UnionPay Flash supports the top-up payment of QCoin, QQ Music, and Tencent Videos. WeChat Mini Programs will gradually support Flash Pay, being in beta test since 22 September.

On October 2nd, Alipay announced the progress in promoting interconnection with China UnionPay. it has opened online payment scenes to the UnionPay Flash app, covering the first batch of 85% Taobao merchants.

For offline, it has also implemented QR code scanning and mutual recognition with UnionPay Flash payment in multiple cities and plans to cover all cities in China by March 2022.

UnionPay, also known as China UnionPay or by its abbreviation, CUP or UPI internationally, is a Chinese financial services corporation headquartered in Shanghai, China. It provides bank card services and a major card scheme in mainland China.

Founded on 26 March 2002, China UnionPay is an association for China’s banking card industry, operating under the approval of the People’s Bank of China (PBOC, central bank of China).

It is also an electronic funds transfer at point of sale (EFTPOS) network, and the only interbank network in China that links all the automatic teller machine (ATMs) of all banks throughout the country.

In 2015, UnionPay overtook Visa and Mastercard in a total amount of value of payment transactions made by customers and became the largest card payment processing organization (debit and credit cards combined) in the world after the two.

China’s 3rd-party payment market 2021-2025e: mobile vs. internet

]]>

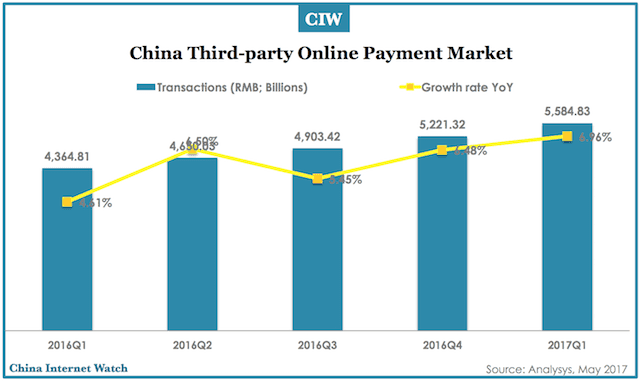

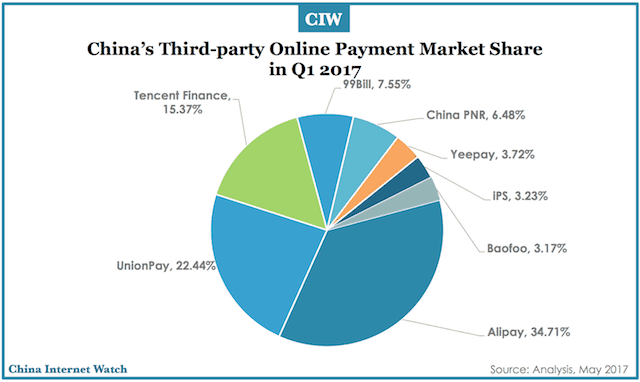

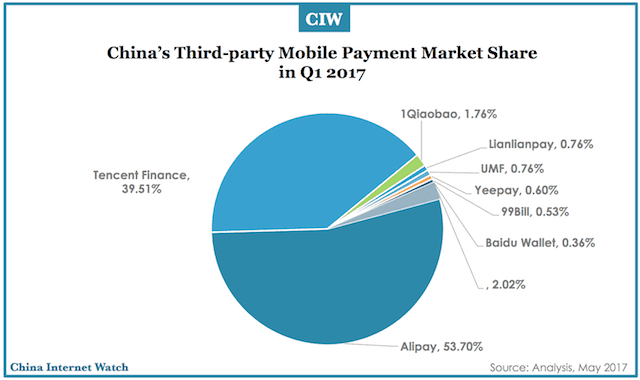

China’s third-party online payment market had total transactions of over US$820 billion in Q1 2017, led by Alipay (34.7%) and UnionPay, while mobile payment transactions reached US$2,761.78 billion in China, led by Alipay (53.7%) and Tencent Finance.

The total transactions of China’s third-party online payment market were 5,584.831 billion yuan (US$820.03 billion) in the first quarter of 2017 with an increase of 6.96% QoQ.

Alipay continued to lead China’s online payment market with 34.71% market share by the total transaction in Q1 2017, followed by UnionPay (22.44%) and Tencent Finance (15.37%). The top three institutions combined account for 72.52% of China’s online payment market.

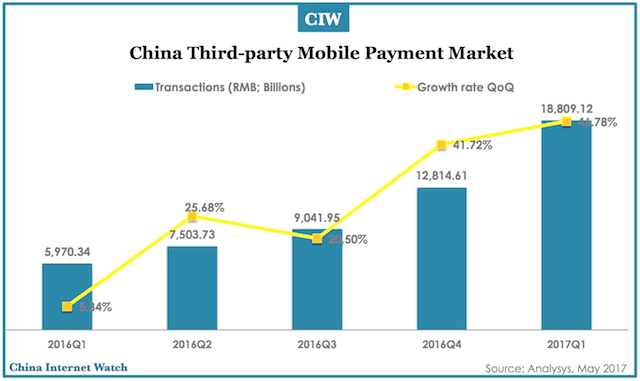

The total transactions of China’s third-party mobile payment market reached 18,809.12 billion yuan (US$2,761.78 bn) with an increase of 46.78% QoQ in Q1 2017.

Alipay has 53.7% market share in China’s mobile payment market in Q1 2017 followed by Tencent Finance (39.51%).

Tencent Finance ranks first in terms of the number of active users in Q1 2017 (841.26 million), followed by Alipay (491.98 million) and Baidu Wallet (68.21 million).

]]>

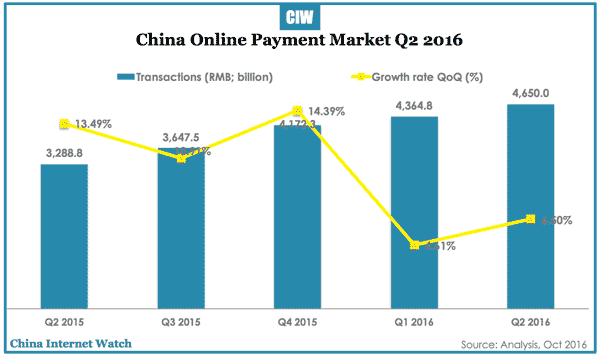

China Third-party online payment market had a total transaction value of RMB 4.65 trillion in Q2 2016, with an increase of 6.5% QoQ according to Analysis.

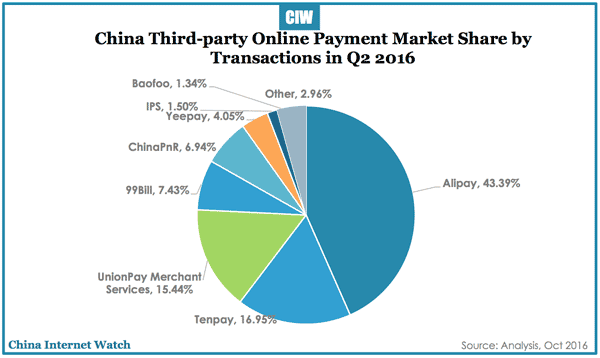

Alipay continued to dominate China’s third-party online payment market by total transaction value with 43.39% market share, followed by Tenpay (16.95%) and UnionPay Merchant Services (15.44%).

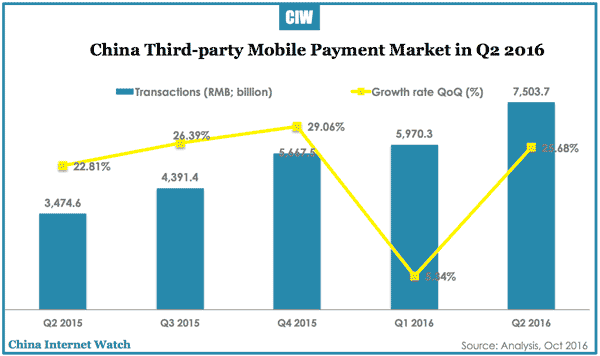

The total transactions of China’s third-party mobile payment market exceeded RMB 7.5 trillion in Q2 2016, an increase of 25.68% QoQ. The total transactions in the first half of 2016 reached RMB 13.48 trillion.

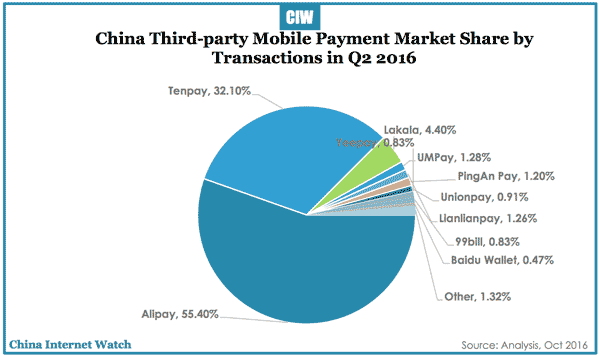

Alipay led China’s third-party mobile payment market with 55.4% market share, followed by Tenpay (32.1%) and Lakala (4.4%).

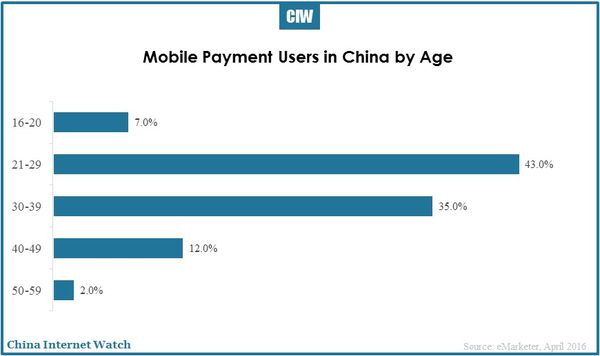

China users in 21 to 29 age group from the first-tier and the second-tier cities are the main mobile payment users, accounting for 43%.

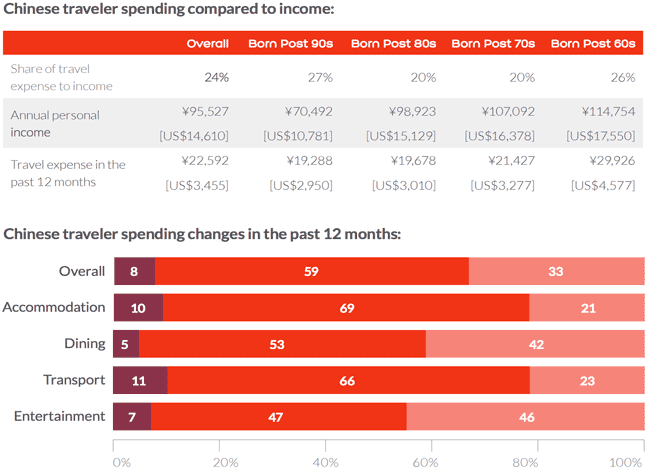

On average Chinese outbound travelers spent 17% less per day in a twelve-month period than the previous year – from RMB3,324 (US$508) to RMB2,849 (US$436) according to a survey from Hotels.com.

Top Chinese spenders cut back by 68%, from RMB13,800 (US$2,111) to RMB8,228 (US$1,258). That meant the majority settling on three star rather than more luxurious hotels. However, the survey also indicates the spending is expected to rebound in the next year, with one-third of travelers planning to spend more.

The survey pointed out two biggest challenges facing those providing accommodation to Chinese travelers: a lack of Mandarin-speaking staff and of China UnionPay card facilities.

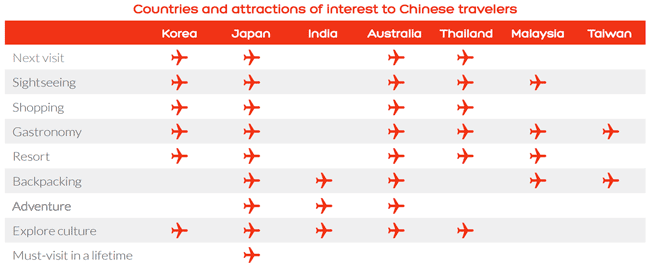

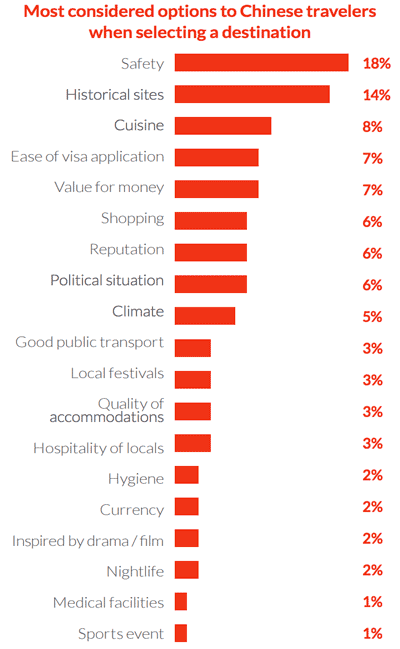

When planning their next trip, Chinese travelers are particularly taking into account safety, sightseeing, dining and ease of visa applications, with the currency of the intended country not generally a factor.

According to hotel room demand on the Hotels.com China website, the most popular countries for Chinese travelers to visit in the last two years were the USA followed by Thailand. In 2015, Japan overtook Hong

Kong in third spot and Australia climbed from eighth most visited to sixth on the list.

In terms of cities, Hong Kong followed by Bangkok remained the top two from 2014 to 2015. Tokyo climbed from the ninth to fourth most visited city from 2014 to 2015 and Chiang Mai entered the top ten list in 2015.

When it comes to a wish list of countries to visit in the next 12 months, Australia came out number one at 15%. Also high on the intended travel list were Japan, Hong Kong, South Korea and the Maldives.

China male consumers spent more on large purchases than female. 51% paid for over half of their online purchase on mobile end; and, mobile payment for virtual goods consumption increased by 6 percentage points higher in 2015 compared with the previous year according to China UnionPay.

Related: UnionPay Rising on Mobile Payment

54% respondents spent over 1,000 yuan (US$154.35) in shopping online each month and the consumption has been increasing year by year according to China UnionPay. The number of male buyers each of whom spent over 5,000 yuan (US$771.76) online were more than female users with 6 percentage points higher. Shanghai online shoppers spent an average of 2,000 yuan (US$308.70) online each month ranking first in China.

Mobile payment was quite common among China’s consumers. 82% respondents once used mobile phones to complete the payment and 51% paid for over half of their online purchases.

The young generation below 20 years old was interested in payment through the mobile wallet and other apps. Mobile payment for physical offline goods reached 33%. Mobile payment for virtual goods consumption increased by 6 percentage points higher in 2015 compared with the previous year.

Mobile safety became even more crucial this year. About one-eighth encountered network fraud with 6 percentage points higher compared to 2014. Nearly 50% were cheated on social accounts. Major scams were viruses, phishing websites, false base-station smishing (pretending as China Mobile and like). 20% respondents lost more than 2,000 yuan from online scams.

Nearly 90% respondents thought it necessary for mobile payment to equip certain verifications before payment transactions which indicated that security must be the priority for mobile payment. 76% used to verify via mobile phone verification code and the ratio increased by 12 percentage points over 2014.

Nearly 70% used dynamic verification code to protect payment security in each online transaction. About 20% set maximum payment limit of SMS verification reflecting cardholders’ different payment scenarios demand. Given that innovative payment, the willingness to use innovative payment among consumers who encountered scams were 4 percentage points lower than those who didn’t suffer such fraud.

Also read: China E-Payment Insights 2015

]]>

Alipay and WeChat Pay are the two most popular mobile payment products in the market in China. Now, UnionPay is making a threat with mobile QuickPass and partnerships with ApplePay and SamsungPay.

China UnionPay and Apple announced a partnership on 18 December 2015 to bring Apple Pay, which transforms mobile payment with an easy, secure and private way to pay, to China. China UnionPay cardholders will be able to easily add their bank cards to Apple Pay on iPhone, Apple Watch and iPad, providing added convenience and security to everyday shopping.

China UnionPay and Samsung on the same day announced the cooperation on Samsung Pay. With Samsung mobile phones, UnionPay cardholders in China will soon be able to enjoy the fast and secure mobile payment service.

Online payment and mobile payment market competition has become more intensified with mobile internet penetrating further and mobile business broadening this year. UnionPay recently launched QuickPass payment collaborating with more than 20 banks in China to deliver safer and more convenient mobile payment for users.

Users can generate a QuickPass card on mobile banking apps as long as their mobile phone is equiped with NFC, which can be identified by POS machines enabled with “QuickPass”. Users don’t need to unlock the screen, scan the QR code, or open certain apps compared to Alipay and WeChat. As long as users activate the phone screen and locate it close to the POS machine, the payment will be processed with a notification beep, which takes about three to five seconds.

Over 20 banks in China including Agricultural Bank of China, China Industrial & Commercial Bank, Bank of China, China Construction Bank, Bank of Communication, Savings Bank, China Commercial Bank and other can generate QuickPass card on mobile apps. Tens of thousands of retail stores such as Carrefour, McDonald’s, Starbucks and other 25 well-known national chain businesses also support the service. Besides, users can enjoy exclusive promotions on these offline stores.

UnionPay aims at not only domestic market but also overseas retailers. In 2015, the acceptance experience of UnionPay QuickPass in overseas markets has been optimized substantially. Currently, there are approximately 100,000 POS terminals in Hong Kong, Macao, Taiwan, Korea, Australia and Singapore accepting QuickPass, while also supporting the mobile QuickPass newly launched by UnionPay on Dec. 12, 2015. On strength of the rapid expansion of its acceptance scope, the overseas transaction volume of UnionPay QuickPass this November is nearly 10 times of that at the beginning of this year.

Alipay and TenPay accounted for 89.1% third-party mobile payment market in the third quarter this year and Alipay (69.9%) led the market with an overwhelming strength basing on Alibaba according to iResearch. By expanding mobile payment scenarios such as utility costs and offline payments, Alipay continues to enhance user stickiness.

Also read: China E-Payment Insights 2015

]]>

According to the latest data from China UnionPay, as of 30 August 2015, the number of China UnionPay internet and mobile payment users has exceeded 260 million. China UnionPay online payment has become an important option for cardholders.

So far there are more than 150 countries and regions where China UnionPay card can be used, covering 26 million merchants and 1.9 million ATMs. China UnionPay has set steps in the tourism industry, and strives to achieve the goal of being a global online payment channel.

In the first quarter of 2015, data of Analysys International showedd that transaction value of China third-party payment market reached 3.13657 trillion yuan (US$0.49 trillion), a QoQ increase of 1.43%. Alipay, China UnionPay and TenPay respectively possessed 36.4%, 35.49% and 12.6% market share, which means that a new pattern of the online payment market has been formed and become firmly established in China.

In recent years, China UnionPay online payment products have appeared in more and more mobile internet merchants cashier and has accessed to more than 50,000 domestic and foreign merchants. Its convenient user experience and attractive discounts have attracted online shoppers of all ages. In addition, China UnionPay mobile payments have access to more than 280 banks, covering the widest range of banks in the same industry.

Also read: China E-Payment Insights 2015

]]>

In Q1 2015, China UnionPay’s total transaction value exceeded USD$1.9 trillion globally according to the latest data, which also means China UnionPay surpassed VISA for the first time in transaction value, becoming the biggest card liquidation organization in the world. According to the financial report of VISA, the total transaction value of VISA was USD$1.75 trillion in Q1 2015.

Besides, in terms of the number of issued cards by China UnionPay, it has already surpassed VISA, becoming the biggest international bank organization by total number of issued cards and transaction value in Q1 2015.

At present, China UnionPay card can be used in 150 foreign countries and regions with over 26 million merchants and 1.8 million ATMs all over the world. China UnionPay issued 5 billion cards in 40 foreign countries.

In 2014, China UnionPay debit card and credit card’s total transaction volume increased by 52.3%. Further, it is still keeping rapid development in transaction volume.

Also read: E-banking Replacing Over 80% of China’s Banking Transactions

]]>

According to China UnionPay, the quantity of chip bank cards (i.e. financial IC cards) released in China in 2014 was doubled compared with the previous year; the total quantity is expected to exceed 1.2 billion.

According to China UnionPay’s statistics report released in 2014, with the increasing perfection of usage environment and expansion of application fields, chip bank card is more increasingly preferred by cardholders.

In 2014, the total transactions of chip bank cards reached RMB6.2 trillion yuan, 4.8 times as much as the previous year. There are about 4 million POS terminals that can accept UnionPay “flash pay” via chip card throughout China.

Compared with traditional magnetic-stripe bank card, chip card is advantageous in sound security and wide application. The People’s Bank of China has clearly stated that, from 2015 onwards, chip cards should be adopted for RMB settlement accounts in the economically developed areas and key industries.

According to UnionPay’s statistics report, inter-bank transaction in China in 2014 amounted to 41.1 trillion yuan, showing a year-on-year growth of 27.3%. According to the domestic transaction data, the trading volume in supermarkets, gas stations and other daily necessities industries still rank top in the residents’ daily consumption in 2014. However, of all nondaily class transactions, real estate transaction showed year-on-year decline for four consecutive quarters over the same period, due to the overall macroeconomic impact, but it significantly rose in the fourth quarter of 2014, showing encouraging trend.

UnionPay’s oversea network has further expanded. UnionPay reports have shown that, by the end of 2014, it has extended to 150 countries and regions, more than 13 million oversea merchants used UnionPay cards, nearly 1.2 million ATMs had been installed in foreign countries, more than 35 million UnionPay cards had been released in more than 30 countries and regions.

Read more: Apple Adds UnionPay Payment for App Store Customers in China

]]>