WPP, across various sectors including advertising, public relations, market research and communications. The report features in-depth analysis of changes in market share and placement trends for different types of media.

GroupM is Kantar’s sister company within WPP.

Traditional TV commercials will see a continued fall in overall spending, with expenditure shifting further toward content marketing and digital marketing and an increase in brand placement in variety shows and dramas. In 2018, the Olympic Winter Games in PyeongChang, FIFA World Cup in Russia and Asian Games in Jakarta will provide a shot in the arm for TV media, while the development of e-sports will create new growth points for traditional sports.

OTT (Over The Top) TV, such as smart TV sets or Internet-based TV set-top boxes, is currently attracting the attention of even more consumers and advertisers and becoming a new area of opportunity in the big-screen market.

Compared with previous years, Internet advertising spending is forecast to grow at a slightly slower rate of 13.5% in 2018, with advertising on e-commerce platforms accounting for a bigger share than any of other Internet ad formats in this category. In 2017, Internet advertising further developed in the directions of product placement, native advertising, and intelligent marketing.

Laws and regulations to deal with the burgeoning information network industry have been issued in quick succession, while news feed ads and “self-media” may also face more strict government scrutinies. As a result, advertising and marketing campaigns will need to continue to discard outdated methods and pursue innovations while complying with the relevant laws, rules, and regulations.

The out-of-home advertising market remains buoyant thanks to its advantages, such as viewability, reach, consumer proximity and low interference, and ad spending growth for this sector is forecast to remain high at 9.2%.

Backed by further developments in big data, new technology and the Internet of Things (IoT), OOH marketing can now be integrated into a variety of “things”, which could evolve into another point of entry to the IoT era, maximizing the value of integrated marketing and cross-screen linkages, which will aid the further development of programmatic buying for outdoor advertising.

Radio media stabilized after experiencing a wave of growth driven by the popularity of mobile radio and private car ownership. Developments in AI and the Internet of Vehicles (IoV) are creating opportunities for innovation in radio media. Newspapers and magazines are currently tapping their core assets, exploring new business growth points, and moving into the knowledge economy market.

Rycan Di, Chief Investment Officer at GroupM China, explained: “The media outlook is continually changing and coalescing, consumer behavior is constantly changing, and marketing campaigns are also transforming to different models and exploring methods such as content marketing and intelligent marketing in search of better audience experiences and greater effectiveness.

Patrick Xu, CEO of GroupM China and WPP China, commented: “Consumption upgrades are coming into play in many sectors in China, and as consumers place increasing emphasis on quality of life and brand experience, improving the quality and personalisation of brand marketing is also increasingly important and will be a strong driver of growth in the advertising ecosystem. However, the trend towards active development across the whole ecosystem is inextricably linked to the creation of uniform standards, improvements in measurement, and further increases in industry integrity, as well as to the combined efforts of all industry players.”

China mobile app user insights 2018

This post was originally published on Kartar.com.

]]>

Ad spending in China finally returns to black after two years in decline: the total spending expands by 4.3% from 2016.

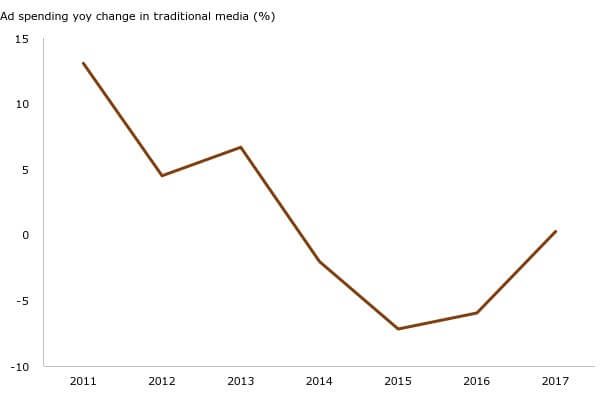

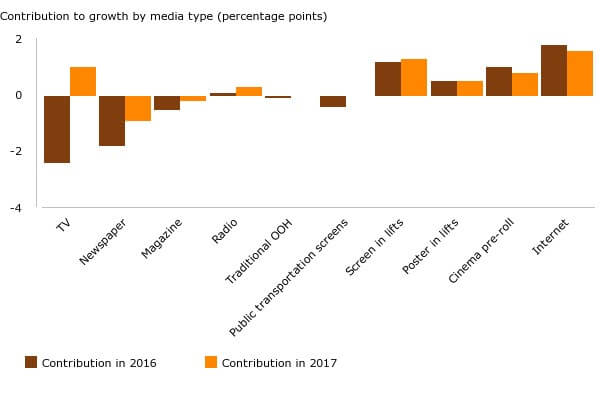

The total rate card ad spending in China in 2017 increased by 4.3% from a year ago, ending a two-year decline, according to the latest annual data from Media Intelligence, CTR. Traditional media contributed significantly to the rebound.

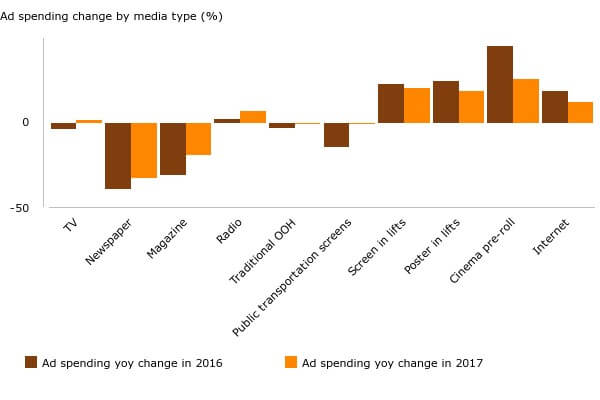

Among all traditional media formats, TV reversed its decline in 2016 (-3.7%) to grow 1.7% in 2017 and again was able to contribute to the net growth of total ad spending.

Looking into the details of TV ad spending, we can see that the nationwide air time of TV commercials was still decreasing: after shrinking by 4.4% in 2016 from the previous year, in 2017 it lost a further 4.5%. But the rate card income for TV ad spending reversed to a 1.7% growth, while it was a decrease of 3.7% in 2016.

The performance of channels under China Central TV Station outgrew all other levels of TV channels by a large margin: it grew 31.8%, while those for provincial satellite TV stations and ground stations were almost flat. The total air time of TV commercials on CCTV channels also grew significantly.

Ad spending on radio channels bottomed out after 2015. In 2017, it grew by 6.95% from a year ago. Newspapers and magazines, however, were still in steep downfall: ad spending in newspapers lost 32.5% while magazines lost 18.9%.

In emerging new media formats, the ad spending on screen in lifts and poster in lifts continued to grow stably. As the once high-flying cinema box revenue growth in China evaporated in 2017, the ad spending in cinema pre-roll ads also slowed down, but still in quite remarkable rate compared with other media formats.

From the advertisers dimension, the top 20 biggest ad buying companies accounted for 20.6% of all ad spending. Among them, P&G continued to rank No.1 even though its spending was down by 18.4%. Hongmao Pharmaceutical Co Ltd, which boosted its spending by 51.3%, ranked second. Coca Cola also increased its ad spending by 27.3% to rank third. Find out more here.

China short-video platform users overview Q3 2017; MAU reached 244M

This article was originally published on Kantar.com

]]>

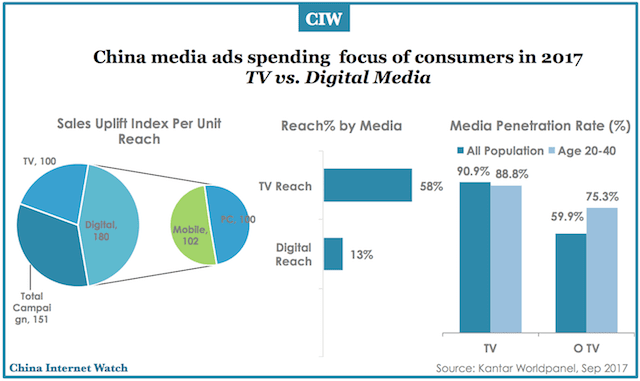

For the first time in history, digital ad spends surpassed TV in 2016 and accounted for half of total media budget according to “This Year, Next Year: China Media Forecasts” by GroupM. It also forecasted that the digital spend would be increased to 57.2% of the total ad spend in China in 2017, and TV commercials dropped by 5.2%.

As the penetration of smartphone keeps going up, Kantar Worldpanel believes that mobile as a medium will become the first choice to catch the consumers’ eyeballs very soon. CTR Advertiser Survey in 2017 also indicated that the mobile budget allocation increased dramatically from 7% in 2015 to 23% in 2017 thus narrowing the gap with TV rapidly.

If the advertisers did not invest in digital media, they would miss a full 13% of the consumers based on the case studies of Kantar Worldpanel from 2015 to 2017. But if they dropped TV altogether, they would have missed as much as 58% of the consumers.

Even for the brands targeting young consumers, halo effect can still be strong resulting from the multi-media investment. The advertisers can reach 75.3% of the young target audience (aged 20-40) by using pre-roll of online video, but they can cover 88.8% of the same target by using traditional TV, 13.5% higher than online video.

The starting point is connecting the consumers’ ad exposure across media with their total channel purchase behavior, then evaluate and quantify the sales impact from media investment, so that the advertisers can optimize the media mix based on the quality of sales conversion.

For example, if an advertiser has invested 10 million yuan for a campaign, Kantar Worldpanel can effectively quantify the brand sales benefited solely from its investment on top of baseline sales. After quantifying the brand sales uplift, Kantar Worldpanel can further differentiate the return on investment by different media type including TV and digital. Kantar Worldpanel then can conclude how the advertiser should optimize the media budget allocation according to different media efficiency level in driving sales. Furthermore, with the in-depth understanding of those consumers, we can bring consumer insights into the brand sales uplift analysis to understand which consumer groups were influenced more by the campaign.

The next questions can be what the optimal times of exposure for driving sales, whether program sponsorship works, what role social media should play, and so on. Please contact us for the answers.

The article was originally published on Kantar.com.

]]>

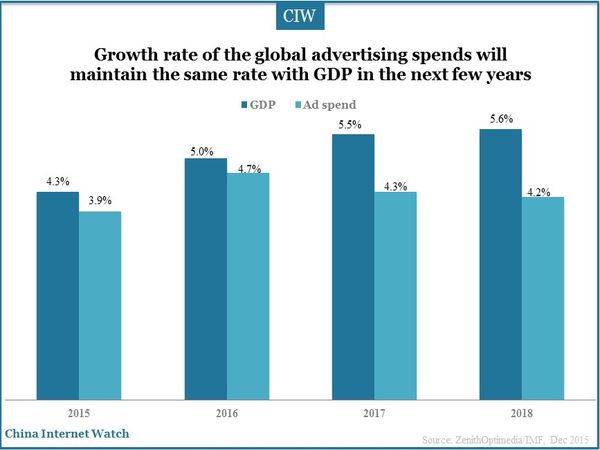

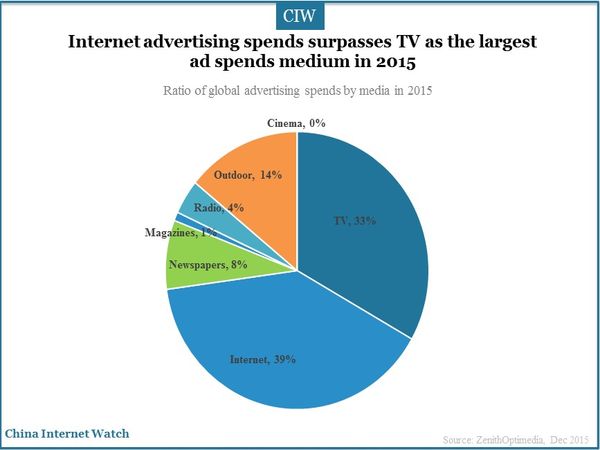

Global advertising spends will reach US$579 billion with an increase by 4.7% by the end of 2016 according to ZenithOptimedia. The global advertising market has maintained a steady growth of 4% to 5% since 2011.

Growth rate of the global advertising spends will maintain the same of about 4% to 5% in the next few years.

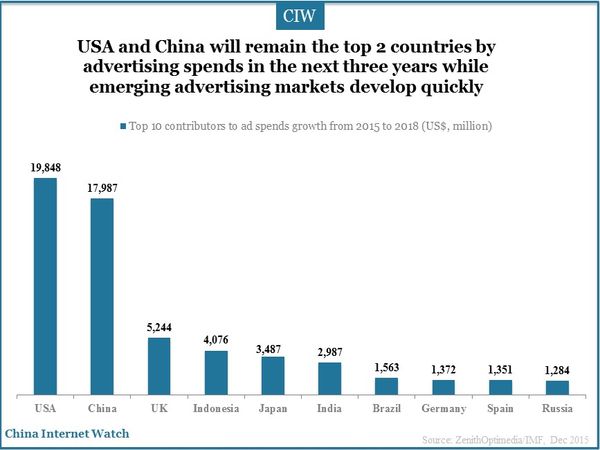

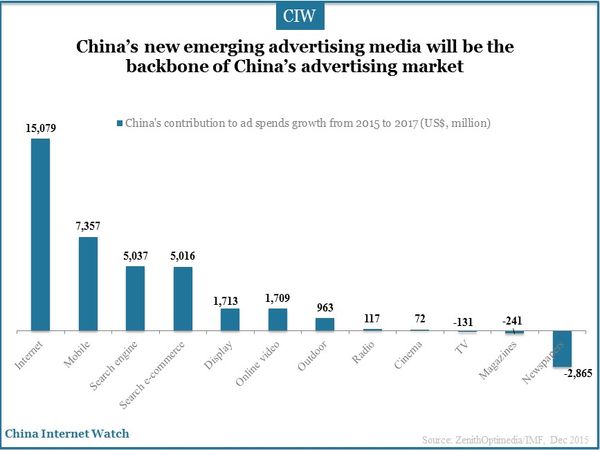

USA and China will remain the top 2 contributors to the total global advertising spends in the next three years while emerging advertising markets develop quickly. The global advertising market will grow by US$77 billion from 2015 to 2018. The United States will account for 26%, followed by China (24%), UK (7%), and Indonesia (5%).

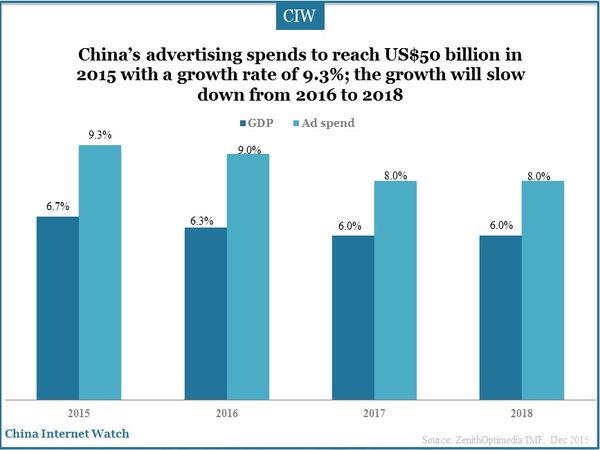

China will be one of the main driving forces of global advertising spends. China’s advertising spends were expected to reach US$50 billion in 2015 with a growth rate of 9.3%. The growth will slow down from 2016 to 2018 while is still much higher than the average global growth rate. By 2015, China’s GDP would reach US$11 trillion among which advertising spends were US$50 billion accounting for 5%.

China’s online ad spends have been rapidly growing over the past five years and it accounted for 36% of total ad spend in 2015. Total online ad spends would reach US$20 billion exceeding the estimated US$16 billion in TV ad spends in 2015. The growth rate of TV advertising will be less than 1% in the next three years predicted by ZenithOptimedia.

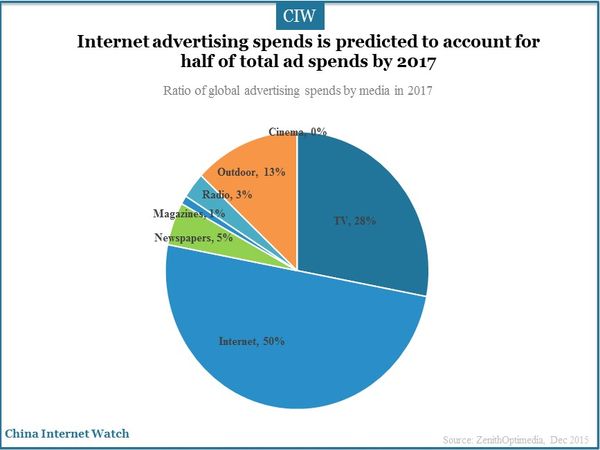

Online advertising spends in China is predicted to account for half of total ad spends by 2017 and TV will still be a major contributor which account for 28%.

Mobile advertising as China’s new emerging advertising media will be the backbone of China’s advertising market. Mobile advertising increased by 118% in 2015 compared with the previous year and will account for 31% of total digital ad spends by 2017. Online video and search e-commerce will increase quickly in the next few years according to ZenithOptimedia.

Online video advertising, the fastest-growing category of internet advertising spends, is expected to increase at an annual growth rate of 35% by 2017. More and more advertisers have regarded online video advertising as the first choice for reaching consumers, especially in some industries with high TV ad spends or high penetration of online video.

Search e-commerce will increase with an average annual growth rate of 33% by 2017, which is primarily driven by the continuous innovation of large online retailers such as Alibaba and Jingdong. Taobao and Tmall gained revenues of 122.937 billion yuan (US$19.34 billion) on Double 11 2015, and 70% from the mobile devices. With the development of China’s e-commerce platforms, e-commerce search spends will grow rapidly.

Ad spend on print media will continue to drop to 21% on newspaper and 12% on magazines in 2017.

Also read: China Overall Advertising Insights Q3 2015

]]>

China will remain the world’s largest advertising market in 2016 according to This Year, Next Year report by GroupM. GroupM predicts the growth rate of China’s advertising market will decline from predicted 8.7% to 7.8% this year and will drop slightly from predicted 9.6% to 9.1% in 2016.

Global ad spends will grow by 3.4% to US$17 billion this year and increase to US$22 billion at an annual growth rate of 4.5%, both lower compared to data released this year earlier (4.0% in 2015 and 4.8% in 2016).

Brazil, Russia, China and India are expected to account for 23% of global advertising spends in 2016. This ratio has been increasing steadily since 2000 and is expected to increase one percentage point every year till 2020.

The growth rate of Indian advertising market will be predicted to increase by 2 percentage points to 15% in 2016. Ad spends in Russia will be 2% growth next year after experiencing a short-time sharp recession in 2015. Brazil will decline by 2 percentage points to 7% in ad appends in 2016 as continuous shrinking in the unemployment and household expenditure.

The Euro region accounts for only 11% of total global advertising spends currently. French advertising spends are expected to maintain zero growth in 2016. Ad spends growth rates in Germany and Italy are expected to increase by only 1% to 2%. The United Kingdom has become the world’s mature advertising market with the fastest growth rate and is expected to be the third largest contributor to the global advertising market.

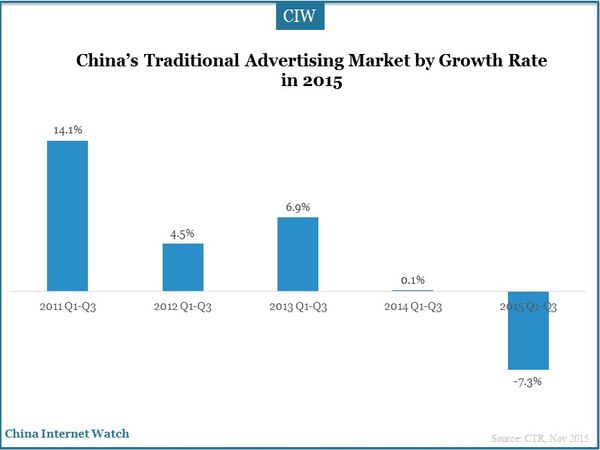

China’s traditional advertising spends have declined in recent years by and large while it declined 7.3% as of 30 September this year out of expectation. In terms of media types, the advertising budget tends to shift to digital media.

Digital global advertising spends is expected to grow by 14% in 2016, accounting for 31% of global advertising spends as GroupM predicted. Digital ad spending growth will slow down next year compared to forecasting 17% growth rate in 2015, however, it will still maintain a strong growth momentum.

Also read: China Social Media Marketing Trends in 2015

]]>

Advertising spend can reflect changes in the economic structure of China. Real estate ad spends decreased by 26.2% year on year and fell down to 28.6% in the first three-quarters this year compared to the same period last year according to CTR.

Related: China social media trend 2015

Following Chinese government’s promotion of “internet plus” strategy, online advertising market in China reached a growth rate of 94.7% as of 30 September this year. Taobao invested 1.3 times more in advertising from January to September 2015 compared to the same period last year, Suning 1.1 times, and Vipshop even 10 times.

China’s traditional advertising spends have declined in recent years by and large while it declined 7.3% as of 30 September this year out of expectation. The traditional advertising market in the third quarter decreased 10.1% compared to the previous quarter which reached a record low.

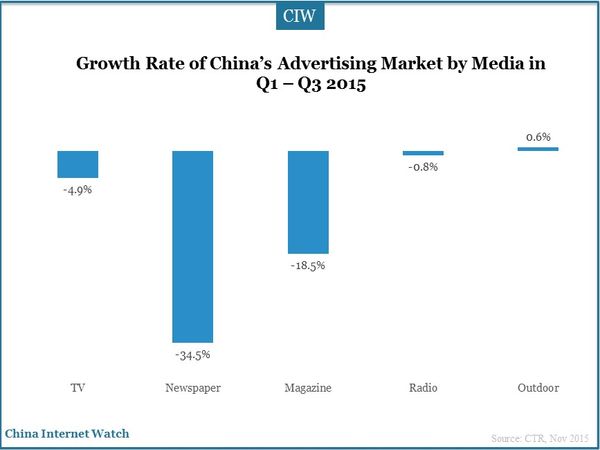

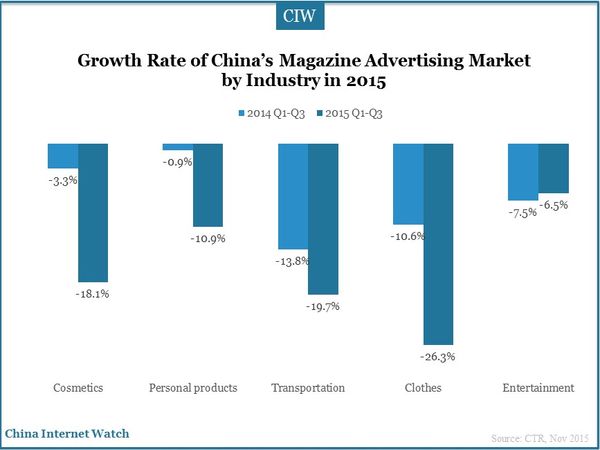

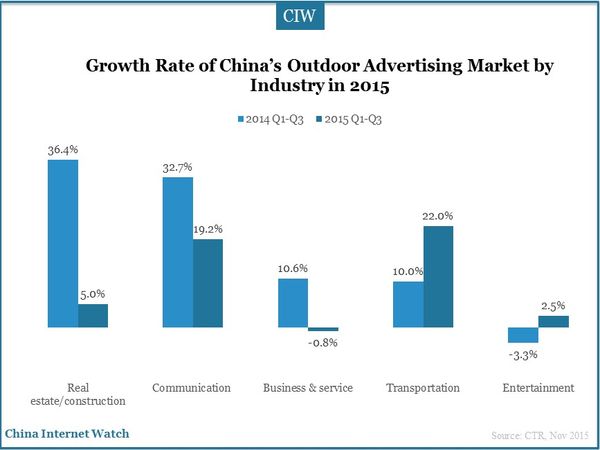

Print media newspaper and magazines advertising spends in this industry also decreased sharply with a growth rate of -34.5% and -18.5% respectively as of Q3 2015 compared to the same period last year. Advertising spend on TV and radio also declined while only the outdoor increased by 0.6%.

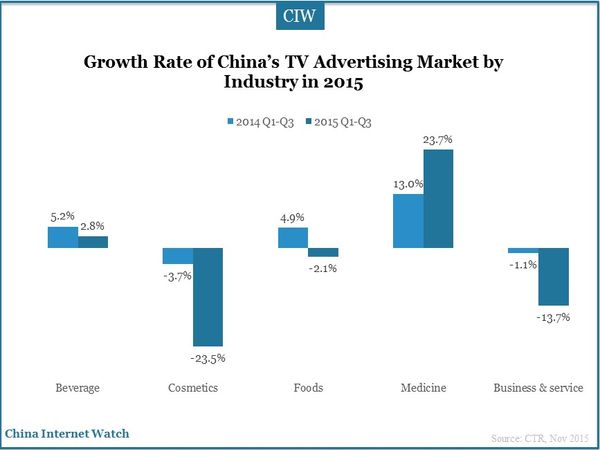

Beverage, cosmetics, foods, medicine, and business and service focused on TV advertising in the first three-quarter this year. However, the overall spends on TV advertising declined compared to the same period last year. Cosmetics decreased by 23.5% and business and service dropped by 13.7%. Medicine increased by 23.7% on TV advertising revenues.

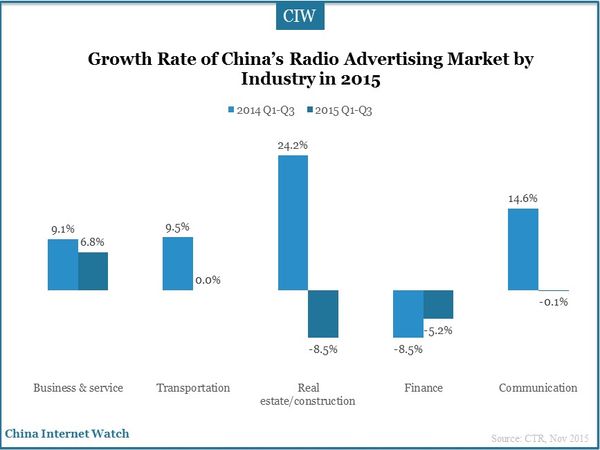

Similarly with TV advertising, the overall radio advertising market also declined, among which real estate industry spend decreased by 8.5% in the first three-quarters of 2015 compared to spends in the same period last year.

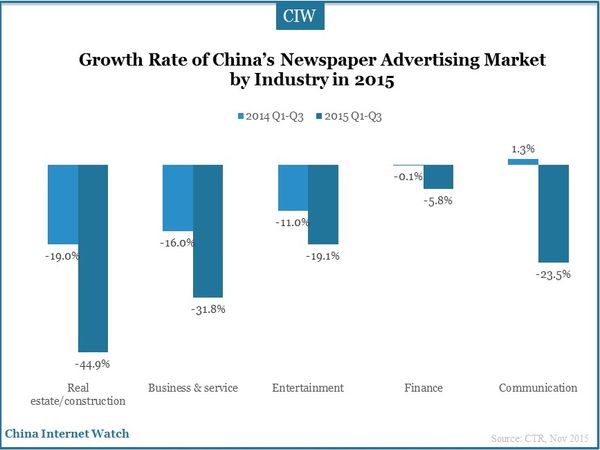

Newspaper and magazine advertising has suffered a great hit. Even among the top 5 advertising sectors, advertising spends decreased to a large extent this year compared to the same period last year.

Compared to the large advertising revenues on the outdoor last year, the real estate industry was more prudent with only 5% increase in advertising in the first three-quarters this year. In general, the outdoor advertising market maintained a relatively good momentum this year.

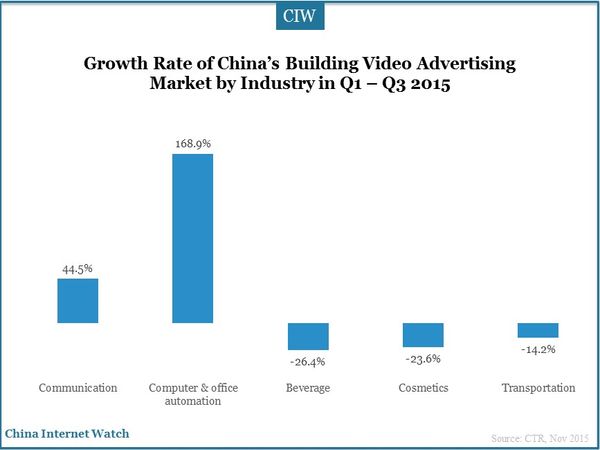

Building video advertising, which mainly referred to the advertising on large LCD screens outside the building and on the TV inside the elevators, increased by 15.2% in revenues this year compared to the same period last year. Beverage, cosmetics and transportation industry declined in advertising spend while telecommunication and computer increased dramatically.

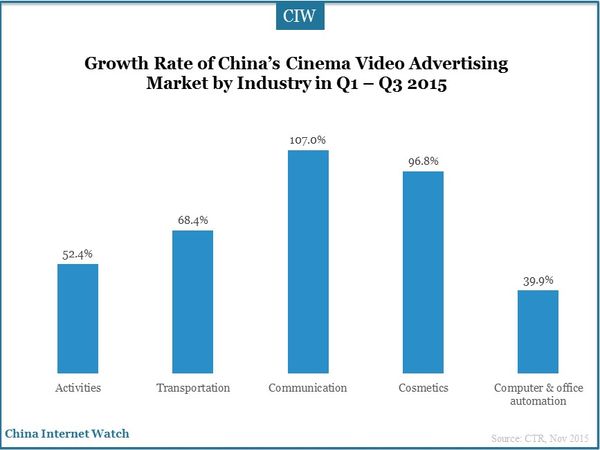

Chinese tended to spend more money on entertainment thus cinema video advertising gained the attention of the entrepreneurs. The overall cinema video advertising market grew by 56.2% among which the telecommunication industry increased by 107% YoY in the first three-quarters this year.

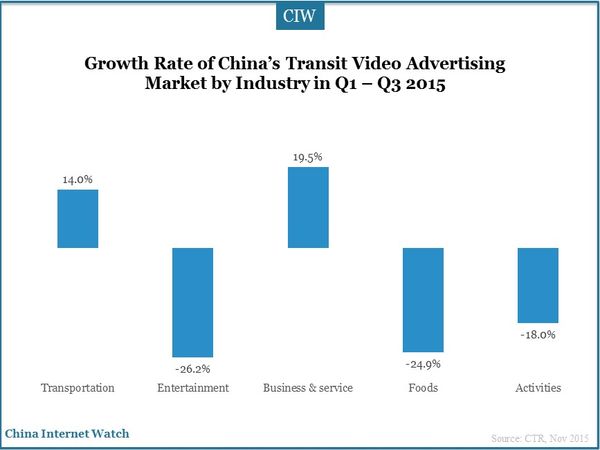

Video advertising on buses, trains, subways and such increased by 8.9% as of 30 September this year. With transit advertising costs increasing, some sectors reduced spend such as as entertainment, foods and events. In contrast, business and service sector sspent 19.5% more on transit video advertising in the first three-quarters this year.

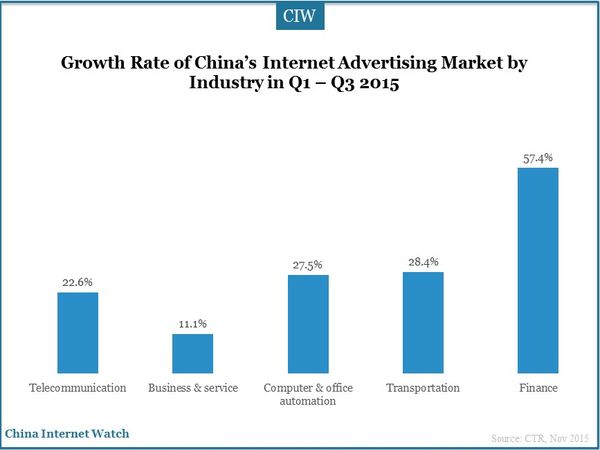

Online advertising market gained a wide-range blossom with a growth rate of 94.7%. Finance industry with a growth rate of 57.4% YoY was the fifth-largest online advertising sector and the telecommunications was the largest. Jingdong, Taobao, Mogujie, Suning, Kaola and other e-commerce companies have invested heavily on online advertising.

Also read: China Advertising Insights 2015

]]>

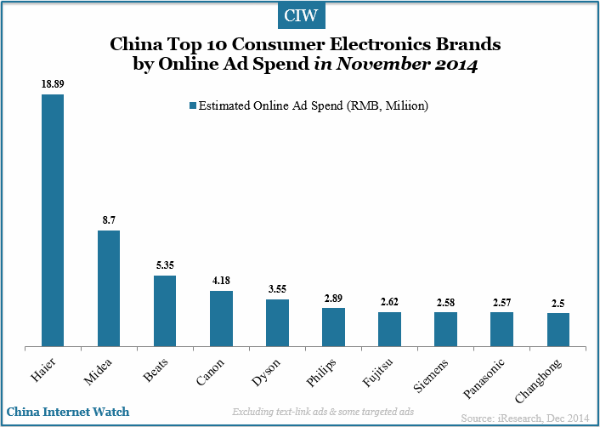

In Nov 2014, total online advertising spend of consumer electronic brands exceeded RMB100 million (US$16.28 million) in China.

Among all the consumer electronic brands, Haier spent RMB18.89 million ($3.07 million) on online advertising in November, ranking first, followed by Midea and Beats according to data from iResearch.

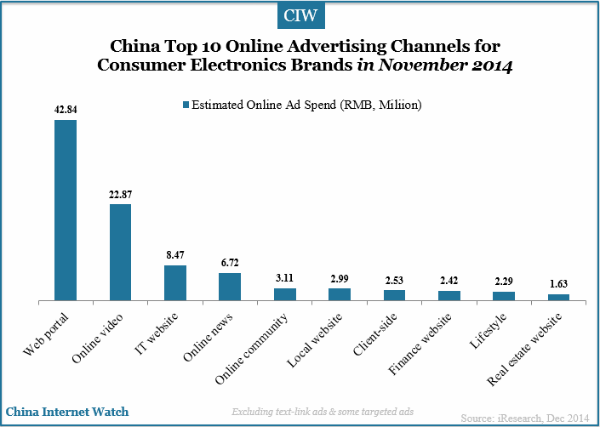

Web portal, online video platforms, and IT website are the top three ad placement channels for consumer electronic companies in China in November 2014. The advertising spend on web portal exceeded RMB42.84 million (US$6.97 million), accounting for 41% of the total spend, followed by online video (21.9%) and IT website (8.1%).

Also read: Kantar: Chinese Consumer Goods Companies Take Share from Foreign Companies

]]>

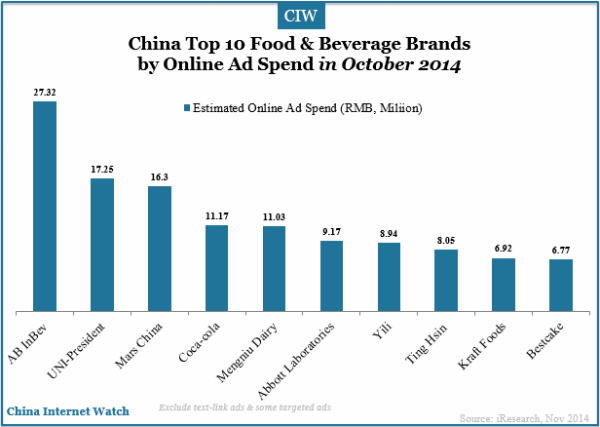

In October 2014, total online advertising spend of food and beverage brands exceeded RMB270 million (US$43.98 million) in China.

Among all the food and beverage brands, AB InBev spent RMB27.32 million ($4.45 million) on online advertising in October 2014, ranking first, followed by UNI-President and Mars China according to data from iResearch.

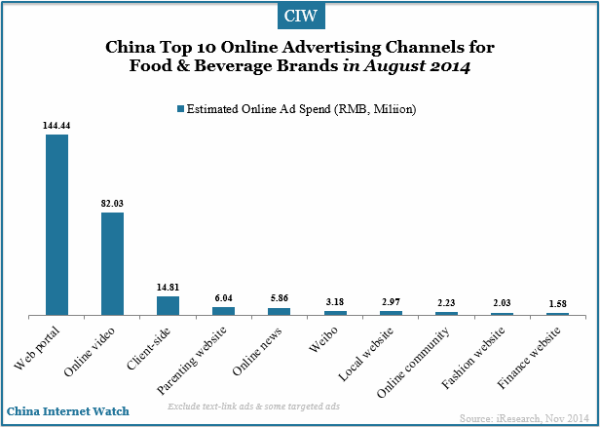

Web portal, online video platforms, and client-side are the top three ad placement channels for food and beverage companies in China in October 2014. The advertising spend on web portal exceeded RMB144.44 million (US$23.52 million), accounting for 53.2% of the total spend, followed by online video (30.2%) and client-side (5.4%).

Also read: Top Brands in China in 2014

]]>

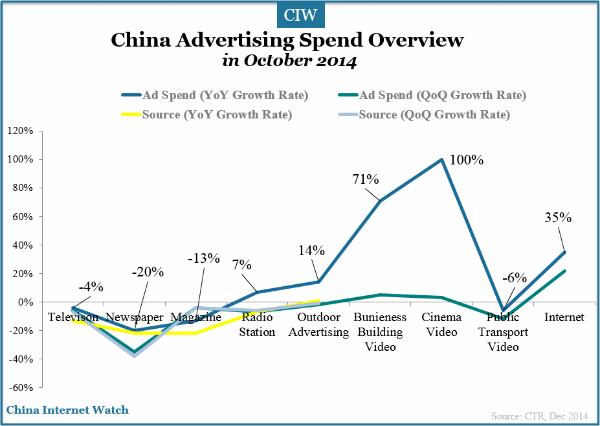

In October 2014, China overall advertising market had an increase of 2.5% from the same period of prior year; and, ads spend on traditional media had a decrease of 4.4% YoY according to data of CTR.

The growth of advertising spend on radio station slowed from September 2014 and in October; it increased by 7% YoY in China. Among top 5 industries by ads spend in October in China, ads spend on finance decreased by 17%, while business & service industry, real estate & construction industry and transport increased by 9%, 6% and 23% respectively from the same period of prior year in October.

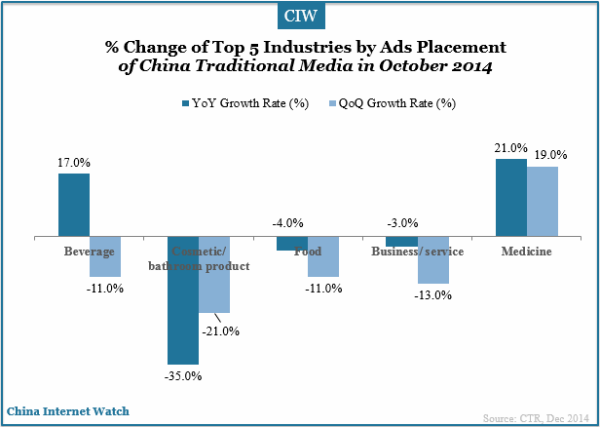

Beverage and medicine increased ads placement on traditional media a lot YoY in October 2014.

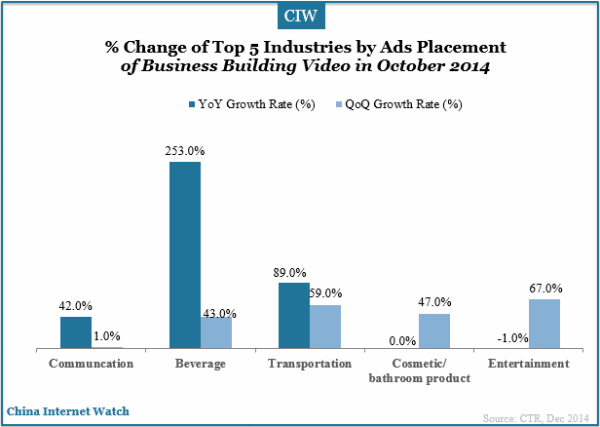

Among the top 5 industries by ads placement on business building videos in October 2014, beverage and transportation industries had great growth YoY.

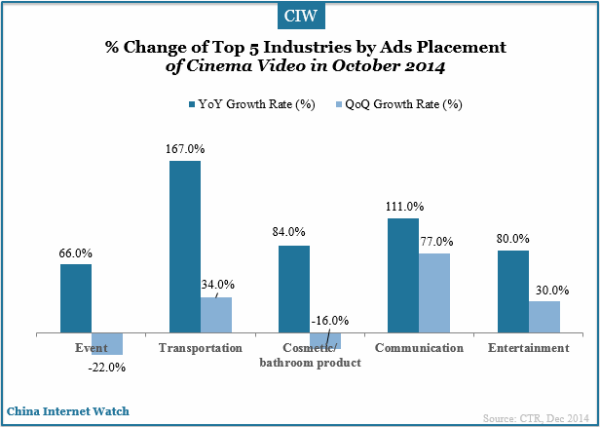

In October 2014, ad spend on cinema video doubled; and top 3 industries by ads spend were transportation, communication and entertainment.

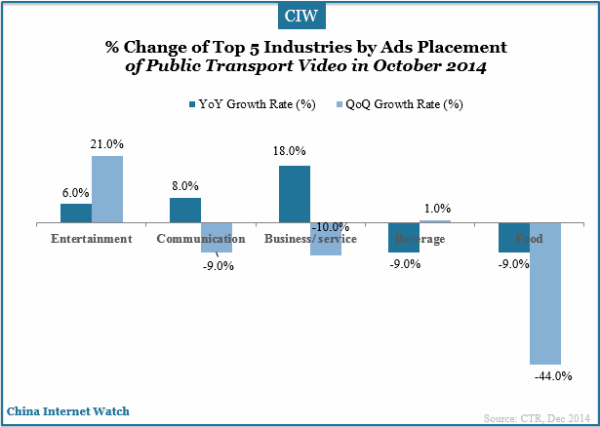

Industries like entertainment, communication and business/ service increased ads placement on public transportation videos from the same period of prior year in October 2014.

Also read: China Advertising Market in Tourism Industry in Q3 2014

]]>

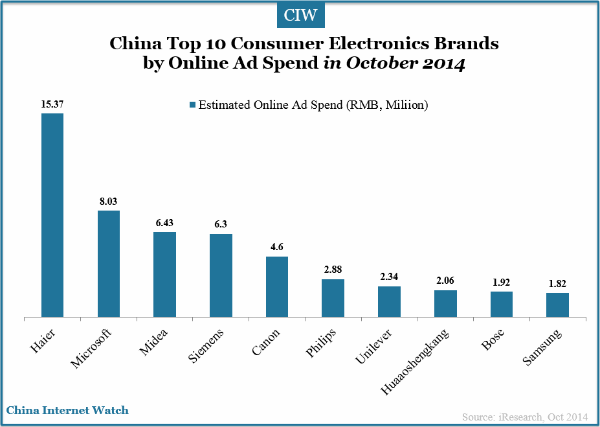

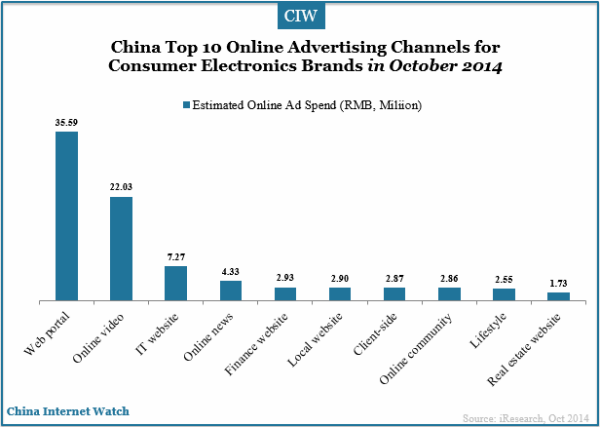

In Oct 2014, total online advertising spend of consumer electronic brands exceeded RMB93.06 million (US$15.19 million) in China.

Among all the consumer electronic brands, Haier spent RMB15.37 million ($2.5 million) on online advertising in October, ranking first, followed by Microsoft and Midea according to data from iResearch.

Web portal, online video platforms, and IT website are the top three ad placement channels for consumer electronic companies in China in October 2014. The advertising spend on web portal exceeded RMB35.59 million (US$5.8 million), accounting for 38.2% of the total spend, followed by online video (23.7%) and IT website (7.8%).

Also read: China 3C Home Appliance B2C Market in Q3 2014

]]>

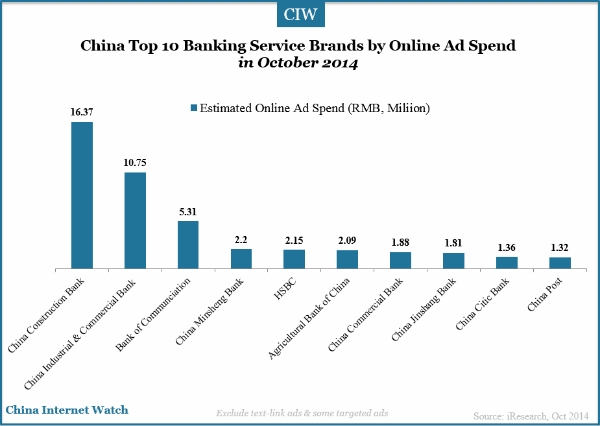

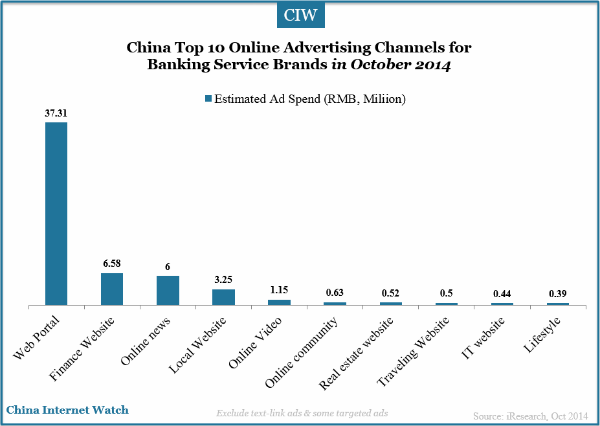

In October 2014, total online display advertising spend of banking service brands exceeded RMB58.29 million (US$9.15 million) in China.

Among all the banking service brands, China Construction Bank spent RMB16.37 million ($2.67 million) in online advertising in October, the biggest advertiser in online display ads (excluding text link ads and some targeted ads), followed by China Industrial & Commercial Bank, Bank of Communication according to data from iResearch.

Web portal,finance website and online news platforms are the top three ad placement channels for banking service companies in China in October 2014. The advertising spend on web portals exceeded RMB37.31 million (US$6.09 million), accounting for 64% of the total spend, followed by online video (11.3%) and finance website (10.3%).

Also read: China Mobile Banking Users Increased by 50% YoY in 2014

]]>

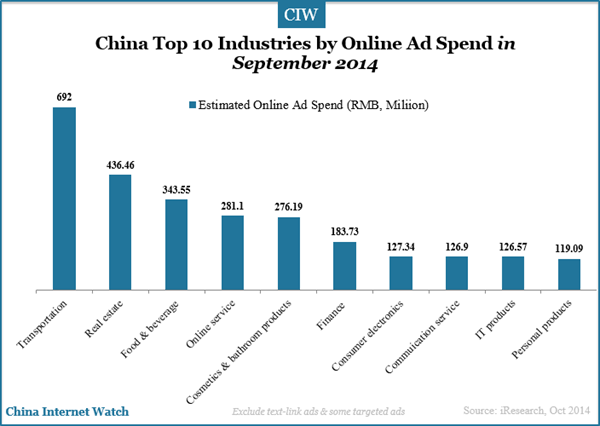

In September 2014, advertisers in transportation verticall spent RMB692 million (US$112.32 million) in online display advertising (excluding text ads and some targeted ads), ranking on top by total ad spend, followed by real estate and food & beverage according to estimates from iResearch.

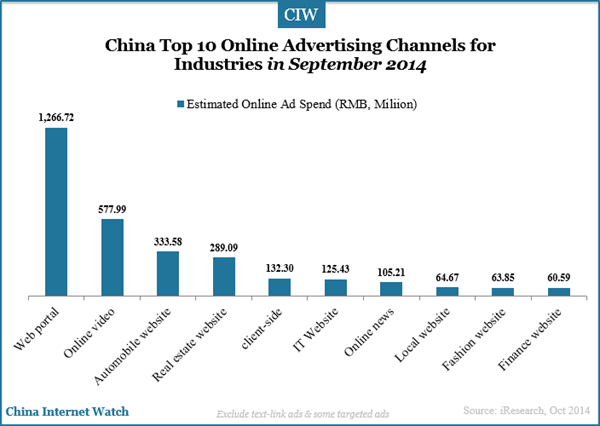

Web portal, online video platforms and automobile website are the top three ad placement channels for industries in China in September 2014. The advertising spend on web portal exceeded RMB1,270 million (US$206.73 million), accounting for 40.1% of the total spend, followed by online video (18.3%) and automobile website (10.6%).

More online display ads statistics for September 2014:

- China Top 10 Laptop Computer Brands by Online Ad Spend in Sep 2014

- China Top 10 Clothing Brands by Online Ad Spend in Sep 2014

- China Top 10 Cosmetic Brands by Online Ad Spend in Sep 2014

- China Top 10 Banking Service Brands by Online Ad Spend in Sep 2014

- Top 10 China Automobile Advertisers in Sep 2014

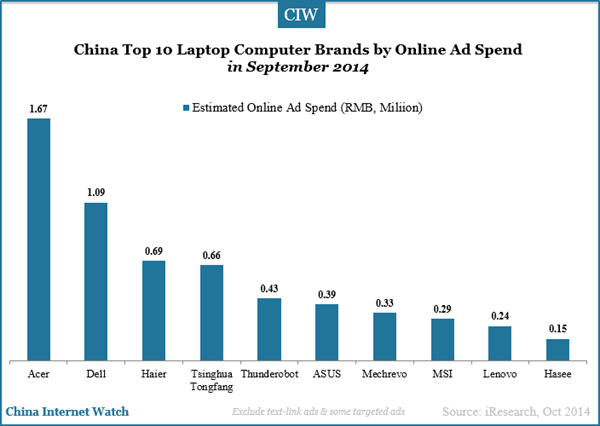

In September 2014, total online display advertising spend of China laptop computer brands exceeded RMB6.15 million (US$1.0 million).

Among all the laptop computer brands, Acer spent RMB1.67 million ($0.27 million) in online display advertising in September 2014, ranking first, followed by Dell and Haier according to data from iResearch.

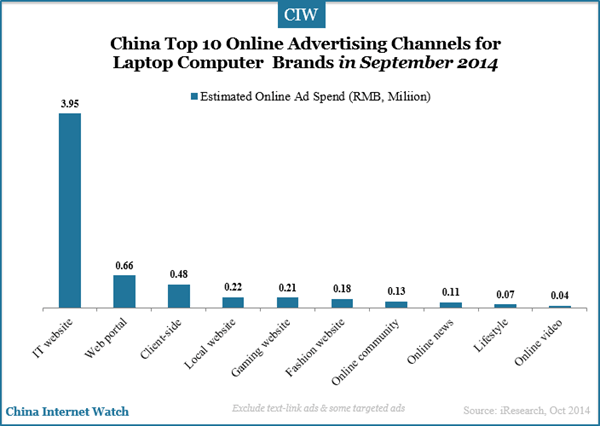

IT website, web portal are the top two ad placement channels for laptop computer companies in China in September 2014. The advertising spend on IT website exceeded RMB3.95 million (US$0.64 million), accounting for 64.3% of the total spend, followed by web portal (10.8%).

]]>