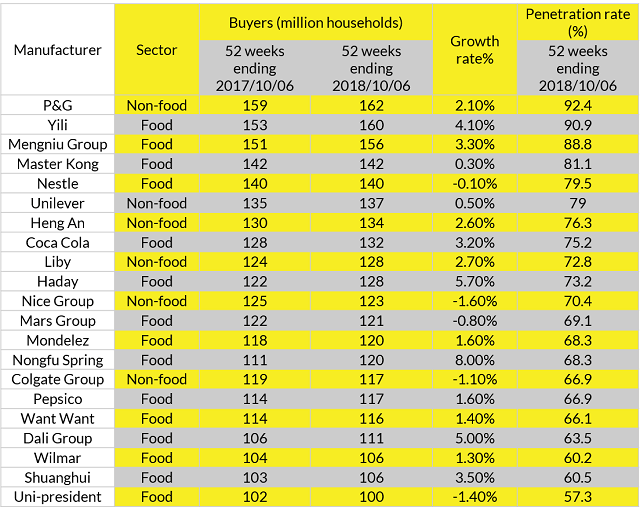

21 Fast Moving Consumer Goods (FMCG) companies reached over 100 million urban households. P&G and Yili led the race, reaching over 160 million families. Nongfu Spring, Haday, and Dali are fastest growers.

21 FMCG companies reached over 100 million urban households during the 52 weeks ending October 5, 2018, with P&G and Yili being the first to hit the 160 million milestones, according to report from Kantar Worldpanel.

The duo reported 92.4% and 90.9% penetration rates respectively, enjoying the widest consumer base in China. In terms of growth rate, Nongfu Spring, Haday, and Dali are the top three performers, reporting over 5% increase in the total number of buying families year-on-year.

Winning over millennials

Despite China’s aging population, winning the love of millennial consumers (meaning post-80s and post-90s generations in China) is critical for brands to thrive. With more disposable income and need to express their individuality, young consumers offer great opportunities to unlock future growth.

For the companies that grow penetration ahead of the market average, most of them saw noticeable advances in young families. For example, Nongfu Spring managed to grow its shopper base amongst young singles/couples by 30% in the last 12 months through its phenomenal success of Victory vitamin water, which rode on the massive popularity of reality show “Idol Producer”.

The company also launched the NFC juice brand 17.5° to cater to younger middle consumers’ aspiration for authenticity and freshness. Similarly, Coca-Cola in China grew its penetration through the smaller pack and new lines such as “Sprite Fiber Plus” to balance young consumers’ needs for both nutrition and indulgence.

Liby, an established player in the home cleaning sector, has actively used sponsorship and film stars to refresh its brand image and won 1.5 million young single/couple families.

Combination of innovation and go-to-market

Almost one new product is launched every three minutes in China in 2017, and consumers in China are facing cluttered shelves with new products trying to grab their attention. However, only 6% of the new launches managed to bring incremental buyers. Brands that succeed in China’s formidably competitive marketplace will have to stand out by offering unique innovation and having go-to-market excellence.

P&G, with its powerful house of brands line, has been leading the FMCG market in terms of penetration for five years in a row. In recent years, P&G has stepped up the innovation pipeline by launching a series of sophisticated and differentiated products, e.g. Whisper Pure Cotton, Always Infinity, Rejoice Micellar Water shampoo as well as Olay and SK II premium range.

In the latest 52-week period, P&G also grew their physical availability, particularly leveraging the strength of social and e-commerce platforms.

Dali, a well-entrenched food conglomerate, reported strong buyer gains in the latest year through its launch of Doubendou, a soy milk product riding on the concept of “natural and GMO bean free”.

Backed up by Dali’s established distribution network to ensure its wide availability and in-store presence, Doubeidou was a blockbuster success and brought 13 million new buyers to Dali Group in the first year after it was launched.

Offline penetration remains paramount

E-commerce has been a game changer in the last 10 years in China, transforming the way brands connect to consumers. In the “New Retail era”, brands will have to adopt a holistic omnichannel view to win consumers at every possible touch point.

Offline stores, especially in lower-tier cities, remain crucial to building trial and engagement through their interactions with millions of shoppers on daily basis. With the expansion in data integration and logistic capabilities, consumers are now able to choose multiple ways to shop and the boundary of online and offline channels are increasingly blurring.

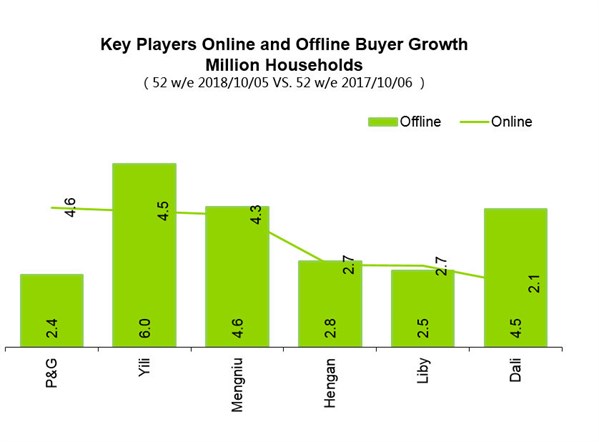

Successful companies in growing shoppers are those who achieved a balanced penetration gain across both online and offline channels. Yili, as a leader in food & beverage, grew its online and offline buyers by 4 and 6 million respectively.

Offline distribution channels brought more shopper growth for companies like Mengniu, Hengan, and Dali. Even for P&G, it managed to add 2.4 million incremental buyers through brick-and-mortar stores. Consequently, the partnership with offline retailers remains essential for brands to keep up the omnichannel footprint.

Read more: Insights of China internet users in lower-tier cities

This post was originally published on Kantar.com.

]]>