Domestic tourism revenue was RMB 26.517 billion, a year-on-year increase of 4.0% and a comparable recovery of 35.1% compared to the same period in the 2019 New Year’s Day holiday.

“Cold escape” is still the first choice for Chinese travelers. Traveling to warmer climes is a favorite. Southern China’s mild winter weather attracts many tourists at home and abroad to escape from the cold. Tourism in rural areas of Guangdong cities such as Meizhou, Qingyuan, and Shantou was a particular bright spot.

According to Alibaba’s OTA platform Fliggy, the amount of tourism bookings in Hainan destinations increased by more than 50% compared with 2022.

At the same time, during New Year’s Day, the number of tourist merchandise bookings, including keywords such as “seascape”, “island”, and “surfing” increased by more than 60% year on year.

The orders for cross-provincial and trans-city tours accounted for nearly 80%, reaching the peak in nearly a year. More than 70% of the post-90s and post-00s young users became the main force during this holiday.

]]>

Over 72 thousand organizations offer 178 thousand courses on Tencent Class in 2019. And, revenues of the top 100 organizations grew by 62%, according to Chen Shujun, VP of Tencent Education.

More than 30 educational institutions have witnessed their revenues surpass 10 million yuan (US$1.5 million) in 2019, according to Tencent Class Report. 70 percent of the users are under 29 years old, with the post-00s (those born in and after 2000) generation increasing significantly.

19 Chinese cities, including 4 tier-1 cities (14.5%) and 15 new tier-1 cities, contribute to 38.1% of total users. Top sources of Tencent Class users are Guangdong, Shandong, Henan, Jiangsu, and Zhejiang.

Tencent Class subsidized 35-100% of traffic cost and the total traffic investment for Tencent Class grew by over 700% compared with 6 months ago.

In 2020, Tencent Class will continue to upgrade and improve the efficiency of institutional customer acquisition through data from four aspects.

First, it will consolidate the mainstream channels of SEM, Tencent Ads, and Weibo Ads. And, it will utilize more channels such as Xiaohongshu and Zhihu to help the organizations drive traffic.

Second, it will deepen information flow and broaden the orientation to find potential users of high quality.

Third, CRM 2.0 provides link monitoring and user life cycle management; fourth, explore a new marketing path that suits the actual capabilities of the organization.

]]>

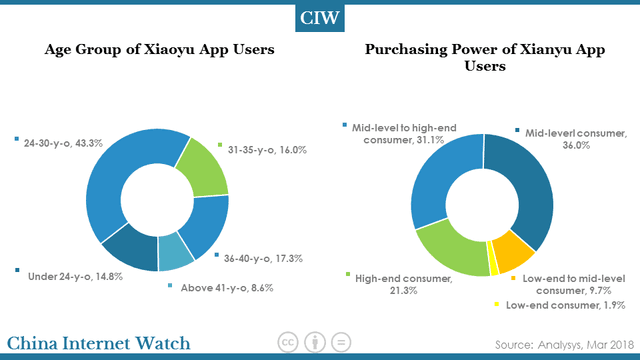

Consumption value and method are changing along with the rising of the Chinese middle class, post-90s, and post-00s. Users aged between 24 and 30 y-o accounted for 43.3% of Alibaba’s second-hand goods trading Xianyu mobile app users while users of mid-level to high-end purchasing power accounted for 52.4% of the total.

The main users of second-hand products trading in China become younger and richer, which reveals that people are developing rational consumption value.

There are 105 vertical platforms on second-hand car trading, indicating an intense competition in this sector. The trading on second-hand 3C digital, luxury goods, and recycling of old things are rising.

The number of e-commerce platforms by category for 2nd hand products in China

]]>

E-commerce has changed the way Chinese consumers live and its influence keeps growing. China has become the largest online retail market; 1.3 yuan out of 10 yuan was spent online by Chinese consumers in 2015.

In Q1 2016, total online retail sales of goods and services in China was 1,025.1 billion yuan (US$158 billion), up by 27.8% year-on-year. A recent survey conducted by Tencent revealed some habits of China online users.

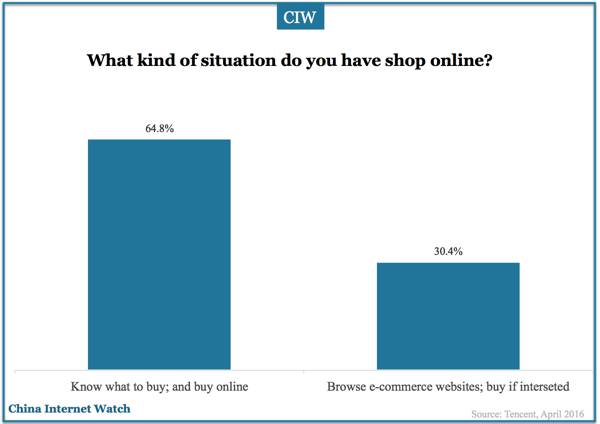

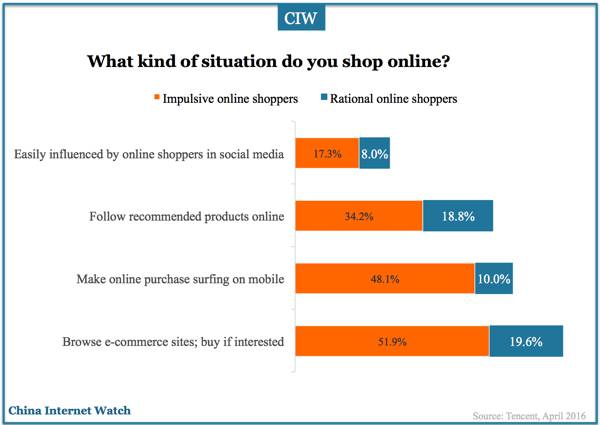

1. About 30% China online shoppers make impulsive purchase online

64.8% users only access online shopping websites when they know what they want to buy. And, 30.4% browse e-commerce shopping sites without a specific shopping list in mind.

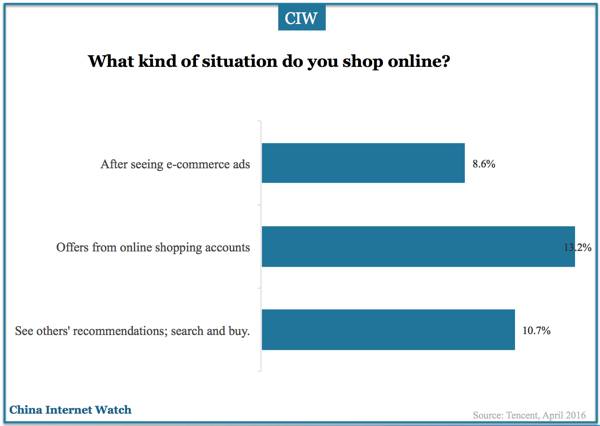

2. Products recommendations in social media is more persuasive than traditional ads.

Social media is better than traditional advertisements triggering online shoppers purchase motivation. 13.2% online users made a purchase after seeing offers from online retailers social media accounts; recommendation from other social media users motivated 10.7% to make a purchase.

3. Impulsive online shoppers rely more on mobile.

The main scenario for impulsive China online shoppers are browsing online shopping websites and buy what they are interested in (51.9%). In comparison, only 19.6% rational online shoppers do that.

Mobile shopping has the most impact on impulsive shoppers; 48.1% of them make a purchase while surfing on mobile.

4. Regular online friends’ recommendations are more influential than online celebrities

Once acquired a large number of ordinary users’ review information, the recommended products can be more persuasive than social online shopping experts’ recommendation to drive a user’s desire to buy.

Among purchases originated from online recommendations, online ordinary users’ review are more purchase (27.7%), followed by those from social online shopping experts (10.7%) and online celebrities (3.6%).

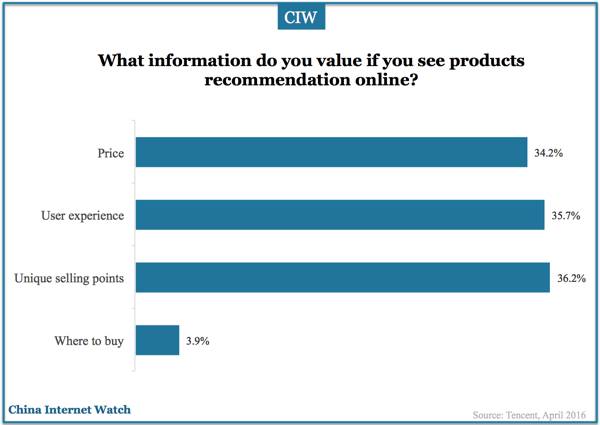

5. China online shoppers value unique features and experiences more.

Only 3.9% respondents deem “where to buy” informaiton valuable. USP, use experience and pricing are much more valuable information.

6. More post-00s’ online shopping decisions are influenced by celebrities.

29.5% post-00s internet users, those born in and after year 2000, would buy products recommended by their favorite celebrities. That ratio is only 8.8% and 6.3% among post-90s and post-80s respectively.

7. China online users are less interested in popular products with low prices.

Only 21.3% respondents in Tencent’s survey would follow social media accounts or communities who recommend lower priced products; 40.9% would follow them for saving shopping time.

Also read: China Cross-border Transactions to Reach US$1 Trillion in 2016

]]>

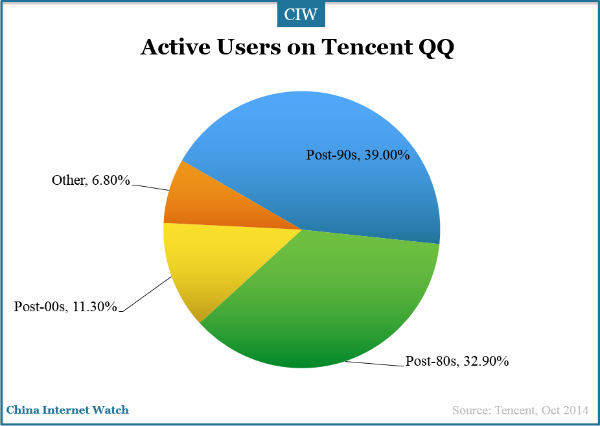

Chinese post-90s are the most active QQ users, accounting for 39% of total users, followed by post-80s and post-00s according to Tencent on Tencent’s Open Day in October 2014.

During period from 4 August to 10 August, Tencent QQ’s daily user coverage exceeded 220.75 million, accounting for 63.5%, ranking the top among China online instant messengers, and effective time on Tencent QQ went up to 759.33 million hours, accounting for 90.7% of total effective time in China instant messengers market.

Tencent QQ got into guinness world record for having the most number of simultaneous online users on an instant messaging platform on 3rd July, 2014.

QQ is making efforts to be featured with young design, colorful characters and social diversity. Tencent is establishing online community based on common interest on mobile QQ. According to research of Tencent and EnfoDesk, 40.89% of Chinese post-90s would like to make friends with ones who have common interest through online social media.

Smart device MAU of QQ was 542 million, more than WeChat which was 468 million in Q3 2014. This is a bit surprising considering the growth rate of QQ has been slowed down.

Also read: The Latest Stats on QQ and Wechat in Q3 2014

]]>