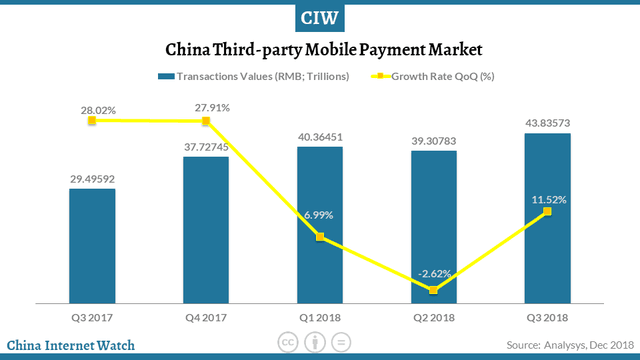

China’s third-party mobile payment grew by 11.52% to 43.8 trillion yuan (US$6.39T) in Q3 2018. Alipay (53.71%) and Tencent Finance (38.82%) combined accounted for 92.53%, leaving a small space for other players.

In Q3 2018, the third-party mobile payment grew to be a roughly 43.8 trillion yuan market in China. It bounced back to double-digit growth (11.52%) quarter-on-quarter after a permanent downturn that was partly influenced by the official crackdown on internet finance risks.

The multiple usage scenarios including e-commerce, food & beverage, air flights, and transportation, etc. help this market keep its growing pace, quick or slow.

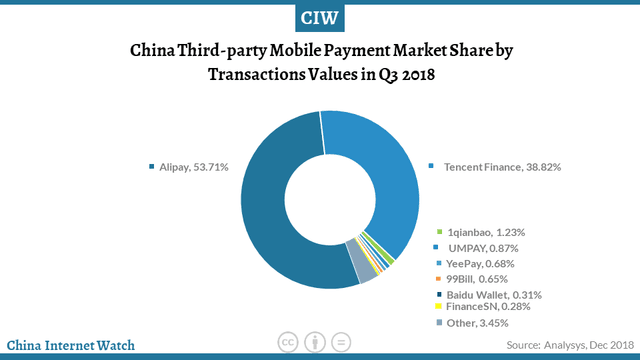

Alipay continued to lead this market with a share of 53.71% in terms of transactions values. Great efforts have been made to acquire new users and get old users further engaged mainly by means of red envelope campaigns.

Tencent Finance followed behind with a share of 38.82%, expanding its user base in financial and offline transactions. That was profited from Tencent Finance-backed LiCaiTong that added pension funds to its fund offering and its aggregated customer assets surpassing 500 billion yuan at the end of Q3. Alipay and Tencent Finance combined accounted for 92.53% of this market, leaving a small space for other players.

Click here for detailed China mobile payment usage insights in Q3 2018

]]>

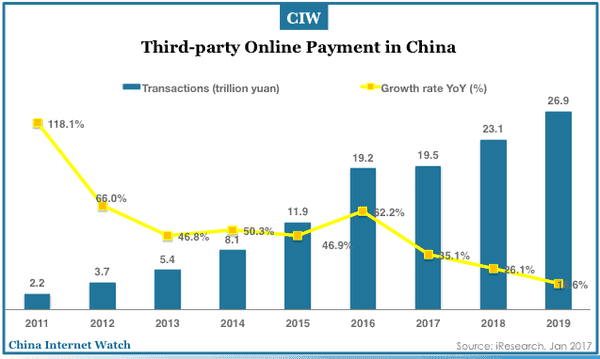

The total transactions of third-party online payment in China totaled 19.2 trillion yuan (US$2.79 trillion) in 2016 with an increase of 62.2%; the growth is slowing down but will continue to grow to 26.9 trillion yuan (US$3.91 trillion) in 2019.

This article is an excerpt from EBook – China Internet Insights 2017

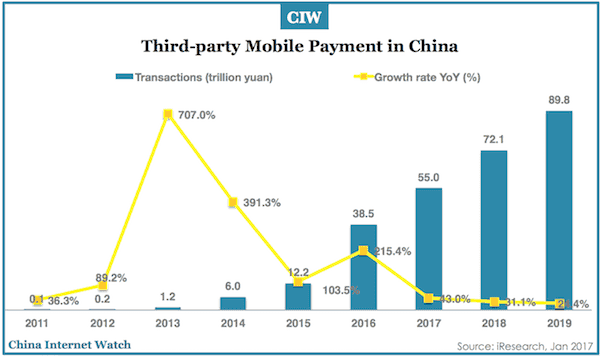

Total transactions of mobile payment in China grew by over twice to 38.5 trillion yuan (US$5.59 trillion) in 2016. And, it will reach 89.8 trillion yuan (US$13.04 trillion) in 2019.

Alipay and Tenpay together accounted for close to 90% of mobile payment users.

Also read: Digital trend of China fund, insurance, p2p loan market 2012-2020e

]]>

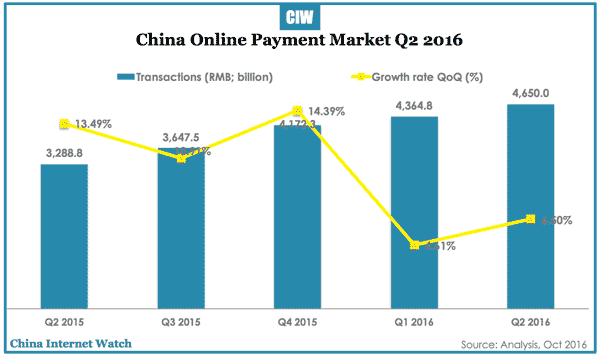

China Third-party online payment market had a total transaction value of RMB 4.65 trillion in Q2 2016, with an increase of 6.5% QoQ according to Analysis.

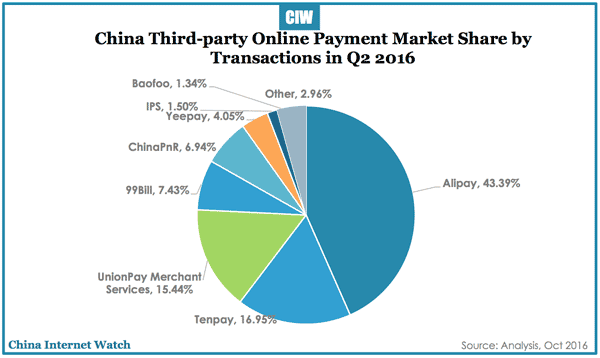

Alipay continued to dominate China’s third-party online payment market by total transaction value with 43.39% market share, followed by Tenpay (16.95%) and UnionPay Merchant Services (15.44%).

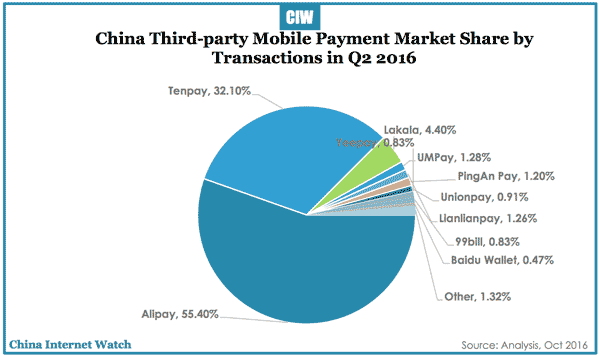

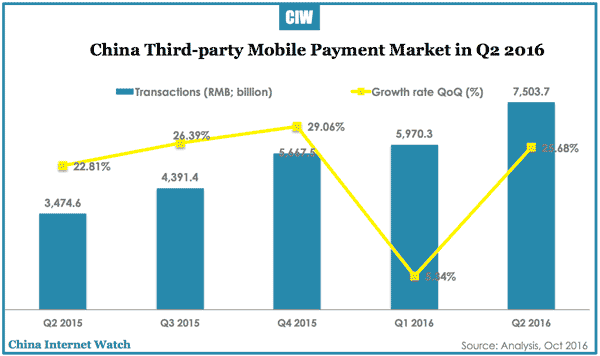

The total transactions of China’s third-party mobile payment market exceeded RMB 7.5 trillion in Q2 2016, an increase of 25.68% QoQ. The total transactions in the first half of 2016 reached RMB 13.48 trillion.

Alipay led China’s third-party mobile payment market with 55.4% market share, followed by Tenpay (32.1%) and Lakala (4.4%).

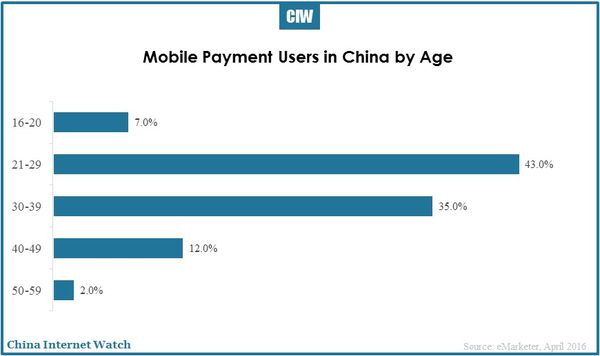

China users in 21 to 29 age group from the first-tier and the second-tier cities are the main mobile payment users, accounting for 43%.

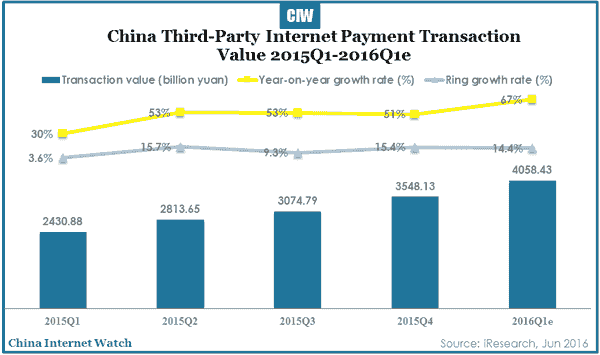

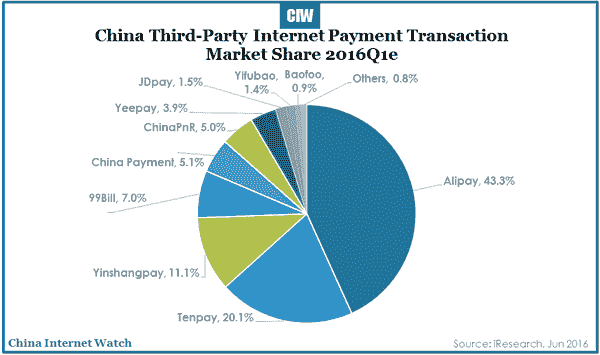

China’s third-party internet payment transactions reached 4,058.43 billion yuan (USD 609.93 billion) in Q1 2016 with a year-on-year growth rate of 67% according to iResearch.

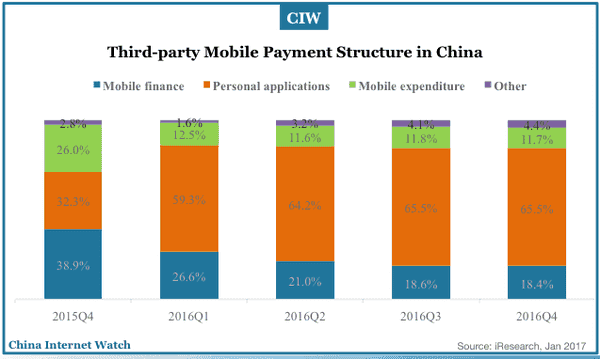

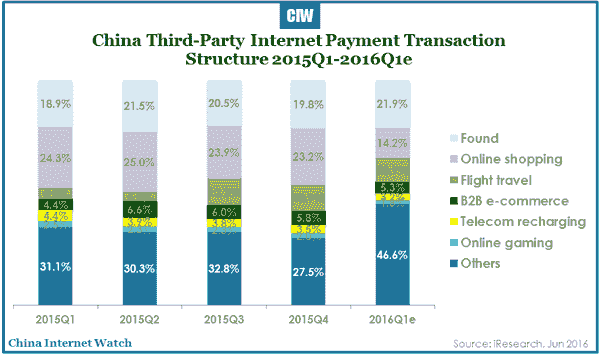

China’s third-party internet payment transactions on online shopping have been declining since Q1 2015 despite a slight increase in Q2, falling to 14.2% in Q1 2016. The share of the fund related transactions have increased from 18.9% in Q1 2015 to 21.9% in Q1 2016.

In terms of market share of China’s third-party internet payment providers, Alipay has 43.3% market share, followed by Tenpay (20.1%), Yinshangpay (11.1%), and 99Bill (7.0%).

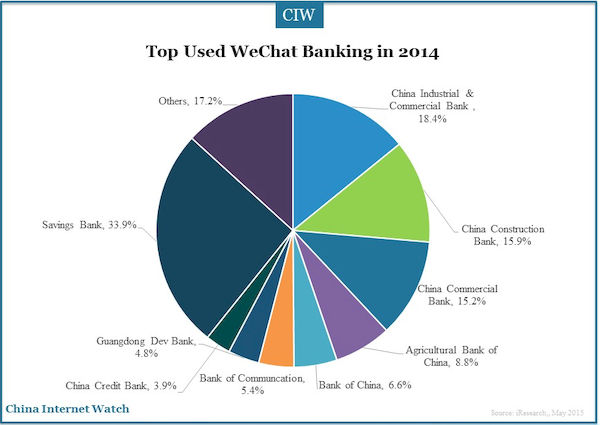

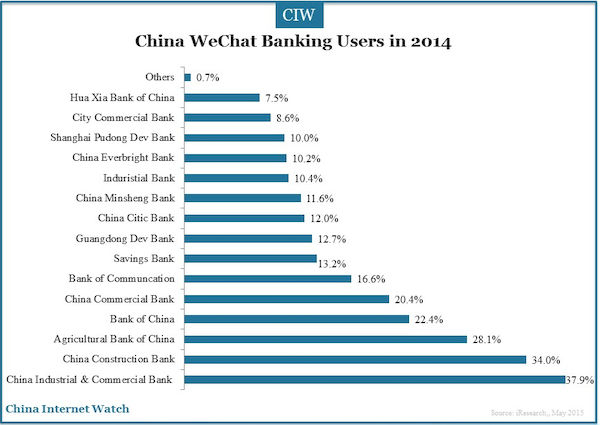

Besides, Chinese internet users also make payment through WeChat banking. In another survey by iResearch, China WeChat banking users prefer to use WeChat banking on ICBC (37.9%), China Construction Bank (34%), and China Commercial Bank (28.1%). The top several WeChat banking that users use more often is ICBC (18.4%), China Construction Bank (15.9%), and Commercial Bank of China (15.2%).

]]>

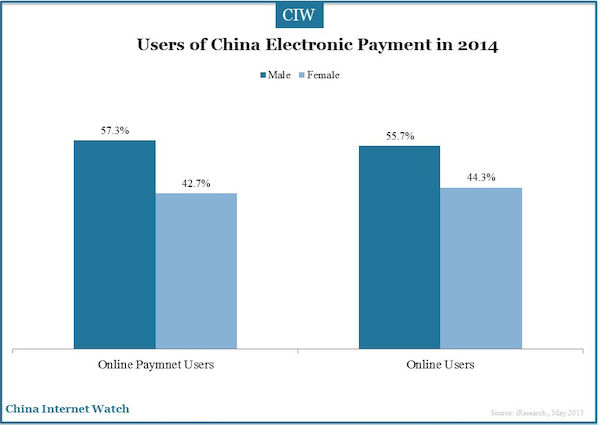

iResearch released a report on Chinese electronic payment users in 2015, which shows data of China e-payment and its users.

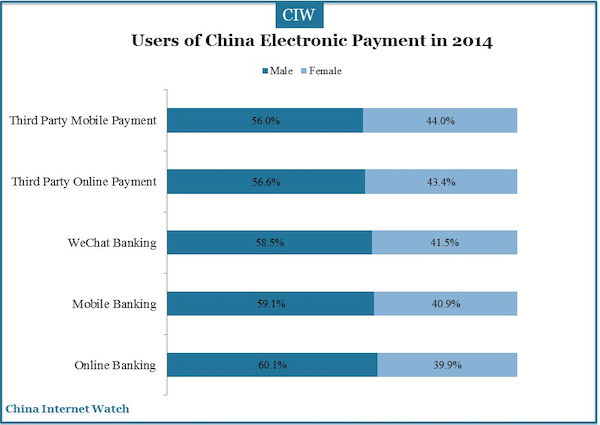

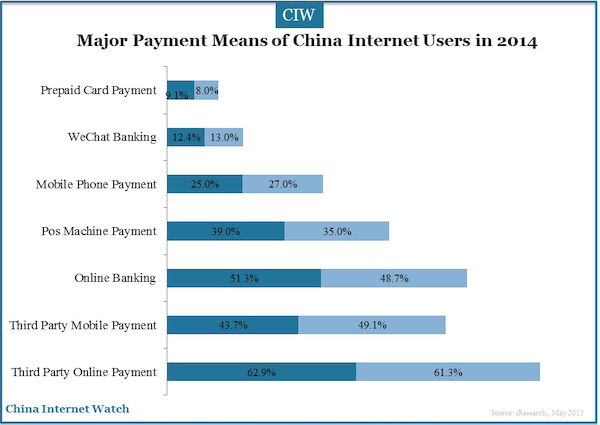

In 2014, male users of China e-payment account for up to 57.3%, while female users only account for 42.7%. The male ratio of online banking, mobile banking and WeChat banking account for more than half of the overall male proportion of electronic payments. While in the third-party online payment, third-party mobile payment, POS machine payments and prepaid cards payment, the ratio of female users is relatively high.

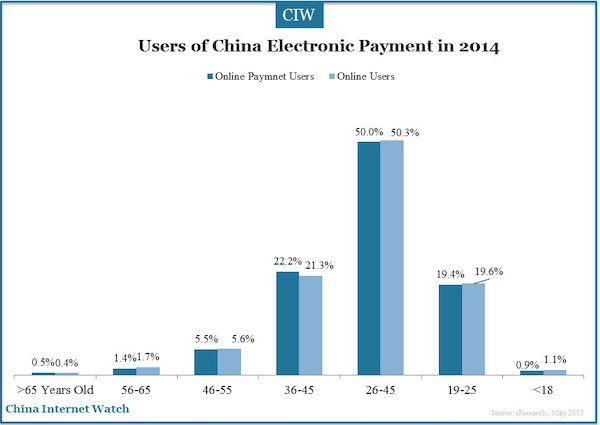

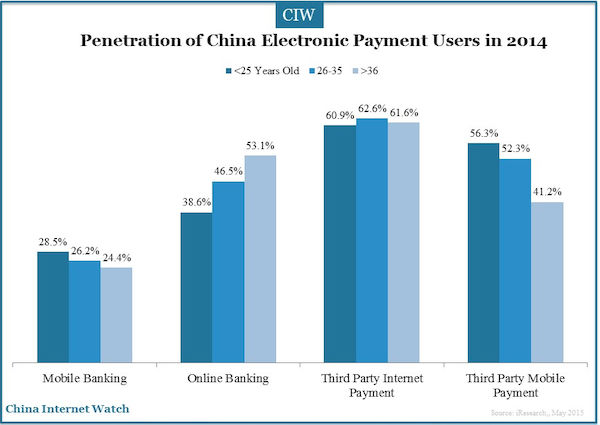

The ratios of China e-payment users and overall internet users are basically the same by ages. Users from 26 to 35 years old are the biggest age group, accounting for 50%. The penetration rate of online banking users increases with higher age groups; users above 36 years old are the biggest age group. At present, the penetration rate of mobile payment is higher, while in the future the situation may change.

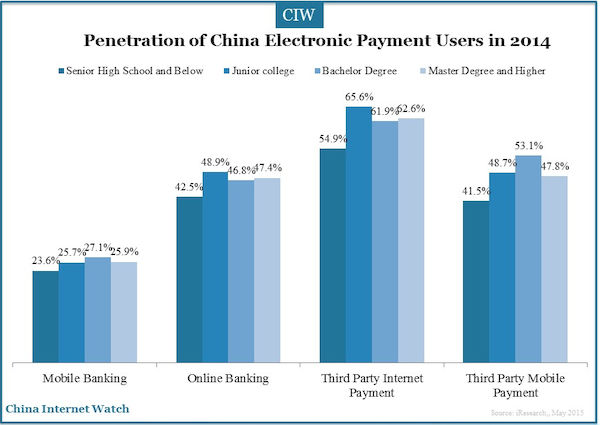

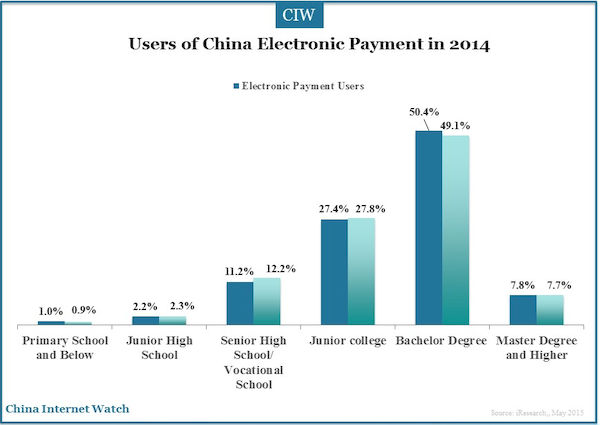

The ratios of China e-payment users and overall internet users are basically the same by education background. While the ratio of penetration tends to be higher among users with higher education background.

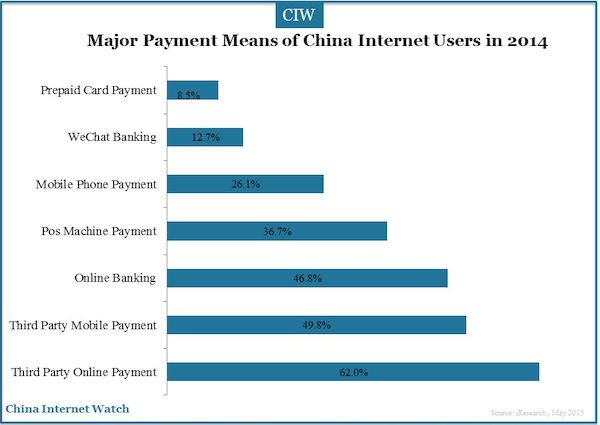

According to iResearch, male users of China’s electronic payment prefer to use electronic banking channels (online banking, mobile banking and WeChat banking), while Chinese women are more likely to use tools offered by third-party payments. In 2014, users of third-party internet payment account for over 60% of the overall payment users, then third-party mobile payment and online banking follow, with each accounting for about 50%.

Male users prefer electronic payment instruments offered by banks such as online banking (5.4% higher than female), mobile banking (relatively 2.0% higher than the female). While female users relatively prefer payment channels offered by third-party payments, such as third party internet payments (relatively 1.6% higher than the male), third-party mobile payments (2.6% higher than male).

iResearch believes that the reason the third-party payment and online banking users are more than POS machine payment users is that, electronic payment channels have less connections with the development level of local areas, the popularity of smart clients, and the internet also makes the payment of internet users migrate with electronic channels.

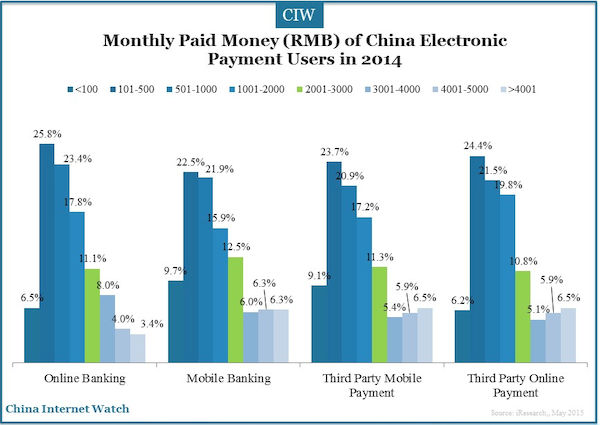

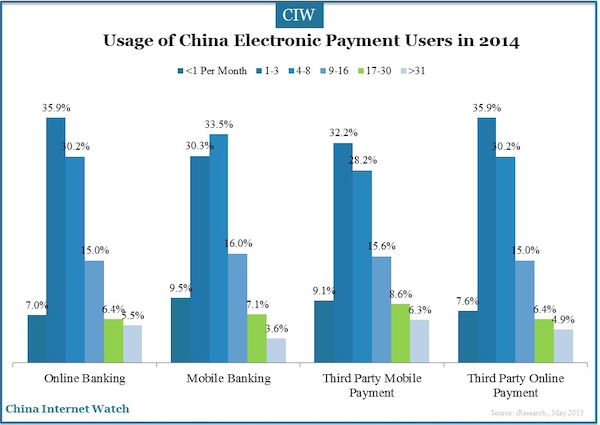

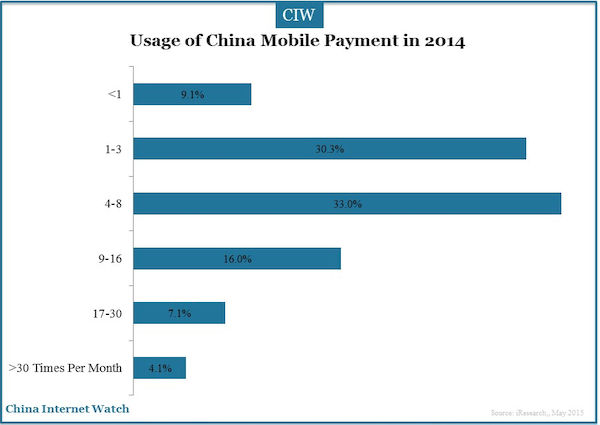

Users use a third-party payment gateways once or twice a week, and spend about 500 yuan per month. The average consumption is about RMB 100.

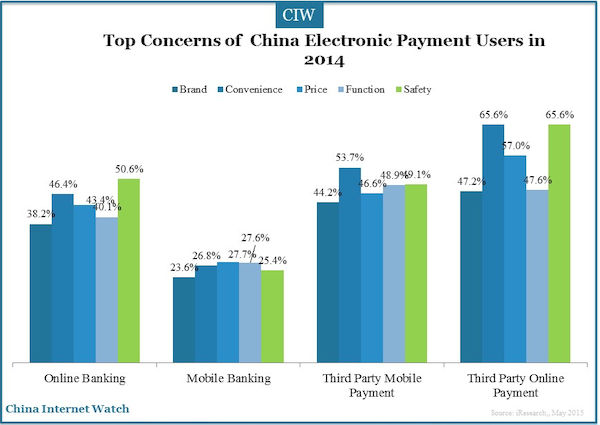

Several factors affect users acceptance of online payment, which are the brand of the company, security level, convenience level, price, and function. High security is the key factor users consider when they make payments online.

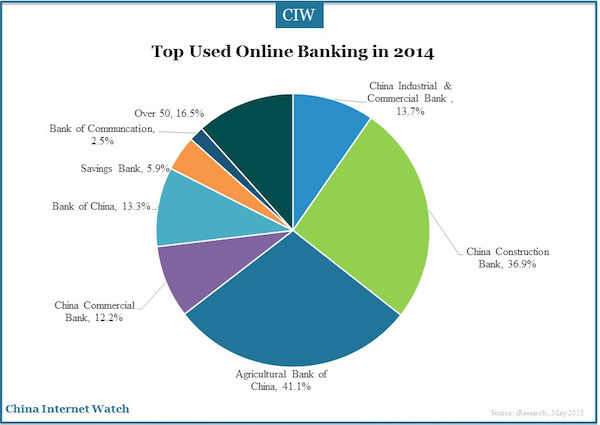

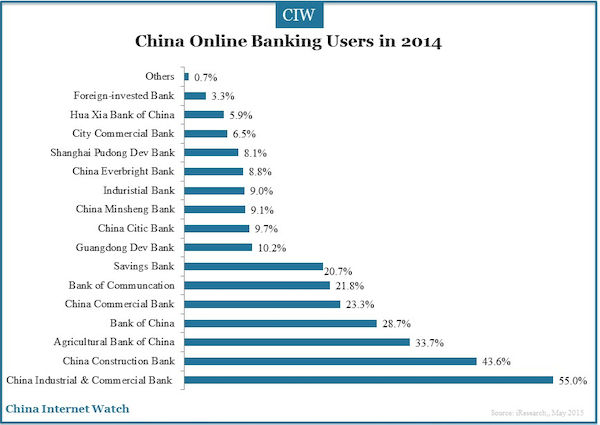

In 2014, China online banking users prefer to use online banking on ICBC, and over 50% of users have used China Construction Bank, Agricultural Bank of China and other five banks. The top several online banking users use more often is ICBC (25.6%), China Construction Bank (17.5%) and Agricultural Bank of China (11.4%).

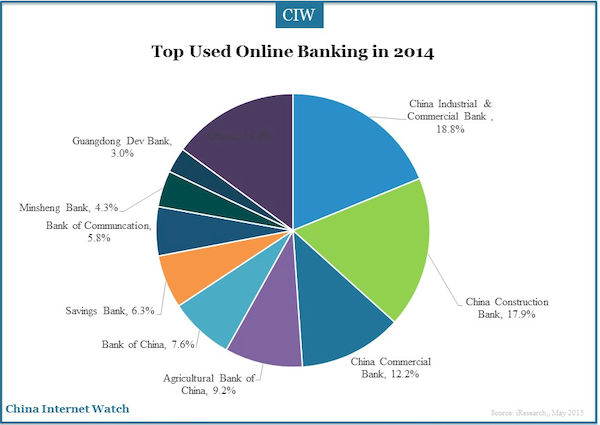

Mobile payment products are more diversified compared with online banking. China mobile banking users prefer to use online banking on ICBC (41.0%), and China Construction Bank (38.9%). The top several online banking that users use more often are ICBC (18.8%), China Construction Bank (17.9%) and Commercial Bank of China (12.2%).

Apart from these common payment means, internet users also make payment through WeChat banking. China WeChat banking users prefer to use WeChat banking on ICBC (37.9%), China Construction Bank (34%) and China Commercial Bank (28.1%). The top several WeChat banking that users use more often is ICBC (18.4%), China Construction Bank (15.9%) and Commercial Bank of China (15.2%).

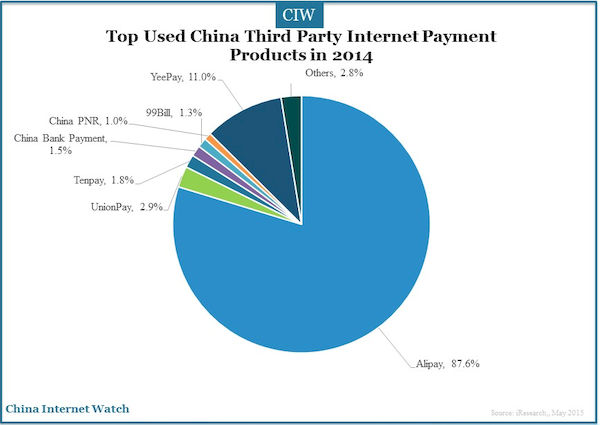

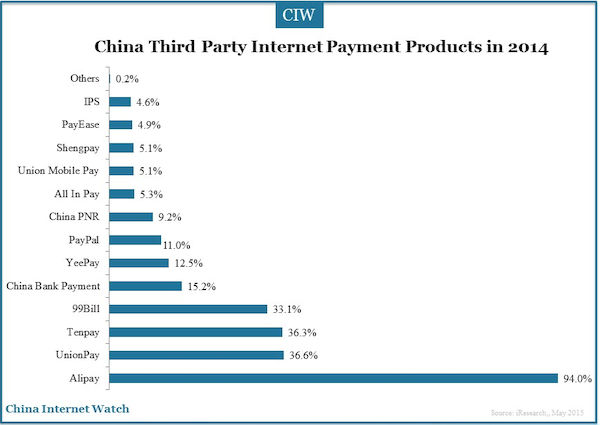

In 2014, China third party internet payment users use Alipay most frequently, with a usage of 94%, followed by China UnionPay (CUP) online (36.6%), Tenpay (36.3%) and 99Bill (33.1%). 87.6% of the users choose Alipay as the most preferred third-party internet payment product; and CUP online ranks second with only 2.9%.

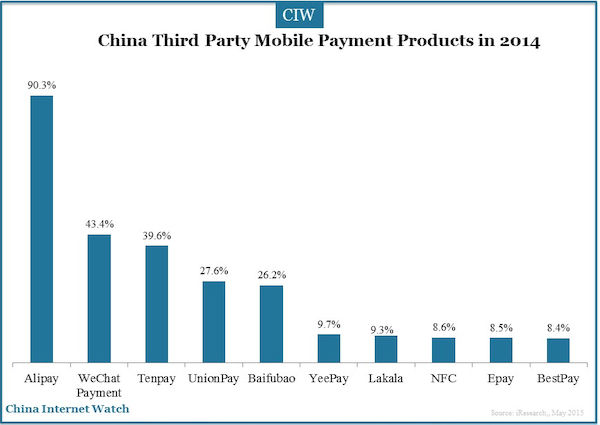

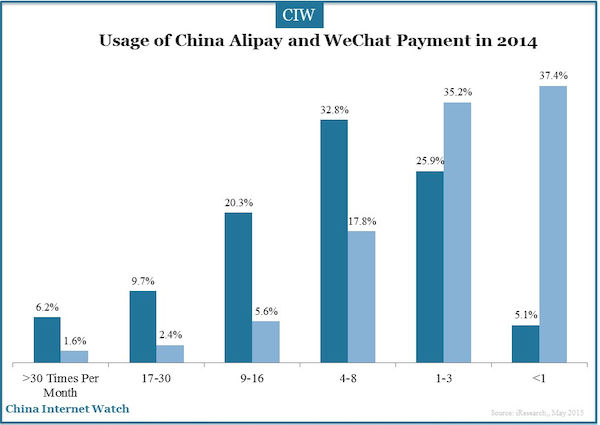

In 2014, people use Alipay more often than WeChat payment. Most WeChat payment users are new to it, and many of them are used to pay by Aipay. While Tencent still has a chance to have a promising future on the mobile payment market with its huge QQ and WeChat user base.

Also read: China Advertising Insights 2015

]]>

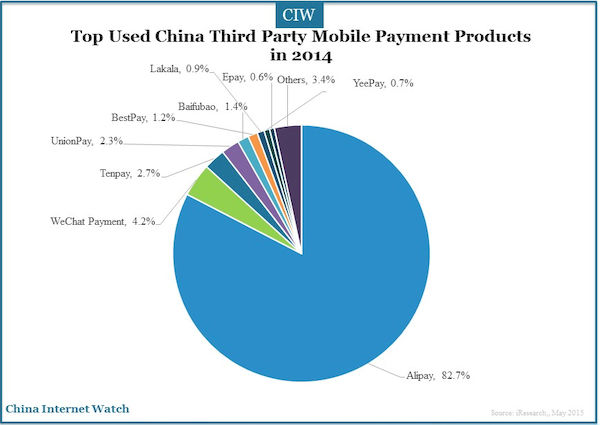

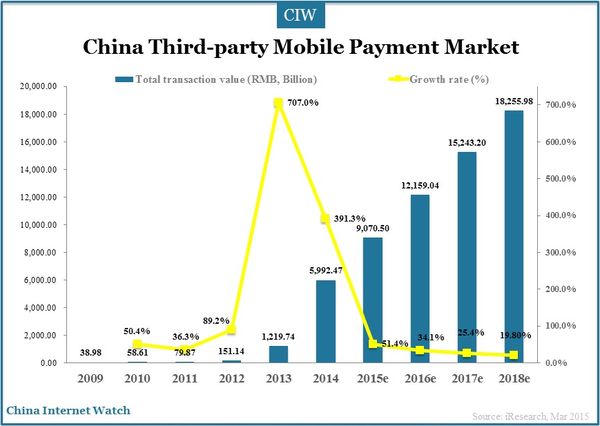

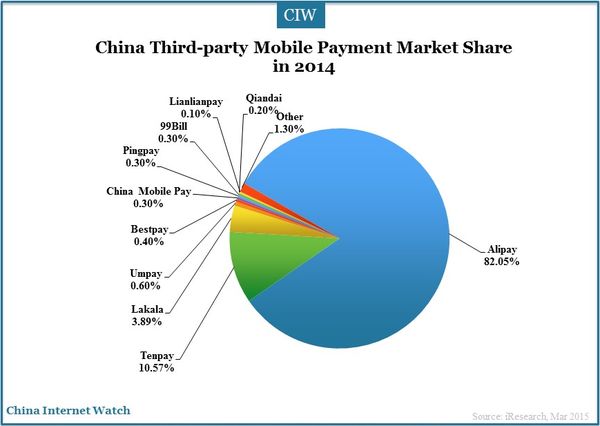

In 2014, total transaction value of China mobile payment market exceeded RMB599.247 billion(US$97.628 billion) with an increase of 391.3% from last year according to data of iResearch.

On 12 February 2015, People’s Bank of China announced China’s Payment Market Report 2014. The report showed in 2014, the total transaction volume and value of non-cash business were 62.752 billion and RMB1,817.38 trillion (US$294.70 trillion) with YoY growth rate of 25.11% and 13.05% respectively.

Among all the transactions, e-payment business is still keeping rapid growth as well as mobile payment. In 2014, total transaction volume of e-payment was 33.333 billion, worth RMB1,404.65 trillion(US$227.78 trillion) in China. Besides, the transaction volume and value of e-payment increased by 29.28% and 30.65% from the same period of prior year.

The transaction volume and value of mobile payment were 4.524 billion and RMB22.59 trillion (US$3.66 trillion) with YoY growth rate of 170.25% and 134.30% respectively in 2014 in China.

In 2014, total transaction volume of online payment from payment agencies was 37.422 billion, worth RMB24.72 trillion (US$4.00 trillion) in China.

In 2013, the growth rate of mobile payment market was 707% from 2012; and in 2015, China mobile payment market growth will slow down. The transaction value is expected to exceed RMB18 trillion in 2018.

Alipay and Tenpay accounted for 93.4% market share in China mobile payment market in 2014. In mobile payment times in China, provider who owns the most users covering various scenarios control the market. Supported by online shopping market, Alipay is growing more and more strong. See more about Alipay’s growth: Over 42.3 Bln Transactions on Alipay in 10 Years

Benefiting from WeChat Pay, Tenpay got its prosperity in 2014. Alipay, WeChat and Weibo are competing for the market share with Hongbao War, see their performance here.

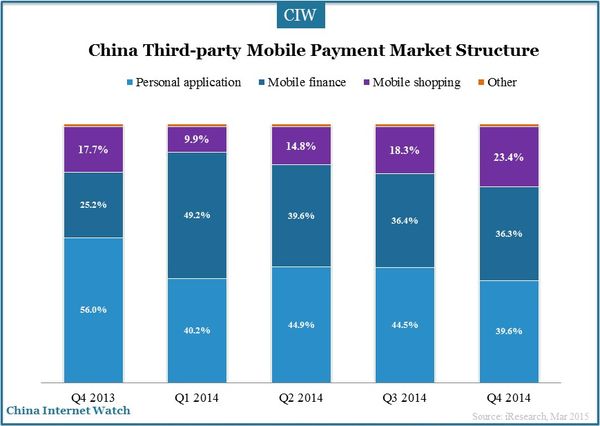

Mobile shopping’s market share in China mobile payment market increased to 23.4% in Q4 2014.

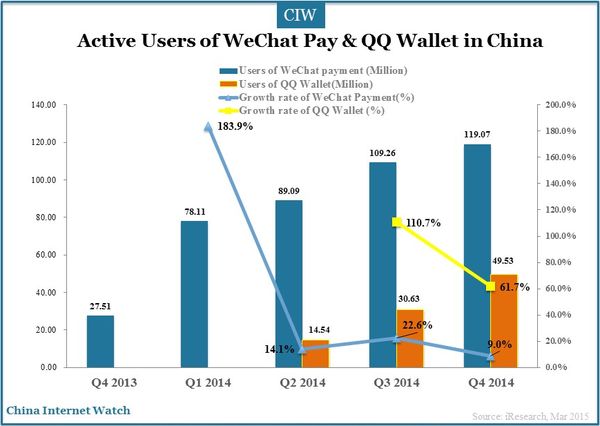

Tencent’s large number of users provide a solid base for QQ Wallet’s development. Users can use QQ Wallet to top up mobile phone accounts, purchase movie tickets, QQ membership, and pay for mobile games etc. Read more about Tencent Got More Than WeChat Payment to Compete with Alipay on Mobile

Also read: Insights of China Mobile Payment (Wechat, Alipay) Users

]]>

Tencent QQ’s monthly active users exceeded 829 million and MAUs on smart device exceeded 521 million according to Tencent’s finance report of first half of 2014. Tencent QQ was the first Chinese instant messenger in Guinness World Record for having the most number of simultaneous online users on an instant messaging platform on 3rd July, 2014. Tencent’s large number of users provide a solid base for QQ Wallet’s development.

QQ Wallet was launched by Tencent in the first quarter of 2014 as an extended feature to mobile QQ apps:

Users can use QQ Wallet to top up mobile phone accounts, purchase movie tickets, QQ membership, and pay for mobile games etc.

Related report: China Mobile Payment User Behavior in 2013

“QQ Wallet will target its users mainly in tier-3 and tier-4 cities in China. It is also a supplement for WeChat payment which can stimulate much need for mobile payment”, said Zhen Haojian, who is in charge of QQ Wallet’s development in Tencent.

Zhen also mentioned that, QQ wallet is a big move on Tencent’s finance. QQ Wallet payment is based on QQ account while WeChat payment is based on WeChat account; and both connect with Tenpay’s fast payment system.

At the present, the number of QQ Wallet users binding bank cards is 90 million. Compared with Alipay and WeChat payment, it is believed that QQ wallet should be featured with unique functions which are distinct and focusing on payment security.

QQ Wallet has many advantages. For example, users can buy QQ coins, QQ members or other services without being redirected to other webpages or other online payment platforms; users can finish payment on Jingdong (Tencent is Jingdong’s significant shareholder and strategic partner since 10 March 2014) Meilishuo, who cooperates with Tencent QQ; users can enjoy convenience with QQ Wallet in O2O market.

Nowadays, the competition in China online payment market is fierce. Take Tencent V.S. Alipay as an example. In terms of taxi app, mobile QQ and Wechat wallet cooperated with Didi Taxi while Aliapy wallet cooperated with Kuaidi Taxi; In China group buying market, mobile QQ and WeChat Wallet are connected to Dianping.com, China’s Yelp while Alipay is connected to Taobao and so on.

Tencent is good at developing online virtual products and gathered great number of users. QQ Wallet can provide more service for such users. However, offline market is still a big challenge for QQ wallet. We can see Alipay’s off-line strategy worked on Double 12 shopping Day this year.

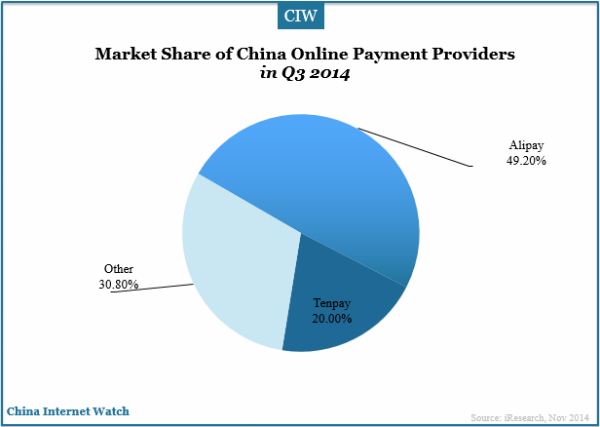

In Q3 2014, Alipay accounted for 49.2% market share in China online payment market, followed by Tenpay with 20% market share. There was over 42.3 billion transactions on Alipay in 10 Years. However, Tencent still has its chance on mobile payment with its huge QQ and WeChat user base.

Also read: Insights of China Mobile Payment (Wechat, Alipay) Users

]]>

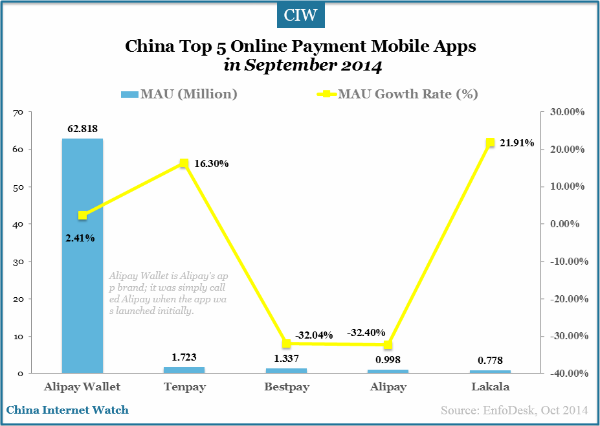

Alipay Wallet, Alipay’s mobile app brand renamed from “Alipay” and the largest mobile payment platform in the world, exceeded 62.818 million MAUs in September 2014 in China according to EnfoDesk; Alipay Wallet is the most popular mobile payment app by MAUs, followed by Tenpay, Bestpay, Alipay and Lakala.

In comparison, the top 4 online payment mobile apps in August 2014 in China were Alipay, Bestpay, Tenpay and Lakala by total MAUs.

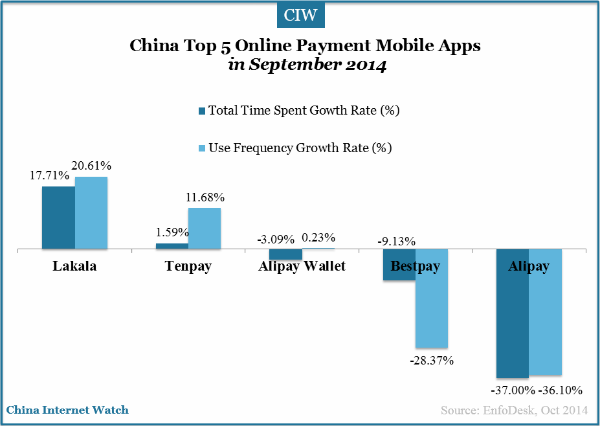

Among China top 5 online payment mobile apps, Lakala, Tenpay and Alipay Wallet all had different use frequency growth rate , especially Lakala who had 20.61% growth rate while Alipay had a decrease of 36.1% in use frequency growth rate in September 2014. Alipay Wallet, Bestpay and Alipay all had decreased growth in time spent in September 2014.

Till 16 October in China, total number of Alipay Wallet’s active users exceeded 190 million and the daily mobile payment transaction volume exceeded 45 million, accounting for more than 50% of total Alipay transactions.

Also read: INFOGRAPHIC: Brief History of Alipay Yu’E Bao’s Rapid Development in China

]]>

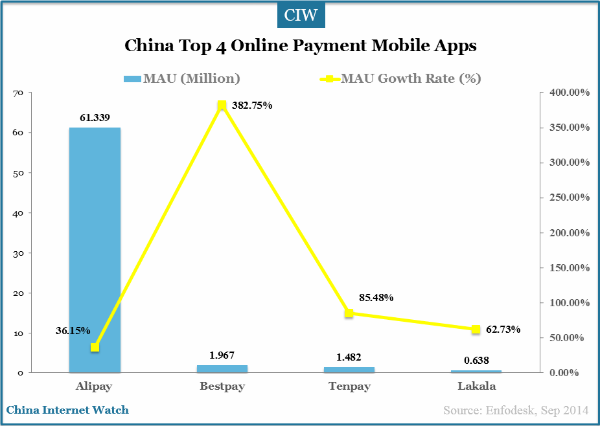

Alipay’s mobile app exceeded 61.339 million MAUs in August 2014 in China according to EnfoDesk, remaining the most popular mobile payment app, followed by that of Bestpay, Tenpay and Lakala.

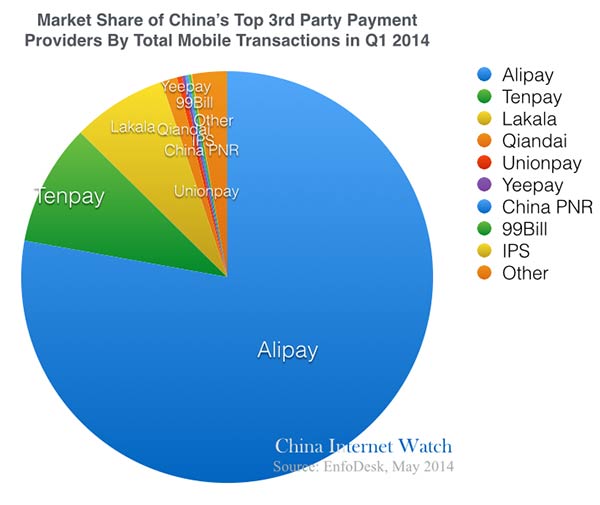

In comparison, the top three online payment providers in the first quarter of 2014 were Alipay, Tenpay and Unionpay by total mobile transactions who together represented over 80% of the total market share.

Bestpay is China Telecom‘s mobile payment solution. Bestpay account, once topped up, can be used to make payment on website, by SMS or voice. China Telecom users who use RFID-UIM phone card can use their phone to make payment.

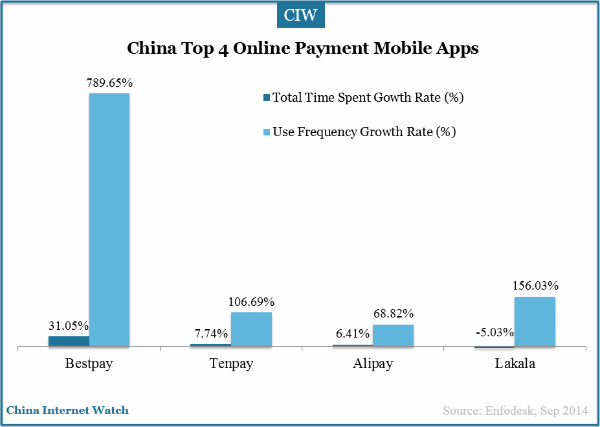

China top 4 online payment mobile apps all had rapid use frequency growth rate , especially Bestpay who had 789.65% growth rate while Lakala had slight decrease in total time spent growth rate in August 2014.

Mobile payment is a big market in China and it’s very competitive. Tencent’s Wechat launched a “card payment” option this month with which users can make fast payment at supported retail chains; this payment is either using remaining fund in Wechat Wallet or linked to the user’s bank ATM card.

Alibaba’s Alipay partnered with Huawei and launched finger payment standard in China, which is first available on Huawei’s smartphone Mate 7. Alipay still dominates China’s mobile payment market in Q2 2014 as it does in online payment market. In addition, more players have entered the market including Baidu; read more here.

]]>

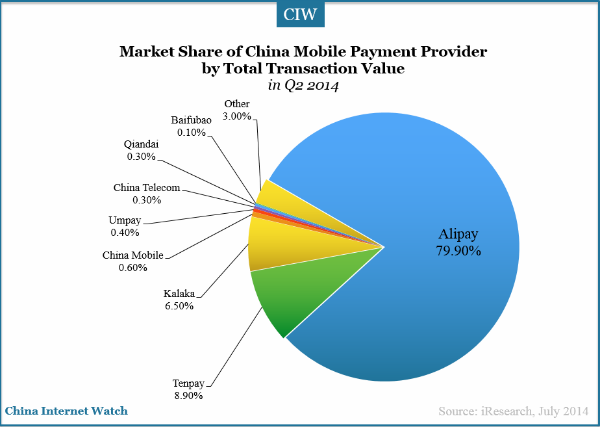

Alipay still dominates China’s mobile payment market in Q2 2014 as it does in online payment market. In addition, more players have entered the market including Baidu.

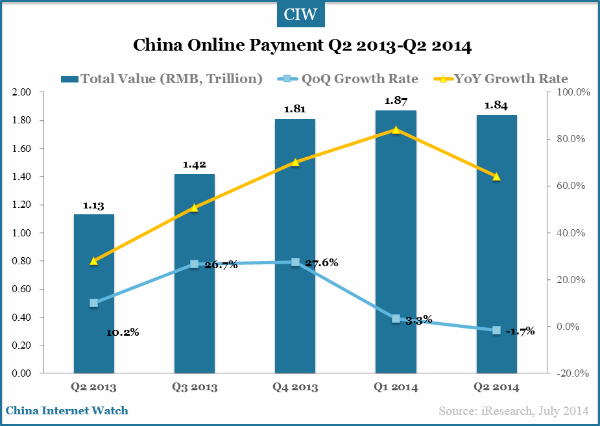

In Q2 2014, total transaction value of China online payment exceeded RMB1.84 trillion (US$299.7 billion) with an increase of 64.1% from the same period of 2013 according to data of iResearch.

Alipay ranked top in China mobile payment market in Q2 2014, accounting for 79.9% by total transaction value, followed by Tenpay and Lakala according to iResearch data.

We can see Baifubao, China Mobile, China Telecom and other channels are getting visible in China mobile payment market nowadays. Baifubao, Baidu’s attempt in mobile payment market, is finally on the map even though it just got 0.1% market share.

Compare with China’s Top Online and Mobile Online Payment Providers in Q1 2014

]]>

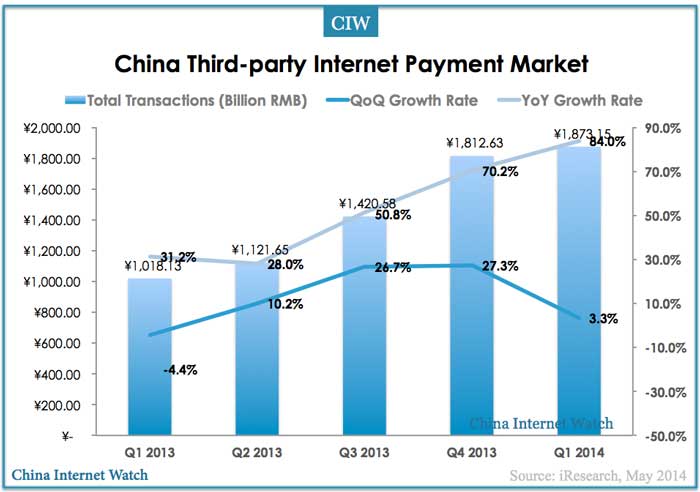

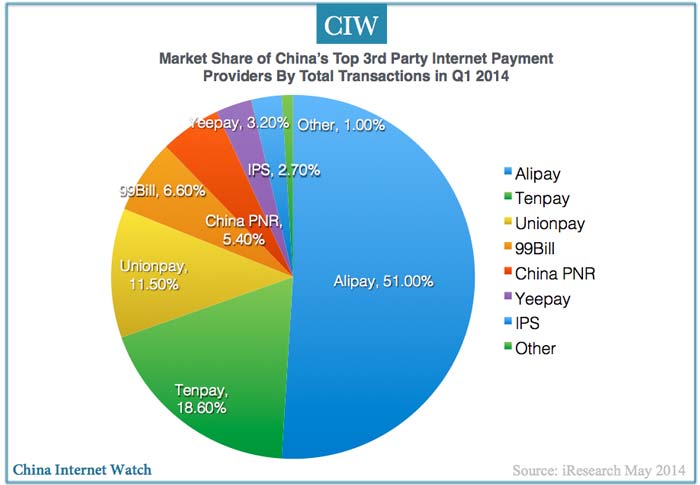

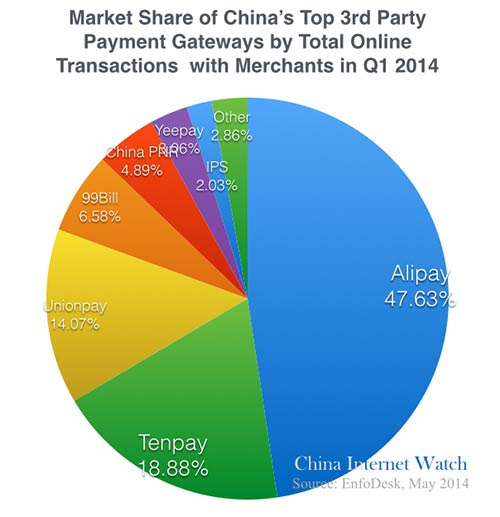

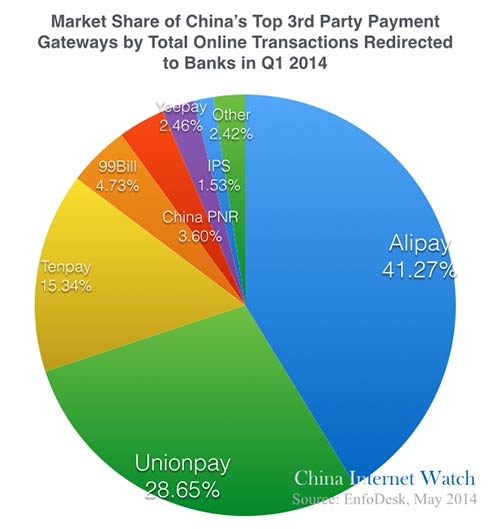

China’s third party internet payment totalled RMB1873.15 billion (USD 302.71 billion) in Q1 2014, with a YoY growth rate of 84% according to iResearch.

With over 300 million users, Alipay remains the market leader in China’s third-party payment market by total transactions, followed by Tenpay and Unionpay; the top 3 has a combined market share of over 80%.

Alipay, Tenpay and Unionpay are also the top 3 in China’s mobile internet payment market according to Analysis International.

]]>

Total online payment market in the first quarter of 2014 reached 1.96 trillion yuan, a growth rate of 5.1% QoQ. The top three providers, Alipay, Tenpay and Unionpay represent over 80% of the total.

Alipay, with its payment mobile apps Alipay Wallet, is dominating mobile payment market with over 77% market share by total transactions:

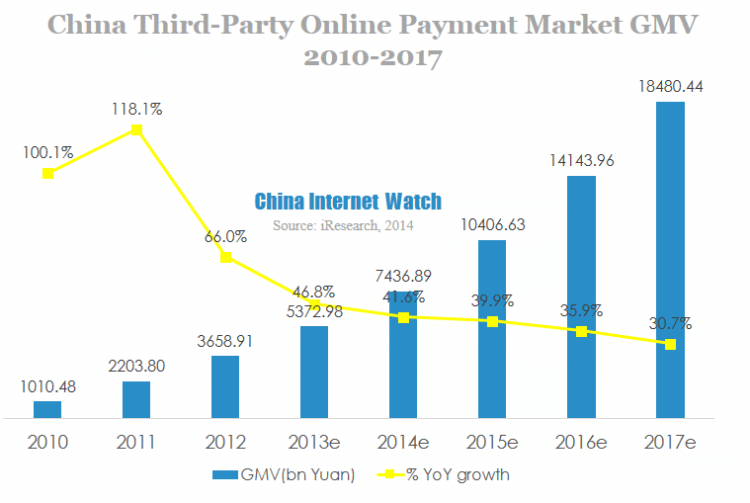

China third-party online payment market reached 5372.98 billion yuan (USD 870.33 billion) in 2013, with 46.8% YoY increase. According to iResearch, it will maintain the high growth rate and its importance in the whole economy strengthened. The deep collaboration with finance enterprises helped third-party online payment find a new growth point. 2013 was only the beginning of this new growth point, it hasn’t realized full potential yet.

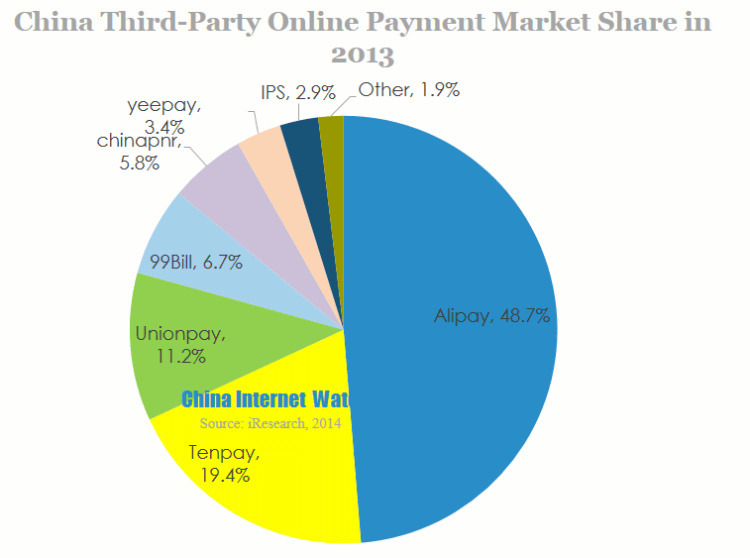

The market share of core third-party online payment enterprises’ market share remained stable in 2013, Alipay led the market with absolute dominance of 48.7%. Tenpay ranked the second with 19.4%, followed by Unionpay with 11.2%.

]]>